Aircraft Slat System Market Size (2024 – 2030)

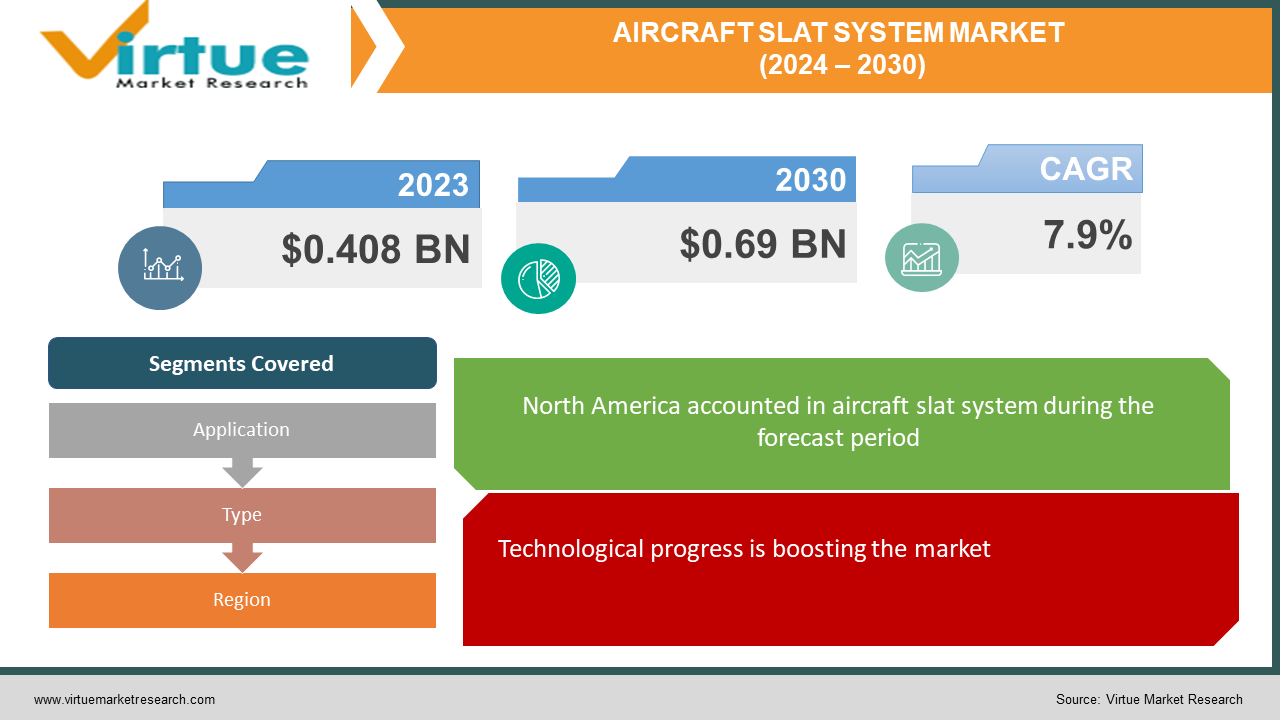

The market for aircraft slat systems at the global level is expanding quickly; it was estimated to be worth 0.408 USD billion in 2023 and is expected to increase to 0.69 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 7.9% from 2024 to 2030.

A set of extensible parts on the leading edge of certain fixed-wing aircraft's wings that improve lift at low speeds is called an aviation slat system. They are usually seen on the wings of fast aircraft, such as jets with swept wings. Slats are employed during approach, landing, takeoff, and first ascent. By extending outward and dipping down, they raise the wing's surface area and camber. When taking off, landing, or doing any other slow-speed task, slats are normally dropped. Certain slats are automatically extended at low speeds using springs or counterweights while being maintained in a retracted state by aerodynamic forces.

