Aircraft Wing Leading Edge Market Size (2024 – 2030)

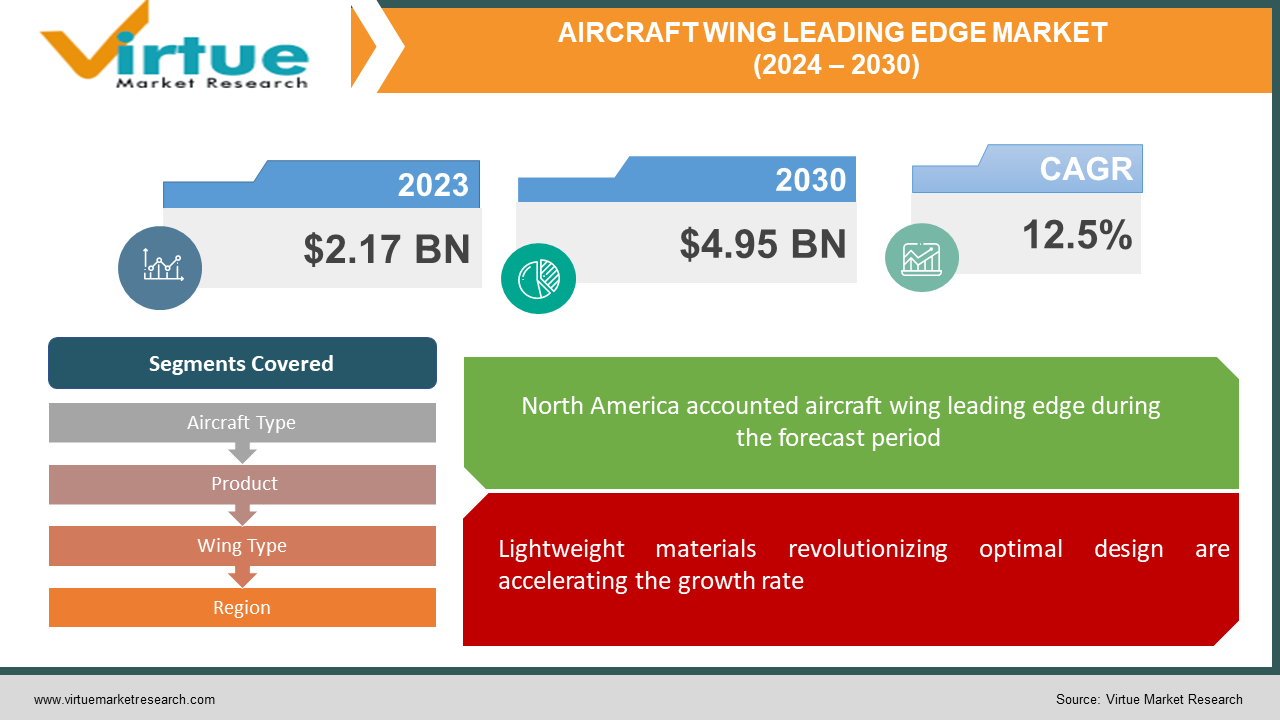

The market for aircraft wing leading edge was estimated to be worth USD 2.17 billion in 2023 and is expected to increase to USD 4.95 USD by 2030, with a projected compound annual growth rate (CAGR) of 12.5% from 2024 to 2030.

The airship wing leading edge market includes a fragment of the aviation industry devoted to the planning, making, and support of wing-driving edge components for different airship types. These components, vital for streamlined execution and basic judgment, play an imperative part in upgrading airplane effectiveness, soundness, and security amid flight. The showcase is driven by ceaseless progressions in aviation innovation, coupled with expanding requests for fuel-efficient and naturally able flying machines. and moderate dangers.

Key Market Insights:

The aircraft wing leading edge market has experienced steady growth at a rate of 7% per year over the past two years. This growth can be attributed to several factors, including increasing air travel demand, the expansion of the commercial aviation sector, and technological advancements in aircraft design.

