Algae Bioplastics Market Size (2024 – 2030)

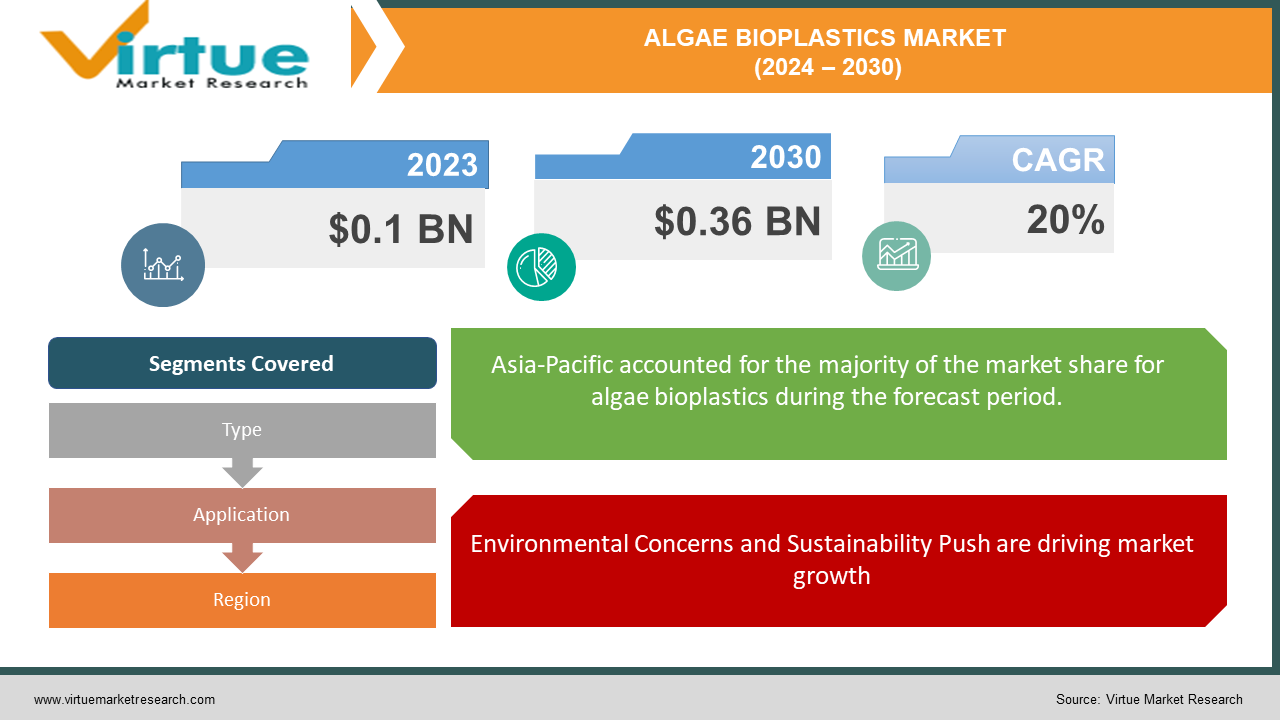

The Global Algae Bioplastics Market was valued at USD 0.1 billion in 2023 and will grow at a CAGR of 20% from 2024 to 2030. The market is expected to reach USD 0.36 billion by 2030.

The Algae Bioplastics Market is a developing sector focused on creating eco-friendly plastics from algae. This bioplastic offers a solution to traditional plastic pollution by using renewable resources and potentially reducing reliance on food crops for bioplastics. While still in its early stages, the market is expected to grow significantly due to rising environmental concerns and a push for sustainable materials. However, overcoming challenges like high production costs will be crucial for widespread adoption.

Key Market Insights:

Rising public awareness about plastic pollution and its impact on ecosystems is driving a shift towards sustainable materials like algae bioplastics. The industry is still young, and production capacity needs to expand to meet potential future demand.

Algae offers a fast-growing, renewable resource for bioplastic production, unlike traditional plastics derived from fossil fuels. Various industries like packaging, automotive, and textiles are increasingly seeking bio-based solutions to meet sustainability goals.

Ongoing research is improving algae cultivation methods, bioplastic extraction processes, and material properties, making them more competitive.

Algae bioplastics are currently more expensive to produce compared to traditional plastics.

