Aluminium Cans Market Size (2025-2030)

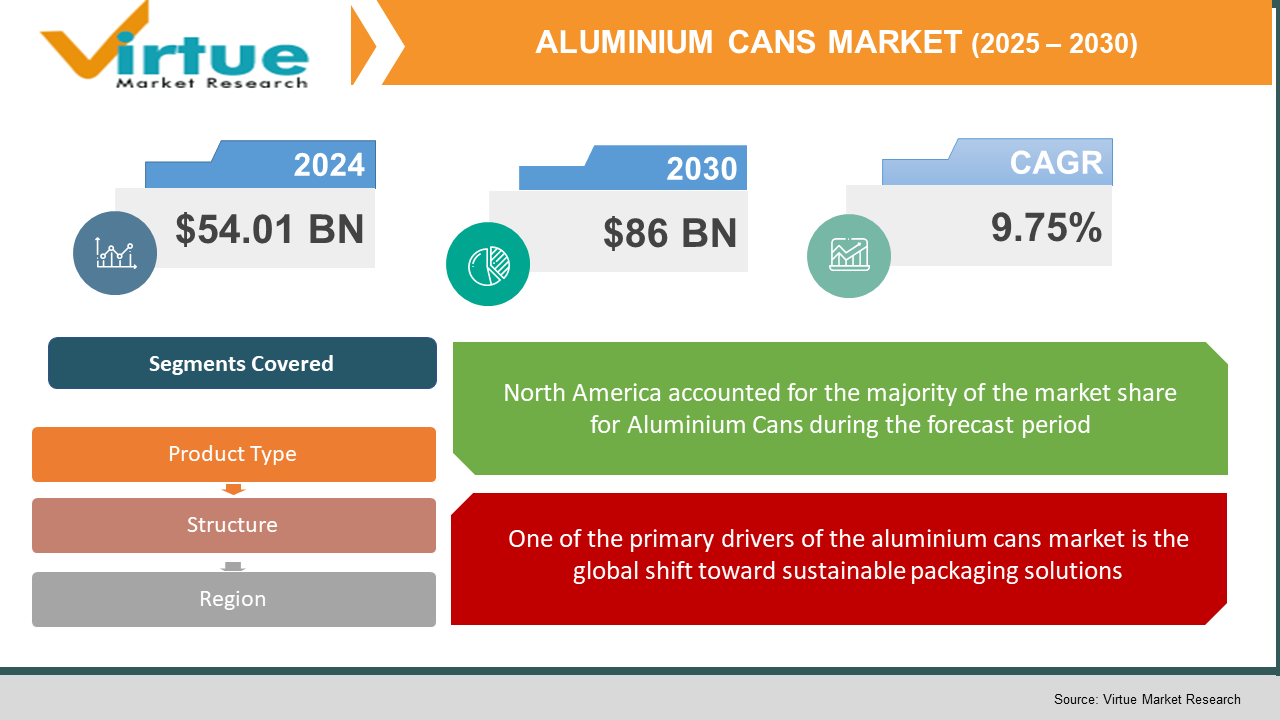

The Aluminium Cans Market was valued at USD 54.01 billion in 2024 and is projected to reach a market size of USD 86 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.75%.

The Aluminium Cans Market plays a vital part in the global food and beverage space due to its wide applications and cost-effective sweetening effects. Corn glucose (or glucose syrup) is one of the products resulting from the enzymatic hydrolysis of corn starch, and it finds use in confectionery, bakery, dairy, beverages, and even in pharmaceutical and personal care products. Manufacturers prefer it because it can improve texture, retain moisture, and prolong shelf life, thus adding to the consistency and quality of their products. Increased demand for processed and packaged foods, especially in emerging economies, keeps boosting the Aluminium Cans Market. Other factors are innovations in food formulation and a growing trend toward replacing sugar with non-sugar sweeteners. While industries explore cleaner labels and healthier alternatives, corn glucose lies at the crossroads of performance, affordability, and functional versatility.

