Airport Security Screening Market Size (2024–2030)

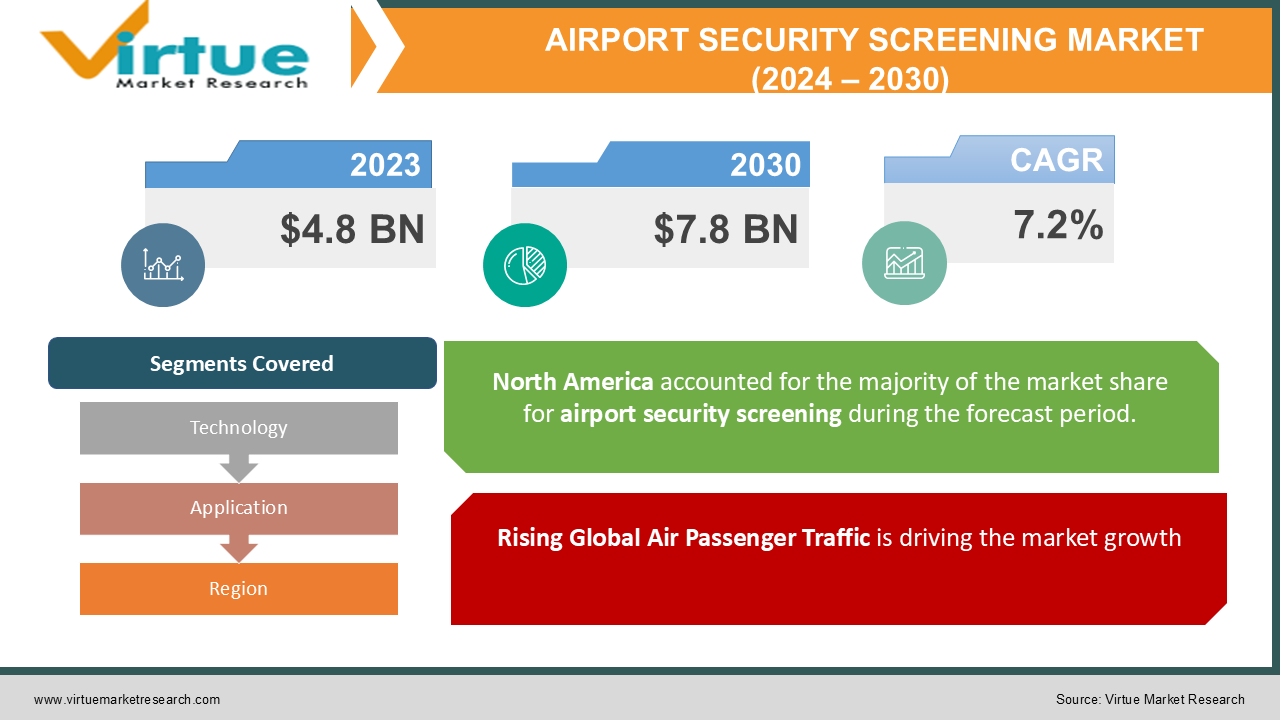

The Global Airport Security Screening Market was valued at USD 4.8 billion in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030, reaching USD 7.8 billion by 2030.

The rise in passenger traffic, coupled with increasing concerns about airport safety and security threats, has driven the need for more advanced and efficient screening systems. Security screening processes are critical to safeguarding travelers, airport staff, and cargo from potential threats, including terrorism and smuggling.

Airport security screening encompasses a wide range of technologies and systems, such as X-ray machines, metal detectors, biometric systems, and explosive trace detectors, aimed at preventing unlawful interference in aviation. Innovations in screening technology and the need for faster, more accurate security measures have also fueled market expansion. Governments around the world are investing heavily in upgrading airport security infrastructure to meet international safety standards and comply with evolving regulations.

Key Market Insights:

-

X-ray systems are the dominant technology in the airport security screening market, holding 40% of the market share in 2023 due to their widespread use in baggage and cargo screening.

-

Biometric security systems are experiencing the fastest growth, with a projected CAGR of 9.5% from 2024 to 2030, driven by the increasing adoption of facial recognition, fingerprint scanning, and iris recognition at checkpoints.

