Global Aluminium Matrix Composites Market Size (2024 - 2030)

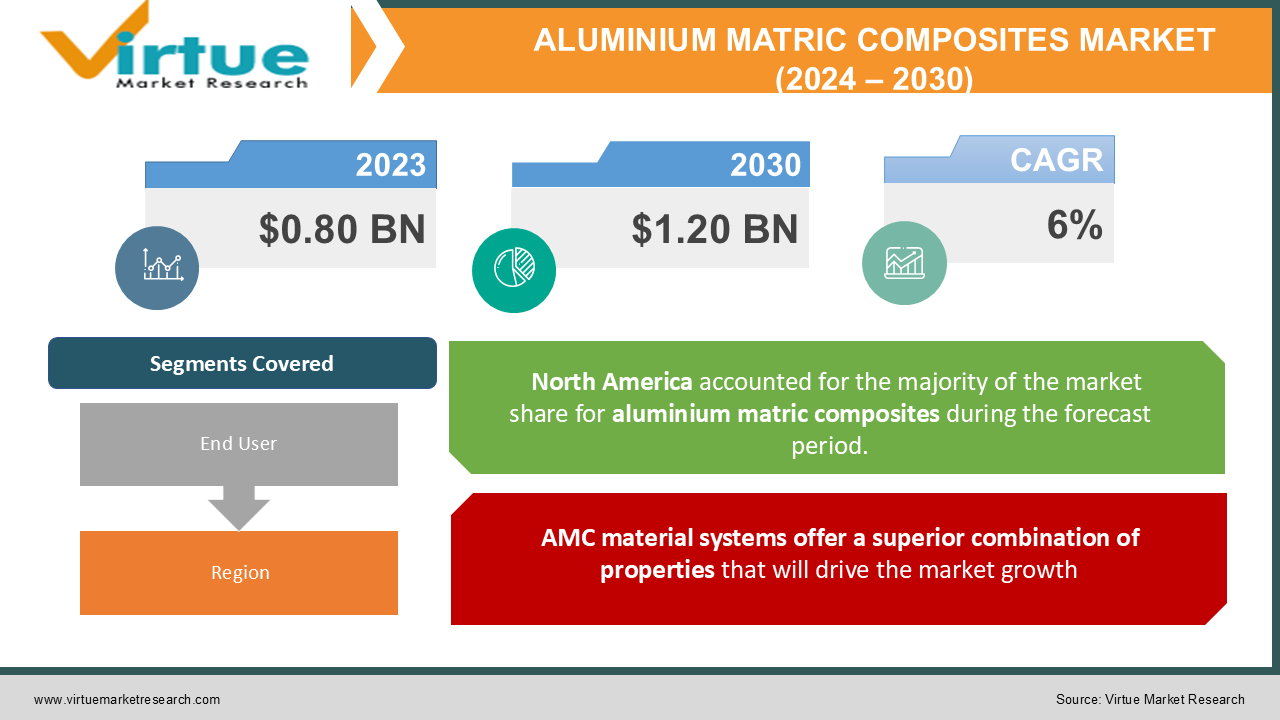

According to the latest analysis by Virtue Market Research, the Global Aluminium Matrix Composites Market is valued at USD 0.80 billion in 2023 and is projected to reach a market size of USD 1.20 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6%.

Industry Overview

Aluminium matrix composites (AMCs) are a type of lightweight, high-performance material systems that are aluminium-centric. In AMCs, reinforcement may take the shape of whiskers, particles, or continuous or discontinuous fibres in volume fractions ranging from a few % to 70%. AMCs' properties can be adjusted to meet the needs of various industrial applications by choosing the right combinations of the matrix, reinforcement, and processing methods. Currently, several AMC grades are produced using various processes. AMCs' physical, mechanical, thermo-mechanical, and tribological properties are affected both directly and indirectly by the inherent and extrinsic impacts of ceramic reinforcement, according to three decades of rigorous research.

Aluminium matrix composites (AMCs) are a category of lightweight materials. AMCs have been used in high-tech structural and functional applications, such as those in the automotive, thermal management, aerospace, and defence industries, as well as in sports and recreation, over the past several years. Intriguingly, research on particle-reinforced cast AMCs began in India in the 1970s, reached industrial maturity in the industrialized world, and is today on the verge of becoming a mainstream material.

