Aliphatic Chemicals Market Size (2024 – 2030)

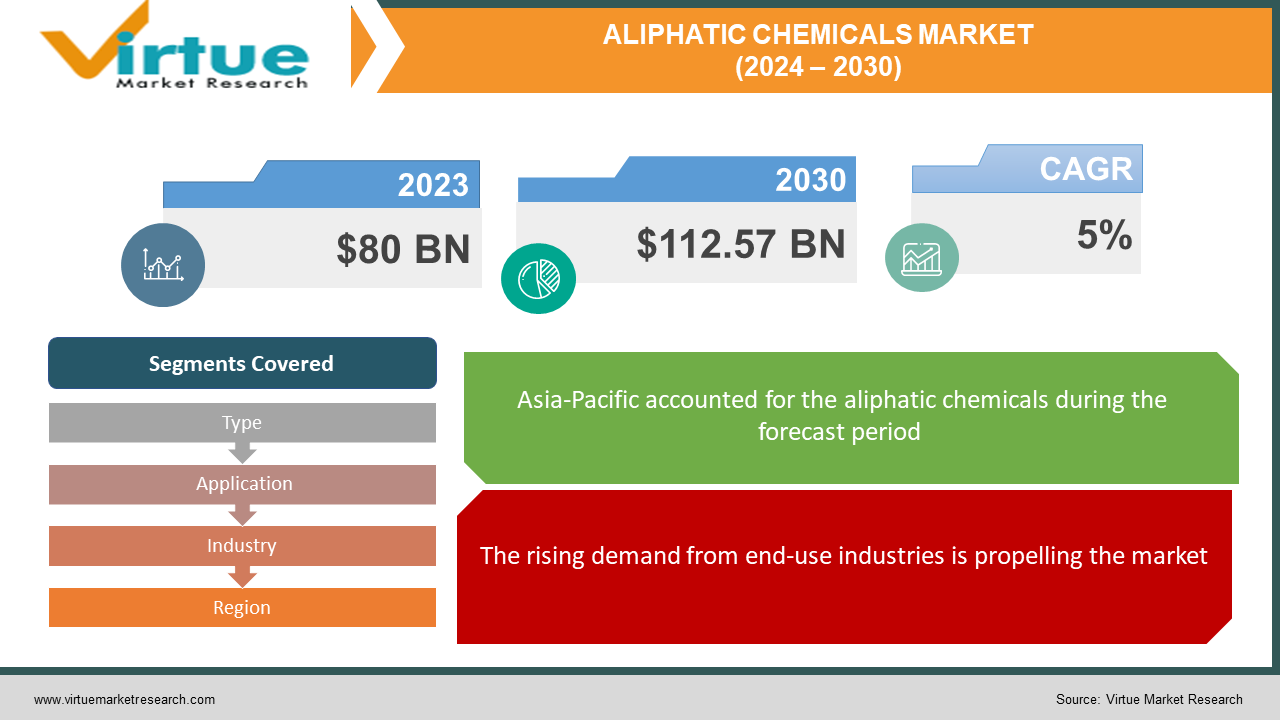

The global aliphatic chemicals market was valued at USD 80 billion in 2023 and is projected to reach a market size of USD 112.57 billion by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 5%.

Aliphatic chemicals are a diverse group of organic compounds characterized by carbon atoms linked together in open-chain, straight, or branched structures rather than closed rings. It encompasses a vast range of compounds with diverse functionalities and properties, including alcohols, solvents, isocyanates, polyamides, acids, and more. It is used extensively in various industries, including paints, coatings, adhesives, plastics, pharmaceuticals, personal care, agriculture, and cleaning products.

Key Market Insights:

A significant increase is being seen in the global market for aliphatic chemicals due to growing demand from important sectors, including packaging, automotive, and construction. Bio-based and biodegradable products are becoming more popular as the focus on sustainability drives industry development. The rate of expansion is being accelerated by technological breakthroughs and expenditures in research and development, which are making industrial processes greener and more efficient. The market is seeing significant growth because of the fast economic expansion and infrastructural development of developing nations, especially in the Asia-Pacific region. However, business expansion is hampered by volatile raw material prices and stringent environmental laws. Notwithstanding the effects of COVID-19, the industry has proven resilient and is anticipated to continue growing moderately with the help of sustainability programs and end-use sectors that are seeing a resurgence. The market for aliphatic chemicals is changing due to emerging trends that are fostering innovation and competition in the industry. These trends include digitization, the emphasis on renewable raw materials, and regionalization.

