Alkylating Agents Market Size (2025 – 2030)

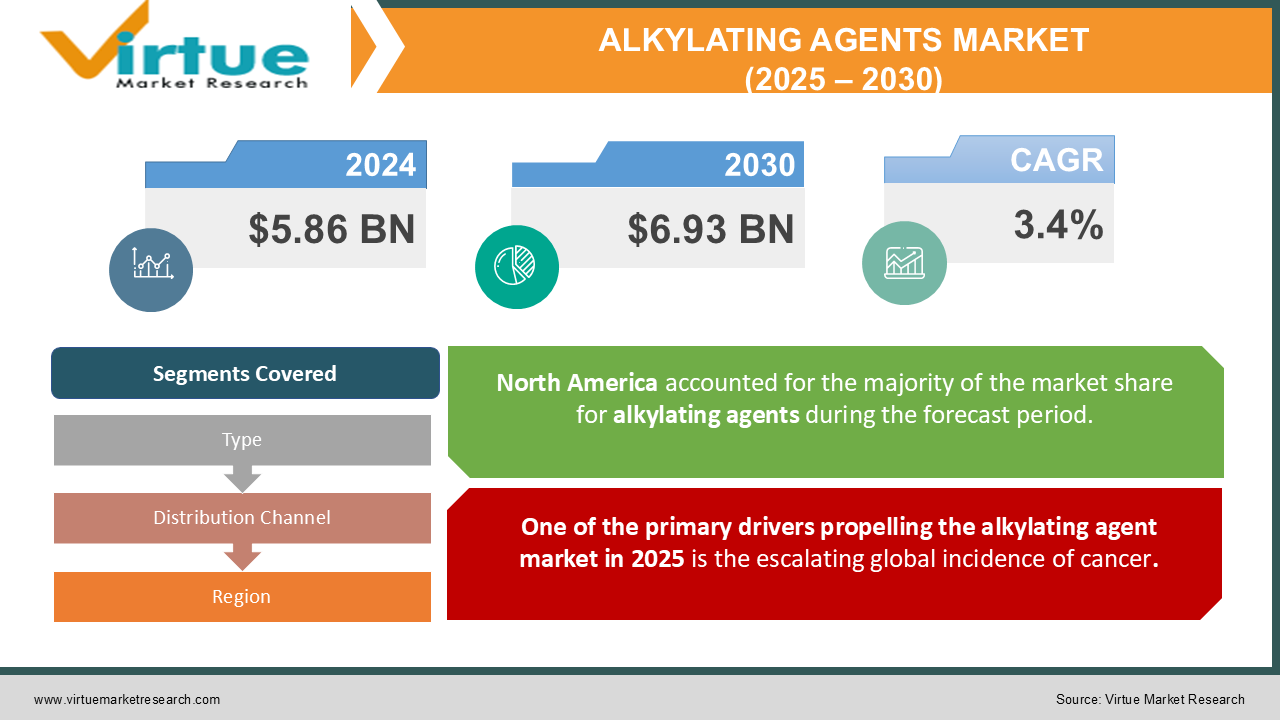

The Alkylating Agents Market was valued at USD 5.86 Billion in 2024 and is projected to reach a market size of USD 6.93 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 3.4%.

The global market for alkylating agents in 2024 is characterized by its dynamic evolution in response to the rising incidence of cancer and continuous advancements in pharmaceutical research and development. Alkylating agents, which form a critical category of chemotherapeutic drugs, operate by damaging the DNA of malignant cells, thereby inhibiting their ability to replicate and spread. This fundamental mechanism has rendered them indispensable in oncology, where they are applied either as monotherapy or in combination with other treatment modalities. Over the past years, the market has experienced significant shifts driven by increased investment in R&D, evolving clinical practices, and the launch of novel formulations that offer improved patient outcomes.

Key Market Insights:

-

In 2024, the alkylating agents market generated approximately USD 8.5 billion in total sales.

-

Over 45 new clinical trials focusing on alkylating agents were initiated in 2024.

-

2024.

-

Regulatory bodies approved an average of 5 new alkylating agent formulations in major markets during 2024.

-

Clinical trials in advanced oncology enrolled over 3,200 patients collectively this year.

-

Sales of orally administered alkylating agents surged by nearly 40% in 2024.

-

Over 1,500 patents pertaining to novel alkylating agent formulations were filed throughout the year.

-

There were 12 strategic research collaborations established between pharmaceutical companies and academic institutions.

-

Post-market surveillance programs initiated over 500 comprehensive studies on safety and efficacy.

-

Training initiatives in 2024 resulted in approximately 4,000 healthcare professionals being certified in advanced oncology treatment protocols.

Market Drivers:

One of the primary drivers propelling the alkylating agent market in 2025 is the escalating global incidence of cancer.

