Alcoholic Beverage Safety Testing Market Size (2024 – 2030)

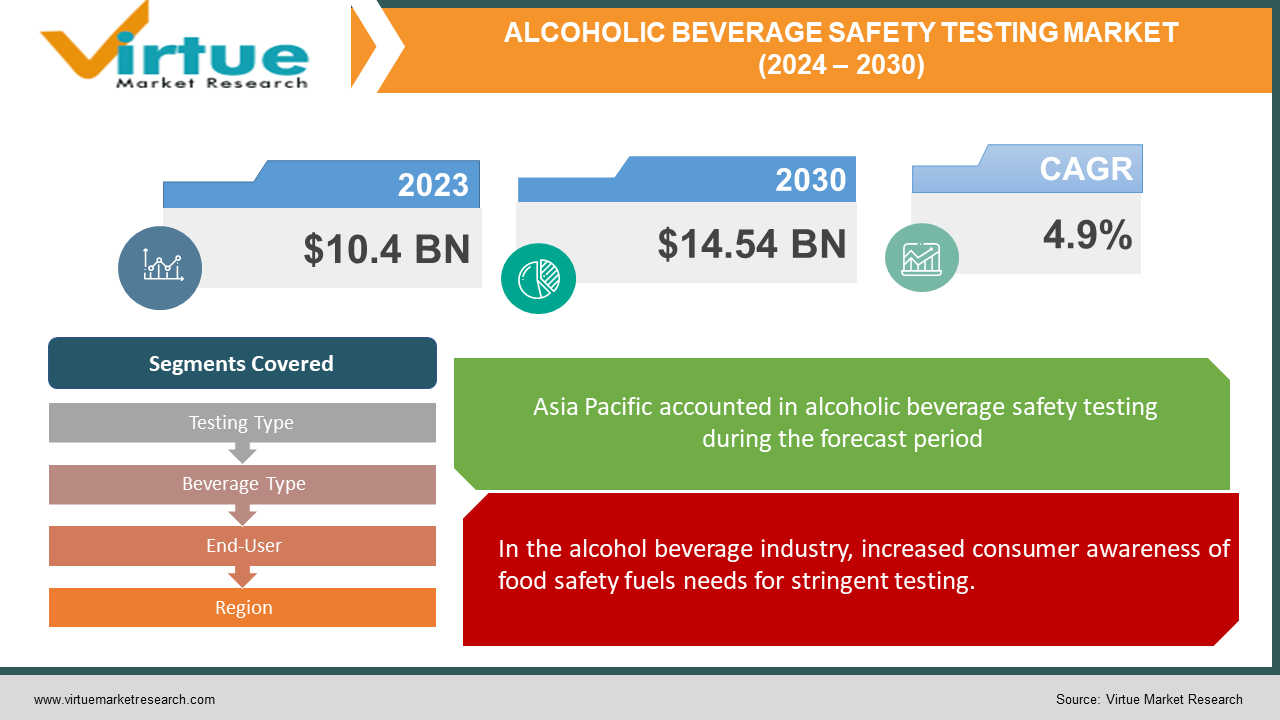

The Global Alcoholic Beverage Safety Testing Market was valued at USD 10.4 Billion in 2023 and is projected to reach a market size of USD 14.54 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.9%.

Alcoholic beverage safety testing is a vital line of defence against dangerous compounds for consumers. Each drink's quality and safety are guaranteed by this multi-layered process before it even reaches store shelves. The foundation is chemical analysis, which measures other essential elements and detects hazardous substances like lead or methanol. It also confirms the amount of alcohol present. Trained tasters use sensory analysis to assess a beverage's texture, aroma, flavour, and appearance to make sure it doesn't have any flavours and satisfies quality requirements. When it comes to identifying potentially dangerous bacteria, yeast, or mould, microbiological testing is essential. Stability testing ensures that the product keeps its intended properties and doesn't develop safety concerns during its shelf life, while packaging testing protects against dangerous substances leaking from the container into the beverage.

