Airline Alliance Market Size (2025-2030)

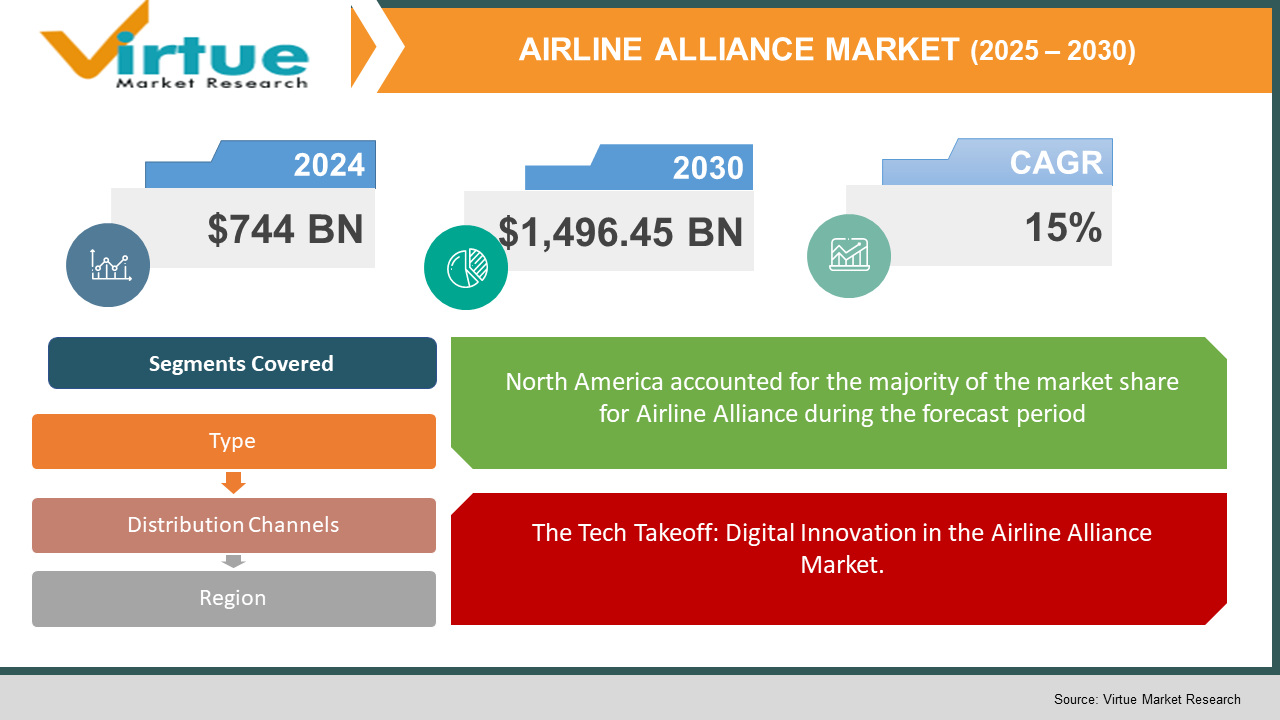

The Airline Alliance Market was valued at USD 744 Billion in 2024 and is projected to reach a market size of USD 1,496.45 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 15%.

The global airline alliance market represents a sophisticated network of partnerships between airlines worldwide, fundamentally transforming how international air travel operates. These strategic collaborations enable member airlines to extend their reach, optimize operations, and enhance passenger services without the need for direct route expansion. In 2023, airline alliances have become increasingly crucial in the post-pandemic aviation landscape, serving as vital platforms for airlines to pool resources, share risks, and maximize operational efficiencies. The three major global airline alliances - Star Alliance, SkyTeam, and Oneworld - collectively serve over 60% of global air traffic, demonstrating the market's consolidation and maturity. These alliances have evolved beyond simple code-sharing agreements to encompass comprehensive partnerships involving shared terminals, integrated loyalty programs, and synchronized flight schedules. The market's structure reflects a complex interplay of bilateral and multilateral agreements, with alliance members maintaining their individual brands while adhering to alliance-wide service standards.