Key Market Insights:

Over 70% of global corn glucose production is consumed by the confectionery industry. Its superior moisture retention and anti-crystallisation properties make it ideal for candies, jellies, and gums, fueling consistent growth in this segment.

Corn glucose is used in over 80% of carbonated beverages and packaged bakery products. Its ability to improve sweetness and shelf-life without altering taste profiles is a key factor driving its popularity among large-scale beverage and bakery producers.

Aluminium Cans Market Drivers:

One of the primary drivers of the aluminium cans market is the global shift toward sustainable packaging solutions.

Global sustainability awareness has revolutionised the packaging world, creating a demand for environment-friendly solutions, recyclable, reusable, anything which is not hurt the planet. The Aluminium Can fits this description, being 100% recyclable with no loss of quality and infinite recyclability. Plastic degrades in quality and has a huge footprint because aluminium keeps its properties through the recycling process. The other feature is that recycling aluminium uses up to 95% less energy than primary production, making it a frontrunner in the reduction of carbon emissions. As a result, brands across beverage, food, and cosmetics are turning to aluminium cans to satisfy their sustainability commitments whilst attracting eco-conscious customers. This growing demand is backed by policy frameworks across Europe and North America banning or taxing single-use plastics. Therefore, aluminium cans are increasingly seen as the gold standard in sustainable packaging, thus actively fuelling the market growth.

The rapid growth of the global beverage industry, especially in the energy drinks, soft drinks, ready-to-drink coffee, and alcoholic beverages segments, is another major factor propelling the aluminium cans market.

One of the major factors that is boosting the aluminium cans market is the rapidly growing global beverage sector, especially in energy drinks, soft drinks, ready-to-drink coffees, and alcoholic beverages. For an average consumer, portability, durability, and ease of use have become the most sought-after features, all of which are fulfilled by aluminium cans. These cans are one of the best packages designed for ground-shaking lifestyles and massive logistics, as they are lightweight and shatterproof. In addition to that, aluminium cans provide good barrier protection from light, oxygen, and contaminants, resulting in better beverage preservation with respect to freshness and flavour, as well as carbonation. Increased consumption of canned beverages, particularly among younger populations, has led to a sharp increase in the demand for aluminium cans. Companies are also paying attention to aesthetics and branding, and aluminium cans allow for high-resolution printing and unique finishes to attract customers on store shelves. This combination of functionality and convenience for consumers, along with an innovative marketing approach, makes aluminium cans a very strategic option and propels the market into further growth.

Aluminium Cans Market Restraints and Challenges:

One of the key restraints in the Aluminium Cans Market is the volatility in aluminium prices and the associated supply chain challenges.

Aluminium price fluctuations, coupled with supply chain challenges, are among the crucial restraints for the Aluminium Cans Market. Metals, including aluminium, are prone to global fluctuations; some of these factors include energy costs, trade policies, mining regulations, and geopolitical tensions. Volatility in raw material prices makes it difficult for can manufacturers and beverage companies to forecast their production costs while protecting reasonable profit margins. Moreover, the aluminium supply chain itself—bauxite mining and smelting, to be specific—faces disruptions from environmental issues, labour strikes, or export restrictions from other major producers such as China, Australia, and Brazil. Such interruptions may result in shortages, delays, and increased production lead times. The energy-intensive extraction and processing techniques used also subject the industry to rising energy costs and carbon taxes. Combined, these challenges hamper the ability of aluminium cans to scale and become affordable; this consequently holds back potential market growth, especially among small and medium enterprises (SMEs).