Key Market Insights:

There is an increase in consumer knowledge of food safety issues. discovered that 78% of customers cite food safety as having a very or very significant impact on their decision to purchase groceries. This immediately affects the alcoholic beverage sector, where there is an increasing need for thorough testing to guarantee that drinks are free of impurities.Safety regulations are continuously being updated and tightened by regulatory agencies. Every year, the European Union alone promulgates 120 new legislations about food safety. Because of this, manufacturers must conduct extensive testing to remain compliant, which presents a huge market potential for safety testing laboratories. The increasing demand for high-end alcoholic drinks is being met by the development of specialised testing services. Producers can get assistance navigating the constantly shifting regulatory landscape from labs that provide comprehensive testing solutions and consulting services.

Global Alcoholic Beverage Safety Testing Market Drivers:

In the alcohol beverage industry, increased consumer awareness of food safety fuels needs for stringent testing.

Customers are now more conscious than ever of the risks to their health from tainted products and the problems with food safety. The alcoholic beverage sector is immediately impacted by this increased awareness. More openness and guarantees that the beverages they drink don't contain any dangerous ingredients like heavy metals, poisons, or pathogens are what consumers are calling for. Producers of alcoholic beverages are under pressure to prioritise thorough safety testing throughout the production process due to this shift in customer behaviour. From sourcing components to bottling the finished product, safety testing helps to guarantee that contaminants are not introduced throughout any stage of production. Producers can enhance their reputation for safe and enjoyable drinking by putting in place extensive testing programmes and earning consumers' trust.

A Challenge and an Opportunity for Alcoholic Beverage Safety Testing in the Changing Regulatory Environment

Global regulatory agencies are constantly updating and tightening laws about food safety and alcohol labelling. These rules frequently specify allowable quantities of pollutants and require testing procedures. It can be difficult for producers to navigate this changing regulatory environment which necessitates constant testing technique adaptation. Producers rely on safety testing labs that stay current on the newest requirements to be compliant. To make sure that testing procedures comply with the most recent criteria, labs are essential. This shows producers' dedication to ethical production methods while also assisting them in avoiding legal consequences. Furthermore, there will probably be a greater need for thorough testing solutions that address a larger spectrum of potential safety risks as laws get stricter.

Global Alcoholic Beverage Safety Testing Market Restraints and Challenges:

There are obstacles in the way of the promising global market for alcohol-based beverage safety testing. Beverage makers, particularly smaller ones, may be compelled to economise on testing due to cost constraints. For multinational exporters, inconsistent testing standards across regions provide difficulties. The complicated and constantly shifting regulatory environment puts a burden on lab and producer resources. Delays could result from restricted lab capacity and a possible scarcity of qualified personnel, particularly during busy periods. The long-term expansion of the market depends on removing these obstacles.

Global Alcoholic Beverage Safety Testing Market Opportunities:

The market for alcohol-based beverage safety testing is booming globally. With its distinctive ingredients and manufacturing processes, the growing craft beverage industry necessitates more specialised testing solutions. Alcohol consumption is expected to rise in developing countries as the middle class grows, which presents a great potential for safety testing labs to reach a wider audience. Technological developments in quick testing, such as PCR, can increase lab competitiveness by streamlining procedures and turnaround times. More complex testing procedures are required due to the premiumization trend in alcoholic beverages, which presents opportunities for labs to create specialised services for high-end goods. Labs may benefit from constantly changing legislation and labelling requirements by providing comprehensive testing solutions and consulting services that guarantee beverage companies are complying.

