Allomones Market Size (2025 – 2030)

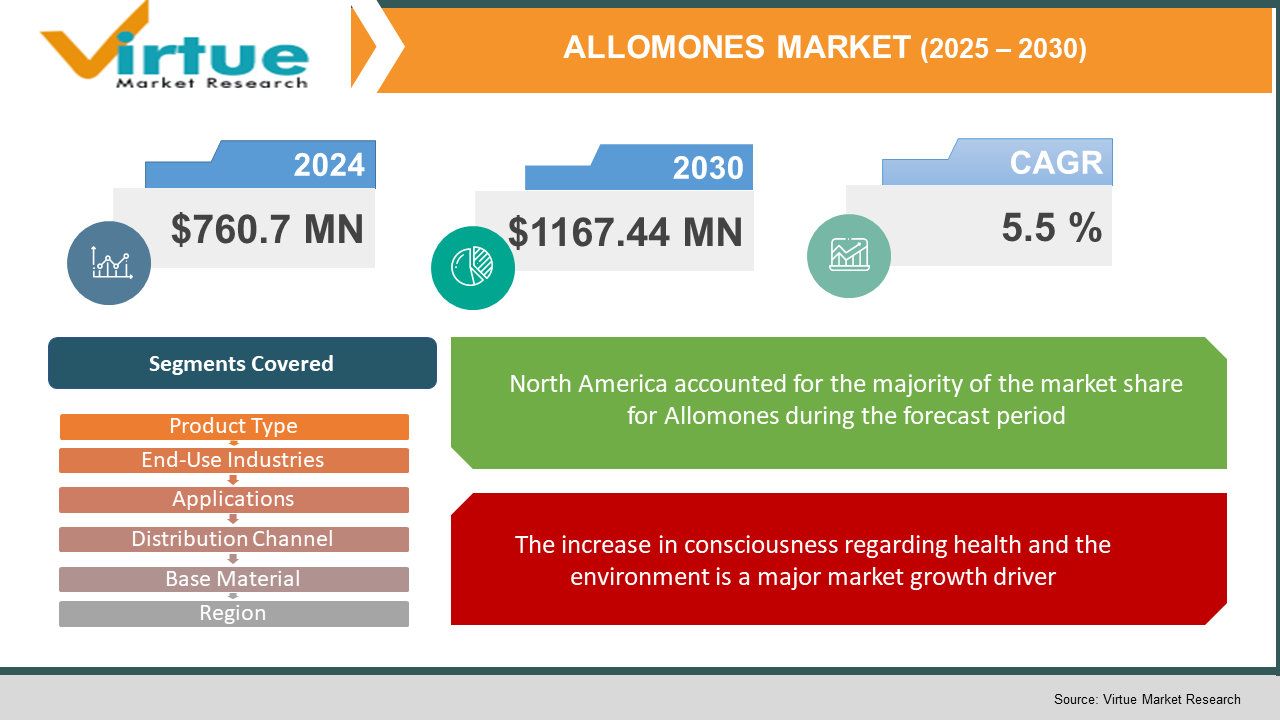

The Global Allomones Market was valued at USD 760.7 million and is projected to reach a market size of USD 1167.44 million by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.5%.

As businesses more and more appreciate the advantages of natural and artificial allomones for pest control, repellent uses, and several bio‑control techniques, the worldwide allomones market is dynamically expanding. From agricultural pest control to improving the efficiency of cosmetic and pharmaceutical products, allomones, chemical signals created by one species to affect the behavior of another, have widespread application. Rising environmental worries and a worldwide move toward eco-safe, non-toxic solutions are driving demand for allomones across several end-use industries. Advanced research in formulation and biochemistry is producing clever items that increase effectiveness and output, while good regulatory changes and increasing consumer knowledge help drive market expansion even further.

Key Market Insights:

- More than 65% of agricultural operators mention better crop yields from allomone-based pest control, which lowers pesticide application.

- More than 70% of people choose organic, biologically based ingredients for cosmetic and health uses.

- Research and development in controlled-release systems and encapsulation has tripled product performance.

- Strong industrial and agricultural investments helped Asia‑Pacific's share reach more than 40%.

Allomones Market Drivers:

The rise in legalization and the evolution of the regulatory environment are acting as a key growth drivers for the market.

