Aircraft Smart Maintenance Market Size (2024 – 2030)

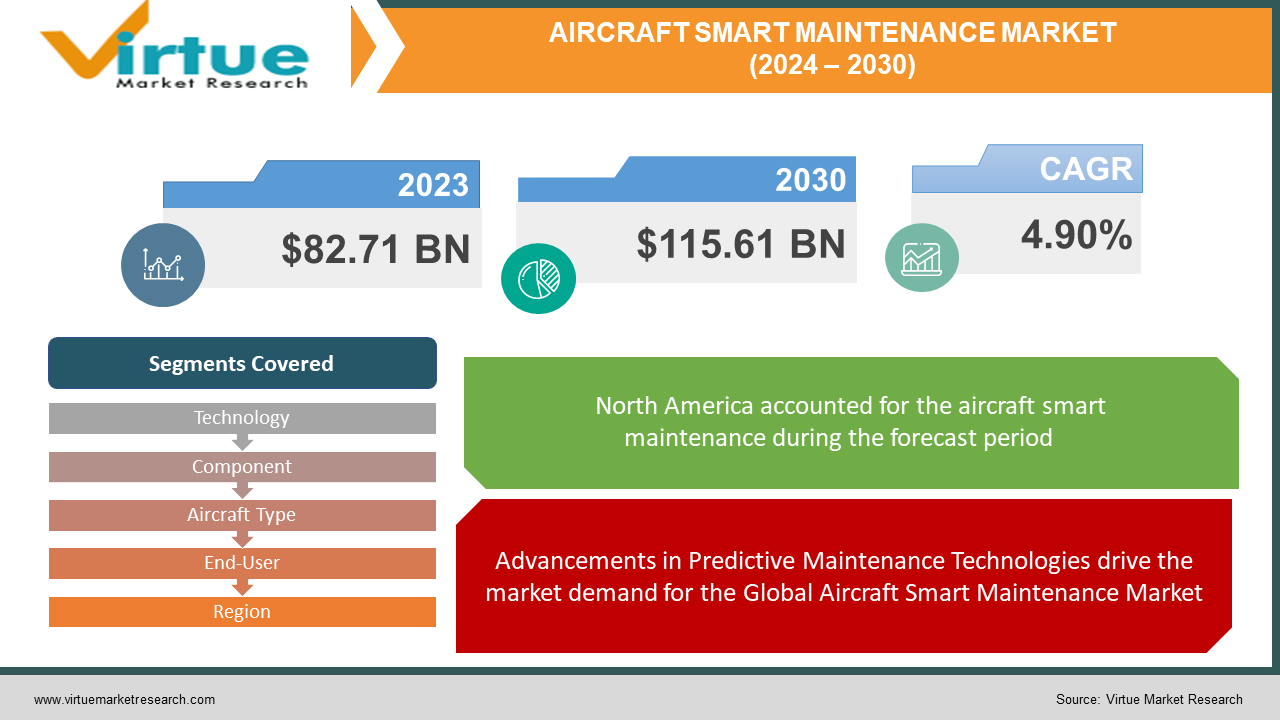

The Global Aircraft Smart Maintenance Market is valued at USD 82.71 billion and is projected to reach a market size of USD 115.61 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.90%.

The global aircraft smart maintenance market is driven by various factors, including the adoption of predictive maintenance technologies, the impact of COVID-19 on cost-saving measures, the emphasis on remote monitoring and diagnostics as short-term drivers, the opportunity for integrated maintenance solutions, and the trend of integrating IoT technology for condition-based maintenance. As airlines continue to prioritize safety, efficiency, and cost optimization, the demand for smart maintenance solutions is expected to continue growing, shaping the future of aircraft maintenance practices and ensuring the reliability and safety of commercial aviation operations.

