Global Alumina Ceramic Balls Market Size (2024-2030)

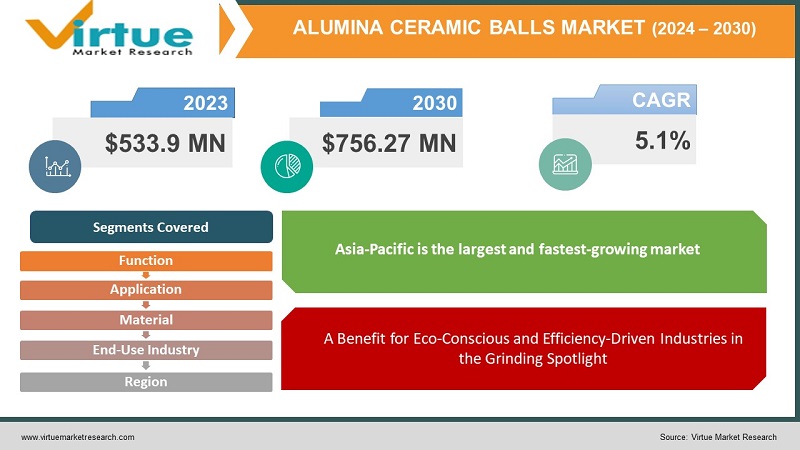

The Global Alumina Ceramic Balls Market was valued at USD 533.9 million in 2023 and is projected to reach a market size of USD 756.27 million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.1%.

Alumina ceramic balls are renowned for their remarkable hardness, wear resistance, and thermal stability. They are carefully manufactured spheres constructed from high-purity alumina ceramic. They are well-liked options for grinding media in ball mills used to handle ceramics, minerals, and pigments. This is because of their great resilience to wear, low product contamination, and capacity to increase mill life.

Key Market Insights:

With a predicted CAGR of 7.2% by 2028, the Asia Pacific region is anticipated to have the highest development in the alumina ceramic balls market. This increase is explained by the area's growing industrial base and growing knowledge of the advantages of alumina ceramic balls.

Development of novel alumina ceramic compositions with wear resistance that is 30% higher than that of conventional balls. This allows for completely new uses in fields where conventional alumina ceramic balls could have worn out too rapidly, such as mining and the processing of extremely abrasive materials.

By minimizing waste creation and implementing energy-efficient procedures, firms may save up to 15% on costs.

Comparing alumina ceramic balls to typical grinding media, they can reduce waste creation by 20% because of their longer lifespan (3-5 times longer) and lower contamination rates.

Global Alumina Ceramic Balls Market Drivers:

A Benefit for Eco-Conscious and Efficiency-Driven Industries in the Grinding Spotlight

An important factor propelling the worldwide market for alumina ceramic balls is the increasing need from major end-user sectors such as chemicals, oil and gas, and pharmaceuticals. High-performance grinding media are necessary for the grinding operations used in all these sectors to get the best possible outcomes. In these applications, alumina ceramic balls are unique because of a few significant benefits. Balls made of alumina ceramic have a remarkable wear life. Alumina ceramic balls are renowned for their extraordinary hardness and longevity, in contrast to conventional grinding media that can deteriorate rapidly. As a result, the grinding media will last longer, requiring fewer replacements and resulting in lower total maintenance expenses. Minimal contamination of the material being treated is provided by alumina ceramic balls. This is critical for sectors where preserving product purity is critical, such as chemicals and medicines. Because alumina ceramics are inert, no chemicals or particles may seep into the finished product, maintaining the output's integrity and quality. Additionally, alumina ceramic balls can help to increase grinding processes' efficiency. Their firm, smooth surface reduces friction and makes grinding easier, which might result in higher manufacturing productivity.