Aluminium Cans Market Opportunities:

Whenever consumers and regulators push for an alternative to plastic, it creates a big potential opportunity in developing markets where the adoption of aluminium packaging is still at an early stage. Surging urbanisation and a change in lifestyle patterns in Asia-Pacific, Latin America, and Africa have all fueled the demand for canned beverages and foods. In addition, the current premiumization trend in alcoholic drinks, energy drinks, and even water has created new opportunities for branded aluminium packaging with bespoke finishes and smart labelling technologies. Innovations on lightweighting are also available—less material is minimised without any loss of functionality or performance. Governments promoting recycling initiatives with tax benefits for sustainable packaging further encourage these. With improved infrastructure for recovery and reuse of aluminium attaining worldwide acceptance, companies investing in eco-friendly, good-looking, and recyclable cans stand to make the most of the changes in this market space.

ALUMINIUM CANS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.75% |

|

Segments Covered |

By Product Type, structure, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

. Ball Corporation, Crown Holdings, Inc., Ardagh Group, Can-Pack S.A., Envases Group, CCL Container, Silgan Containers LLC, and Tecnocap Group |

Aluminium Cans Market Segmentation:

Aluminium Cans Market Segmentation: By Product Type

- 2-Piece Cans

- 3-Piece Cans

Based on product types, the aluminium cans market is primarily divided into 2-piece and 3-piece cans, which serve unique application requirements and manufacturing processes. 2-piece cans are the most typically used cans in the beverages industry because their bodies are seamless, allowing better resistance to pressure and leak prevention-ideal for carbonated and energy drinks. The cans are produced by a drawing and ironing process, thus lightweight and better-looking design for branding and shelf appeal. On the other hand, 3-piece cans have a cylindrical body and two ends, and they are widely available for food packaging. They are comparatively less expensive in smaller production runs. Moreover, they have provisions for different sizes and shapes that best suit canned vegetables, soups, and pet foods. While 2-piece cans have a significant market share because of the high demand for bottled beverages, 3-piece cans still have a strong position in countries that consume processed food.

Aluminium Cans Market Segmentation: By Structure

- Necked-in Cans

- Straight-wall Cans

- Shaped Cans

From a structural standpoint, the aluminium cans market includes necked-in cans, straight-wall cans, and shaped cans, each of which offers exceptional advantages. Necked-in cans are the most widely used in the beverage industry; their feature is a reduced diameter at the top, which not only aids stacking of the can during storage and transportation but also helps in reducing the material and costs. These are highly favoured in soft drinks and beers that undergo mass production. Straight-wall cans, which are of a constant diameter from top to bottom, provide ease of use and sturdiness, making them apt for industrial and household aerosols. Their design also allows for ease of labelling and consistent branding. Shaped cans - usually customised - are fast becoming favourites in the premium and niche markets like limited-edition beverages and cosmetics. These cans make the brand stand out when sitting side by side with other products on retail shelves by providing the brand with a unique visual identity, even though they create much more costly production. This structural diversity allows manufacturers to create a flexible solution to meet both performance and marketing goals in any industry.

Aluminium Cans Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The Aluminium Cans Market shows varied growth throughout the globe in 2024, wherein it is not being hindered in the way North America was growing, considering the utmost consumption of canned beverages, well-developed recycling systems, and strong sustainability initiatives. The closely following Europe is mainly poised toward growth because of stringent environmental mandates and altering consumer preferences for eco-friendly packaging options. Asia-Pacific is becoming a lively marketplace with urbanisation, increasing disposable income, and the rising demand for convenient packaged food and drinks. South America is experiencing gradual growth, with local food and beverage industries expanding and growing knowledge about aluminium's recyclability. The Middle East and Africa are slowly adopting aluminium packaging, thanks to the growth in modern retail infrastructure and the penetration of international brands. Each region stands in for a unique contributor to the global context defined by local consumer behaviour, industrial capacities, and regulatory frameworks.