Major expansion in the allomones industry is being driven by worldwide changes in attitude and legislation of natural and plant-derived substances. Many areas, especially in North America and Europe, have relaxed rules on the use of biological control agents and natural pesticides, whereas developing economies in Latin America are little by little embracing more lenient regulations. This changing regulatory context lowers legal obstacles to market entry and strengthens consumer and industrial trust in allomone-based solutions. For example, modern regulatory changes in important markets have simplified approval procedures for natural pesticides, enabling companies to introduce creative goods at a faster pace to market. Manufacturers can invest more confidence in R&D as regulatory norms keep harmonizing globally, mostly driven by environmental and public health concerns, to produce high-efficacy goods quickly accepted on the market and to drive long-term growth.

The increase in consciousness regarding health and the environment is a major market growth driver.

Consumer and regulatory demand for non-toxic, environmentally friendly alternatives to conventional pesticides and synthetic chemicals is markedly rising. Heightened awareness about the adverse effects of chemical pesticides on both health and the environment has spurred a shift toward natural, biologically derived solutions. Studies have demonstrated that the adoption of allomones can reduce pesticide usage by up to 50%, contributing to more sustainable and eco-friendly agricultural practices. Concurrent with this, sectors including pharmaceuticals and cosmetics are starting to include allomones into products to appeal to consumers serious about their health. The worldwide move toward sustainable agriculture and green chemistry also serves to strengthen this trend and drive increased adoption of allomone-based goods. Rising demand for allomones as shoppers get more knowledgeable about the advantages of pure, natural ingredients drives manufacturers to broaden their product portfolio and increase quality to satisfy changing demands.

The recent technical advancements in the formulation and delivery systems are seen as a great market driver.

By changing the processing and delivery of allomones, technological innovation is arming manufacturers with instruments to improve product effectiveness and stability. Development in chemical engineering and biotechnology that is, microencapsulation, nanotechnology, and controlled-release systems, has allowed for the creation of allomones with better bioavailability, long shelf life, and precise delivery. These technological advances guarantee that active ingredients keep their power across years and even under changing environmental circumstances. Furthermore, developments in purification methods and extraction techniques have resulted in better product quality and improved performance. These developments enable a varied product line that satisfies particular industry and consumer requirements, so increasing company investment in R&D strengthens market penetration and propels innovation in many sectors of application.

The recent expansion in the application scope is a market driver too, giving the market a chance to expand into diverse industries.

Allomones are increasingly accepted across a broad range of sectors, so their conventional use in agriculture is turning into new uses in cosmetics, pharmaceuticals, and industrial processes. In agriculture, allomones are growing used as environmentally friendly pesticide control agents that provide a natural alternative to synthetic chemicals, which is vital for sustainable crop management. Concurrently, in cosmetics as well as in personal care, allomones are appreciated for their natural repellent and skin-beautifying effects, therefore matching the clean beauty movement. Allomones are being included in inventive therapeutic formulas in the pharmaceutical industry to improve product effectiveness and patient responses. Furthermore, developing specialized fields with great promise is industrial uses such as integrated pest management and bio-preservation. This portfolio not only enlarges the complete market footprint but also generates several revenue flows, hence offering companies excellent chances to be creative and capture premium segments in a challenging environment.

Allomones Market Restraints and Challenges:

The production cost for this market is very high, thus posing a major challenge faced by the market.

Cutting-edge extraction, exclusion, and encapsulation technologies are needed to create high-quality allomones from natural sources, in particular. Subcritical fluid extraction for organic compounds, high-level chromatography for purification, and complex encapsulation technologies to guard and regulate the release of active components call for extensive financial resources using processes used. To guarantee batch-to-batch consistency, which is essential for performance, manufacturers have to have their plants provided with special equipment and keep strict standards of quality assurance to Operational expenses remain high since these activities are energy-demanding and depend on high-purity starting ingredients. Smaller businesses and those in cost-conscious sectors have difficulties in expanding production without lowering standards, which might restrict market penetration and keep end-product prices high, thus possibly damaging price-sensitive competition in other markets.

The lack of standardization is another big challenge faced by the market, hindering its growth.

There are no universal guidelines for preparation, strength, and labeling in the allomones industry today. As allomones can be synthesized in the laboratory from a great range of natural sources or derived, the composition and performance of the end product vary greatly. This discrepancy complicates the certification process and hinders regulatory agencies from defining clear quality criteria. This leads to uncertainty and decreased confidence since consumers could experience variances in product efficiency. This slows general innovation and hampers marketing efforts since firms then find it hard to compare their goods against rivals. Further constraints on cross-border commerce and potential slowing of the fast expansion of high-quality allomone goods into new markets result from the lack of industry-standard procedures for testing and quality control.

The existence of a high level of variability in the supply chain is a great market challenge, as it makes it difficult for the market to expand.