Aliphatic Chemicals Market Drivers:

The rising demand from end-use industries is propelling the market.

Industries like the construction, automotive, and packaging sectors are experiencing consistent growth, driving demand for aliphatic chemicals in paints, coatings, adhesives, and plastics. For instance, China's construction spending is expected to reach $5.2 trillion by 2025, boosting aliphatic solvent demand.

Emphasis on sustainable chemicals is facilitating the expansion.

As environmental concerns and regulations are rising around, the bio-based and biodegradable options are gaining traction. Major governments and global bodies are acting to reduce environmental damage by implementing policies for sustainable goods. People’s preferences have also changed to environment-friendly alternative products, leading to rising demand for the bio-based aliphatic alcohol market. Increasing focus on environmentally friendly products and processes is leading to the development of bio-based and biodegradable aliphatic chemicals, creating new market opportunities. For instance, the global bio-based aliphatic alcohols market is projected to reach $18.8 billion by 2028, growing at a CAGR of 8.4%.

Increasing investments in technological development are accelerating the growth rate.

Major industries are investing in research and development of new technology for the aliphatic chemicals market to cope with opportunities and challenges and gain a competitive advantage in the market. Innovations in areas like catalysis and separation are enabling the production of cleaner and more efficient aliphatic chemicals, further propelling market growth. The aliphatic chemicals Market is witnessing rising demand as improved efficiency and cleaner production processes contribute to growth. For instance, new catalyst technology reduces waste by 30% in aliphatic isocyanate production.

Developing Economies is a major growth driver for aliphatic chemicals.

As developing economies are rapidly growing in industries like infrastructure, construction, and agriculture, they are also fuelling growth for the aliphatic chemicals market. The growing demand for consumer goods and infrastructure in Asia-Pacific fuels market expansion. Rapid economic development in emerging countries like China and India is boosting demand for consumer goods and infrastructure, which rely heavily on aliphatic chemicals. For instance, India plans to invest $1.4 trillion in infrastructure by 2030, driving demand for aliphatic chemicals.

Aliphatic Chemicals Market Restraints and Challenges:

Fluctuating raw materials prices are a major concern for the aliphatic chemicals market.

The volatility of oil and gas prices, key raw materials for aliphatic chemicals, can impact production costs and profitability. Fluctuations in oil and gas prices impact production costs and profitability. Prices in oil and gas markets face volatility due to geopolitical events, supply disruptions, and demand trends. Oil price volatility in 2023 led to price hikes for aliphatic hydrocarbon solvents. Manufacturers are taking steps like building strong relationships with suppliers to enable negotiation for favorable terms, including pricing adjustments based on market conditions. They are also trying to improve production processes to reduce waste and energy consumption, indirectly lowering costs.

Strict environmental rules and regulations are a major challenge to the growth of the industry.

Governments and regulatory bodies worldwide are imposing stricter regulations to protect the environment and human health. Aliphatic chemicals, commonly used in coatings, adhesives, and other applications, must comply with these standards. Compliance often requires costly modifications to production processes, waste management, and emissions control. Environmental regulations governing emissions and waste disposal can increase production costs and limit market access for certain aliphatic chemicals. For instance, the EU's REACH regulation restricts the use of certain aliphatic solvents, increasing compliance costs.

Aliphatic Chemicals Market Opportunities:

Specialty aliphatic chemicals are an opportunity for market growth.

Specialty aliphatic chemicals serve specific industries and applications. Their unique properties make them indispensable in areas like high-performance coatings, adhesives, and specialty plastics. As industries seek customized solutions, demand for these specialized chemicals grows. Specialty aliphatic chemicals offer superior performance compared to generic alternatives. They enhance durability, UV resistance, gloss retention, and chemical stability. Industries such as automotive, aerospace, and electronics value these enhancements. Differentiated offerings give companies a competitive edge and attract discerning customers.