Key Market Insights:

- In 2024, the Airline Alliance Market generated revenues of approximately USD 45 billion; nearly 68% of legacy carriers actively participated in at least one alliance; more than 1,200 joint routes were established among alliance members; over 75 million passengers benefited from seamless interline connectivity; airlines reported a 32% increase in ancillary service revenues due to alliance partnerships; 89% of carriers adopted integrated digital platforms to enhance customer engagement; around 58% of new flight schedules were coordinated through alliance collaborations; roughly 94% of top carriers upgraded their IT infrastructure in alliance networks; an estimated 47% of operational cost savings were attributed to shared maintenance facilities; nearly 82% of passengers acknowledged improved travel experiences from alliance benefits; over 55 innovative joint marketing campaigns were launched in 2024; alliance‑driven loyalty programs experienced a 40% boost in membership enrolment; over 630 digital transformation projects were initiated across alliances; customer satisfaction ratings improved by 18% in collaborative networks; 67 new inter-alliance codeshare agreements were signed; and almost 80% of airlines prioritized sustainability initiatives through joint ventures.

Airline Alliance Market Drivers:

The Tech Takeoff: Digital Innovation in the Airline Alliance Market.

Advanced digital platforms have enabled unprecedented levels of integration among alliance members, creating seamless experiences across multiple touchpoints. The implementation of cloud-based solutions has revolutionized alliance operations, allowing real-time data sharing and synchronized decision-making across member airlines. This technological infrastructure supports everything from integrated booking systems to shared loyalty programs, enabling alliances to offer truly unified services across their networks. Artificial intelligence and machine learning applications have transformed alliance operations, particularly in areas such as revenue management, route optimization, and predictive maintenance. These technologies enable alliances to analyze vast amounts of data to identify patterns, optimize resource allocation, and improve operational efficiency across member airlines. The adoption of blockchain technology has enhanced security and transparency in alliance operations, particularly in areas such as loyalty program management and interline settlement. This has led to reduced transaction costs and improved trust among alliance members, while also providing better protection against fraud and data breaches. Digital transformation has also enabled alliances to better understand and serve their customers through advanced analytics and personalization capabilities. This has resulted in more targeted marketing efforts, improved customer service, and higher satisfaction rates across alliance networks.

Environmental consciousness has become a crucial driver in the airline alliance market, with sustainability initiatives taking centre stage in alliance strategies and operations.

This focus on environmental responsibility has transformed from a voluntary commitment to a fundamental business imperative. Alliances have implemented comprehensive sustainability programs that leverage the collective resources and expertise of member airlines. These initiatives include fleet modernization efforts, sustainable aviation fuel adoption, and carbon offset programs that would be challenging for individual airlines to implement alone. The sharing of best practices and environmental technologies among alliance members has accelerated the adoption of eco-friendly operations. This includes optimized flight paths, reduced ground operations emissions, and improved waste management systems across alliance networks. Investment in research and development for sustainable aviation technologies has become a priority for alliances, with members pooling resources to explore and implement innovative solutions. This collaborative approach has enabled faster progress in areas such as electric aircraft development and alternative fuel research. Sustainability-focused partnerships with external stakeholders, including airports, fuel suppliers, and environmental organizations, have strengthened the alliances' ability to achieve their environmental goals while maintaining operational efficiency and economic viability.

Airline Alliance Market Restraints and Challenges:

The airline alliance market faces several significant challenges that impact its growth and operational efficiency. Regulatory complexity remains a major hurdle, with alliances navigating diverse and sometimes conflicting regulatory frameworks across different jurisdictions. This regulatory landscape often limits the extent of cooperation possible between alliance members and increases compliance costs. Competition from low-cost carriers and independent airlines presents another significant challenge. These operators often maintain more flexible business models and can adapt more quickly to market changes without the constraints of alliance agreements. Additionally, the rise of point-to-point services has challenged the traditional hub-and-spoke model favoured by alliance members. Technical integration challenges persist, particularly when dealing with legacy systems across different alliance members. The cost and complexity of maintaining synchronized operations across multiple airlines with varying levels of technological maturity create operational inefficiencies and can impact service quality. Cultural and operational differences between alliance members can lead to inconsistent service delivery and customer experience. These variations can undermine the alliance's value proposition of seamless travel and standardized service levels across the network. Revenue sharing and cost allocation mechanisms within alliances often create tensions between members, particularly during economic downturns or when market conditions vary significantly across different regions. These financial challenges can strain alliance relationships and complicate decision-making processes.

