Aloe Vera Juice Market Size (2024 – 2030)

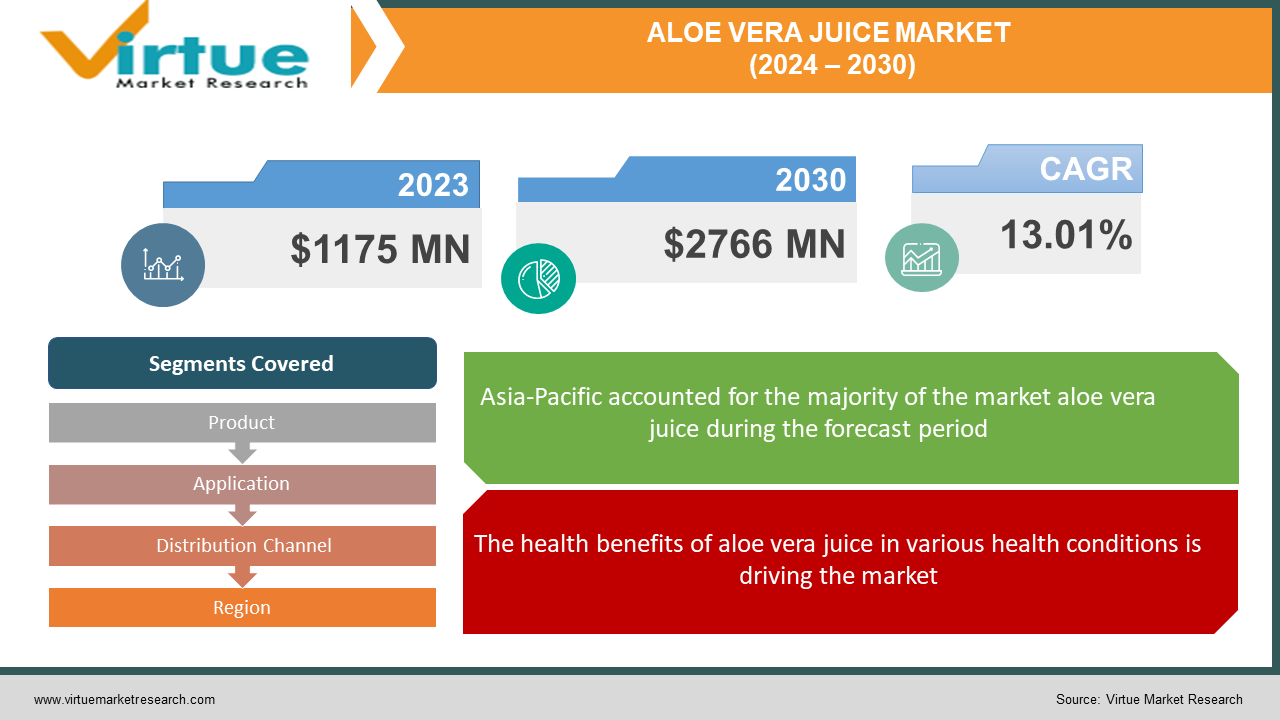

The Global Aloe Vera Juice Market Size was valued at USD 1175 million in 2023 and is expected to reach USD 2766 million by 2030 growing at a CAGR of 13.01% over the forecast period 2024-2030.

Aloe vera, a succulent plant species, thrives in tropical climates worldwide. It finds applications in the healthcare, beauty, and food & beverage industries. The juice of aloe vera is extracted by grinding the leaves and then purifying the resultant liquid. Aloe vera juice is known for its mild and agreeable taste, making it a popular additive in smoothies and shakes, and serving as a nutritional supplement. This plant offers numerous health advantages, including enhanced hydration, liver function improvement, nutritional enrichment, and digestive health support. Aloe vera drinks are rich in various vitamins, amino acids, and folic acid, contributing to immune system fortification. As a gelatinous plant-based food, it also plays a role in detoxifying the body's cells.