ALCOHOLIC BEVERAGE SAFETY TESTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.9% |

|

Segments Covered |

By Testing Type, Beverage Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Thermo Fisher Scientific Inc., Eurofins Scientific SE, SGS SA, Intertek Group plc, Bureau Veritas S.A., ALS Limited, Mérieux NutriSciences Corporation, QIMA Limited, TÜV SÜD AG, Romer Labs Division Holding GmbH |

Global Alcoholic Beverage Safety Testing Market Segmentation: By Testing Type

-

Chemical Analysis

-

Sensory Analysis

-

Microbiological Testing

-

Packaging Testing

-

Stability Testing

Due to data limitations, it can be difficult to determine which section of the alcoholic beverage safety testing market is the largest and fastest expanding. However, given their crucial roles in safety, Chemical Analysis and Microbiological Testing are probably strong candidates for the top rank. The growing emphasis on food safety and customer desires for longer shelf lives indicate that microbiological testing and stability testing have the potential to expand at the quickest rates. Reports on market research might offer more conclusive information on sector leaders.

Global Alcoholic Beverage Safety Testing Market Segmentation: By Beverage Type

-

Beer

-

Wine

-

Spirits

Because it's so widely consumed, beer probably leads the alcoholic beverage safety testing market. The rise in popularity of craft beer, with its varied ingredients and brewing methods, increases the necessity for testing. Although large, wine may represent a smaller segment in terms of volume. However, the emphasis on distinctive varietals and quality in wine may result in a greater testing value per unit. Spirits are expected to increase at the quickest rate because of their complex nature and growing appeal. Spirits have additional testing requirements due to strict regulations. While beer is the industry leader in volume, spirits could overtake it in growth. Growth in all categories may be impacted by the craft beer movement and the general emphasis on quality in all beverages. Reports on market research can paint a more accurate image of the leaders in each category.

Global Alcoholic Beverage Safety Testing Market Segmentation: By End-User

-

Alcoholic Beverage Producers

-

Regulatory Bodies

-

Retailers

Alcoholic Drink Safety Evaluation Alcoholic beverage producers dominate the market, making them the fastest-growing end-user group as well as the largest. To maintain consumer safety and comply with rules, producers insist on frequent testing, thereby consolidating their dominant position. Although regulatory agencies possess certain internal testing capabilities, their overall influence on the market's growth is limited as they mostly depend on external laboratories for verification and enforcement. Retailers mainly rely on producer certifications and sporadic sample checks, with little to no involvement in safety testing. Producers should expect a corresponding increase in demand for testing as the industry expands, further reinforcing their position as the market's motor. Stricter rules may result in more testing by regulatory agencies, but this expansion is not expected to overtake the producer segment's hegemony.

Global Alcoholic Beverage Safety Testing Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The two largest regions are probably North America and Europe, with their well-established and regulated beverage industries. But in terms of fastest growth, Asia Pacific is an emerging star. The region's burgeoning middle class and increasing disposable money are fuelling an increase in alcohol consumption. Furthermore, certain Asia-Pacific nations may have laxer restrictions than those in the West, which could increase testing requirements as laws adjust to the spike in consumption. Asia Pacific is expected to grow at the highest rate in the upcoming years due to its distinct market dynamics, even though North America and Europe may currently occupy the top spot.

COVID-19 Impact Analysis on the Global Alcoholic Beverage Safety Testing Market:

Unquestionably, the COVID-19 epidemic caused a disruption in the global market for alcohol beverage safety testing. Testing capabilities were probably hindered by lab closures brought on by lockdowns and social distancing tactics, which led to delays and possible backlogs. The supply chain disruptions caused by border closures and transit restrictions may have further reduced efficiency by impeding the flow of samples and testing materials. Furthermore, labs may have prioritised COVID-19 testing during the pandemic due to the emphasis on public health, which would have limited funding for assessing the safety of alcoholic beverages.