There has been a notable shift towards the use of lightweight materials in aircraft manufacturing, driven by the need to improve fuel efficiency and reduce carbon emissions. This trend has led to a 10% increase in the overall market value of Aircraft Wing Leading Edge components as manufacturers invest in innovative materials such as carbon fiber composites and advanced alloys.

Manufacturers in the aircraft wing leading-edge market have embraced advanced manufacturing techniques such as additive manufacturing (3D printing), robotic automation, and computer-aided design (CAD) software. These technologies have enabled more efficient production processes, reduced material waste, and streamlined supply chains, leading to a significant 15% reduction in production costs.

The rapid growth of the global aviation sector, particularly in emerging markets, has spurred a corresponding increase in demand for new aircraft and aircraft components. As airlines modernize their fleets and expand their operations, there is a growing need for advanced wing leading-edge components to improve aerodynamic performance, fuel efficiency, and safety. This surge in demand has resulted in a 12% increase in the market for aircraft wing leading-edge components.

A 5% decline in profit margins is observed due to intensified competition. To address declining profit margins, manufacturers can implement cost optimization strategies such as streamlining supply chains, negotiating favorable contracts with suppliers, and leveraging automation technologies to improve operational efficiency and reduce overhead costs.

Global Aircraft Wing Leading Edge Market Drivers:

Lightweight materials revolutionizing optimal design are accelerating the growth rate.

The appropriation of advanced lightweight materials such as carbon fiber composites and titanium amalgams is revolutionizing flying machine wing plans and fabrication. These materials offer remarkable strength-to-weight proportions, empowering the generation of more slender and more efficiently productive wing-driving edge components. By lessening weight and drag, lightweight materials improve flying machine fuel effectiveness, amplify run, and make strides in general execution, driving requests within the airplane wing leading edge market.

The need for fuel-efficient aircraft is driving the advancement.

Rising natural concerns and fuel costs are driving carriers and flying machine producers to prioritize fuel productivity in airplane plans. This center on fuel productivity is driving an expanded request for efficiently optimized wing driving edge plans aimed at diminishing drag and upgrading lift. Producers are joining inventive highlights such as winglets, vortex generators, and laminar stream control innovations to progress streamlined execution and fuel efficiency, thus fueling development within the airplane wing leading edge market.

Demand for commercial aviation is facilitating the expansion.

The fast development of the worldwide commercial flying segment, driven by expanding discussion travel demand and financial development in rising markets, could be a critical driver of advertising development for flying machine wing driving edge components. Carriers are growing their armadas and modernizing existing airplanes to meet developing traveler requests, driving a surge in airplane orders and conveyances. This extension requires the generation of unused wing driving edge components and the retrofitting of existing armadas, driving requests within the airplane wing leading edge market.

Global Aircraft Wing Leading Edge Market Restraints and Challenges:

Adherence to rigid certification is a major difficulty.

Players within the market confront challenges in complying with exacting administrative guidelines and security certifications required by flying specialists around the world. These benchmarks direct thorough testing, approval, and quality affirmation forms for wing driving edge components to guarantee airworthiness and traveler security. Accomplishing and keeping up compliance with these controls requires considerable speculation in testing offices, designing mastery, and documentation, making it a critical challenge for producers and providers.

Reliance on crude fabric supply chains is another hurdle.

The market is defenseless to variances in crude fabric costs and supply chain disturbances, especially for basic materials such as carbon fiber composites and titanium combinations. Instability in product markets, geopolitical pressures, and supply chain disturbances can lead to cost variances and deficiencies, affecting fabrication costs and benefits for showcase players. Additionally, long lead times and constrained provider capacity for specialized materials pose challenges in assembly generation requests and satisfying client orders, assisting in exacerbating supply chain dangers within the industry.

Planning complexity and fabricating imperatives create challenges.

The plan and fabrication of airship wing driving edge components include perplexing design forms and rigid quality benchmarks. Advertisers must address challenges related to complex geometries, streamlined prerequisites, and fabricating resistances to guarantee ideal execution and security. Also, progressions in flying machine plans, such as mixed winglets and tall perspective proportion wings, present unused plan complexities and fabricating limitations that require imaginative arrangements and progressed fabricating methods. Overcoming these challenges requires considerable ventures in inquiring about improvement, collaboration with providers, and persistent preparation of enhancements to meet advancing advertising requests, whereas keeping up takes a toll on competitiveness.

