Alcohol Colorants Market Size (2024 – 2030)

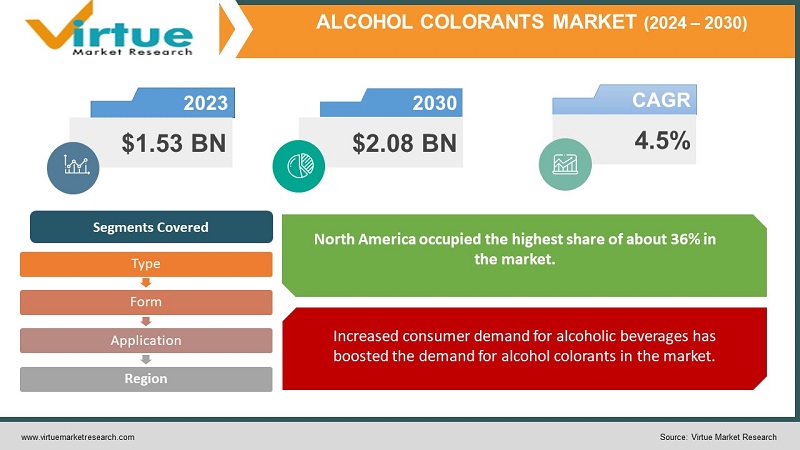

The Alcohol Colorants Market was valued at USD 1.53 billion and is projected to reach a market size of USD 2.08 billion by the end of 2030. Over the outlook period of 2024-2030, the market is anticipated to grow at a CAGR of 4.5%.

In the past, alcohol colorants were prepared using natural ingredients such as vegetables, fruits, certain special flowers, and spices. However, limited resource availability resulted in a slowdown in the production of alcohol-based colorants. Furthermore, in the present scenario, advancements in the chemicals and colorants industry led to the development of varied shades and colors of alcoholic colorants that are widely used in crafting alcoholic beverages such as wine and beer. Moreover, synthetic formulation of alcoholic colorants enabled technicians to produce colorants with extended shelf-life and increased efficiency, as opposed to natural sources that are perishable in nature. Furthermore, the future holds for the alcohol colorants market, with increasing trends in sustainable production and manufacturing, and the technology of producing alcohol colorants moving back to the earlier methods of sourcing alcohol colorants such as deriving colorants from plants, vegetables, and fruits, as consumers have increased their demand for natural and organic food products in the market. Furthermore, trends in edible and eco-friendly packaging and labeling are further increasing the usage of natural alcohol colorants in the packaging and coating industry.

Key Market Insights:

As per the American Addiction Center, nearly 446 billion liters of beer, wine, and spirits are consumed annually around the globe, of which the majority share is beer, lager, and ciders accounting for 396.76 billion liters of consumption every year.

Pharmaceutical color coding has increased the demand for alcohol colorants, as it helps to reduce medication errors. This is depicted by FDA statistics, medication errors cause 7000 deaths each year.

As per the CDC, hand sanitizers should contain at least 60% of ethyl alcohol or isopropyl alcohol, as they help in killing bacteria and viruses.

Alcohol Colorants Market Drivers:

Increased consumer demand for alcoholic beverages has boosted the demand for alcohol colorants in the market.

Alcohol colorants are extensively used as flavoring and coloring agents in alcoholic beverages such as wines, whiskey, cocktails, beer, and others. The increased demand consumers for strong and flavored alcoholic beverages is propelling the demand for alcohol colorants, especially ethanol colorants in the market. Moreover, weekend party culture and social gatherings are further boosting the usage of beers and wines. In addition, colorful cocktails that contain natural alcohol colorants such as those prepared from fruit extracts are gaining popularity due to their tangy taste and texture in the market. Furthermore, rising trends in seasoned drinks are further increasing the usage of alcohol colorants in hand-crafted cocktails, beers, and rums.

Technological advancements in the colorants industry have boosted the demand for alcohol colorants in the market.