Key Market Insights:

Predictive maintenance utilizes advanced analytics, sensors, and artificial intelligence to forecast potential maintenance issues before they occur, allowing airlines to address problems proactively and minimize aircraft downtime. However, the COVID-19 pandemic has had a notable impact on the market. With airlines facing unprecedented disruptions and financial challenges due to travel restrictions and reduced passenger demand, the focus on cost-saving measures has intensified. As a result, the adoption of predictive maintenance solutions has accelerated as airlines seek to optimize operational efficiency and reduce maintenance costs amidst the challenging economic environment. With advancements in connectivity and data analytics, airlines can now remotely monitor aircraft systems in real time and diagnose potential issues without the need for physical inspection. This capability enables airlines to conduct proactive maintenance activities, minimize unscheduled maintenance events, and improve aircraft reliability and safety. Furthermore, an opportunity in the market lies in the growing demand for integrated maintenance solutions. Airlines are increasingly seeking comprehensive maintenance solutions that encompass predictive maintenance, inventory management, and workforce optimization to streamline operations and enhance overall efficiency.

Moreover, a notable trend observed in the aircraft smart maintenance market is the integration of Internet of Things (IoT) technology. IoT-enabled sensors installed on aircraft components collect real-time data on various parameters such as temperature, pressure, and vibration. This data is then analyzed using advanced analytics algorithms to identify potential maintenance issues and predict component failures. By leveraging IoT technology, airlines can transition from traditional time-based maintenance schedules to condition-based maintenance, where maintenance activities are performed based on the actual condition of aircraft components. This trend not only improves maintenance efficiency but also reduces operational costs and extends the lifespan of aircraft components.

Global Aircraft Smart Maintenance Market Drivers:

Advancements in Predictive Maintenance Technologies drive the market demand for the Global Aircraft Smart Maintenance Market.

Predictive maintenance technologies leverage data analytics, sensors, and artificial intelligence to forecast potential maintenance issues before they occur. This approach enables airlines to address maintenance needs proactively, reducing unplanned downtime and improving aircraft reliability. The continuous advancements in predictive maintenance technologies drive the adoption of smart maintenance solutions in the aircraft industry.

Regulatory Requirements and Safety Standards have boosted the market for Global Aircraft Smart Maintenance Market.

Stringent regulatory requirements and safety standards imposed by aviation authorities worldwide drive the adoption of smart maintenance solutions. Airlines are obligated to comply with regulations and standards related to aircraft maintenance, ensuring the safety and airworthiness of their fleets. Smart maintenance technologies help airlines meet regulatory requirements more efficiently while enhancing safety and operational reliability.

Cost Reduction and Operational Efficiency drive the market demand for the Global Aircraft Smart Maintenance Market.

Airlines are under constant pressure to reduce operational costs and improve efficiency to remain competitive in the aviation industry. Smart maintenance solutions offer opportunities for cost reduction by optimizing maintenance processes, minimizing unscheduled downtime, and extending the lifespan of aircraft components. As airlines seek to enhance their bottom line and streamline operations, the demand for smart maintenance solutions continues to grow.

Increasing Aircraft Fleet Size and Complexity has boosted the market for Global Aircraft Smart Maintenance Market.

The global aviation industry is experiencing steady growth, leading to an increase in the size and complexity of aircraft fleets. With larger fleets and more technologically advanced aircraft, airlines face greater challenges in managing maintenance operations effectively. Smart maintenance solutions address these challenges by providing innovative tools and technologies to monitor, analyze, and optimize maintenance activities across large and complex fleets.

Global Aircraft Smart Maintenance Market Restraints and Challenges:

One of the primary challenges in implementing smart maintenance solutions is the high initial investment costs associated with technology adoption. Smart maintenance systems require investment in hardware, software, sensors, and infrastructure, which can be substantial for airlines, particularly smaller operators. The upfront costs of implementing smart maintenance solutions may deter some airlines from adopting these technologies, especially during periods of financial constraints. Smart maintenance solutions rely on the collection, storage, and analysis of large volumes of sensitive aircraft and operational data. Ensuring the privacy and security of this data is paramount to protect against cyber threats, data breaches, and unauthorized access. Airlines must implement robust cyber security measures, encryption protocols, and access controls to safeguard sensitive information and comply with regulatory requirements.