Global Algae Bioplastics Market Drivers:

Environmental Concerns and Sustainability Push are driving market growth:

The world faces a plastic crisis. Traditional plastics clog landfills and leak microplastics into our ecosystems, harming wildlife and potentially even human health. Algae bioplastics offer a beacon of hope. Made from fast-growing, renewable algae, these bioplastics are biodegradable, unlike their conventional counterparts. This translates to a significant reduction in plastic waste and its detrimental environmental impact. Furthermore, algae don't compete with food crops for resources, unlike some bioplastics. Adding to the appeal, consumers are demanding eco-friendly products, pushing industries like packaging, automotive, and textiles to embrace sustainable alternatives. With its eco-friendly nature, renewable resource base, and growing consumer demand, the algae bioplastics market is poised for significant growth, offering a glimmer of hope in the fight against plastic pollution.

The advantages of Algae as a Feedstock are driving market growth:

Algae presents a unique solution to the plastic problem due to its rapid growth and ability to thrive in unconventional environments. Unlike land crops used for bioplastics, algae don't compete for valuable resources like arable land or freshwater. Instead, they can be cultivated in controlled settings, multiplying quickly under ideal conditions. This translates to a readily available and constantly renewable source for bioplastic production. Furthermore, algae offers a two-for-one solution when it comes to resource management. They have the potential to be cultivated using wastewater streams, a clever way to repurpose what would otherwise be a burden on treatment facilities. This wastewater provides essential nutrients for the algae, while the algae itself acts as a natural biofilter, cleaning the water before it's released back into the environment. This innovative approach not only reduces reliance on freshwater for bioplastic production but also contributes to wastewater treatment, making algae an incredibly sustainable option for the future.

Technological Advancements are driving market growth:

While algae offers a promising solution, researchers are continuously working to refine and improve the process. Optimizing cultivation techniques is a key area of focus. This involves finding the perfect balance of nutrients, light, and temperature to maximize algae growth while minimizing costs. Additionally, advancements in bioplastic extraction processes are crucial. Scientists are developing more efficient methods to separate the desired bioplastics from the algae biomass, leading to higher yields and potentially lower production costs. But the ultimate goal lies in the bioplastics themselves. Extensive research is underway to create algae bioplastics that rival traditional plastics in terms of performance. Scientists are working on enhancing their strength, durability, and functionality to ensure they can seamlessly replace conventional plastics in various applications. These advancements will not only improve the economic viability of algae bioplastics but also make them a more attractive and practical alternative for industries seeking sustainable solutions.

Global Algae Bioplastics Market challenges and restraints:

High Production Costs is a significant hurdle for Algae Bioplastics:

The high cost of algae bioplastics compared to traditional plastics is a major hurdle for widespread adoption. Complex cultivation processes are a significant contributor. Unlike traditional crops, algae require specialized equipment and precisely controlled environments to thrive for bioplastic production. This includes maintaining ideal light, temperature, and nutrient levels within large photobioreactors or open ponds. These setups are expensive to maintain and require significant energy input, driving up production costs. Furthermore, current methods for extracting bioplastics from the algae biomass are often complex and inefficient. These processes can involve multiple steps like cell disruption, purification, and drying, with each step adding to the overall cost. Additionally, these methods often yield a relatively low amount of bioplastic per unit of algae, further inflating the price per kilogram. Simplifying cultivation processes and developing more efficient extraction methods are crucial to bringing down the cost of algae bioplastics and making them a more competitive alternative to traditional plastics.

Limited Production Capacity is throwing a curveball at the Algae Bioplastics market:

The nascent stage of the Algae Bioplastics Market creates a self-reinforcing loop that hinders its growth. Currently, production facilities are limited in scale, unable to meet the potential future demand for this sustainable alternative. This limited capacity has a domino effect on several aspects. Firstly, it restricts the ability to leverage economies of scale, keeping production costs high. Since large-scale production isn't happening yet, the cost per unit of algae bioplastic remains significantly higher than traditional plastics. This high cost discourages wider adoption, further dampening demand and hindering investment in expanding production facilities. This cycle creates a barrier to entry, making it difficult for the market to gain momentum and reach a tipping point where production scales up and costs come down. Overcoming this challenge requires breaking the cycle. Incentives and investments can encourage the development of large-scale production facilities. This increased capacity will eventually lead to lower production costs, making algae bioplastics a more attractive option, stimulating demand, and further justifying investments in even larger-scale production.