ALIPHATIC CHEMICALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Type, Application, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Dow Chemical Company, Exxon Mobil Corporation, Royal Dutch Shell plc, LyondellBasell Industries Holdings N.V., SABIC, Evonik Industries, Arkema Group, Solvay, Huntsman Corporation |

Aliphatic Chemicals Market Segmentation: By Type

-

Aliphatic Hydrocarbon Solvents & Thinners

-

Aliphatic Isocyanates

-

Aliphatic Alcohols

-

Aliphatic Polyamides

-

Others

Aliphatic alcohols are the largest and fastest-growing segment in the market for aliphatic chemicals, accounting for around 53-56% of the total. These adaptable substances are used in many different industries, such as paints & coatings as diluents and solvents, and pharmaceuticals & personal care as components of medications and sanitizers. With a 14–15% share, aliphatic hydrocarbon solvents and thinners are essential for cleaning and degreasing industrial surfaces and equipment as well as paints and coatings. 9–10% of all isocyanates are aliphatic, and they play a major role in high-performance bonding in adhesives and sealants as well as lightweight, durable materials in plastics and polymers. Although making approximately 19–20%, aliphatic polyamides are mostly used in textiles for high-performance fabrics and plastics and polymers for engineering plastics and fibers.

Aliphatic Chemicals Market Segmentation: By Application

-

Paints & Coatings

-

Cleaning & Degreasing

-

Adhesives & Sealants

-

Plastics & Polymers

-

Pharmaceuticals & Personal Care

-

Agriculture

-

Others

The market for aliphatic chemicals offers a wide range of applications in numerous sectors. With almost 50% of the market, paints & coatings is the largest and fastest-growing segment, mostly serving the building and automotive industries. Solutions for cleaning and degreasing, essential for both domestic and industrial use, account for around 15% of the market. Here, they are used in the formulation of household detergents and the degreasing of equipment and surfaces. About 10% of the total are adhesives and sealants, and they are essential to building and packaging. Moreover, plastics & polymers (18%) have a wide range of applications, such as textile fibers and packaging films. They make up 5% of pharmaceuticals & personal care and are used as ingredients in medications and cosmetics. Lastly, agriculture uses them in fertilizers and agrochemicals at a rate of 2%.

Aliphatic Chemicals Market Segmentation: By Industry

-

Construction

-

Automotive

-

Packaging

-

Electronics

-

Personal Care & Cosmetics

-

Pharmaceuticals

-

Agriculture

-

Other

Aliphatic chemicals hold a diverse realm of applications, each contributing significantly to the market's success. The construction sector is the largest growing industry in this market. paints & coatings are used heavily in the construction and automotive industries. Cleaning & degreasing play a crucial role in keeping things spotless, from heavy-duty industrial tasks to household chores. Adhesives & sealants are used in construction, packaging, and transportation. Plastics & polymers offer incredible versatility, shaping everything from everyday packaging to comfortable fibers. Pharmaceuticals & personal care rely on aliphatic chemicals for ingredients in drugs, cosmetics, and hygiene products, keeping us healthy and looking our best. Agriculture leverages these versatile chemicals in agrochemicals, fertilizers, and crop protection, ensuring bountiful harvests. Beyond these major segments, aliphatic chemicals extend their reach to electronics, textiles, and even printing inks, demonstrating their remarkable range and impact across various industries.

Aliphatic Chemicals Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The aliphatic chemicals market showcases diverse regional dynamics. Asia-Pacific is the largest and fastest-growing market, holding a commanding 40% share, driven by its rapidly developing economies and high demand for construction and packaging. North America, with 25%, focuses on automotive and paints & coatings applications. Europe, at 20%, prioritizes pharmaceuticals & personal care and agriculture. South America, accounting for 8%, utilizes them in industrial cleaning and plastics & polymers. Finally, the Middle East and Africa, with a 7% share, primarily employ them in construction adhesives & sealants and other applications like electronics and printing inks.

COVID-19 Impact Analysis on the Global Aliphatic Chemicals Market:

COVID-19 has severely impacted the global aliphatic chemicals market. Lockdowns and supply chain disruptions led to a decline in demand from end-use industries like construction, automotive, and manufacturing, impacting demand for aliphatic chemicals used in paints, coatings, adhesives, and plastics. Factory closures and workforce disruptions hampered production, limiting supply and further affecting market stability. Fluctuations in oil and gas prices, coupled with pandemic-related uncertainties, caused price volatility for raw materials, impacting production costs and profitability. COVID-19 also had a positive impact on the market, demand for hand sanitizers, disinfectants, and cleaning products, often containing aliphatic alcohols, surged due to hygiene concerns. The pandemic triggered increased focus on sustainability, pushing demand for bio-based and biodegradable aliphatic options. While the pandemic initially caused a setback, the aliphatic chemicals market demonstrated resilience and adapted to the changing landscape. The market showed signs of recovery in the latter half of the pandemic and is expected to maintain moderate growth in the coming years, driven by factors like rebounding end-use industries, sustainability initiatives, and technological advancements.