In an environmentally conscious era, sustainable champions for efficiency-driven grinding processes

The increasing emphasis on sustainability and efficiency in various sectors is another major factor driving the global market for alumina ceramic balls. Businesses in all industries are actively looking for methods to streamline their processes and reduce their environmental effect as environmental consciousness gains traction. The intrinsic qualities of alumina ceramic balls make them an ideal match for this expanding trend in terms of sustainability and efficiency. The longer lifespan of alumina ceramic balls is one of its main benefits. These balls have outstanding resistance to wear, in contrast to conventional grinding media that deteriorate rapidly. This results in a large decrease in the number of replacements that are required, which lowers waste production and the environmental impact overall. Furthermore, alumina ceramic balls' low contamination rates add to a more environmentally friendly procedure. They do not introduce impurities into the substance being treated since they are chemically inert. This lowers the possibility of environmental contamination from possible pollutants and minimizes the need for extra purification procedures. Additionally, alumina ceramic balls can help reduce the amount of energy used in grinding operations. Their firm, smooth surface reduces friction, enabling more effective grinding with less energy use. This results in a lower total carbon footprint and cheaper operating expenses for businesses. Alumina ceramic balls, in short, provide a win-win option for companies aiming for sustainability and efficiency. Their long lifespan, low rates of contamination, and energy-saving qualities make them an extremely appealing option for a variety of grinding applications, ideally aligning with the developing environmental consciousness.

Global Alumina Ceramic Balls Market Restraints and Challenges:

The global market for alumina ceramic balls faces several obstacles despite its many benefits. The high cost of alumina, a necessary component, results in high production costs for the balls. In markets where consumers prioritize cost, this might be a big barrier that makes them choose less expensive options. Furthermore, alumina ceramic balls' better performance over conventional grinding media may not be well known, which might impede its adoption in new sectors. Lastly, strict manufacturing restrictions that are imposed for environmental and health reasons may complicate and increase the cost of production.

Global Alumina Ceramic Balls Market Opportunities:

There are plenty of intriguing prospects in the global market for alumina ceramic balls. The need for high-performance grinding media is driven in large part by the growing demand from important end-use sectors including chemicals, oil and gas, and pharmaceuticals. Ceramic balls made of alumina provide these sectors with several benefits. Furthermore, the extended lifespan, low contamination rates, and energy savings linked with alumina ceramic balls become even more alluring as enterprises lay an increasing focus on sustainability and efficiency. Another important component is technological progress; for example, advances in material science have allowed to production of increasingly more sophisticated alumina ceramic balls with improved characteristics. This creates opportunities for completely new uses. Lastly,alumina ceramic balls have a huge prospective market due to the growing industrial base in emerging nations, especially as more people become aware of their advantages.

ALLUMINA CERAMIC BALLS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Function, application, material, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Axens, Catalyst Private Limited, Coorstek Inc, Fineway Inc., Global Precision Ball & Roller, Devson, Honeywell International, Industrial Tectonics Inc., Saint-Gobain, Topack Ceramics Pvt. Ltd., Toshiba Materials Co. Ltd. |

Global Alumina Ceramic Balls Market Segmentation:

Global Alumina Ceramic Balls Market Segmentation: By Material:

- Alumina

- Silicon Nitride

- Zirconia

- Others

Alumina leads the material-segmented worldwide market for ceramic balls made of alumina because of its remarkable hardness, remarkable resistance to wear, and remarkable thermal stability, making it ideal for a wide range of grinding applications. While zirconia provides great corrosion resistance, other materials such as silicon nitride address the demand for even better wear resistance. A section dedicated to less common materials used in specialized applications, such as fused silica, is also included. Although alumina is the market leader, more investigation may be required to identify the rising material category with the greatest rate of growth.

Global Alumina Ceramic Balls Market Segmentation: By Function:

- Inert

- Active

The market for alumina ceramic balls is divided into two categories: active and inert. As of right now, inert balls are the best option for ordinary grinding and milling applications where purity is crucial. As companies prioritize effective grinding processes, active balls, on the other hand, have experienced the quickest development due to their particularly designed surfaces or structures that boost grinding efficiency, making them a rising star in the market.