Global Aircraft Wing Leading Edge Market Opportunities:

The selection of feasible materials and fabricating forms is beneficial.

The developing emphasis on natural maintainability within the flying industry presents openings for innovation and showcase extension within the airplane wing leading edge market. Producers are progressively focusing on the advancement and appropriation of feasible materials, such as bio-based composites and recyclable thermoplastics, to decrease the natural impression of airship wing driving edge components. Also, headways in eco-friendly fabricating forms, such as added substance fabricating and computerized get-together procedures, offer openings to improve generation productivity while minimizing squandering and vitality utilization.

Leveraging digitalization and Industry 4.0 advances can provide many possibilities.

The integration of digitalization and Industry 4.0 advances presents noteworthy opportunities for showcase players to improve the execution and usefulness of airplane wing driving edge components. Progressed innovations such as computerized twins, IoT sensors, and prescient analytics empower real-time observing, prescient support, and execution optimization of wing-driving edge frameworks. By leveraging data-driven bits of knowledge and prescient modeling, producers can progress operational productivity, decrease downtime, and upgrade airship security and unwavering quality, in this way driving showcase development and separation.

The development of UAV advertising drives requests for specialized components.

The multiplication of unmanned ethereal vehicles (UAVs) over military, commercial, and recreational applications presents openings for showcase extension within the airplane wing leading edge market. UAVs require specialized wing driving edge components optimized for lightweight development, streamlined execution, and solidity. Showcase players can capitalize on this slant by creating customized arrangements custom-fitted to the one-of-a-kind prerequisites of UAV stages, such as long-endurance rambles, reconnaissance airships, and conveyance rambles.

AIRCRAFT WING LEADING EDGE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.5% |

|

Segments Covered |

By Aircraft Type, Product, Wing Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Safran SA, Collins Aerospace (Raytheon Technologies Corporation), GKN Aerospace (Melrose Industries PLC), UTC Aerospace Systems (Raytheon Technologies Corporation), Spirit AeroSystems Holdings, Inc., Leonardo S.p.A., Boeing Company, Airbus SE, Bombardier Inc., Triumph Group, Inc. |

Aircraft Wing Leading Edge Market Segmentation: By Aircraft Type

-

Narrow-body Aircraft

-

Wide-body Aircraft

-

Others

Narrow-body airplanes are the largest and fastest-growing segment. Narrow-body flying machines, moreover known as single-aisle airships, speak to a noteworthy portion of the worldwide commercial flying armada and are broadly utilized for brief to medium-haul courses. These airships are favored by aircraft for their flexibility, operational effectiveness, and cost-effectiveness, making them the favored choice for territorial and household flights. The tall request for narrow-body airships, driven by expanding discussion travel requests, armada development, and aircraft arrangement optimization methodologies, powers advertising development for related components such as wing-driving edge frameworks. In addition, headways in the narrow-body airship plan, counting progressed streamlined features, fuel-efficient motors, and upgraded traveler consolation, drive the request for imaginative wing driving edge components optimized for execution, security, and maintainability. As aircraft proceed to modernize their armadas and supplant maturing airplanes with next-generation narrow-body models, the advertisement for wing-driving edge frameworks custom-fitted to these flying machine sorts is anticipated to involve unfaltering growth and venture openings within the predictable future.

Aircraft Wing Leading Edge Market Segmentation: By Product

-

Flaps

-

Spoilers

-

Slats and Slots

-

Leading Edge Flaps

-

Vortex Generators

The largest and fastest-growing segment is that of edge flaps. These parts are essential for optimizing lift and drag characteristics by modifying the form of the wing during various flight stages, such as takeoff and landing. Leading edge flaps are still developing as a result of developments in materials science and aerodynamics, which enhance aircraft performance, safety, and fuel economy. Leading-edge flaps are also in high demand due to the continuous modernization and growth of the global commercial aviation fleets, as well as the creation of new aircraft types with cutting-edge wing designs.

