ALLOY STEEL MARKET SIZE (2024 - 2030)

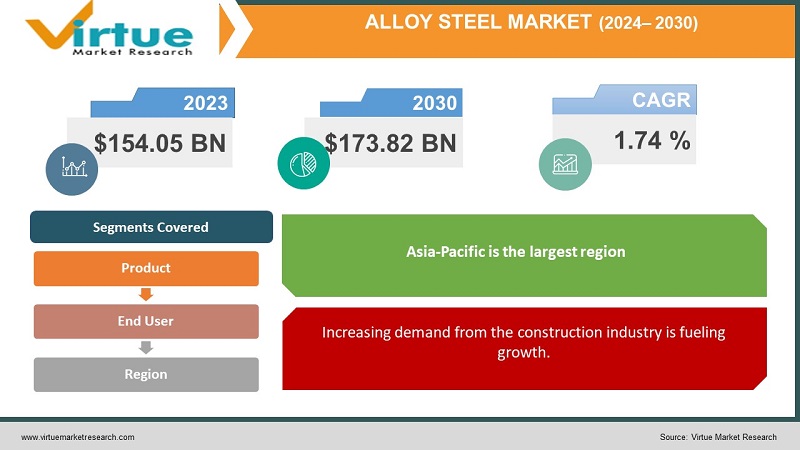

The Global Alloy Steel Market was valued at USD 154.05 billion and is projected to reach a market size of USD 173.82 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 1.74 %.

A kind of steel that has been alloyed with many elements is called alloy steel. These elements include silicon, boron, chromium, manganese, nickel, chromium, platinum, and vanadium. Strength, hardness, toughness, wear resistance, and other mechanical qualities are enhanced by alloying this with a range of elements in total quantities between 1.0% and 50% by weight. This market has had a historical presence in the past owing to its applications in end-user industries like automotive, construction, aerospace, mining, and many more. Currently, due to globalization, worldwide operations, and technological advancements, this market has expanded tremendously. In the future, with a growing focus on advanced materials, sustainability, and emerging innovations, this market will see significant growth. During the forecast period, notable growth is anticipated.

Key Market Insights:

The total amount of alloy steel produced in India as of 2022 was close to six million metric tons. China was the world's top producer of steel as of 2020, with India coming in second.

Special steels make up a sizable portion of the overall output. In 2022, alloy steels accounted for 56% of total output.

Approximately 2.6 million metric tons of alloy and stainless steel were imported by India by the end of 2022.

Shanghai-based Baowu recorded sales of about 98 billion US dollars for the fiscal year that concluded on or before March 31, 2021, dwarfing all other firms as the world's largest iron and steel manufacturer in terms of revenue, including Luxembourg-based ArcelorMittal.

Nickel prices on the London Metal Exchange (LME) fluctuated a lot in 2021, averaging between $15,000 and $20,000 per metric ton. This demonstrated a notable fluctuation in price throughout that year, which was caused by changes in global demand, supply chain interruptions, geopolitical events, and market speculation. As a result, cost-effectiveness was being emphasized along with maintaining quality.

Alloy Steel Market Drivers:

Increasing demand from the construction industry is fueling growth.

Alloy steel has several benefits. It helps to enhance robustness and longevity. Secondly, because alloy steel is stronger and more durable than regular steel, it's perfect for hard jobs like building bridges or running large machinery. Thirdly, it has various compounds like manganese, nickel, chromium, molybdenum, and vanadium. Manganese decreases brittleness and increases tensile strength. Nickel promotes corrosion resistance, hardness, and power. Chromium carbides make steel tougher. Molybdenum improves sliding resistance. Vanadium increases hardness and wear resilience. Besides, urbanization has caused a lifestyle change. Economic conditions have improved. This has raised the infrastructure activities. Furthermore, an upsurge in population is aiding market expansion.

Rising applications in the automobile sector have been contributing to market expansion.

The production of motor vehicle components, such as gears, crankshafts, axles, camshafts, cylinder heads, and other engine parts, has been made possible by the exceptional performance of high-strength low alloy steel. The automotive industry has been expanding continuously due to public demand. Many people have started to invest in buying automobiles due to cost-effectiveness, the rising middle class, and increasing disposable income. Vehicles are being equipped with unique features and advancements, making them attractive. Furthermore, there is a growing demand for electric vehicles owing to their economic friendliness. Electric 2-wheelers have gained immense popularity. Increasing consumer awareness about the environment is predicted to escalate the market.