With a steady rise in cancer diagnoses worldwide, the demand for effective chemotherapy options has intensified. The increasing prevalence of various types of cancers—from common solid tumors to rarer hematologic malignancies—has necessitated a broader deployment of alkylating agents as a core component of oncologic therapy. This surge in cancer incidence can be attributed to several factors including aging populations, lifestyle changes, environmental exposures, and improved diagnostic capabilities. As more individuals are diagnosed at earlier stages due to enhanced screening programs, the clinical reliance on established treatments such as alkylating agents has grown significantly. As a result, pharmaceutical companies are investing robustly in research and development to fine-tune the efficacy of alkylating agents while mitigating their side effects. This ongoing innovation has led to the emergence of novel drug formulations that provide improved safety profiles, reduced toxicity, and enhanced patient outcomes. The increasing demand is further amplified by a growing patient population that seeks therapies that offer a balance between efficacy and quality of life. In this context, the rising global incidence of cancer is not only a catalyst for market expansion but also a driving force for continuous improvement and innovation within the alkylating agent segment.

Another compelling driver for the 2025 alkylating agents market is the significant technological progress and increased investments in research and development.

The relentless pursuit of innovation in drug discovery has transformed the landscape of oncology therapeutics. Pharmaceutical companies are channeling substantial resources into the development of next-generation alkylating agents, which are designed to maximize the destruction of cancer cells while minimizing collateral damage to healthy tissues. Advancements in molecular biology and precision medicine have enabled scientists to identify new drug targets and to engineer molecules with enhanced selectivity and potency. This evolution is critical in addressing the limitations of earlier generations of alkylating agents, particularly concerning toxicity and resistance. Furthermore, strategic partnerships between biotechnology firms, academic institutions, and established pharmaceutical companies have led to a collaborative environment that fosters innovation. Joint ventures and co-development agreements have resulted in shared expertise, reduced research costs, and expedited regulatory approvals. The increased flow of venture capital and government funding into oncology research has further accelerated the pace of discovery. In 2024, these investments have manifested in a notable increase in the number of breakthrough formulations and novel drug delivery systems, which are reshaping the treatment landscape.

Market Restraints and Challenges:

Despite the considerable advancements and growing demand, the alkylating agents market faces several notable restraints and challenges in 2024. One of the most significant hurdles is the inherent toxicity associated with these agents. The very mechanism that allows alkylating agents to disrupt cancer cell DNA also predisposes patients to adverse side effects, such as myelosuppression, nausea, and increased susceptibility to infections. These adverse effects not only impact patient quality of life but also necessitate rigorous monitoring and supportive care, thereby increasing the overall cost of treatment. Moreover, the high toxicity levels limit the dosage and duration of therapy, which can compromise long-term treatment efficacy. Another challenge is the evolving regulatory landscape, which has become increasingly stringent as safety standards are raised globally. Pharmaceutical companies must navigate complex regulatory requirements that vary significantly from one jurisdiction to another. This has led to extended timelines for clinical trials and market approvals, thereby delaying the launch of new formulations. In addition, the constant need for post-marketing surveillance and compliance with evolving guidelines can place a significant administrative and financial burden on companies. The rigorous regulatory scrutiny is essential for patient safety but can also dampen innovation and deter smaller players from entering the market. Supply chain vulnerabilities have further compounded these challenges. Disruptions in the supply of raw materials or manufacturing inefficiencies can lead to shortages, which in turn affect the timely delivery of these critical medications to healthcare facilities.

Market Opportunities:

Amid the challenges that confront the alkylating agent market, numerous opportunities have emerged in 2024 that promise to propel industry growth and improve patient care. One of the most compelling opportunities lies in the expansion of treatment indications. As research delves deeper into the molecular underpinnings of various cancers, there is growing evidence that alkylating agents may be effective against a broader spectrum of malignancies than previously recognized. This potential for repurposing existing drugs for new cancer types opens up a vast market opportunity that could significantly enhance revenue streams while improving therapeutic outcomes. Another key opportunity is the evolution of combination therapy strategies. By integrating alkylating agents with immunotherapies, targeted treatments, or novel biologics, healthcare providers can tailor treatment regimens that not only improve efficacy but also mitigate the adverse effects associated with high-dose monotherapies. This synergistic approach is particularly promising in overcoming drug resistance, a persistent issue in cancer treatment, and has already shown encouraging results in early-stage clinical trials. The promise of combination therapies also aligns with the broader trend toward personalized medicine, wherein treatment is customized based on the genetic and molecular profile of each patient’s cancer.

ALKYLATING AGENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

3.4% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Pfizer, Merck & Co., Roche, Novartis, Bristol Myers Squibb, Johnson & Johnson, AstraZeneca, Bayer, Sanofi, Eli Lilly |

Alkylating Agents Market Segmentation: by Type

-

Nitrogen Mustards

-

Nitrosoureas

-

Aziridines

-

Ethylenimines

-

Triazines

-

Alkyl sulfonates

Among these, nitrogen mustards continue to dominate due to their long-established clinical efficacy and broad application across multiple cancer types. In contrast, aziridines are emerging as the fastest-growing type, driven by recent innovations that have significantly enhanced their therapeutic index and reduced toxicity.