Recent Trends and Developments in the Global Alcoholic Beverage Safety Testing Market:

There is a dynamic transition occurring in the global market for alcohol-based beverage safety testing. First, there is a growing emphasis on quick testing techniques, with PCR and other automated technologies gaining popularity for quicker microbiological investigation. Second, more specialised and sophisticated testing techniques are required due to the growth of craft beverages and consumer demand for distinctive, premium products. Thirdly, companies must provide thorough testing solutions to guarantee compliance with the more stringent regulations about food safety and labelling. Finally, the growing middle class in developing countries is anticipated to increase the demand for alcoholic drinks, offering safety testing labs a fantastic chance to enter these new markets.

Key Players:

-

Thermo Fisher Scientific Inc.

-

Eurofins Scientific SE

-

SGS SA

-

Intertek Group plc

-

Bureau Veritas S.A.

-

ALS Limited

-

Mérieux NutriSciences Corporation

-

QIMA Limited

-

TÜV SÜD AG

-

Romer Labs Division Holding GmbH

Chapter 1. Alcoholic Beverage Safety Testing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Alcoholic Beverage Safety Testing Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Alcoholic Beverage Safety Testing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Alcoholic Beverage Safety Testing Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Alcoholic Beverage Safety Testing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Alcoholic Beverage Safety Testing Market – By Testing Type

6.1 Introduction/Key Findings

6.2 Chemical Analysis

6.3 Sensory Analysis

6.4 Microbiological Testing

6.5 Packaging Testing

6.6 Stability Testing

6.7 Y-O-Y Growth trend Analysis By Testing Type

6.8 Absolute $ Opportunity Analysis By Testing Type, 2024-2030

Chapter 7. Alcoholic Beverage Safety Testing Market – By Beverage Type

7.1 Introduction/Key Findings

7.2 Beer

7.3 Wine

7.4 Spirits

7.5 Y-O-Y Growth trend Analysis By Beverage Type

7.6 Absolute $ Opportunity Analysis By Beverage Type, 2024-2030

Chapter 8. Alcoholic Beverage Safety Testing Market – By End-User

8.1 Introduction/Key Findings

8.2 Alcoholic Beverage Producers

8.3 Regulatory Bodies

8.4 Retailers

8.5 Y-O-Y Growth trend Analysis By End-User

8.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Alcoholic Beverage Safety Testing Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Testing Type

9.1.3 By Beverage Type

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Testing Type

9.2.3 By Beverage Type

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Testing Type

9.3.3 By Beverage Type

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Testing Type

9.4.3 By Beverage Type

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Testing Type

9.5.3 By Beverage Type

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Alcoholic Beverage Safety Testing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Thermo Fisher Scientific Inc.

10.2 Eurofins Scientific SE

10.3 SGS SA

10.4 Intertek Group plc

10.5 Bureau Veritas S.A.

10.6 ALS Limited

10.7 Mérieux NutriSciences Corporation

10.8 QIMA Limited

10.9 TÜV SÜD AG

10.10 Romer Labs Division Holding GmbH

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Alcoholic Beverage Safety Testing Market size is valued at USD 10.4 billion in 2023.

The worldwide Global Alcoholic Beverage Safety Testing Market growth is estimated to be 4.9% from 2024 to 2030.

The Global Alcoholic Beverage Safety Testing Market is segmented By Testing Type (Chemical Analysis, Sensory Analysis, Microbiological Testing, Packaging Testing, Stability Testing); By Beverage Type (Beer, Wine, Spirits); By End-User (Alcoholic Beverage Producers, Regulatory Bodies, Retailers) and by region.

The growing demand for premium and craft beverages, along with growing concerns about food safety, is likely to propel expansion in the global market for alcoholic beverage safety testing. While entering emerging markets offers a chance, prospective trends include automation and the use of rapid testing techniques.

Due to lab closures, problems with the supply chain, and adjustments in testing priorities, the COVID-19 pandemic most likely caused disruptions in the global market for alcoholic beverage safety testing. It's possible that labs prioritised COVID-19 testing over testing for alcoholic beverages. There may have been disruptions to the supply chains for testing supplies and samples.