Smart maintenance technologies rely on skilled personnel capable of operating, maintaining, and troubleshooting complex systems effectively. However, there is a shortage of qualified personnel with expertise in data analytics, AI, and advanced maintenance technologies in the aviation industry. Airlines must invest in workforce training and development programs to build the necessary skills and competencies required to maximize the benefits of smart maintenance solutions.

Global Aircraft Smart Maintenance Market Opportunities:

The increasing adoption of predictive analytics and artificial intelligence (AI) presents significant opportunities for smart maintenance solutions. Predictive analytics and AI algorithms enable airlines to analyze vast amounts of maintenance data, identify patterns, and predict potential issues before they occur.

The integration of Internet of Things (IoT) technology presents opportunities for airlines to transform their maintenance operations. IoT-enabled sensors installed on aircraft components collect real-time data on various parameters such as temperature, pressure, and vibration. This data is then analyzed using advanced analytics algorithms to monitor the health and performance of critical systems and components. The emergence of Maintenance-as-a-Service (MaaS) models offers opportunities for airlines to outsource maintenance activities to third-party providers. MaaS providers offer comprehensive maintenance solutions that encompass predictive maintenance, inventory management, and workforce optimization, allowing airlines to focus on their core operations while reducing overhead costs.

AIRCRAFT SMART MAINTENANCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.90% |

|

Segments Covered |

By Technology, Component, Aircraft Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Airbus SAS, Boeing Company, General Electric Company, Honeywell International Inc., Lufthansa Technik AG, Rolls-Royce Holdings plc, Safran S.A., Textron Inc., United Technologies Corporation, MTU Aero Engines AG |

Global Aircraft Smart Maintenance Market Segmentation: By Technology

-

Predictive Maintenance

-

Condition-Based Maintenance

-

Health Monitoring Systems

-

Data Analytics and Artificial Intelligence

Predictive maintenance technology is the largest segment in the aircraft smart maintenance market. It involves the use of advanced analytics and machine learning algorithms to predict potential maintenance issues before they occur, allowing airlines to take proactive measures to prevent downtime and improve aircraft reliability.

The data analytics and artificial intelligence segment is the fastest-growing segment in the aircraft smart maintenance market. As airlines increasingly rely on data-driven insights to optimize maintenance operations, the demand for advanced analytics and AI solutions is rising rapidly. These technologies enable airlines to analyze vast amounts of maintenance data, identify patterns, and make informed decisions to enhance maintenance efficiency and effectiveness.

Global Aircraft Smart Maintenance Market Segmentation: By Component

-

Hardware

-

Software

-

Services

The services segment is the largest in the aircraft smart maintenance market. It includes a wide range of services such as maintenance planning, predictive maintenance, system integration, training, and support. Service providers offer comprehensive solutions to help airlines implement and optimize smart maintenance technologies effectively.

The software segment is the fastest-growing segment in the aircraft smart maintenance market. With the increasing adoption of digitalization and automation in maintenance operations, the demand for software solutions that enable predictive analytics, remote monitoring, and data management is on the rise. Software providers offer innovative solutions to address the evolving needs of airlines and improve maintenance efficiency.

Global Aircraft Smart Maintenance Market Segmentation: By Aircraft Type

-

Narrow-Body Aircraft

-

Wide-Body Aircraft

-

Regional Aircraft

-

Business Jets

-

Military Aircraft

The narrow-body aircraft segment is the largest in the aircraft smart maintenance market. Narrow-body aircraft, such as single-aisle commercial jets, constitute a significant portion of the global aircraft fleet. Airlines operating narrow-body aircraft seek smart maintenance solutions to optimize maintenance schedules, reduce downtime, and improve fleet reliability.