Key Market Insights:

The business for aircraft slat systems is developing as a result of the increased demand for air travel globally, which is driving airlines to prioritize fuel-efficient and environmentally friendly aircraft to stay competitive. R&D investments to create cutting-edge slat designs and technologies are being driven by regulatory demands to achieve fuel economy and reduce emissions. Advanced slat systems help airplanes fulfill strict emissions objectives and environmental regulations by enhancing wing aerodynamics, lowering drag, and increasing overall aircraft efficiency. The adoption of state-of-the-art slat technology is severely hampered by financial demands and economic limits, especially for smaller airlines or operators with tighter budgets. Manufacturers have additional challenges in the form of intricate certification procedures and regulatory compliance requirements, which extend development schedules and raise development costs. Affected customer satisfaction and market dynamics may result from supply chain disruptions, such as material shortages and delays, which can impede the timely manufacturing and delivery of aircraft slat systems. Strong and diverse supply networks are essential in the aviation sector since relying too much on certain suppliers or geographical areas for essential commodities might raise the risks of supply chain disruptions.

Global Aircraft Slat System Market Drivers:

Technological progress is boosting the market.

The efficiency of aircraft slat systems is increasing significantly as a result of continuous advancements in actuation mechanisms, manufacturing processes, and materials. Airlines can lower their total weight, improve fuel efficiency, and save operational costs by using lightweight composite materials. Furthermore, by offering tighter control and quicker reaction times, the development of electric actuation systems enhances overall aerodynamic performance.

Growing demand for air travel is aiding the expansion.

The growing worldwide demand for air travel is one of the key drivers of the aircraft slat system industry. With airline fleets expanding and passenger numbers rising, there is a growing demand for environmentally friendly and fuel-efficient aircraft. To meet the demands of a more competitive aviation market, slat systems are essential for improving aircraft performance. They make it possible to carry heavier loads, take off from shorter distances, and maneuver more easily.

Regulations aimed at fuel economy and reducing emissions are contributing to the success.

Regulations enforcing stringent emissions targets and environmental standards have put pressure on aviation manufacturers to produce more fuel-efficient and environmentally friendly aircraft. Slat systems are crucial in achieving these goals because they improve wing aerodynamics, reduce drag, and increase overall aircraft efficiency. Because of this, producers are investing in R&D to develop innovative slat designs and technologies that meet these regulatory obligations, which is driving the growth of the global market for aviation slat systems.

Global Aircraft Slat System Market Restraints and Challenges:

Budgetary pressures and cost constraints are major barriers.

One of the main obstacles to the global market for aircraft slat systems is the high cost of researching, developing, and deploying cutting-edge slat technology. For aircraft operators and manufacturers, budgetary constraints are a significant problem, particularly in the wake of recessions or significant industrial disruptions such as the COVID-19 pandemic. High upfront costs can prevent adoption when it comes to modernizing or retrofitting outdated aircraft with new slat systems, particularly for smaller airlines or operators with fewer budgets.

Regulatory compliance and complex certification processes are another concern.

Since the aviation industry operates in a highly regulated environment, all new technologies and aircraft components, including slat systems, must pass rigorous certification processes. The stringent safety and performance standards set by aviation agencies such as the Federal Aviation Administration (FAA) and the European Aviation Safety Agency (EASA) may pose significant challenges for manufacturers. Delays in obtaining regulatory permits or addressing compliance issues could obstruct the market spread of aircraft slat systems, leading to longer development timelines and greater development costs.

Material shortages and supply chain interruptions can hinder growth.

The aircraft manufacturing business is susceptible to supply chain interruptions due to unforeseen events such as natural disasters, geopolitical crises, and the COVID-19 pandemic. Supply chain disruptions can lead to increased manufacturing costs, shortages of necessary components or resources, and delays in component delivery. The risks may also be increased by relying on certain suppliers or geographical areas for essential materials like complicated alloys or composites. The aforementioned challenges may impede the timely production and delivery of airplane slat systems, thereby affecting consumer satisfaction and the overall dynamics of the market.