Advancements in colorant technology such as the use of advanced quality controllers such as sensors for monitoring the processing of alcoholic food colorant and colorant for beverages. Moreover, the incorporation of environment-friendly packaging designs and labeling such as green labeling, 3D colored printing, and digital labeling, on account of increasing trends in sustainable production and manufacturing, has further contributed to the demand for alcohol colorants in the market. Additionally, rising consumer demand for natural and organic products further led to the development of organic and natural alcohol colorants that require minimal processing and reduce the negative carbon footprint that is released during the production and manufacturing of alcohol colorants. Additionally, rising trends in health & fitness have led to the development of sugar-free formulations using advanced dispersion methods, leading to low-sugar or zero-sugar alcoholic and non-alcoholic beverages.

Alcohol Colorants Market Restraints and Challenges:

Health concerns can decrease the demand for alcohol colorants in the market. Some products that contain alcohol colorants may lead to health concerns due to the presence of harmful chemicals inside the product that can damage the health of individuals if not used within prescribed limits. This can also include alcohol-based coloring kits for children that can damage the health of children, as children can consume the color during drawing or painting, leading to increased health risks.

Furthermore, environmental concerns can further decline the market growth of alcohol colorants, as colorants obtained through synthetic or chemical processes release harmful gases and chemicals into the atmosphere during the production and manufacturing process, which can damage the environment as well as the health of the people.

Alcohol Colorants Market Opportunities:

The Alcohol Colorants Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches, and agreements during the forecasted period. Furthermore, increasing consumer demand for flavored and vibrant beverages, especially alcoholic beverages is predicted to develop the market for alcohol colorants and enhance its future growth opportunities.

ALCOHOL COLORANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Type, Application, Form, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kremer Pigmente, Beyond Inks, Jacquard Products, Shreemahalxmi Chemicals, Sato Food Industries Co.ltd, Astra Chemicals, Tenants Textile Colors Ltd, The Chemical Company |

Alcohol Colorants Market Segmentation: By Type

-

Ethanol

-

Isopropanol

In 2022, ethanol occupied the highest share of about 33% in the market. It is the most common form of alcohol that is widely used as a colorant in the food and beverage industry for food coloring and flavor-enhancing purposes. Moreover, the increased demand for organic and natural food has increased the demand for fruit-based ethanol colorants that I prepared by fermenting fruits.

Isopropanol is the fastest-growing segment during the forecast period. This form of alcohol is increasingly used in the beauty industry for preparing hair and skin formulations, perfumes, soaps, aftershaves, toners, and others due to their ability to destroy bacteria by acting as a solvent. Moreover, due to its quick evaporating properties, it is increasingly used as a cleaning and disinfecting agent, as it leaves no residues behind and provides a smooth surface.

Alcohol Colorants Market Segmentation: By Application

-

Pharmaceuticals

-

Food & Beverage

-

Industrial

-

Beauty & Personal Care

-

Others

In 2022, food & and beverage occupied the highest share of about 42% in the market. Alcoholic colorants find increased applications in the food & beverage industry, as they enhance the overall visual appeal and taste of the product. These include the use of fruit-based colorants in alcoholic beverages such as wine, beer, spirits such as whiskeys, vodka, and rum; using processed alcohol colorants in assorted desserts and confectionary such as chocolates, cakes, muffins, cookies, and others. Moreover, the increased demand for ready-to-eat and processed foods has increased the demand for alcohol colorants as dressings and sauces, as they enhance the visual appeal and maintain the freshness of the food.

Pharmaceuticals are the fastest-growing segment during the forecast period. Alcohol colorants are increasingly used in the pharmaceutical industry for coloring medicines, special formulations, and in the preparation of gel capsules, soft gels, sanitizers, and others due to visually appealing abilities that help patients in consuming medicines easily, thereby increasing the treatment efficiency. Moreover, it is also used to color code drugs with different formulations, which helps healthcare professionals identify high dosages and strong medications from moderate ones. This further reduces the risk of human error in delivering the wrong amount of medications to patients.

Alcohol Colorants Market Segmentation: By Form

-

Liquid

-

Powder

In 2022, the liquid segment occupied the highest share of about 52% in the market. Liquid alcohol colorants make it easier to apply in various industries, as they are easily soluble and can be easily blended with other formulations. This is especially used in the preparation of perfumes, in pharmaceuticals for preparing specialized syrups or drug formulations, and in alcoholic and non-alcoholic beverages to enhance the taste of drinks.