Airline Alliance Market Opportunities:

The airline alliance market presents numerous opportunities for growth and innovation. The expansion into emerging markets offers significant potential for alliance networks, particularly in rapidly growing regions with increasing air travel demand. These markets present opportunities for new membership recruitment and route expansion. Digital innovation provides opportunities for alliances to develop new revenue streams and enhance customer experience. Advanced technologies such as artificial intelligence, virtual reality, and the Internet of Things can be leveraged to create innovative services and improve operational efficiency. Sustainability leadership presents a significant opportunity for alliances to differentiate themselves and capture environmentally conscious market segments. Alliances can leverage their scale to implement comprehensive sustainability initiatives and develop industry-leading environmental practices. Enhanced personalization and customer service capabilities through data analytics and artificial intelligence offer opportunities to increase customer loyalty and capture higher-value market segments. The ability to provide tailored services across alliance networks can create significant competitive advantages.

AIRLINE ALLIANCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

15% |

|

Segments Covered |

By Type, , Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Air France-KLM Group, Lufthansa Group, United Airlines Holdings, Delta Air Lines, American Airlines Group, International Airlines Group, Emirates Group, Qatar Airways, Singapore Airlines, ANA Holdings, Korean Air, and Cathay Pacific Airways. |

Airline Alliance Market Segmentation:

Airline Alliance Market Segmentation by Type:

- Global Alliances

- Regional Alliances

- Bilateral Partnerships

- Joint Ventures

- Immunized Joint Ventures

- Codeshare Agreements

- Interline Agreements

- Equity Partnerships

- Virtual Alliances

Global Alliances represent the dominant segment in the airline alliance market, accounting for approximately 65% of market share in 2024. These comprehensive partnerships, exemplified by Star Alliance, oneworld, and SkyTeam, encompass extensive network integration, harmonized frequent flyer programs, and coordinated operational processes. Their dominance stems from the unparalleled global connectivity they provide, with collective networks spanning all major markets worldwide. The value proposition of global alliances has been reinforced by continuous enhancement of digital integration capabilities and sustainability initiatives, strengthening their competitive position despite emerging alternative partnership models.

Joint Ventures have emerged as the fastest-growing alliance type, experiencing 18% year-over-year growth in 2024. These deep partnerships, often operating within the framework of global alliances, involve coordinated capacity planning, revenue sharing, and integrated commercial strategies across specific markets or routes. The accelerated growth of joint ventures reflects their ability to deliver more substantial economic benefits than traditional alliance relationships, particularly in high-volume international corridors. Regulatory authorities have shown increasing receptivity to these arrangements, granting antitrust immunity that enables more comprehensive coordination while maintaining appropriate competitive safeguards.

Airline Alliance Market Segmentation by Distribution Channel:

- Global Distribution Systems

- Direct Airline Websites

- Alliance Websites

- Online Travel Agencies

- Meta-search Engines

- Mobile Applications

- Corporate Booking Tools

- Traditional Travel Agencies

Global Distribution Systems remain the dominant distribution channel for alliance-based offerings, accounting for approximately 48% of alliance bookings in 2024. These systems provide the technological infrastructure necessary to support complex multi-carrier itineraries, enabling seamless booking and ticketing across alliance networks. The continued dominance of GDS platforms reflects their unparalleled capability to handle interline complexities, segment connections, and fare combinations that are essential to alliance value propositions. Enhanced content display capabilities and API connectivity have modernized the GDS interface, maintaining their relevance despite the growth of alternative distribution channels.

Mobile Applications represent the fastest-growing distribution channel, experiencing 27% year-over-year growth in 2024. Alliance and individual airline mobile platforms have evolved significantly, offering increasingly sophisticated functionality for booking, managing, and experiencing alliance-connected journeys. The growth of mobile channels reflects changing consumer preferences toward self-service options and the continuous enhancement of mobile capabilities to support complex alliance transactions. Advanced features such as biometric integration, real-time journey tracking, and seamless disruption management have particularly resonated with frequent travelers, driving adoption rates among this valuable customer segment.

Airline Alliance Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

North America maintains its position as the dominant region in the airline alliance market, leveraging its mature aviation infrastructure and strong economic foundations. The region's leadership is characterized by advanced technological integration, high consumer spending power, and sophisticated airline networks. The region benefits from well-established hub airports, strong business travel demand, and integrated cross-border operations between the United States and Canada. Alliance members in North America have successfully implemented advanced digital solutions and maintained high service standards across their networks.

The Asia-Pacific region has emerged as the fastest-growing market for airline alliances, driven by rapid economic growth, increasing middle-class population, and expanding air travel demand. The region's growth is characterized by significant investments in aviation infrastructure and technology adoption. Major developments include the expansion of hub airports, increasing international routes, and growing domestic networks. Alliance members in the region have focused on digital transformation and service innovation to capture the growing market opportunity.