Technical Hurdles are a growing nightmare for Algae Bioplastics:

Even with ongoing research, technical hurdles remain for algae bioplastics. One major challenge is the inconsistency in material properties. Different algae strains can yield bioplastics with varying characteristics like strength, flexibility, and heat resistance. This inconsistency makes it difficult to guarantee the desired properties for specific applications. Imagine trying to build a car part with a bioplastic that might be too brittle or prone to melting. Researchers are working on optimizing cultivation and extraction processes to achieve more consistent bioplastic properties. Another technical hurdle lies in integrating algae bioplastics with existing infrastructure. Traditional plastic production lines and recycling facilities are not designed to handle this new material. This means significant investments would be required to modify existing equipment or build entirely new facilities specifically for algae bioplastics. Addressing these technical challenges is crucial for ensuring consistent, high-quality bioplastics and enabling seamless integration with current manufacturing processes. This will pave the way for the wider adoption of algae bioplastics without requiring a complete overhaul of the existing infrastructure.

Market Opportunities:

The Algae Bioplastics Market brims with exciting opportunities driven by environmental concerns, resource limitations, and growing consumer demand for sustainable solutions. Public awareness about plastic pollution and its detrimental impact on ecosystems is fueling a shift towards eco-friendly alternatives. Algae bioplastics offer a compelling solution. Made from fast-growing, renewable algae, they biodegrade after use, significantly reducing plastic waste and its environmental footprint. Unlike some bioplastics derived from crops, algae don't compete with food production for land or resources. Additionally, they have the potential to be cultivated using wastewater streams, offering a double benefit of bioplastic production and wastewater treatment. This environmentally friendly nature, coupled with growing consumer demand for sustainable products, is creating fertile ground for the Algae Bioplastics Market across various industries. The packaging industry, a major contributor to plastic waste, is a prime target. Replacing single-use plastics with biodegradable algae-based alternatives can significantly reduce packaging waste. The automotive industry is also exploring algae bioplastics for interior components and potentially even body panels, driven by sustainability goals. Furthermore, the fashion industry is seeking eco-friendly materials for clothing and textiles, with algae offering a promising bio-based option. Beyond these established applications, research and development are opening doors to novel uses. Advancements in material properties could see algae bioplastics incorporated into electronics, construction materials, and even medical applications. Additionally, the potential to integrate algae cultivation with existing infrastructure, such as wastewater treatment plants, presents exciting possibilities for a circular economy. By overcoming challenges like high production costs and limited capacity through continued research and investment, the Algae Bioplastics Market is poised for significant growth. This growth will not only benefit the environment by reducing plastic pollution but also create new sustainable economic opportunities across various industries.

ALGAE BIOPLASTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

20% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Algenol (US), Sapphire Energy (US), Solix BioSystems (US), Joule Unlimited (US), LanzaTech (US), Phycobloom (France), Algotec (France), Tethys (Netherlands), EAlgae (Israel), Sea6 Energy (India) |

Algae Bioplastics Market Segmentation - By Type

-

Microalgae Bioplastics

-

Macroalgae Bioplastics

While both microalgae and macroalgae bioplastics have a role in the Algae Bioplastics Market, microalgae are currently considered the more prominent sector. This is because microalgae offer a wider range of potential material properties. Different microalgae strains have unique characteristics that can be harnessed to create bioplastics with varying degrees of strength, flexibility, and other functionalities. This versatility allows them to be tailored for specific applications. Additionally, microalgae can be cultivated in controlled environments with higher growth rates compared to macroalgae. However, macroalgae hold promise for the future due to their potential for higher volume production. As research progresses, advancements in cultivation techniques could make macroalgae bioplastics a more viable option for broader applications.

Algae Bioplastics Market Segmentation - By Application

-

Packaging

-

Automotive

Currently, packaging is the most prominent sector for Algae Bioplastics. This is due to several factors. Firstly, the packaging industry generates a significant amount of plastic waste, particularly single-use plastics. Replacing these with biodegradable algae-based alternatives offers a clear environmental benefit. Secondly, packaging applications often don't require the high-performance properties that might be needed in the automotive industry. The focus for packaging is often on functionality, biodegradability, and cost-effectiveness, areas where algae bioplastics are making significant strides. While the automotive industry is exploring algae bioplastics for interior components, the technical challenges and higher performance requirements may take longer to overcome. This makes packaging a more mature and readily addressable market for algae bioplastics in the short term.