In the upcoming years, the market is estimated to be driven by rising demand for lightweight and high-performance materials in the automotive and aerospace sectors. These composites are made of metal alloys that have been wired, whiskered, or reinforced with fibres. Due to their exceptional mechanical qualities and a broad range of applications, metal matrix composites (MMC) are in high demand in the aerospace and automotive industries. Additionally, rising fuel costs have prompted a demand for lightweight components to improve fuel efficiency, which is anticipated to positively affect market growth.

Impact of Covid-19 on the industry

The COVID-19 pandemic is anticipated to cause a fall in the market for aluminium matrix composites in 2021. The entire world has been negatively impacted by this terrible illness, particularly North America and Europe. Due to the pandemic, the aerospace and defence and automobile industries have seen extremely challenging conditions. Companies shut down operations and industrial facilities, and the government curtailed production activities to stop the virus from spreading further. As a result, the use of ceramic matrix composites has decreased across all industries.

Market Drivers

AMC material systems offer a superior combination of properties that will drive the market growth

There is currently no monolithic material that can compete with the superior mix of properties (profile of properties) offered by AMC material systems. AMCs have been tested and employed over the years in a variety of structural, non-structural, and functional applications in several technical fields. Performance, economic, and environmental advantages are the driving forces behind the use of AMCs in various domains. Lower fuel consumption, reduced noise, and lower airborne emissions are the main advantages of AMCs in the transportation sector. The usage of AMCs in the transportation industry will be necessary and desirable in the next years due to tightening environmental restrictions and a focus on increased fuel efficiency.

AMC is a good substitute for monolithic materials

In several applications, AMCs are meant to replace monolithic materials such as aluminium alloys, ferrous alloys, titanium alloys, and polymer-based composites. It is now understood that the entire system must be redesigned to achieve significant weight and volume savings before AMCs may widely replace monolithic materials in engineering systems. The UK Advisory Council on Science and Technology claims that AMCs can be used to either enable fundamental changes in the system or product design or to replace existing materials with ones that have greater qualities. Moreover, AMCs can provide commercially viable solutions for a wide range of applications by using near-net shape formation and selective reinforcement techniques.

Market Restraints

Factors such as low yield, high manufacturing costs, and complex fabrication methods, are estimated to limit market growth

It is anticipated that constraints including low yield, high manufacturing costs, and complicated fabrication techniques will restrain market expansion. To provide affordable products, major industry participants are making significant investments in R&D projects. In addition, several government agencies are providing money for initiatives aimed at the creation of novel goods and production methods.

ALUMINIUM MATRIX COMPOSITES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Materion Corporation, GKN plc, 3M, ADMA Products, Inc., TISICS Ltd., Thermal Transfer Composites LLC, DWA Aluminum Composites USA, Inc., CPS Technologies Corporation, Deutsche Edelstahlwerke GmbH, Plansee Group, Sandvik AB, Mi-Tech Tungsten Metals, LLC, DAT Alloytech Company Limited, AMETEK Specialty Metal Products, CeramTec, Santier, Inc. |

This research report on the global aluminium matrix composites market has been segmented and sub-segmented based on, End-User and Geography & region.

Global Aluminium Matric Composite Market- By End-User

-

Ground Transportation

-

Electronics/Thermal Management

-

Aerospace

-

Others

In 2021, ground transportation dominated the market and generated more than 50% of worldwide revenue. Commodity commerce, regional economies, businesses, travel demand, and consumer expenditure are some characteristics of the ground transportation sector. Over the projected period, the segment's growth is anticipated to be driven by the rising demand for high-performance materials in bulk and passenger vehicles within the transportation sector.

Numerous car parts, including brake fins, driveshafts, and engine parts, are made of metal matrix composites. Additionally, MMCs are employed in the manufacturing of several railway vehicle parts, such as brake rotors, calliper liners, engine blocks, pistons, and bearings. Over the forecast period, it is anticipated that the growing significance of lightweight railway cars will increase demand for MMCs in the ground transportation end-use segment.

In terms of revenue, the electronics/thermal management end-use category is predicted to experience the quickest CAGR throughout the projection period. The need for MMCs in the electronics sector is anticipated to increase over the next few years as a result of recent advancements in microelectronics and changing usage trends for electronic components, including semiconductors and computer parts.