Alloy Steel Market Restraints and Challenges:

Cost fluctuation, sophisticated methods, and ecological issues are the main problems that the market is currently experiencing.

Volatility in prices is the biggest hindrance. The raw materials used for manufacturing and production are very expensive. Secondly, complex procedures are involved regarding the maintenance of temperature, pressure, and other environmental factors. They are more difficult to weld than carbon steel, coupled with corrosion hurdles. Moreover, they have a lower melting point. Besides, quality control can be time-consuming and challenging. This can further increase the funding. Thirdly, environmental concerns can hamper market growth. The production process consumes a lot of energy and resources. Furthermore, it can lead to waste accumulation, the emission of harmful substances contributing to pollution, and water contamination disrupting the aquatic ecosystem.

Alloy Steel Market Opportunities:

Technological advancements have been providing the market with an ample number of possibilities. R&D activities are being carried out to advance metallurgy to improve quality, corrosion, durability, etc. Recycling techniques are being given prominence to reduce waste generation. Work is being carried out to find alternative and advanced materials. Innovations in product development with catered and customized needs are helping the market develop. The renewable energy sector has increased the employment of these materials. Startups are coming up with creative solutions for sustainable methods.

ALLOY STEEL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

1.74% |

|

Segments Covered |

By Product, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ArcelorMitta, POSCO (Pohang Iron and Steel Company), Nippon Steel Corporation), ThyssenKrupp AGJFE Steel Corporation, Baosteel Group Corporation, Tata Steel, JSW Steel , SAIL (Steel Authority of India Limited) , Voestalpine AG |

Alloy Steel Market Segmentation:

Market Segmentation: By Product:

-

High Alloy Steel

-

Low Alloy Steel

Low alloy steel is the largest segment based on product type. Great strength may be obtained from low-alloy steel, surpassing the strength of several high-strength martensitic stainless steels, such as MTEK M-152, which also offers great corrosion resistance. Because of this, low alloy steel might be the best option for high-strength applications where corrosion resistance and other qualities are not as important. It is a popular choice in construction, automotive, and other machinery-based equipment. Moreover, it improves formability and mechanical properties. High-alloy steel is considered to be the fastest-growing because its strength, toughness, hardness, and creep resistance are enhanced when heated to a particular temperature. Additionally, corrosion resistance and machinability are improved. Furthermore, it even fortifies the characteristics of other alloying elements. Apart from this, its increasing usage in the industries of energy & power, aerospace & defense, and oil & gas is aiding progress.

Market Segmentation: By End User:

-

Building & Construction

-

Automotive

-

Mining

-

Aerospace & Defence

-

Energy & Power

-

Electrical & Electronics

-

Others

Based on end users, the building & construction segment is the most dominant segment. This is because of changes in lifestyle, preference, urbanization, industrialization, economic stability, global operations, and the need for infrastructure development, tourism, a rise in projects, and a growing population. Additionally, the benefits of steel alloys like durability, longevity, resistance to corrosion, strength, harness, and ease of usage contribute to their flourishment. This segment holds a share exceeding 50%. The automotive segment is also among the leading categories owing to the need for high-strength materials, applications, advancements, and extensive usage. The energy & power industry is one of the fastest-growing due to increased emphasis on sustainability, demand for solar panels and wind turbines, their ability to withstand harsh environments, and utilization in support structures, towers, and other structural components.

Market Segmentation: Regional Analysis:

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

With a roughly 40% share, Asia-Pacific is the largest region. The population, mass production, growing industry, urbanization, globalization, presence of key companies, demand, funds, import-export trade activities, and economic advancements are the causes of this. Additionally, this helps strengthen the region of Asian countries, thereby boosting growth. As per Statista, nearly 25% of the global special steel market in 2020 came from the high-strength steel category, with a total market value of 214.8 billion US dollars. By 2027, the special steel market is projected to grow to a size of almost 363 billion dollars. Countries among the top three include China, India, and Japan. North America is among the regions with the quickest growth rates because of factors including increased demand, utilization in a variety of sectors, creative startups, product diversification, partnerships, and changes in lifestyle, investments, government support, and sustainability-related activities. The United States and Canada stand at the forefront. The total share of this region is approximately 22%. Europe, with countries like Germany, the United Kingdom, and Italy, is also showing significant development owing to environmental-friendly initiatives, technological innovations, demand, and utilization in the automotive sector.