The wide-body aircraft segment is the fastest-growing segment in the aircraft smart maintenance market. With the increasing demand for long-haul travel and the expansion of international routes, airlines are investing in wide-body aircraft to meet passenger demand. Smart maintenance solutions tailored for wide-body aircraft offer opportunities for airlines to enhance maintenance efficiency and ensure the reliability of their long-haul fleets.

Global Aircraft Smart Maintenance Market Segmentation: By End-User

-

Airlines

-

Maintenance, Repair, and Overhaul (MRO) Providers

-

OEMs (Original Equipment Manufacturers)

The airline segment is the largest end-user segment in the aircraft smart maintenance market. Airlines are the primary operators of aircraft and have the greatest need for smart maintenance solutions to manage their fleets effectively. Airlines deploy smart maintenance technologies to optimize maintenance operations, reduce costs, and enhance aircraft reliability and safety.

The maintenance, repair, and overhaul (MRO) providers segment is the fastest-growing segment in the aircraft smart maintenance market. MRO providers offer maintenance services to airlines and other aircraft operators and play a crucial role in ensuring the airworthiness of aircraft. As MRO providers seek to differentiate themselves and offer value-added services, the adoption of smart maintenance technologies is increasing to improve efficiency

Global Aircraft Smart Maintenance Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In the global aircraft smart maintenance market segmentation by region, the largest segment encompasses North America, followed closely by Europe. North America leads due to its established aerospace industry, technological advancements, and significant investments in smart maintenance solutions. The region is home to major aircraft manufacturers, airlines, and maintenance providers, driving the demand for advanced maintenance technologies. Additionally, the presence of regulatory bodies such as the Federal Aviation Administration (FAA) in the United States encourages the adoption of smart maintenance practices to ensure safety and compliance.

The fastest-growing segment globally in the aircraft smart maintenance market segmentation by region is the Asia-Pacific region. Asia-Pacific is witnessing rapid growth in air travel demand, driven by rising disposable incomes, urbanization, and expanding middle-class populations. As a result, airlines in the region are expanding their fleets and seeking innovative maintenance solutions to manage their growing aircraft operations efficiently. Moreover, governments in countries like China and India are investing in the development of aerospace infrastructure and technology, further fueling the adoption of smart maintenance solutions in the region. The Asia-Pacific region presents significant opportunities for smart maintenance solution providers to capitalize on the burgeoning demand for aircraft maintenance services.

COVID-19 Impact Analysis on Global Aircraft Smart Maintenance Market Global:

The sharp decline in air travel demand during the pandemic has resulted in reduced airline operations and flight frequencies. With fewer flights and grounded fleets, the need for aircraft maintenance and repair services has decreased significantly. Airlines have scaled back their maintenance activities, deferred non-essential maintenance tasks, and postponed fleet expansion plans to conserve cash and mitigate financial losses.

The economic impact of the pandemic has intensified the focus on cost optimization and efficiency improvement within the aviation industry. Airlines and maintenance providers are seeking ways to reduce operating costs, streamline maintenance processes, and improve resource utilization. While smart maintenance solutions offer long-term benefits in terms of efficiency and reliability, the immediate priority for many organizations is to minimize expenses and preserve liquidity.

Latest Trends/ Developments:

AI and machine learning technologies are increasingly being integrated into aircraft maintenance systems to enhance predictive maintenance capabilities. These advanced analytics algorithms analyze vast amounts of data collected from aircraft sensors to predict potential maintenance issues and optimize maintenance schedules. AI-driven predictive maintenance solutions enable airlines to reduce downtime, minimize disruptions, and improve fleet reliability.