Latest Trends/Developments:

Digitalization and automation is a recent trend that is being employed in the market. The adoption of digital technologies and automation in production processes can enhance efficiency, reduce costs, and improve safety in the aliphatic chemicals industry. Many companies are adopting automated production lines and AI-powered predictive maintenance for aliphatic chemical facilities.

Focus on renewable raw materials is being given prominence. A growing interest in utilizing renewable resources like biomass and plant oils for the production of aliphatic chemicals is a key trend. The market for bio-based aliphatic acids is expected to reach $8.5 billion by 2028, growing at a CAGR of 9.2%.

Regionalization and nearshoring are beneficial. To mitigate supply chain disruptions and geopolitical risks, companies are increasingly looking to regionalize the production and sourcing of aliphatic chemicals. Chemical companies are building new production facilities in regions closer to their end markets.

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Companies are

spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

Key Players:

-

BASF SE

-

Dow Chemical Company

-

Exxon Mobil Corporation

-

Royal Dutch Shell plc

-

LyondellBasell Industries Holdings N.V.

-

SABIC

-

Evonik Industries

-

Arkema Group

-

Solvay

-

Huntsman Corporation

In February 2023, Ames Lab announced the development of a new catalyst to introduce functional groups into aliphatic hydrocarbons. It would make aliphatic hydrocarbon-based single-use plastics easier to upcycle, recycle, and biodegrade.

Chapter 1. Aliphatic Chemicals Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aliphatic Chemicals Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aliphatic Chemicals Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aliphatic Chemicals Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aliphatic Chemicals Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aliphatic Chemicals Market – By Application

6.1 Introduction/Key Findings

6.2 Paints & Coatings

6.3 Cleaning & Degreasing

6.4 Adhesives & Sealants

6.5 Plastics & Polymers

6.6 Pharmaceuticals & Personal Care

6.7 Agriculture

6.8 Others

6.9 Y-O-Y Growth trend Analysis By Application

6.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Aliphatic Chemicals Market – By Type

7.1 Introduction/Key Findings

7.2 Aliphatic Hydrocarbon Solvents & Thinners

7.3 Aliphatic Isocyanates

7.4 Aliphatic Alcohols

7.5 Aliphatic Polyamides

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Type

7.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Aliphatic Chemicals Market – By Industry

8.1 Introduction/Key Findings

8.2 Construction

8.3 Automotive

8.4 Packaging

8.5 Electronics

8.6 Personal Care & Cosmetics

8.7 Pharmaceuticals

8.8 Agriculture

8.9 Other

8.10 Y-O-Y Growth trend Analysis By Industry

8.11 Absolute $ Opportunity Analysis By Industry, 2024-2030

Chapter 9. Aliphatic Chemicals Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Type

9.1.4 By By Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Type

9.2.4 By Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Type

9.3.4 By Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Type

9.4.4 By Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Type

9.5.4 By Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Aliphatic Chemicals Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BASF SE

10.2 Dow Chemical Company

10.3 Exxon Mobil Corporation

10.4 Royal Dutch Shell plc

10.5 LyondellBasell Industries Holdings N.V.

10.6 SABIC

10.7 Evonik Industries

10.8 Arkema Group

10.9 Solvay

10.10 Huntsman Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global aliphatic chemicals market was valued at USD 80 billion in 2023 and is projected to reach a market size of USD 112.57 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 5%.

Key drivers include the rising demand from end-user industries, rising demand for sustainable chemicals, and increased investment in technological development.

Construction, automotive, packaging, electronics, personal care & cosmetics, pharmaceuticals, agriculture, and others are end users of the global aliphatic chemicals market.

Asia-Pacific reigns supreme, holding a commanding 40% share, driven by its rapidly developing economies and high demand in construction and packaging.

BASF SE, Dow Chemical Company, Exxon Mobil Corporation, and Royal Dutch Shell plc are some leading players in the global aliphatic chemicals market.