Power alcohol colorants occupy a sizeable share of the market and are increasingly used in the preparation of bakery and confectionary products such as a coloring agent in candies, cakes, pastries, and in frosting. Additionally, it is added in cosmetics formulations to enhance the visual appeal by increasing the vibrancy of colors in blushes, eyeshadows, powdered foundations, and others. Moreover, powdered alcohol colorants offer easy storage and extended shelf-life to various products, which makes them a suitable choice in various industries.

Alcohol Colorants Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle-East & Africa

In 2022, North America occupied the highest share of about 36% in the market. Rising demand for alcoholic beverages such as beer, whiskeys, cocktails, and wines, as a result of the prevalence of party culture and increased consumer demand for organic and natural food products, has contributed to the demand for alcohol colorants in the region.

Asia-Pacific is the fastest-growing region during the forecast period. The rapidly developing cosmetics industry with increased demand for premium perfumes and hair products, abundance of natural ingredients for preparing organic alcohol colorants, and increased demand for colorants in drug formulations and development has contributed to the demand for alcohol colorants in the region.

COVID-19 Impact Analysis on the Alcohol Colorants Market

The pandemic had a significant impact on the alcohol colorants in the market. On one hand, there was an increased demand for alcohol colorants in the healthcare sector for coating medicines, sanitizers, surface disinfectants, and others. However, supply chain disruption resulted in difficulty in sourcing and processing of these colorants, which was caused due to restrictions in movement and closure of various industries, leading to a slowdown in the production and distribution of alcohol colorants. Additionally, fluctuations in the consumption of alcohol during the pandemic resulted in reduced usage of alcohol colorants in the market.

Latest Developments:

The market for alcohol colorants is witnessing an upward trend due to rising demand for unique flavored cocktails and other beverages that use alcohol colorants. Moreover, rising health & fitness awareness is increasing the demand for natural alcohol colorants that pose less risk to health and also provide delicious taste and enhanced texture to food products. Furthermore, trends in 3D printing and edible printing in the packaging industry are propelling the growth of alcohol colorants in the market.

Key Players:

-

Kremer Pigmente

-

Beyond Inks

-

Jacquard Products

-

Shreemahalxmi Chemicals

-

Sato Food Industries Co.ltd

-

Astra Chemicals

-

Tenants Textile Colors Ltd

-

The Chemical Company

Chapter 1. Alcohol Colorants Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Alcohol Colorants Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Alcohol Colorants Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Alcohol Colorants Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Alcohol Colorants Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Alcohol Colorants Market – By Type

6.1 Introduction/Key Findings

6.2 Ethanol

6.3 Isopropanol

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Alcohol Colorants Market – By Application

7.1 Introduction/Key Findings

7.2 Pharmaceuticals

7.3 Food & Beverage

7.4 Industrial

7.5 Beauty & Personal Care

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Alcohol Colorants Market – By Form

8.1 Introduction/Key Findings

8.2 Liquid

8.3 Powder

8.4 Y-O-Y Growth trend Analysis By Form

8.5 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 9. Alcohol Colorants Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Application

9.1.4 By Form

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Application

9.2.4 By Form

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Application

9.3.4 By Form

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Application

9.4.4 By Form

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Application

9.5.4 By Form

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Alcohol Colorants Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Kremer Pigmente

10.2 Beyond Inks

10.3 Jacquard Products

10.4 Shreemahalxmi Chemicals

10.5 Sato Food Industries Co.ltd

10.6 Astra Chemicals

10.7 Tenants Textile Colors Ltd

10.8 The Chemical Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Alcohol Colorants Market was valued at USD 1.53 billion and is projected to reach a market size of USD 2.08 billion by the end of 2030. Over the outlook period of 2024-2030, the market is anticipated to grow at a CAGR of 4.5%.

Increased consumer demand for alcoholic beverages and Technological advancements in the colorants industry are the market drivers of the Alcohol Colorants market.

Ethanol and Isopropanol, are the segments under the Alcohol Colorants Market by type.

North America is the most dominant region for the Alcohol Colorants Market.

Asia-Pacific is the fastest-growing region in the Alcohol Colorants Market.