The market for aloe vera is experiencing robust growth due to its increasing incorporation in the food & beverage sector, favored by its widespread availability and a shift in consumer preference towards aloe vera-infused products over traditional flavor enhancers. The market expansion is further supported by the growing elderly population, rising incidence of skin conditions, and heightened awareness of the benefits of aloe vera juice. Additionally, the escalating demand for flavored beverages worldwide and the growing consumption of functional drinks, particularly in developing nations, are propelling market growth. However, excessive consumption of aloe vera juice can lead to liver issues and allergic reactions, posing challenges to market expansion. Furthermore, the higher cost of aloe vera-based beverages may impede market growth.

Key Market Insights:

There is an upward trend in the Aloe Vera juice market, primarily driven by heightened consumer consciousness about its health benefits. The market is increasingly inclined towards natural and organic variants, with organic Aloe Vera juice gaining significant traction. The Asia-Pacific region is a major contributor, capitalizing on its strong aloe vera cultivation base and an expanding health-aware populace. The market is evolving with a variety of flavors and innovative packaging to attract consumers. Businesses are strategically leveraging online sales platforms to expand their market presence and connect with the digital-savvy consumer segment. Despite facing hurdles like regulatory barriers and potential contamination risks during processing, the Aloe Vera juice market is set for consistent growth, buoyed by enduring demand for natural health and wellness products.

Global Aloe Vera Juice Market Drivers:

The health benefits of aloe vera juice in various health conditions is driving the market.

The aloe vera juice market is driven by the beverage's health-enhancing properties for various medical conditions. Aloe vera's extensive benefits span across multiple sectors such as food, beverage, beauty, and pharmaceuticals. Research has highlighted aloe vera juice's effectiveness in addressing dental issues, constipation, diabetes-related foot ulcers, antimicrobial activity, UV radiation protection, and skin ailments, among others. Ongoing research in additional fields is anticipated to expand aloe vera's uses, paving the way for the introduction of innovative products targeting new health indications.

Increased global acceptance of aloe vera is also a driving factor.

With a rise in lifestyle diseases globally, there's a growing trend of health awareness among consumers. This shift has led to a perception of natural ingredient-based products, like aloe vera juice, as safer and healthier compared to processed or chemical-laden alternatives. The high level of consumer acceptance of aloe vera juice also fuels market growth. The benefits and applications of aloe vera have been known globally for thousands of years, reducing the need for extensive consumer education by manufacturers.

Growing prevalence of hair loss coupled with benefits offered by aloe vera to cure the hair loss is another driving factor.

The occurrence of female pattern hair loss, for example, is estimated at 5% in women under 50 and 37% in those over 70. Studies show that aloe vera-based herbal treatments are effective in promoting hair growth. Aloe vera juice not only conditions and moisturizes hair but also helps reverse hair loss. Drinking aloe vera juice fosters hair growth, with its vitamins A, C, and E promoting healthy cell growth and shiny hair. Consequently, the rising incidence of hair loss is expected to boost demand for aloe vera juice.

Global Aloe Vera Juice Market Restraints and Challenges:

The side effects associated with over consumption of aloe vera may impede market growth.

The burgeoning market for aloe vera products, revered for their health benefits, faces a significant hurdle due to the potential side effects stemming from overconsumption. While aloe vera is celebrated for its therapeutic properties, excessive intake can lead to adverse health consequences. These include gastrointestinal issues such as cramps and diarrhea, electrolyte imbalances, and in severe cases, kidney problems. Such negative effects are increasingly becoming a matter of concern for health-conscious consumers and medical professionals alike. This growing awareness might lead to caution among potential buyers, thereby restraining the market's expansion. Companies in the aloe vera market may need to address these concerns by educating consumers about responsible usage and potentially exploring formulations with reduced risk of side effects to sustain market growth and consumer trust.

Strict regulatory norms present a significant challenge to the growth of the aloe vera juice market.

Globally, various governmental bodies impose rigorous standards and regulations on the processing and production of aloe vera juice. In the United States, USDA regulations outline specific guidelines for product description, packaging, aloe vera juice type, color, and flavor. The European Union, through Council Directive 2001/112/EC, sets forth detailed provisions for the production, composition, and labeling of fruit juices and similar products.