COVID-19 Impact Analysis on the Aluminium Cans Market:

The COVID-19 pandemic had a mixed impact on the aluminium can market. On one hand, the initial lockdowns, together with supply chain disruption, halted production through shortages of raw materials and delayed shipments in 2020. This affected the manufacturing process in several regions. On the other hand, the market began to witness demand for canned beverages and packaged food, as consumers shifted to at-home consumption, and stockpiling behaviour began to set in. The rise of e-commerce and at-home beverage formats further observed demand for aluminium cans due to the durability and easy transportation route of aluminium cans. Furthermore, the growing concerns of hygiene and tamper-proof packaging worked in favour of metal cans over plastic or glass. Even though the bit for industrial and out-of-home consumption dipped for some time, the long-term prospects got stronger due to the rising trend of recyclability and health-oriented packaging. Overall, the pandemic gave a thrust to the market transformation, creating avenues for sustainability-oriented innovations and cementing aluminium cans as a robust and future-ready package.

Latest Trends/ Developments:

The aluminium cans market is in a fast evolution; frontrunners are sustainability, innovation, and digital integration. Advanced recycling and lightweighting initiatives are being upgraded, thus reducing energy costs and CO₂ emissions and keeping product strength. High definition and digital printing technologies are pushing for very vibrant and customizable packaging aids that help brands with shelf appeal and enable quick launches of limited editions. Custom and shape cans are gaining prominence in premium and niche beverage segments, providing brands with visually distinctive formats. In tandem with this, smart packaging is rising: QR codes, NFC, Augmented Reality, and thermochromic inks allow for interactive consumer experiences and supply. Another interesting trend is the formulation of eco-friendly can coatings and BPA-free linings that foster food safety and compliance with regulations. Sustainability endorsement schemes backed by circular-economy models and government incentives markets with strong can recycling systems, like Europe and Brazil among them, report recovery rates between 75-98%.

Key Players:

- Ball Corporation

- Crown Holdings, Inc.

- Ardagh Group

- Can-Pack S.A.

- Envases Group

- CCL Container

- Silgan Containers LLC

- Tecnocap Group

Chapter 1. Aluminium Cans Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary source

1.5. Secondary source

Chapter 2. ALUMINIUM CANS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. ALUMINIUM CANS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. ALUMINIUM CANS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. ALUMINIUM CANS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. ALUMINIUM CANS MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 2-Piece Cans

6.3 3-Piece Cans

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 7. ALUMINIUM CANS MARKET – By Structure

7.1 Introduction/Key Findings

7.2 Necked-in Cans

7.3 Straight-wall Cans

7.4 Shaped Cans

7.5 Y-O-Y Growth trend Analysis By Structure

7.6 Absolute $ Opportunity Analysis By Structure , 2025-2030

Chapter 8. ALUMINIUM CANS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Structure

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product Type

8.2.3. By Structure

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product Type

8.3.3. By Structure

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product Type

8.4.3. By Structure

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product Type

8.5.3. By Structure

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. ALUMINIUM CANS MARKET – Company Profiles – (Overview, Product Type Product Type , Portfolio, Financials, Strategies & Developments)

9.1 Ball Corporation

9.2 Crown Holdings, Inc.

9.3 Ardagh Group

9.4 Can-Pack S.A.

9.5 Envases Group

9.6 CCL Container

9.7 Silgan Containers LLC

9.8 Tecnocap Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Aluminium Cans Market was valued at USD 54.01 billion in 2024 and is projected to reach a market size of USD 86 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.75%.

The Aluminium Cans Market is driven by the rising demand for sustainable and recyclable packaging and the growing consumption of canned beverages across the globe. Environmental regulations and consumer preference for eco-friendly alternatives are accelerating market growth

Based on Service Provider, the Aluminium Cans Market is segmented into material manufacturers, Raw Material Suppliers, Lab information management systems, Distributors & Wholesalers, End-to-End Solution Providers.

North America is the most dominant region for the Aluminium Cans Market.

Ball Corporation, Crown Holdings, Inc., Ardagh Group, Can-Pack S.A., Envases Group, CCL Container, Silgan Containers LLC, and Tecnocap Group are the key players in the Aluminium Cans Market.