Global Alumina Ceramic Balls Market Segmentation: By Application:

- Bearing

- Grinding

- Valve

- Others

The market for alumina ceramic balls is worldwide and serves a range of uses. Grinding comes in first place because these balls work well in industries like chemicals and pharmaceuticals to reduce particle size and withstand wear. They are also useful in flow control valves and equipment bearings. Although grinding is the most common use, other uses, such as polishing media and catalyst carriers, may be growing at the quickest rate because of their specialized usage in particular sectors; however, further study is required to verify this.

Global Alumina Ceramic Balls Market Segmentation: By End-Use Industry:

- Chemicals

- Oil & Gas

- Pharmaceuticals

- Automotive

- Aerospace

- Others

The market for alumina ceramic balls serves a wide range of customers. Chemicals are the industry leaders in the use of these balls for grinding jobs because of their low wear resistance and low contamination. Their qualities are used in a variety of ways by other sectors, including aircraft, oil and gas, and even medicines. Notably, the end-use industry with the quickest rate of growth may not be one of the more established ones. Alumina ceramic balls may be gaining traction in new industries at a rapid pace due to global industrialization; additional research is necessary to pinpoint this industry's rising star.

Global Alumina Ceramic Balls Market Segmentation: By Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Asia Pacific is the rising star in the alumina ceramic balls market when broken down by region. This area is growing at the quickest rate because of its growing industrial base and growing awareness of the advantages of these balls. With its well-established manufacturers, North America is still a major participant, while Europe is a mature market that is expanding steadily. As their industrial sectors flourish, South America the Middle East, and Africa exhibit potential for future growth.

COVID-19 Impact Analysis on the Global Alumina Ceramic Balls Market:

The global market for alumina ceramic balls was affected by the COVID-19 epidemic in a variety of ways. On the one hand, COVID-19's effects on the global supply chain made raw materials more difficult to obtain and may have made it more difficult to transport completed balls. Price swings and temporary shortages could have come from this. Lockdowns and economic downturns may also have decreased demand from important user industries like chemicals, oil, and gas, and automotive, which might have short-term slowed market growth. But there were also some advantageous lessons to be learned. The COVID-19 pandemic may have increased awareness of cleanliness, which might have helped the market. Because of their low potential for contamination, alumina ceramic balls would have been a better option for applications involving cleanliness and sanitation. Moreover, alumina ceramic balls used in the grinding of pharmaceutical materials may have found new market niches because of the pandemic's spike in demand for medications and medical supplies.

Recent Trends and Developments in the Global Alumina Ceramic Balls Market:

A new wave of innovation and encouraging advancements is driving the global market for alumina ceramic balls, which is seeing an exciting growth trajectory. The ongoing progress in the field of material science is one important factor. The goal of continuously developing new and enhanced alumina ceramic blends is to achieve even higher levels of thermal stability, wear resistance, and corrosion resistance. This creates opportunities for completely new uses for which the conventional alumina ceramic balls would not have worked. Another area of increasing emphasis is sustainability. Manufacturers of alumina ceramic balls are placing a higher priority on environmentally friendly production methods that use less energy and trash. This is exactly in line with end-use sectors' growing desire for sustainable solutions. Because of their quick industrialization, rising nations like China and India are also seeing market booms. Demand is anticipated to soar as word of the advantages of alumina ceramic balls spreads throughout these areas. Another growing tendency is product diversity. Producers are realising that a greater variety of applications must be served. As a result, alumina ceramic balls with varied porosities, grades, and sizes are being developed, enabling more specialized approaches to meet the demands of diverse sectors. Collaboration between manufacturers of alumina ceramic balls and end-user industries is becoming more and more common. Through co-development, tailored solutions that maximize grinding performance and processes may be created for applications. The market for alumina ceramic balls is active and changing, as seen by these recent developments. This industry is positioned for substantial growth in the years to come thanks to continued innovation and rising awareness.