Global Aloe Vera Juice Market Opportunities:

Innovations in extraction techniques now enable the utilization of aloe vera juice in its purest form. Enhanced preservatives have successfully prolonged product shelf-life, meeting consumer expectations for quality and freshness. A growing trend is observed among producers in developing nations, introducing aloe vera gel products enriched with artificial sweeteners and fiber, consequently stimulating market demand. Moreover, as personal care companies venture into the aloe vera market, there is a strategic shift towards avoiding synthetic ingredients, a move aimed at heightening consumer appeal. These collective efforts underscore a dynamic market response to evolving consumer preferences, emphasizing natural purity, and sustainability in aloe vera-based products.

ALOE VERA JUICE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.01% |

|

Segments Covered |

By Product, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Forever Living Products (U.S.), Aloe Farms (U.S.), Tulip International Inc. (South Korea), Dabur Ltd. (India), Himalaya Wellness Company (India), Aloe Veda (India), Patanjali Ayurved Ltd. (India), Rattan Organic Foods Pvt. Ltd (India) |

Global Aloe Vera Juice Market Segmentation: By Product

-

Unflavored

-

Flavored

In 2023, unflavored aloe vera juice dominated the market, accounting for over 60% share, and is projected to continue leading through the forecast period. This variant is popular for its health benefits, such as liver detoxification and digestive aid, and is often consumed for hydration and immunity boosting.

Conversely, flavored aloe vera juice is expected to exhibit rapid growth, with a predicted CAGR of 11.6% from 2024 to 2030. This growth is driven by the shifting consumer preference towards nutritious, plant-based beverages over sugary drinks, particularly in regions with a growing vegan demographic like the U.S.

Global Aloe Vera Juice Market Segmentation: By Distribution Channel

-

Hypermarket & Supermarket

-

Pharmaceutical Stores

-

Online Sales Channel

Hypermarkets and supermarkets, holding more than 40% market share in 2023, are the predominant distribution channels, with their dominance expected to continue. Major brands are focusing on these channels for product promotion and are also expanding their physical store presence globally. The online sales channel, however, is forecasted to grow significantly, propelled by increasing digitalization, smartphone usage, and internet accessibility. Manufacturers are leveraging online platforms, including their websites and e-commerce portals, to enhance product visibility, particularly in emerging markets.

Global Aloe Vera Juice Market Segmentation: By Application

-

Food & Beverages

-

Medicine

-

Cosmetics & Skincare

The worldwide market for aloe vera juice is assessed and categorized based on demand and supply according to its applications in food & beverages, medicine, and cosmetics & skincare. Within these divisions, the cosmetics & skincare segment is projected to dominate the global aloe vera juice market, primarily due to the widespread incorporation of aloe vera juice and extracts in the formulation of diverse skincare products like moisturizers, facial serums, and eye creams. Aloe vera, recognized for its therapeutic and medicinal attributes, particularly for skin healing, contributes to the segment's anticipated growth. Furthermore, the swift expansion of the cosmetic and skincare sector is poised to further boost the segment's development throughout the forecast period.

Global Aloe Vera Juice Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, the Asia Pacific region dominates as the primary market for aloe vera drinks, commanding a market share surpassing 30%. The consumption of aloe-based beverages, a culturally ingrained tradition, is prevalent across various countries, including India, South Korea, and Japan. This popularity is attributed to the multitude of health advantages associated with aloe vera drinks, such as enhanced liver functionality, nutritional enrichment, improved hydration, and digestive benefits.

Concurrently, North America is poised to witness the most rapid regional market growth. Particularly in the United States, there is a notable surge in the demand for aloe-based beverages. This surge is fueled by the populace's increasing inclination towards adopting a healthier lifestyle, driven by the demands of their busy and hectic work schedules. Furthermore, the escalating prevalence of obesity provides a novel opportunity for the utilization of these efficacious aloe-based drinks in weight management strategies.