Global Aircraft Slat System Market Opportunities:

A focus on sustainable aviation solutions is beneficial.

Due to the global push for sustainable aviation solutions, the market for aircraft slat systems is expected to expand. Environmental sustainability is becoming more and more important to airlines and aircraft manufacturers as a means of reducing carbon emissions and the environmental impact of air travel. Modern slat technologies that maximize aerodynamics and minimize drag, such as morphing or adaptive slats, can assist in lowering emissions and improving fuel efficiency. By investing in eco-friendly slat solutions that align with sustainable aviation efforts, market participants can gain a competitive advantage and capitalize on the growing demand for greener aircraft technologies.

The adoption of next-generation aircraft platforms provides the market with many possibilities.

The aviation slat system market has a lot of potential due to the ongoing development and implementation of next-generation aircraft platforms, like electric or hybrid-electric aircraft. When comparing these state-of-the-art aircraft designs to traditional combustion-engine aircraft, there are inherent advantages in terms of reduced noise, pollution, and operational expenses. Slat systems intended for next-generation platforms can further enhance aerodynamic performance and efficiency by utilizing electronic actuation and lightweight materials. By creating slat systems that are optimized for electric aircraft, industry players can take the lead in this cutting-edge market niche.

AIRCRAFT SLAT SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.9% |

|

Segments Covered |

By Application, Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Safran S.A., Airbus SE, The Boeing Company, Spirit AeroSystems Holdings, Inc., UTC Aerospace Systems (Collins Aerospace), GKN Aerospace (Melrose Industries PLC), Parker Hannifin Corporation, Triumph Group, Inc., Bombardier Inc., FACC AG, Liebherr Group, Slatpro Limited |

Aircraft Slat System Market Segmentation: By Application

-

Commercial Aircraft

-

Military Aircraft

-

General Aviation

The commercial segment is the largest and fastest-growing type. Due to the constant rise in demand for air travel around the globe, commercial aviation makes up the majority of the world's aircraft fleet. Airlines give priority to things like passenger comfort, operational dependability, and fuel efficiency. Slat systems are essential for optimizing aircraft performance, facilitating quick takeoffs and landings, using less fuel, and increasing flight safety. Furthermore, there is a significant aftermarket opportunity because operators of commercial aircraft frequently look for retrofit options. By concentrating on commercial aircraft, businesses can benefit from ongoing demand and

Aircraft Slat System Market Segmentation: By Type

-

Slats

-

Fixed Leading Edge

In the aviation slat system industry, fixed leading-edge slats are the largest and fastest-growing category. A vital feature of an aircraft's wing, fixed leading edge slats are positioned to maximize aerodynamic performance and provide lift, especially during takeoff and landing. Their fixed design offers constant performance in a range of flying circumstances while also simplifying maintenance requirements. Fixed leading-edge slats are becoming more and more popular in the aviation sector due to their capacity to increase aircraft performance and fuel efficiency while guaranteeing improved operational dependability. This is due to the industry's continuous focus on efficiency, safety, and sustainability.

Aircraft Slat System Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

With its strong presence of well-established aerospace manufacturers and a steady stream of technical breakthroughs, North America is the largest growing market. The need for fuel-efficient aircraft and the upgrading of current fleets are what propel the aviation industry in the region. With a focus on innovation and sustainability, North American companies remain at the forefront of the development and use of state-of-the-art slat systems, satisfying the evolving needs of both commercial and military aircraft. The market for aircraft slat systems is developing at the fastest rate in the Asia-Pacific area due to rising air travel demand, swift economic expansion, and rising aviation infrastructure investments. To increase operational effectiveness and passenger comfort, airlines in the Asia-Pacific region are progressively implementing sophisticated slat systems due to their growing fleet size and transition to more fuel-efficient aircraft. Furthermore, the region's aerospace sector is growing due to the existence of up-and-coming manufacturers and an emphasis on domestic manufacturing capabilities.