Aircraft Wing Leading Edge Market Segmentation: By Wing Type

-

Fixed Wing

-

Rotary Wing

Fixed-wing airplanes are the largest and fastest-growing category. Fixed-wing airplanes include a wide range of airplane types, including commercial carriers, commerce planes, military warrior planes, and common flying machines. These airplanes include wings that stay stationary relative to the fuselage amid flight, giving lift through the streamlined strengths produced by their shape and wind current over the wing surface. Fixed-wing flying machines are eminent for their effectiveness, speed, and run, making them the favored choice for long-distance travel, cargo transport, and airborne missions requiring high-speed maneuverability. Their versatility and capability to function in assorted situations, from commercial air terminals to farther airstrips, contribute to their adequacy in satisfying a huge number of flying parts. In addition, fixed-wing flying machines offer focal points in terms of solidity, perseverance, and payload capacity compared to rotary-wing flying machines, making them perfect for applications such as traveler transport, cargo coordination, observation, and ethereal firefighting. As a result, the advertisement for wing-driving edge components custom-made for fixed-wing flying machines encounters supported requests and venture openings driven by the ceaseless development and modernization of the worldwide flying industry.

Aircraft Wing Leading Edge Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

North America is the largest growing market, driven by the nearness of key aviation producers, innovative advancements, and a vigorous commercial flying division. The Asia-Pacific is fast-growing, fueled by expanding discussion travel requests, rising speculations in aviation foundations, and the development of modern flying markets in nations such as China and India. Europe is being driven by set-up aviation industry players, broad inquiries about advancement capabilities, and a solid accentuation on maintainability and natural activities. South America, the Middle East, and African locales are characterized by growing flying markets, framework advancement, and government activities to support aviation industry development. The territorial dispersion of showcase share underscores the worldwide nature of the Airplane Wing Driving Edge Showcase, with each locale advertising interesting openings and challenges for advertising players to explore as they endeavor to advertise extension and competitiveness on a worldwide scale.

COVID-19 Impact Analysis on the Global Aircraft Wing Leading Edge Market:

COVID-19 has essentially affected the worldwide airplane wing leading edge market, causing disturbances in the aviation industry supply chain and diminishing requests for modern airplanes. As aircraft confronted exceptional decreases in traveler activity and income, numerous put-off or canceled flying machine orders led to diminished generation rates and conveyance delays. The downturn in travel also brought about a diminished request for aftermarket wing driving edge components, as carriers conceded upkeep and armada extension plans to preserve cash and diminish working costs. Furthermore, travel limitations, border closures, and lockdown measures executed to contain the spread of the infection hampered aviation fabricating operations and coordination, driving supply chain disturbances and generation slowdowns. Despite the challenges posed by the widespread, the airplane wing leading edge market has illustrated flexibility, with producers adjusting to the unused typical by executing exacting well-being and security conventions, optimizing generation forms, and differentiating their item offerings. In addition, the slow recuperation of discussed travel requests and the rollout of inoculation campaigns in numerous nations are anticipated to drive a progressive bounce back in flying machine orders and conveyances, giving openings for advertise recuperation and development within the post-pandemic period. In any case, instabilities encompassing the term and seriousness of the widespread, as well as the pace of flying industry recuperation, pose posture challenges for showcase members, requiring progressing carefulness, deftness, and vital arranging to explore the advancing scene viably.

Latest Trends/ Developments:

The airplane wing leading edge market is seeing a few noteworthy patterns and improvements that are reshaping the industry scene. One outstanding slant is the expanding selection of advanced materials and fabricating procedures to improve the execution and proficiency of wing-driving edge components. To reduce weight and improve fuel efficiency, manufacturers are using lightweight materials like carbon fiber composites and titanium amalgams. They are also looking into creative fabrication techniques like automated assembly and additional material fabrication to expedite production and save costs. Another key drift is the integration of savvy innovations and sensors into wing-driving edge frameworks to empower real-time checking, prescient support, and execution optimization.