COVID-19 Impact Analysis on the Global Alloy Steel Market:

The outbreak of the virus hurt the market. The new normal included social isolation, movement limitations, and lockdowns. Transportation, logistics, and the supply chain were all affected by this. Import-export trade activity suffered greatly as a result. In addition, a labor shortage created operational difficulties. Numerous businesses and production facilities were closed. These all contributed to the economic collapse. Moreover, there was an increased environmental consciousness. This led to the incorporation of sustainable products.

Latest Trends/ Developments:

The companies in this market are motivated to achieve a higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are also spending heavily to improve existing technologies while maintaining competitive pricing.

Organizations in the market are focusing on augmenting their operations globally. The supply chain is being optimized. Industrialization and economic stability are helping the market. Asian countries have shown momentous progress in their expansion. All nations are systematizing their trade activities, international laws, and other regulations.

Key Players:

-

ArcelorMittal

-

POSCO (Pohang Iron and Steel Company)

-

Nippon Steel Corporation

-

ThyssenKrupp AG

-

JFE Steel Corporation

-

Baosteel Group Corporation

-

Tata Steel

-

JSW Steel

-

SAIL (Steel Authority of India Limited)

-

Voestalpine AG

In June 2023, in partnership with Oak Ridge National Laboratory, engine maker Cummins created a high-temperature steel alloy (ORNL). Since 2018, Cummins has been collaborating with Oak Ridge National Laboratory to create a novel alloy that it claimed was stronger at high temperatures than commercial steel that is typically used and that has virtually eliminated several deterioration routes.

In February 2023, an agreement was inked between Hindustan Aeronautics Limited (HAL), the Foundry & Forge (F&F) Division, Saarloha Advanced Materials Pvt Ltd (Saarloha), and Bharat Forge Limited (BFL) to work together on the research and manufacturing of steel alloys of aeronautical quality. The country's ability to produce aerospace-grade raw materials would lessen its reliance on foreign original equipment manufacturers and enable Hindustan Aeronautics Ltd to uphold its promise to the armed services.

In November 2021, Kanthal joined a team-based investigation on electrifying steel manufacturing. The project aimed to promote the shift away from conventional gas-powered heating by optimizing electric heating solutions for large-scale furnaces, which could have a significant impact on lowering CO2 emissions in the steel sector. The project will involve electric heating simulations with various parameters that are tailored for low alloy steel and stainless steel.

Chapter 1. GLOBAL ALLOY STEEL MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL ALLOY STEEL MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL ALLOY STEEL MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL ALLOY STEEL MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL ALLOY STEEL MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL ALLOY STEEL MARKET – By Product

-

- High Alloy SteeL

- Low Alloy Steel

Chapter 7. GLOBAL ALLOY STEEL MARKET – By End User

7.1. Building & Construction

7.2. Automotive

7.3. Mining

7.4. Aerospace & Defence

7.5. Energy & Power

7.6. Electrical & Electronics

7.7. Others

Chapter 8. GLOBAL ALLOY STEEL MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Product

8.1.3. By End User

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By End User

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By End User

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By End User

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By End User

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL ALLOY STEEL MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. ArcelorMittal

9.2. POSCO (Pohang Iron and Steel Company)

9.3. Nippon Steel Corporation

9.4. ThyssenKrupp AG

9.5. JFE Steel Corporation

9.6. Baosteel Group Corporation

9.7. Tata Steel

9.8. JSW Steel

9.9. SAIL (Steel Authority of India Limited)

9.10. Voestalpine AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Alloy Steel Market was valued at USD 154.05 billion and is projected to reach a market size of USD 173.82 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 1.74 %.

Increasing demand from the construction industry and rising applications in the automobile sector are propelling the Global Alloy Steel Market

Based on End Users, the Global Alloy Steel Market is segmented into Building & Construction, Automotive, Mining, Aerospace & Defence, Energy & Power, Electrical & Electronics, and Others.

North America is the most dominant region for the Global Alloy Steel Market.

ArcelorMittal, POSCO (Pohang Iron and Steel Company), and Nippon Steel Corporation are the key players operating in the Global Alloy Steel Market.