Allomones’ production depends greatly on natural ingredients, including specific minerals and plant extracts. These resources can upset supply chains via seasonal variations, environmental changes, and political movements. For example, weather-related events such as droughts or excessive rainfall could have a significant influence on crop yields, therefore causing scarcities or price fluctuations for natural extracts. Furthermore, geopolitical conflicts or trade barriers in important sourcing areas might interfere with supply and raise expenses, therefore influencing total production efficiency. Such variation can lead to delivery delays and poor product quality, which threaten the capacity of companies to keep a consistent output. Although it is crucial, the complexity and cost of operations can often be reduced by good supply chain management and varied use of sourcing techniques.

The market faces a great challenge from strict regulations and legal challenges, which affect the growth of the market.

The rules covering allomone items vary widely from one area to another. Significant compliance issues arise from the many regulations different countries and areas impose on food content disclosure, packaging, and health claims. Before goods may be approved for market entry, regulatory authorities can require rigorous testing, medical trials, and qualifications. These activities raise production costs as well as lengthen the time-to-market for new goods. Moreover, companies have to constantly adjust their recipes and quality control processes given changing consumer safety worries and environmental factors that drive regular changes to legislation. For companies working worldwide, negotiating these complex regulatory systems calls for significant investment in legal and technical knowledge, therefore possibly slow down innovation and restrict fast market expansion.

Allomones Market Opportunities:

Developing nations are the emerging markets for this market, giving it an opportunity to expand its reach.

Allomone products have great chances in emerging continents, including Asia-Pacific, Latin America, and Africa. Fast industrialization and growing disposable incomes in these areas are driving up customer awareness of organic and eco-friendly alternatives. Government programs, particularly those supporting sustainable agriculture and integrated pest management, are setting the stage for the acceptance of natural allomones in industrial as well as agricultural uses. Moreover, increasing consumer interest in clean and organic goods as urbanization quickens is a driving force for the cosmetic and personal care industries to include allomones in their products. In these high-growth areas, companies that customize their products to fit local cultural and environmental preferences and that utilize modern digital outlets (e-commerce, social media) as well as established traditional distribution networks can effectively reach previously untapped market segments and generate new profit flows.

The market has an opportunity to expand into new areas of application, providing it a chance to grow.

Once used primarily for pest control in agriculture, allomones can be used in several other sectors. In the field of cosmetics, for their non-toxic preservative and repellent qualities, natural allomones are valued as well as in healthcare and pharmaceuticals for innovative therapeutic compositions; therefore, emerging possibilities are being investigated. For instance, ongoing studies are working to include allomones in non-toxic deodorants, natural food and drink preservatives, and even in compounds meant for wound treatment or anti-inflammatory uses. In addition to providing fresh value propositions that allow businesses to distinguish their items in a competitive sector, this diversification of sources also opens up premium segments with greater profit margins. Expanding into non-conventional markets helps businesses to reduce risks related to market saturation in agriculture and reach new customer bases, focusing on health, sustainability, and natural ingredients.

The recent advancement in the field of technology is seen as a great opportunity for market growth.

Constant investments in advanced formulation technologies significantly enhance the effectiveness, stability, and shelf life of allomone goods. Precise distribution of active components is made possible by new approaches such as microencapsulation, controlled release systems, and nanotechnology, therefore preserving the functional advantages over time. These developments produce goods that meet rigorous safety and quality standards and routinely operate under several different environmental conditions. By providing concrete advantages, better manufacturing processes improve consumer trust and enable product tailoring to meet particular uses or consumer needs. This technical development allows businesses to improve manufacturing processes, minimize waste, and demand premium pricing in niche sectors, in addition to driving product differentiation by itself.

The efforts made regarding strategic collaboration and standardization are said to be a good market opportunity to bring in innovations.

Industry players have a great chance to set uniformity across product formulations, quality benchmarks, and testing techniques as the allomones industry develops. Driving industry-wide best practices and innovation depends on cooperative work among technology providers, government agencies, research institutions, and manufacturers. Sharing of R&D investments and technological knowledge through joint ventures and strategic alliances helps to minimize the risk and cost linked with creating next-generation allomone goods. Standardization efforts may streamline regulatory clearance, increase product homogeneity, and worldwide create consumer trust by means of them. Collaborating will allow sector participants to reduce manufacturing expenditures, overcome market fragmentation, and hasten the global growth of high-quality allomone goods.