Algae Bioplastics Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

While reliable data for the specific Algae Bioplastics Market is limited, Asia-Pacific (APAC) is currently considered the fastest-growing region. This is driven by several factors: a large and growing population with rising environmental awareness, a significant manufacturing base for bioplastics, and government initiatives promoting sustainable practices. North America, with its established packaging and consumer goods industries and focus on sustainability, is another strong contender. Europe, a pioneer in bioplastics adoption, also holds a sizeable share. However, APAC's rapid growth and focus on bioplastics production position it as the most dominant region in the Algae Bioplastics Market for the foreseeable future.

COVID-19 Impact Analysis on the Global Algae Bioplastics Market

The COVID-19 pandemic presented a complex scenario for the Algae Bioplastics Market. On the one hand, there was a surge in single-use plastics due to increased reliance on personal protective equipment (PPE) and hygiene measures. This might have initially diverted attention away from sustainable alternatives like algae bioplastics. However, the pandemic also heightened awareness of hygiene and sanitation, potentially leading to a long-term shift towards bioplastics in the future. Additionally, supply chain disruptions and fluctuating oil prices during COVID-19 could incentivize the exploration of more stable, bio-based alternatives like algae. Research and development efforts might have also faced slowdowns due to lockdowns and resource limitations. However, government initiatives promoting green recovery and a growing focus on sustainable practices in the post-pandemic world could provide a tailwind for the Algae Bioplastics Market in the long run. The overall impact of COVID-19 on this developing market remains to be seen, but it presents both challenges and potential opportunities for future growth.

Latest trends/Developments

The Algae Bioplastics Market is experiencing a wave of exciting developments fueled by growing environmental concerns and advancements in technology. A major trend is the increasing focus on improving cost-effectiveness. Research is directed towards optimizing algae cultivation processes for higher yields and lower energy consumption. Additionally, advancements in bioplastic extraction methods are aimed at improving efficiency and reducing waste. This focus on cost reduction is crucial for making algae bioplastics competitive with traditional plastics. Another trend is the growing emphasis on material properties. Scientists are working on tailoring algae bioplastics to achieve specific functionalities like enhanced strength, flexibility, and heat resistance. This will broaden the range of applications for algae bioplastics, making them suitable for demanding sectors like automotive and construction. Furthermore, the integration of algae cultivation with existing infrastructure is gaining traction. Concepts like cultivating algae using wastewater streams offer a dual benefit of bioplastic production and wastewater treatment. This not only promotes sustainability but also reduces reliance on freshwater resources for algae growth. Finally, there's a growing interest in utilizing different algae strains. Researchers are exploring the unique properties of various microalgae and macroalgae species to create a wider range of bioplastics with diverse functionalities. These trends, coupled with ongoing research and development efforts, paint a promising picture for the future of the Algae Bioplastics Market, paving the way for a more sustainable future.

Key Players:

-

Algenol (US)

-

Sapphire Energy (US)

-

Solix BioSystems (US)

-

Joule Unlimited (US)

-

LanzaTech (US)

-

Phycobloom (France)

-

Algotec (France)

-

Tethys (Netherlands)

-

EAlgae (Israel)

-

Sea6 Energy (India)

Chapter 1. Algae Bioplastics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Algae Bioplastics Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Algae Bioplastics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Algae Bioplastics Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Algae Bioplastics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Algae Bioplastics Market – By Type

6.1 Introduction/Key Findings

6.2 Microalgae Bioplastics

6.3 Macroalgae Bioplastics

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Algae Bioplastics Market – By Application

7.1 Introduction/Key Findings

7.2 Packaging

7.3 Automotive

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Algae Bioplastics Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Algae Bioplastics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Algenol (US)

9.2 Sapphire Energy (US)

9.3 Solix BioSystems (US)

9.4 Joule Unlimited (US)

9.5 LanzaTech (US)

9.6 Phycobloom (France)

9.7 Algotec (France)

9.8 Tethys (Netherlands)

9.9 EAlgae (Israel)

9.10 Sea6 Energy (India)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Algae Bioplastics Market was valued at USD 0.1 billion in 2023 and will grow at a CAGR of 20% from 2024 to 2030. The market is expected to reach USD 0.36 billion by 2030.

Environmental Concerns and Sustainability Push, Advantages of Algae as a Feedstock, and Technological Advancements These are the reasons that are driving the market.

Based on Application it is divided into two segments – Packaging, Automotive.

Asia Pacific is the most dominant region for the luxury vehicle Market.

Algenol (US), Sapphire Energy (US), Solix BioSystems (US), Joule Unlimited (US), LanzaTech (US).