-

Commercial airports account for the largest application segment, contributing 80% of the market revenue, owing to the growing volume of international and domestic air travelers.

-

North America leads the global airport security screening market, holding 35% of the market share in 2023, supported by the United States’ large-scale investments in airport security technology and stringent regulations.

-

Increasing air passenger traffic, particularly in Asia-Pacific, is expected to fuel market growth, with the region forecast to achieve the highest CAGR of 8.2% during the forecast period.

Global Airport Security Screening Market Drivers:

Rising Global Air Passenger Traffic is driving the market growth:

The surge in global air passenger traffic is one of the primary drivers of the airport security screening market. In 2023, more than 4.5 billion passengers traveled via air globally, a number expected to increase significantly over the coming years. This growth is being fueled by the expansion of low-cost carriers, rising disposable incomes in developing countries, and the recovery of international tourism following the COVID-19 pandemic. As airports accommodate more passengers, there is an increasing need to enhance security measures without causing delays or disruptions. Airport security systems must be capable of handling large volumes of passengers while ensuring the highest level of safety. The introduction of faster, more reliable security screening technologies, such as advanced imaging systems and automated threat detection, helps airports manage this growing demand while maintaining efficient operations. Moreover, the International Air Transport Association (IATA) predicts that air traffic will double by 2035, which will further strain existing airport security infrastructure. To address this, airports are investing in state-of-the-art security systems that can process more passengers in less time while accurately identifying potential threats. These developments are expected to drive the continuous growth of the airport security screening market.

Increasing Security Threats and Regulatory Mandates are driving the market growth:

The rising number of security threats, including terrorism, human trafficking, smuggling, and cyberattacks, has made airport security a top priority for governments and aviation authorities worldwide. High-profile incidents, such as terrorist attacks on airplanes and airport facilities, have highlighted the importance of robust security screening protocols. As a result, there has been an increase in the deployment of cutting-edge security systems that can detect explosives, weapons, drugs, and other prohibited items more effectively. Regulatory bodies, such as the U.S. Transportation Security Administration (TSA), the European Civil Aviation Conference (ECAC), and the International Civil Aviation Organization (ICAO), have set stringent guidelines and requirements for airport security screening. For example, TSA mandates the use of advanced imaging technology (AIT) for passenger screening and has implemented enhanced explosive detection systems for checked baggage. Compliance with these regulations requires airports to continuously upgrade their security infrastructure and adopt the latest technologies to meet safety standards. Additionally, airports in high-risk regions or those that handle high volumes of international travelers are particularly focused on enhancing their security measures, driving the demand for advanced screening solutions.

Technological Advancements in Security Screening Systems is driving the market growth:

The airport security screening market is benefiting from rapid technological advancements, particularly in the fields of artificial intelligence (AI), machine learning (ML), and biometric technologies. These innovations are transforming the way security screening is conducted, improving accuracy, efficiency, and the overall passenger experience. AI and ML-powered security systems are capable of analyzing vast amounts of data in real-time, enabling more accurate detection of threats such as explosives, weapons, and contraband. These systems can also learn and adapt over time, improving their performance and reducing the occurrence of false alarms. AI-driven algorithms are being integrated into X-ray and CT scanners, allowing for automated threat recognition and minimizing the need for manual inspection. Biometric security systems, including facial recognition, fingerprint scanning, and iris recognition, are also gaining traction in airports. These technologies streamline the security process by allowing passengers to pass through checkpoints without the need for traditional boarding passes or identification documents. Biometric systems not only enhance security but also improve the efficiency of passenger flow, reducing wait times and enhancing the overall travel experience. The development of non-intrusive security screening technologies, such as millimeter-wave scanners and terahertz imaging systems, is another significant trend. These technologies enable security personnel to detect concealed items without the need for physical pat-downs or invasive searches, providing a more comfortable experience for passengers while maintaining high levels of security.