Key Players:

- Axens

- Catalyst Private Limited

- Coorstek Inc,

- Fineway Inc.

- Global Precision Ball & Roller, Devson

- Honeywell International

- Industrial Tectonics Inc.

- Saint-Gobain

- Topack Ceramics Pvt. Ltd.

- Toshiba Materials Co. Ltd.

Chapter 1. Global Alumina Ceramic Balls Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Alumina Ceramic Balls Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Alumina Ceramic Balls Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Alumina Ceramic Balls Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Alumina Ceramic Balls Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Alumina Ceramic Balls Market– By Material

6.1. Introduction/Key Findings

6.2. Alumina

6.3. Silicon Nitride

6.4. Zirconia

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Material

6.7. Absolute $ Opportunity Analysis By Material , 2024-2030

Chapter 7. Global Alumina Ceramic Balls Market– By Function

7.1. Introduction/Key Findings

7.2 Inert

7.3. Active

7.4. Y-O-Y Growth trend Analysis By Function

7.5. Absolute $ Opportunity Analysis By Function , 2024-2030

Chapter 8. Global Alumina Ceramic Balls Market– By End-User

8.1. Introduction/Key Findings

8.2. Chemicals

8.3. Oil & Gas

8.4. Pharmaceuticals

8.5. Automotive

8.6. Aerospace

8.7. Others

8.8. Everyday Consumers

8.9. Y-O-Y Growth trend Analysis End-User

8.10. Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 9. Global Alumina Ceramic Balls Market– By Application

9.1. Introduction/Key Findings

9.2. Bearing

9.3. Grinding

9.4. Valve

9.5. Others

9.6. Y-O-Y Growth trend Analysis Application

9.7. Absolute $ Opportunity Analysis Application , 2024-2030

Chapter 10. Global Alumina Ceramic Balls Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Material

10.1.3. By Function

10.1.4. By Application

10.1.5. End-User

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Material

10.2.3. By Function

10.2.4. By Application

10.2.5. End-User

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.1. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Material

10.3.3. By Function

10.3.4. By Application

10.3.5. End-User

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By Material

10.4.3. By Function

10.4.4. By Application

10.4.5. End-User

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.1. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Material

10.5.3. By Function

10.5.4. By Application

10.5.5. End-User

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Alumina Ceramic Balls Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Axens

11.2. Catalyst Private Limited

11.3. Coorstek Inc,

11.4. Fineway Inc.

11.5. Global Precision Ball & Roller, Devson

11.6. Honeywell International

11.7. Industrial Tectonics Inc.

11.8. Saint-Gobain

11.9. Topack Ceramics Pvt. Ltd.

11.10. Toshiba Materials Co. Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Alumina Ceramic Balls Market size is valued at USD 533.9 million in 2023

The worldwide Global Alumina Ceramic Balls Market growth is estimated to be 5.1% from 2024 to 2030

The Global Alumina Ceramic Balls Market is segmented By Material (Alumina, Silicon Nitride, Zirconia, Others); By Function (Inert, Active); By Application (Bearing, Grinding, Valve, Others); By End-Use Industry (Chemicals, Oil & Gas, Pharmaceuticals, Automotive, Aerospace, Others) and by region

The market for alumina ceramic balls has a bright future ahead of it. It is anticipated that developments in material science will result in the creation of even more sophisticated balls with better qualities, creating opportunities for new uses. Growing attention to sustainability will spur the creation of environmentally friendly production methods. Further driving market expansion will be growing applications in new regions and increasing demand in important sectors.

The COVID-19 epidemic affected the world market for alumina ceramic balls in a variety of ways. Although short-term slowdowns were caused by supply chain disruptions and decreased demand from certain industries, the focus on hygiene and the expansion of the pharmaceutical industry may have opened new prospects. In the near run, the effect was probably neutral or slightly negative overall