COVID-19 Impact Analysis on the Global Aircraft Slat System Market:

The global aviation slat system industry has seen significant interruptions due to the COVID-19 pandemic. Travel restrictions, border closures, and a severe decrease in passenger demand have caused airlines worldwide to reduce operations, postpone plans to expand their fleets and postpone maintenance chores. Consequently, this slump has had a direct impact on the market for new aircraft and retrofit solutions, which in turn affects the slat systems sector. Production halts, delays in aircraft deliveries, and disruptions in the supply chain have all hindered the manufacturing and distribution of slat components. In addition, industrial players have been wary because of uncertainties about the severity and course of the epidemic, leading to a cautious approach to investment and spending.

Latest Trends/ Developments:

A lot of significant trends and developments have occurred in the aviation slat systems market recently, indicating the industry's ongoing pursuit of efficiency and innovation. One significant trend is the growing use of state-of-the-art materials and production techniques, with an emphasis on additive manufacturing and lightweight composites. These developments allow manufacturers to construct slat systems with higher strength-to-weight ratios, which enhance aircraft performance and fuel efficiency while requiring less maintenance. Another significant advancement is the integration of intelligent and networked functions into slat systems, which offer real-time monitoring, predictive maintenance, and enhanced operational performance. Furthermore, as the emphasis on environmental sustainability grows, manufacturers are looking at eco-friendly designs and materials to lessen their impact on the environment.

Advances in active control systems and aerodynamic design are also driving the development of next-generation slat systems that can maximize airflow and minimize drag, which will further enhance aircraft performance and efficiency. Future developments in the aircraft slat system market are expected to be influenced by these trends, which will encourage innovation and meet the evolving needs of the aviation industry.

Key Players:

-

Safran S.A.

-

Airbus SE

-

The Boeing Company

-

Spirit AeroSystems Holdings, Inc.

-

UTC Aerospace Systems (Collins Aerospace)

-

GKN Aerospace (Melrose Industries PLC)

-

Parker Hannifin Corporation

-

Triumph Group, Inc.

-

Bombardier Inc.

-

FACC AG

-

Liebherr Group

-

Slatpro Limited

Chapter 1. Aircraft Slat System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aircraft Slat System Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aircraft Slat System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aircraft Slat System Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aircraft Slat System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aircraft Slat System Market – By Application

6.1 Introduction/Key Findings

6.2 Commercial Aircraft

6.3 Military Aircraft

6.4 General Aviation

6.5 Y-O-Y Growth trend Analysis By Application

6.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Aircraft Slat System Market – By Type

7.1 Introduction/Key Findings

7.2 Slats

7.3 Fixed Leading Edge

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Aircraft Slat System Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Aircraft Slat System Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Safran S.A.

9.2 Airbus SE

9.3 The Boeing Company

9.4 Spirit AeroSystems Holdings, Inc.

9.5 UTC Aerospace Systems (Collins Aerospace)

9.6 GKN Aerospace (Melrose Industries PLC)

9.7 Parker Hannifin Corporation

9.8 Triumph Group, Inc.

9.9 Bombardier Inc.

9.10 FACC AG

9.11 Liebherr Group

9.12 Slatpro Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for aircraft slat systems at the global level was estimated to be worth 0.408 USD billion in 2023 and is expected to increase to 0.69 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 7.9% from 2024 to 2030.

The increasing need for air travel, technological advancements, and government laws requiring reduced emissions and fuel economy are the main factors driving the global market for aircraft slat systems.

The global market for aircraft slat systems faces a few formidable challenges, including budget constraints, complex certification processes, and disruptions in the supply chain.

In 2023, North America held the largest share of the global aircraft slat system market.

The major participants in the global aircraft slat system market are Safran S.A., Airbus SE, The Boeing Company, Spirit AeroSystems Holdings, Inc., UTC Aerospace Systems, and GKN Aerospace.