Global Airport Security Screening Market Challenges and Restraints:

High Costs of Advanced Security Systems are restricting the market growth:

One of the major challenges facing the airport security screening market is the high cost associated with deploying and maintaining advanced security systems. Technologies such as full-body scanners, explosive trace detectors, and biometric systems require significant investment in both hardware and software. The installation of these systems involves complex infrastructure upgrades, which can be costly for airports, especially smaller regional airports with limited budgets. In addition to the initial investment, ongoing operational costs, including maintenance, software updates, and training of security personnel, can further strain airport finances. For many airports, particularly those in developing regions, the high cost of adopting cutting-edge security solutions poses a significant barrier to entry. Furthermore, with the rapid pace of technological advancements, security screening systems may become obsolete within a few years, necessitating frequent upgrades or replacements. This continuous cycle of investment can be burdensome for airport authorities, especially when balancing the need for security with budget constraints.

Privacy Concerns and Passenger Experience is restricting the market growth:

While advanced security screening technologies offer enhanced safety, they also raise concerns about passenger privacy and the overall travel experience. Technologies such as full-body scanners and facial recognition systems have sparked debates about the extent to which personal data and images are being collected, stored, and used. Privacy advocates have expressed concerns over the use of facial recognition at airports, particularly regarding the potential for misuse or unauthorized access to biometric data. There are also worries that such systems may disproportionately target specific groups of travelers based on race, ethnicity, or nationality. Governments and airport authorities must strike a delicate balance between improving security and safeguarding passengers' privacy rights. Additionally, the implementation of new security technologies can sometimes lead to longer wait times and increased frustration among passengers. While systems like X-ray scanners and metal detectors are designed to enhance safety, they can also slow down the security screening process if not managed efficiently. Airports must focus on optimizing the integration of these technologies to minimize disruptions and ensure a smooth passenger experience.

Market Opportunities:

The global airport security screening market offers several growth opportunities, particularly in the areas of biometric systems, artificial intelligence (AI), and automated screening processes. As airports around the world strive to improve security while minimizing passenger inconvenience, the demand for innovative solutions that can enhance both safety and efficiency is expected to rise. Biometric systems, such as facial recognition and iris scanning, are emerging as a key area of growth in airport security. These systems streamline the screening process by eliminating the need for traditional boarding passes and identification documents, allowing passengers to move through checkpoints more quickly. Many airports have already begun implementing biometric screening technologies, and the trend is expected to continue as more travelers become accustomed to this technology. In addition to biometrics, the integration of AI-powered threat detection systems is poised to transform the airport security landscape. AI algorithms can analyze vast amounts of data in real time, identifying potential threats with greater accuracy and reducing false alarms. This technology is particularly useful in X-ray and CT scanners, where automated threat recognition can enhance the efficiency of baggage and cargo screening. Moreover, the development of automated security screening lanes and self-service checkpoints presents significant opportunities for reducing congestion and improving the passenger experience. These systems use AI and machine learning to assess risk levels and determine the appropriate level of screening for each passenger, allowing for a more personalized and efficient security process.

AIRPORT SECURITY SCREENING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Smiths Detection Inc., OSI Systems, Inc., Leidos Holdings, Inc., L3Harris Technologies, Inc., FLIR Systems, Inc., Analogic Corporation, Nuctech Company Limited, CEIA SpA, Autoclear, LLC, Vanderlande Industries |

Airport Security Screening Market Segmentation: By Technology

-

X-ray Systems

-

Metal Detectors

-

Explosive Trace Detectors

-

Biometric Systems

The X-ray systems segment holds the largest market share in 2023, accounting for over 40% of the total market revenue. X-ray systems are widely used for scanning both carry-on and checked baggage, and their ability to detect a wide range of prohibited items, including weapons, explosives, and drugs, makes them a critical component of airport security infrastructure.

Airport Security Screening Market Segmentation: By Application

-

Commercial Airports

-

Defense Airports

The commercial airports segment dominates the global airport security screening market, contributing 80% of the market revenue in 2023. The growing number of passengers traveling through commercial airports, coupled with stringent security regulations, has driven the demand for advanced security screening systems in this segment.