ALLOMONES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Product Type, BASE MATERIAL, Application, end user industries, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF Dow Chemical, Syngenta AG, Bayer CropScience, BASF Plant Science, Corteva Agriscience, FMC Corporation, Nufarm Limited, Sumitomo Chemical, Adama Agricultural Solutions |

Allomones Market Segmentation:

Allomones Market Segmentation: By Product Type

- Natural Allomones

- Synthetic Allomones

- Modified Allomones

The Natural Allomones segment dominates because consumers wish to have natural, free-of-chemical items. They are naturally sourced and popular for their environmentally friendly profile. The Modified Allomones is the fastest-growing segment because of their capacity for precise performance and improved stability, using either natural or synthetic ingredients customized for particular uses. The Synthetic Allomones are chemically synthesized for scalability and uniformity.

Allomones Market Segmentation: By Application

- Pest Control

- Repellants

- Attractants

- Others

Here, the pest control segment dominates the market, and the repellants segment is the fastest-growing segment. Pest control is dominant, as a conventional and long-established application. It is utilized mostly in agriculture to handle pests without strong chemicals. Increasing use of environmentally friendly pest control techniques is driving the repellent segment’s rapid growth. Attractants are used in integrated pest management to draw pests for control or observation. The others segment includes new uses in food preservation or cosmetics.

Allomones Market Segmentation: By End-Use Industries

- Agriculture

- Pharmaceuticals

- Cosmetics

- Others

The agricultural segment dominates the market because of the great need for non-toxic pest control. It is mainly used in sustainable pest management and crop protection. The cosmetics segment is the fastest-growing, as brands are emphasizing clean beauty and natural ingredients are rapidly expanding. Included in natural skincare formulations. In the pharmaceutical segment, it is used in health formulations and natural preservative ingredients. The Other segment includes food and beverage uses among niche sectors.

Allomones Market Segmentation: By Distribution Channel

- Direct Sales

- Distributors

- Online Retail

Here, the direct sales segment dominates the market, since high-value agreements and bulk buys are immediately handled. It includes sales straight to significant industrial consumers or huge agricultural cooperatives. Whereas, the online retail segment is the fastest-growing segment in the market, due to digital transformation and improved availability. In regional and developing markets, distributors are intermediaries that help in expanding market exposure.

Allomones Market Segmentation: By Base Material

- Biochemical

- Synthetic

The biochemical segment dominates this market, due to consumer demand for organic components. Extracted from plants or other natural sources, they are preferred for clean-label products. The synthetic segment is the fastest-growing segment. Synthetic allomones are growing rapidly in applications where cost efficiency and consistency are critical. These are created in a laboratory for constant quality and a higher volume output of allomones.

Allomones Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

The North American region is the leader of the market, because of developed agricultural and cosmetics sectors and strict consumer safety standards, therefore a highly regulated mature market with strong use of groundbreaking agriculture techniques and clean-label goods. The Asia-Pacific region is said to be the fastest-growing region of the market, driven by major infrastructural investments, government initiatives, and an expanding middle-class population.

Europe is considered a developed market with an emphasis on green initiatives and sustainability. Whereas, South America and the MEA regions are considered emerging markets due to growing natural product use and improved distribution channels.

COVID-19 Impact Analysis on the Global Allomones Market:

Consumers and businesses looking for environmentally sensitive alternatives to synthetic chemicals drove pressure for natural and sustainable solutions, including allomones, during the COVID‑19 epidemic. Rising health worries over chemical residues and disruptions to conventional pesticide supplies in the agriculture industry drove a boom in the use of natural allomone-derived pest control methods. Furthermore, driving digital transformation and e-commerce growth, the epidemic opened up more direct consumer access for companies. Short-lived difficulties arose from supply chain disturbances and regulatory setbacks during the epidemic, but these forced firms to increase their investments in more resilient production and logistics networks. Renewing three emphases on sustainability and natural ingredients in many end-use sectors, the post-pandemic scene has accelerated long-term expansion.

Latest Trends/ Developments:

Consumer trends increasingly favor allomone formulations that emphasize organic and natural origins, supporting "clean-label" beauty and agricultural products.

Improvements in microencapsulation are increasing the stability and controlled-release of active ingredients in allomone formulations, therefore raising effectiveness and shelf-life.

Companies are using digital platforms and e-commerce to connect with small customers and niche markets, therefore boosting general market expansion.

Rising environmental consciousness is driving more attention to sourcing renewable raw ingredients and using ecologically friendly production methods, therefore appealing both legally and consumer-wise.