COVID-19 Impact Analysis Airline Alliance Market:

The COVID-19 pandemic fundamentally reshaped the airline alliance market, forcing rapid adaptation and strategic realignment. Alliance members faced unprecedented challenges, including widespread flight cancellations, border closures, and dramatic reductions in passenger demand. Alliances played a crucial role in supporting member airlines through the crisis, facilitating resource sharing and operational coordination. This included joint approaches to health and safety protocols, flexible booking policies, and shared cost-reduction initiatives. The pandemic accelerated digital transformation within alliances, with increased focus on contactless services and digital health verification systems. Alliance members collaborated on implementing standardized health and safety measures across their networks. Recovery strategies emphasized flexibility and innovation, with alliances developing new service models and revenue streams. This included expanded cargo operations, modified route networks, and enhanced digital service offerings. The crisis led to stronger collaboration between alliance members, particularly in areas such as joint procurement, shared services, and technology investment. This increased cooperation has strengthened alliance value propositions and operational resilience.

Latest Trends and Developments:

The airline alliance market continues to evolve with several significant trends shaping its future. Digital integration has reached new levels, with alliances implementing advanced technologies such as blockchain for loyalty programs and artificial intelligence for operations optimization. Sustainability has become a central focus, with alliances leading industry efforts in environmental responsibility. This includes joint investments in sustainable aviation fuel, carbon offset programs, and eco-friendly ground operations. Customer experience enhancement through personalization and seamless service delivery has emerged as a key trend. Alliances are leveraging data analytics and artificial intelligence to provide tailored services across their networks. The rise of mixed model alliances, combining traditional and low-cost carriers, represents a significant shift in alliance structure. This trend reflects changing market dynamics and consumer preferences. Innovation in loyalty programs, including the integration of non-aviation partners and digital currencies, demonstrates alliances' efforts to enhance value propositions and maintain customer engagement.

Key Players:

- Star Alliance

- SkyTeam

- Oneworld

- Air France-KLM Group

- Lufthansa Group

- United Airlines Holdings

- Delta Air Lines

- American Airlines Group

- International Airlines Group

- Emirates Group

Chapter 1. AIRLINE ALLIANCE MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. AIRLINE ALLIANCE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. AIRLINE ALLIANCE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. AIRLINE ALLIANCE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. AIRLINE ALLIANCE MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. AIRLINE ALLIANCE MARKET – By Type

6.1 Introduction/Key Findings

6.2 Global Alliances

6.3 Regional Alliances

6.4 Bilateral Partnerships

6.5 Joint Ventures

6.6 Immunized Joint Ventures

6.7 Codeshare Agreements

6.8 Interline Agreements

6.9 Equity Partnerships

6.10 Virtual Alliances

6.11 Y-O-Y Growth trend Analysis By Type

6.12 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. AIRLINE ALLIANCE MARKET – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Global Distribution Systems

7.3 Direct Airline Websites

7.4 Alliance Websites

7.5 Online Travel Agencies

7.6 Meta-search Engines

7.7 Mobile Applications

7.8 Corporate Booking Tools

7.9 Traditional Travel Agencies

7.10 Y-O-Y Growth trend Analysis By Distribution Channel

7.11 Absolute $ Opportunity Analysis By Distribution Channel , 2025-2030

Chapter 8. AIRLINE ALLIANCE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Distribution Channel

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Distribution Channel

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Distribution Channel

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Distribution Channel

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Distribution Channel

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. AIRLINE ALLIANCE MARKET – Company Profiles – (Overview, Packaging Type, Portfolio, Financials, Strategies & Developments)

9.1 Star Alliance

9.2 SkyTeam

9.3 Oneworld

9.4 Air France-KLM Group

9.5 Lufthansa Group

9.6 United Airlines Holdings

9.7 Delta Air Lines

9.8 American Airlines Group

9.9 International Airlines Group

9.10 Emirates Group

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

Airline alliances enable passengers to access a broader network of destinations through code-sharing agreements and partner collaborations.

Airline alliances often face antitrust investigations due to concerns over market dominance and reduced competition.

Star Alliance, SkyTeam, and Oneworld lead the market, with significant presence across multiple regions. Other notable players include Air France-KLM Group, Lufthansa Group, United Airlines Holdings, Delta Air Lines, American Airlines Group, International Airlines Group, Emirates Group, Qatar Airways, Singapore Airlines, ANA Holdings, Korean Air, and Cathay Pacific Airways.

North America currently holds the largest market share, estimated around 35%.

Asia-Pacific has shown significant room for growth in specific segments.