Airport Security Screening Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America leads the global airport security screening market, accounting for 35% of the market share in 2023. The region’s dominance is driven by the United States, which has one of the largest aviation industries in the world and is home to some of the busiest airports. The presence of stringent government regulations, such as those enforced by the Transportation Security Administration (TSA), has fueled investments in upgrading airport security systems.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a mixed impact on the global airport security screening market. In the early stages of the pandemic, there was a sharp decline in air travel as countries imposed lockdowns and travel restrictions to curb the spread of the virus. This led to a reduction in passenger traffic, causing temporary delays in the implementation of new security systems and the postponement of planned airport infrastructure upgrades. However, as the world adapted to the pandemic and air travel gradually resumed, airports began prioritizing contactless security solutions to minimize physical contact between passengers and security personnel. The need for touchless biometric systems, such as facial recognition and automated boarding, gained prominence as airports sought to enhance passenger safety and reduce the risk of virus transmission. The pandemic also underscored the importance of resilient and adaptable security infrastructure that can handle fluctuations in passenger traffic while maintaining high levels of safety. In the post-pandemic era, there has been a renewed focus on modernizing airport security systems to not only address current health and safety concerns but also prepare for future crises. This has driven demand for advanced technologies such as AI-powered threat detection and automated screening systems, which are expected to play a key role in the market’s recovery and growth.

Latest Trends/Developments:

Several key trends are shaping the future of the global airport security screening market. The integration of AI and machine learning into security screening systems is revolutionizing the way threats are detected, allowing for more accurate and efficient identification of dangerous items. AI-powered security systems are capable of analyzing large datasets in real time, reducing the likelihood of false positives and improving overall security outcomes. Another significant trend is the growing adoption of biometric security technologies. Airports around the world are increasingly implementing facial recognition, fingerprint scanning, and iris recognition systems to enhance the efficiency of passenger screening. Biometric systems offer a seamless and contactless experience, reducing the need for manual document checks and minimizing wait times at security checkpoints. The demand for non-intrusive screening technologies is also on the rise. Technologies such as millimeter-wave scanners and terahertz imaging systems enable security personnel to detect concealed weapons and explosives without requiring passengers to undergo invasive pat-downs or body scans. These systems are becoming increasingly popular in airports looking to enhance security while improving the passenger experience.

Key Players:

-

Smiths Detection Inc.

-

OSI Systems, Inc.

-

Leidos Holdings, Inc.

-

L3Harris Technologies, Inc.

-

FLIR Systems, Inc.

-

Analogic Corporation

-

Nuctech Company Limited

-

CEIA SpA

-

Autoclear, LLC

-

Vanderlande Industries

Chapter 1. Airport Security Screening Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Airport Security Screening Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Airport Security Screening Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Airport Security Screening Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Airport Security Screening Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Airport Security Screening Market – By Technology

6.1 Introduction/Key Findings

6.2 X-ray Systems

6.3 Metal Detectors

6.4 Explosive Trace Detectors

6.5 Biometric Systems

6.6 Y-O-Y Growth trend Analysis By Technology

6.7 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Airport Security Screening Market – By Application

7.1 Introduction/Key Findings

7.2 Commercial Airports

7.3 Defense Airports

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Airport Security Screening Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Technology

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Technology

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Technology

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Technology

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Technology

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Airport Security Screening Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Smiths Detection Inc.

9.2 OSI Systems, Inc.

9.3 Leidos Holdings, Inc.

9.4 L3Harris Technologies, Inc.

9.5 FLIR Systems, Inc.

9.6 Analogic Corporation

9.7 Nuctech Company Limited

9.8 CEIA SpA

9.9 Autoclear, LLC

9.10 Vanderlande Industries

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global airport security screening market was valued at USD 4.8 billion in 2023 and is projected to reach USD 7.8 billion by 2030, growing at a CAGR of 7.2%.

Key drivers include the rising volume of air passengers, increasing security threats, regulatory mandates, and advancements in security screening technology, such as AI and biometric systems.

The market is segmented by technology (X-ray systems, metal detectors, biometric systems, explosive trace detectors) and applications (commercial airports, defense airports).

North America is the dominant region, accounting for 35% of the market share in 2023, with the United States playing a major role in the market’s growth.

Leading players include Smiths Detection Inc., OSI Systems, Inc., Leidos Holdings, Inc., L3Harris Technologies, Inc., and FLIR Systems, Inc.