Alkylating Agents Market Segmentation: by Distribution Channel

-

Hospitals and Cancer Centers

-

Clinics and Specialty Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

Institutional Distribution

Hospitals and cancer centers remain the most dominant channels for the distribution of alkylating agents, as they are primary sites for cancer diagnosis and treatment. However, the online pharmacy segment has emerged as the fastest-growing channel, fueled by digital transformation in healthcare and the increasing adoption of telemedicine platforms, which facilitate easier access to medication and patient support services.

Alkylating Agents Market Segmentation: by Regional Analysis

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East and Africa

In 2024, North America continues to hold the largest share, accounting for an estimated 35% of the global market. Europe follows with approximately 25%, while Asia-Pacific represents a significant portion of the market at around 30%. Latin America and the Middle East & Africa contribute the remaining shares, each capturing roughly 5% of the market. Although North America is the most dominant region in terms of overall market size, the Asia-Pacific region is experiencing the fastest growth, driven by rapidly improving healthcare infrastructure, increased investment in oncology, and rising public awareness of cancer treatment options.

COVID-19 Impact Analysis on the Market:

The COVID-19 pandemic introduced significant disruptions across the global healthcare landscape, and the alkylating agent's market was no exception. In 2024, the residual effects of the pandemic were still evident in various facets of the market—from research and development delays to supply chain disruptions. Initially, the pandemic forced a reallocation of healthcare resources and shifted priorities toward managing the immediate crisis, which temporarily impacted clinical trial schedules and regulatory review timelines. However, the industry’s resilience was evident as companies quickly adapted to new modes of operation, including the integration of remote monitoring systems and digital platforms for clinical data management. Clinical trials experienced temporary setbacks due to restrictions on patient movement and in-person consultations. Many trials were either paused or adapted to virtual formats, which, while ensuring continuity, also required significant operational adjustments. Despite these challenges, the experience garnered during the pandemic has accelerated the adoption of digital technologies and telemedicine. This transformation has led to more streamlined trial designs, enhanced patient recruitment, and improved remote data collection processes, which are now being leveraged to optimize ongoing and future studies.

Latest Trends and Developments:

Innovation and technological evolution remain at the forefront of the alkylating agent's market in 2024, driving significant trends and developments that are reshaping the industry. One of the most notable trends is the increasing adoption of combination therapy regimens. Pharmaceutical companies are actively investigating synergistic effects between alkylating agents and novel targeted therapies, immunotherapies, and biologics. These combination approaches are designed to overcome resistance mechanisms and improve patient outcomes, leading to more personalized and effective treatment protocols. Additionally, there is a growing emphasis on developing formulations that reduce systemic toxicity while enhancing drug delivery to tumor sites, which has spurred research into nanoparticle-based and liposomal encapsulation technologies. Another emerging trend is the shift towards oral formulations. Enhanced drug stability and improved bioavailability have encouraged pharmaceutical companies to develop oral versions of traditional alkylating agents, thereby offering patients a more convenient and less invasive treatment option. This transition not only improves patient compliance but also broadens the market potential by making treatments accessible in outpatient settings.

Key Players in the Market

-

Pfizer

-

Merck & Co.

-

Roche

-

Novartis

-

Bristol Myers Squibb

-

Johnson & Johnson

-

AstraZeneca

-

Bayer

-

Sanofi

-

Eli Lilly

Chapter 1. Alkylating Agents Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Alkylating Agents Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Alkylating Agents Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Alkylating Agents Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Alkylating Agents Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Alkylating Agents Market – By Type

6.1 Introduction/Key Findings

6.2 Nitrogen Mustards

6.3 Nitrosoureas

6.4 Aziridines

6.5 Ethylenimines

6.6 Triazines

6.7 Alkyl sulfonates

6.8 Y-O-Y Growth trend Analysis By Type

6.9 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Alkylating Agents Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Hospitals and Cancer Centers

7.3 Clinics and Specialty Pharmacies

7.4 Retail Pharmacies

7.5 Online Pharmacies

7.6 Institutional Distribution

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Alkylating Agents Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Alkylating Agents Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Pfizer

9.2 Merck & Co.

9.3 Roche

9.4 Novartis

9.5 Bristol Myers Squibb

9.6 Johnson & Johnson

9.7 AstraZeneca

9.8 Bayer

9.9 Sanofi

9.10 Eli Lilly

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Key factors driving the robust growth of the alkylating agents market include rising global cancer incidence, advanced technological innovations, increased R&D investments, novel formulation developments with improved safety, strategic global partnerships, expanding treatment indications, and digital transformation in clinical trials.

Key concerns for the Alkylating Agents Market include severe toxicity, persistent drug resistance, stringent regulatory requirements, supply chain vulnerabilities, high R&D costs, and intense competition from emerging targeted therapies and immunotherapies, which could significantly compromise treatment efficacy and patient adherence.

Pfizer, Merck & Co., Roche, Novartis, Bristol Myers Squibb, Johnson & Johnson, AstraZeneca

North America currently holds the largest market share, estimated at around 35%.

Asia Pacific has shown significant room for growth in specific segments.