These composite materials provide improved strength and particular stiffness, which boosts an aircraft's overall performance. The widespread use of MMCs in both commercial and military aircraft is the main factor driving the need for them in the aerospace sector. Furthermore, the demand for space-related applications is anticipated to increase over the projection period as a result of the improved resilience to thermal and mechanical stress.

Global Aluminium Matric Composite Market- By Geography & Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

Due to the presence of numerous significant automotive and aerospace manufacturers in the area, North America dominated the market and contributed 43.2% of worldwide revenue share in 2021. Furthermore, over the course of the forecast period, the MMC market in the area is anticipated to be driven by strict government laws concerning automobile pollution as well as an increase in demand for fuel-efficient vehicles.

Europe's product demand is estimated to increase dramatically, with Germany, France, Italy, and the United Kingdom as the main drivers. The region's well-established construction, electronics, aerospace & military, and automotive industries are anticipated to continue expanding, which is also likely to foster market expansion.

The expansion of the manufacturing sector and the rapid increase in automobile output are likely to lead to faster market growth in developing nations in the Asia Pacific region, such as India and China. Additionally, over the course of the projected period, MMC makers should benefit from the significant concentration of electronics producers in China, Japan, South Korea, and Taiwan.

Over the projection period, it is anticipated that the Middle East's expanding defence and aerospace industries will increase demand for MMCs. In addition, nations like the UAE and Kuwait are boosting their trucking and freight transportation industries to keep up with consumer demand and the expansion of the retail industry. These elements are anticipated to have a favourable effect on the overall market growth.

Global Aluminium Matric Composite Market- By Companies

-

Materion Corporation

-

GKN plc

-

3M

-

ADMA Products, Inc.

-

TISICS Ltd.

-

Thermal Transfer Composites LLC

-

DWA Aluminum Composites USA, Inc.

-

CPS Technologies Corporation

-

Deutsche Edelstahlwerke GmbH

-

Plansee Group

-

Sandvik AB

-

Mi-Tech Tungsten Metals, LLC

-

DAT Alloytech Company Limited

-

AMETEK Specialty Metal Products

-

CeramTec

-

Santier, Inc.

NOTABLE HAPPENINGS IN THE GLOBAL ALUMINUM MATRIX COMPOSITE MARKET IN THE RECENT PAST:

-

Business Partnership: - In 2021, To improve metal matrix composite technology for practical applications, 3M and Alvant, a pioneer in the production of aluminium matrix composites (AMC) materials, inked a Memorandum of Understanding.

-

Business Partnership: - In 2021, As the only integrated ceramic fibre and metal composite factory in the world, TISICS worked with SPRINT for testing and manufacturing metal composites for spacecraft, which was sponsored by SPRINT.

Chapter 1. ALUMINIUM MATRIC COMPOSITE MARKET– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. ALUMINIUM MATRIC COMPOSITE MARKET– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. ALUMINIUM MATRIC COMPOSITE MARKET– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. ALUMINIUM MATRIC COMPOSITE MARKETEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. ALUMINIUM MATRIC COMPOSITE MARKET– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. ALUMINIUM MATRIC COMPOSITE MARKET– By End-User

6.1 Introduction/Key Findings

6.2 Ground Transportation

6.3 Electronics/Thermal Management

6.4 Aerospace

6.5 Others

6.6 Y-O-Y Growth trend Analysis By End-User

6.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 7. ALUMINIUM MATRIC COMPOSITE MARKET, By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 By End-User

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 By End-User

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 By End-User

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 By End-User

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 By End-User

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. ALUMINIUM MATRIC COMPOSITE MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 Materion Corporation

8.2 GKN plc

8.3 3M

8.4 ADMA Products, Inc.

8.5 TISICS Ltd.

8.6 Thermal Transfer Composites LLC

8.7 DWA Aluminum Composites USA, Inc.

8.8 CPS Technologies Corporation

8.9 Deutsche Edelstahlwerke GmbH

8.10 Plansee Group

8.11 Sandvik AB

8.12 Mi-Tech Tungsten Metals, LLC

8.13 DAT Alloytech Company Limited

8.14 AMETEK Specialty Metal Products

8.15 CeramTec

8.16 Santier, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900