Condition-based maintenance (CBM) approaches are becoming increasingly prevalent in the aircraft maintenance industry. CBM relies on real-time data from aircraft sensors to assess the condition of critical components and perform maintenance tasks only when necessary. By moving away from traditional time-based maintenance schedules, airlines can optimize maintenance activities, reduce unnecessary maintenance tasks, and extend the life of aircraft components. CBM enhances operational efficiency and reduces maintenance costs while ensuring aircraft safety and airworthiness.

Predictive health management (PHM) systems are being integrated into aircraft maintenance operations to monitor the health and performance of aircraft systems and components in real time. PHM systems utilize advanced analytics and AI algorithms to analyze sensor data, identify potential issues, and predict component failures before they occur. By proactively addressing maintenance issues, PHM systems help airlines minimize downtime, improve reliability, and optimize maintenance resources.

Key Players:

-

Airbus SAS

-

Boeing Company

-

General Electric Company

-

Honeywell International Inc.

-

Lufthansa Technik AG

-

Rolls-Royce Holdings plc

-

Safran S.A.

-

Textron Inc.

-

United Technologies Corporation

-

MTU Aero Engines AG

Chapter 1. Aircraft Smart Maintenance Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aircraft Smart Maintenance Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aircraft Smart Maintenance Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aircraft Smart Maintenance Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aircraft Smart Maintenance Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aircraft Smart Maintenance Market – By Technology

6.1 Introduction/Key Findings

6.2 Predictive Maintenance

6.3 Condition-Based Maintenance

6.4 Health Monitoring Systems

6.5 Data Analytics and Artificial Intelligence

6.6 Y-O-Y Growth trend Analysis By Technology

6.7 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Aircraft Smart Maintenance Market – By Component

7.1 Introduction/Key Findings

7.2 Hardware

7.3 Software

7.4 Services

7.5 Y-O-Y Growth trend Analysis By Component

7.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 8. Aircraft Smart Maintenance Market – By Aircraft Type

8.1 Introduction/Key Findings

8.2 Narrow-Body Aircraft

8.3 Wide-Body Aircraft

8.4 Regional Aircraft

8.5 Business Jets

8.6 Military Aircraft

8.7 Y-O-Y Growth trend Analysis By Aircraft Type

8.8 Absolute $ Opportunity Analysis By Aircraft Type, 2024-2030

Chapter 9. Aircraft Smart Maintenance Market – By End-User

9.1 Introduction/Key Findings

9.2 Airlines

9.3 Maintenance, Repair, and Overhaul (MRO) Providers

9.4 OEMs (Original Equipment Manufacturers)

9.5 Y-O-Y Growth trend Analysis By End-User

9.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 10. Machine Learning Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Technology

10.1.2.1 By Component

10.1.3 By Aircraft Type

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Technology

10.2.3 By Component

10.2.4 By Aircraft Type

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Technology

10.3.3 By Component

10.3.4 By Aircraft Type

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Technology

10.4.3 By Component

10.4.4 By Aircraft Type

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Technology

10.5.3 By Component

10.5.4 By Aircraft Type

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Aircraft Smart Maintenance Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Airbus SAS

11.2 Boeing Company

11.3 General Electric Company

11.4 Honeywell International Inc.

11.5 Lufthansa Technik AG

11.6 Rolls-Royce Holdings plc

11.7 Safran S.A.

11.8 Textron Inc.

11.9 United Technologies Corporation

11.10 MTU Aero Engines AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Aircraft Smart Maintenance Market is valued at USD 82.71 billion and is projected to reach a market size of USD 115.61 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.90%.

Advancements in Predictive Maintenance Technologies, Regulatory Requirements and Safety Standards, Cost Reduction and Operational Efficiency, and Increasing Aircraft Fleet Size and Complexity are the market drivers of the Global Aircraft Smart Maintenance Market.

Hardware, Software, and Services are the segments under the Global Aircraft Smart Maintenance Market by component.

North America is the most dominant region for the Global Aircraft Smart Maintenance Market.

Asia-Pacific is the fastest-growing region in the Global Aircraft Smart Maintenance Market.