COVID-19 Impact Analysis on the Global Aloe Vera Juice Market:

The global Aloe Vera juice market encountered challenges and opportunities amid the COVID-19 pandemic. Initially, disruptions in the supply chain and lockdown measures posed significant challenges, affecting the raw material supply and distribution channels, resulting in a temporary sales decline. However, the heightened focus on health and immunity during the pandemic increased consumer interest in natural, health-enhancing products, leading to a surge in demand for Aloe Vera juice. This shift not only stabilized the market but also facilitated growth. Additionally, the pandemic accelerated the adoption of e-commerce in the Aloe Vera juice market, with manufacturers and retailers expanding their digital presence to reach a broader customer base, counteracting the impact of physical store closures. This shift to online shopping, coupled with sustained consumer interest in health and wellness, is expected to propel the Aloe Vera juice market post-pandemic.

Recent Trends and Developments in the Aloe Vera Juice Market:

A Dublin-based company named Veganic announced its intention to introduce Ireland's 100% organic and plant-based Aloe Vera fruit juices to the U.S. market. The company is set to launch its Aloe Vera with Apple juice, crafted from 100% organic Aloe Vera pulp and devoid of added sugars or artificial ingredients, across the United States. Aloe Vera fruit juices have historical roots traced back to ancient Egypt, referred to as the "plant of immortality." Veganic distinguishes itself by a commitment to producing only 100% organic and plant-based beverages with premium-quality ingredients, setting it apart from competitors.

Key Players:

-

Forever Living Products (U.S.)

-

Aloe Farms (U.S.)

-

Tulip International Inc. (South Korea)

-

Dabur Ltd. (India)

-

Himalaya Wellness Company (India)

-

Aloe Veda (India)

-

Patanjali Ayurved Ltd. (India)

-

Rattan Organic Foods Pvt. Ltd (India)

Chapter 1. Aloe Vera Juice Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aloe Vera Juice Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aloe Vera Juice Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aloe Vera Juice Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aloe Vera Juice Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aloe Vera Juice Market – By Product type

6.1 Introduction/Key Findings

6.2 Unflavored

6.3 Flavored

6.4 Y-O-Y Growth trend Analysis By Product type

6.5 Absolute $ Opportunity Analysis By Product type , 2024-2030

Chapter 7. Aloe Vera Juice Market – By Application

7.1 Introduction/Key Findings

7.2 Food & Beverages

7.3 Medicine

7.4 Cosmetics & Skincare

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Aloe Vera Juice Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Hypermarket & Supermarket

8.3 Pharmaceutical Stores

8.4 Online Sales Channel

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Aloe Vera Juice Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product type

9.1.3 By Application

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product type

9.2.3 By Application

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product type

9.3.3 By Application

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product type

9.4.3 By Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product type

9.5.3 By Application

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Aloe Vera Juice Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Forever Living Products (U.S.)

10.2 Aloe Farms (U.S.)

10.3 Tulip International Inc. (South Korea)

10.4 Dabur Ltd. (India)

10.5 Himalaya Wellness Company (India)

10.6 Aloe Veda (India)

10.7 Patanjali Ayurved Ltd. (India)

10.8 Rattan Organic Foods Pvt. Ltd (India)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Aloe Vera Juice Market size is valued at USD 1175 million in 2023.

The worldwide Global Aloe Vera Juice Market growth is estimated to be 13.01% from 2024 to 2030.

The Global Aloe Vera Juice Market is segmented By Product (Flavored, Unflavored); By Distribution Channel (Hypermarket & Supermarket, Pharmaceutical Stores, Online Sales Channel); By Application (Food & Beverages, Medicine, Cosmetics & Skincare).

The Global Aloe Vera Juice Market is poised for growth, driven by increasing consumer awareness of health and wellness, and a growing inclination towards natural and organic products. Future opportunities lie in harnessing e-commerce platforms for wider market reach and in product innovation, including the introduction of new flavors and enhanced formulations to cater to diverse consumer preferences.

COVID-19 initially disrupted the Aloe Vera Juice Market because of supply chain issues, but increased health consciousness among consumers led to renewed demand and e-commerce growth.