By leveraging information analytics and prescient analytics, carriers and administrators can proactively recognize upkeep issues, optimize flight operations, and make strides toward large airplanes with unwavering quality and security. Furthermore, there's a developing center on supportability and natural obligation, driving the improvement of eco-friendly wing-driving edge arrangements that minimize carbon emanations and natural effects. These patterns emphasize the industry's commitment to development, efficiency, and supportability because it proceeds to advance to meet the requests of a changing flying scene.

Key Players:

-

Safran SA

-

Collins Aerospace (Raytheon Technologies Corporation)

-

GKN Aerospace (Melrose Industries PLC)

-

UTC Aerospace Systems (Raytheon Technologies Corporation)

-

Spirit AeroSystems Holdings, Inc.

-

Leonardo S.p.A.

-

Boeing Company

-

Airbus SE

-

Bombardier Inc.

-

Triumph Group, Inc.

Chapter 1. AIRCRAFT WING LEADING EDGE MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. AIRCRAFT WING LEADING EDGE MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. AIRCRAFT WING LEADING EDGE MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. AIRCRAFT WING LEADING EDGE MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. AIRCRAFT WING LEADING EDGE MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. AIRCRAFT WING LEADING EDGE MARKET – By Aircraft Type

6.1 Introduction/Key Findings

6.2 Narrow-body Aircraft

6.3 Wide-body Aircraft

6.4 Others

6.5 Y-O-Y Growth trend Analysis By Aircraft Type

6.6 Absolute $ Opportunity Analysis By Aircraft Type, 2024-2030

Chapter 7. AIRCRAFT WING LEADING EDGE MARKET – By Product

7.1 Introduction/Key Findings

7.2 Flaps

7.3 Spoilers

7.4 Slats and Slots

7.5 Leading Edge Flaps

7.6 Vortex Generators

7.7 Y-O-Y Growth trend Analysis By Product

7.8 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 8. AIRCRAFT WING LEADING EDGE MARKET – By Wing Type

8.1 Introduction/Key Findings

8.2 Fixed Wing

8.3 Rotary Wing

8.4 Y-O-Y Growth trend Analysis By Wing Type

8.5 Absolute $ Opportunity Analysis By Wing Type, 2024-2030

Chapter 9. AIRCRAFT WING LEADING EDGE MARKET , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Aircraft Type

9.1.3 By Product

9.1.4 By Wing Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Aircraft Type

9.2.3 By Product

9.2.4 By Wing Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Aircraft Type

9.3.3 By Product

9.3.4 By Wing Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Aircraft Type

9.4.3 By Product

9.4.4 By Wing Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Aircraft Type

9.5.3 By Product

9.5.4 By Wing Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. AIRCRAFT WING LEADING EDGE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Safran SA

10.2 Collins Aerospace (Raytheon Technologies Corporation)

10.3 GKN Aerospace (Melrose Industries PLC)

10.4 UTC Aerospace Systems (Raytheon Technologies Corporation)

10.5 Spirit AeroSystems Holdings, Inc.

10.6 Leonardo S.p.A.

10.7 Boeing Company

10.8 Airbus SE

10.9 Bombardier Inc.

10.10 Triumph Group, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for aircraft wing leading edge was estimated to be worth USD 2.17 billion in 2023 and is expected to increase to USD 4.95 billion by 2030, with a projected compound annual growth rate (CAGR) of 12.5% from 2024 to 2030.

The essential drivers of the global airplane wing leading-edge market include the demand for fuel-efficient airplanes, mechanical progressions in optimal design, and the development of the commercial flying segment.

The key challenges confronting the global airplane wing leading-edge market are supply chain disturbances, administrative compliance complexities, and instability in crude fabric costs.

In 2023, North America held the largest share of the global airplane wing leading-edge market.

Safran SA, Collins Aviation, GKN Aviation, UTC Aviation Frameworks, Spirit AeroSystems Property, Inc., Leonardo S.p.A., Boeing Company, Airbus SE, Bombardier Inc., and Triumph Bunch, Inc. are the important players in the global airplane wing leading edge market.