Key Players:

- BASF

- Dow Chemical

- Syngenta AG

- Bayer CropScience

- BASF Plant Science

- Corteva Agriscience

- FMC Corporation

- Nufarm Limited

- Sumitomo Chemical

- Adama Agricultural Solutions

Chapter 1 Allomones Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2 Allomones Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3 Allomones Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4 Allomones Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5 Allomones Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6 Allomones Market – By Product Type

6.1 Introduction/Key Findings

6.2 Natural Allomones

6.3 Synthetic Allomones

6.4 Modified Allomones

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7 Allomones Market – By Application

7.1 Introduction/Key Findings

7.2 Pest Control

7.3 Repellants

7.4 Attractants

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8 Allomones Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Distributors

8.4 Online Retail

8.5 Y-O-Y Growth trend Analysis Distribution Channel

8.6 Absolute $ Opportunity Analysis Distribution Channel , 2025-2030

Chapter 9 Allomones Market – By Base Material

9.1 Introduction/Key Findings

9.2 Biochemical

9.3 Synthetic

9.4 Y-O-Y Growth trend Analysis Base Material

9.5 Absolute $ Opportunity Analysis Base Material , 2025-2030

Chapter 10 Allomones Market – By End-User

10.1 Introduction/Key Findings

10.2 Agriculture

10.3 Pharmaceuticals

10.4 Cosmetics

10.5 Others

10.6 Y-O-Y Growth trend Analysis End-User

10.7 Absolute $ Opportunity Analysis End-User , 2025-2030

Chapter 11 Allomones Market, By Geography – Market Size, Forecast, Trends & Insights

11.1. North America

11.1.1. By Country

11.1.1.1. U.S.A.

11.1.1.2. Canada

11.1.1.3. Mexico

11.1.2. By End-User

11.1.3. By Base Material

11.1.4. By Distribution Channel

11.1.5. Application

11.1.6. Product Type

11.1.7. Countries & Segments - Market Attractiveness Analysis

11.2. Europe

11.2.1. By Country

11.2.1.1. U.K.

11.2.1.2. Germany

11.2.1.3. France

11.2.1.4. Italy

11.2.1.5. Spain

11.2.1.6. Rest of Europe

11.2.2. By End-User

11.2.3. By Base Material

11.2.4. By Distribution Channel

11.2.5. Application

11.2.6. Product Type

11.2.7. Countries & Segments - Market Attractiveness Analysis

11.3. Asia Pacific

11.3.1. By Country

11.3.1.2. China

11.3.1.2. Japan

11.3.1.3. South Korea

11.3.1.4. India

11.3.1.5. Australia & New Zealand

11.3.1.6. Rest of Asia-Pacific

11.3.2. By End-User

11.3.3. By Base Material

11.3.4. By Distribution Channel

11.3.5. Application

11.3.6. Product Type

11.3.7. Countries & Segments - Market Attractiveness Analysis

11.4. South America

11.4.1. By Country

11.4.1.1. Brazil

11.4.1.2. Argentina

11.4.1.3. Colombia

11.4.1.4. Chile

11.4.1.5. Rest of South America

11.4.2. By End-User

11.4.3. By Base Material

11.4.4. By Distribution Channel

11.4.5. Application

11.4.6. Product Type

11.4.7. Countries & Segments - Market Attractiveness Analysis

11.5. Middle East & Africa

11.5.1. By Country

11.5.1.1. United Arab Emirates (UAE)

11.5.1.2. Saudi Arabia

11.5.1.3. Qatar

11.5.1.4. Israel

11.5.1.5. South Africa

11.5.1.6. Nigeria

11.5.1.7. Kenya

11.5.1.11. Egypt

11.5.1.11. Rest of MEA

11.5.2. By End-User

11.5.3. By Base Material

11.5.4. By Distribution Channel

11.6.5. Application

11.5.6. Product Type

11.5.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12 Allomones Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

12.1 BASF

12.2 Dow Chemical

12.3 Syngenta AG

12.4 Bayer CropScience

12.5 BASF Plant Science

12.6 Corteva Agriscience

12.7 FMC Corporation

12.8 Nufarm Limited

12.9 Sumitomo Chemical

12.10 Adama Agricultural Solutions

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growing popularity of organic ingredients and natural pest control powers the expansion of this market.

Harmonized rules lower obstacles and increase consumer confidence, therefore driving market growth.

Geopolitical conditions and environmental fluctuations cause raw material instability in the market.

Particularly in developing areas, e-commerce and digital channels increase market reach, helping the market to grow.

Clean, organic options are becoming more popular; cosmetics and agriculture sectors seem to be quite promising segments in this market.