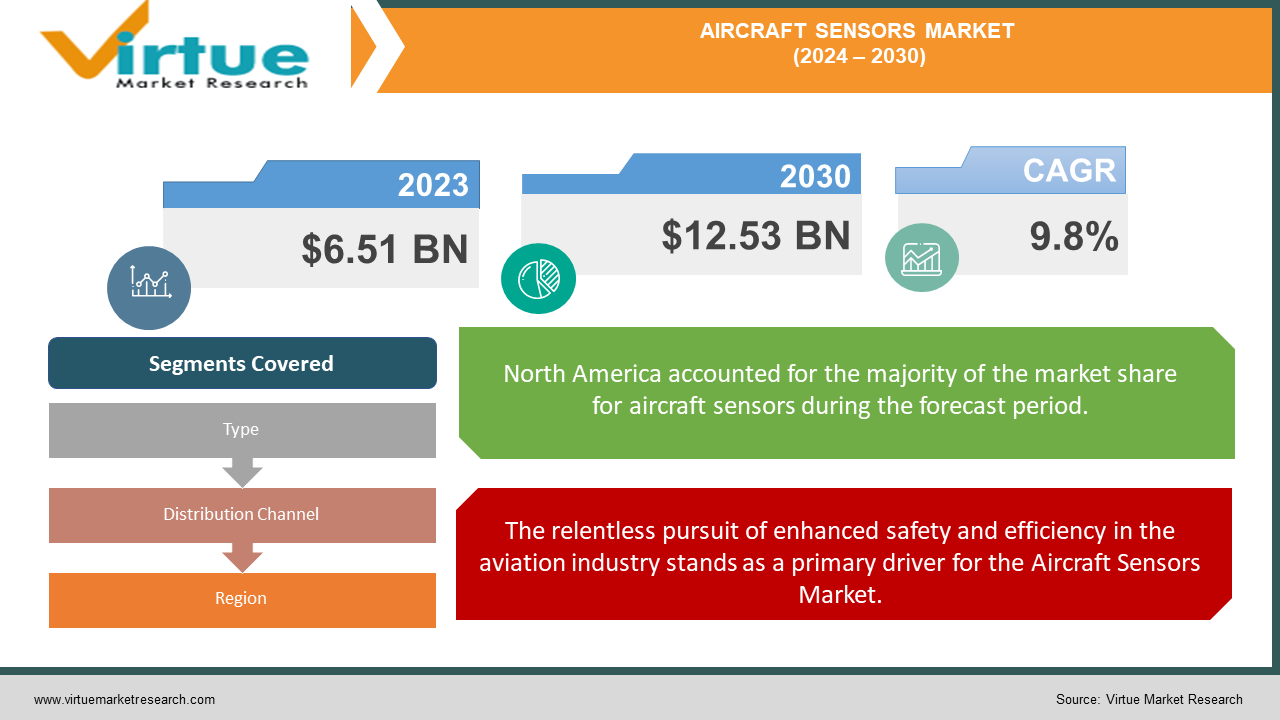

Aircraft Sensors Market Size (2025 – 2030)

The Aircraft Sensors Market was valued at USD 5.17 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 7.60 billion by 2030, growing at a CAGR of 8.01%.

An aircraft sensor is a device designed to detect changes or events in its surroundings and convert them into a signal that can be easily interpreted. Even small irregularities in the aircraft can result in significant disasters. The sensors installed in the aircraft identify such anomalies and alert the pilot. These occurrences have contributed to the growing demand for aircraft sensors within the aviation industry. With increasing automation, the number of sensors in aircraft is on the rise, enhancing the precision of various aircraft functions. The advancements in microelectromechanical systems (MEMS) technology have had a profound influence on the global market. Furthermore, the growing adoption of sensors in unmanned aerial vehicles (UAVs) is expected to create numerous opportunities in the market in the near future. Key factors driving market growth include the development of sophisticated sensors and the increasing demand for wireless sensors for both commercial and military applications.

Key Market Insights:

-

Technological innovations, including the development of smart sensors and the miniaturization of components, play a crucial role in advancing the market by improving real-time data acquisition and enabling predictive maintenance, all while ensuring optimal aircraft performance.

-

The increase in aircraft production, driven by rising passenger demand and defense modernization efforts, is another factor boosting market growth. Moreover, stringent safety regulations imposed by regulatory bodies such as the FAA and EASA require the implementation of high-quality sensors for continuous monitoring and data recording, ensuring compliance and enhancing operational safety. The growing adoption of UAVs and the retrofitting of older aircraft with advanced sensors further contribute to the expansion of the market.

Aircraft Sensors Market Drivers:

The growing demand for unmanned aerial vehicles (UAVs) is expected to drive significant market growth.

UAVs incorporate a diverse array of sensors to enhance vehicle performance or collect data. In addition to traditional sensors like flight control, flow and level, temperature and pressure, UAVs also deploy advanced sensor technologies such as LIDAR (Light Detection and Ranging) sensors, which are crucial for navigation and imaging purposes.

The growing use of UAVs in military operations for Intelligence, Surveillance, and Reconnaissance (ISR) is expected to significantly contribute to the expansion of the aircraft sensors market. Additionally, the increasing application of UAVs in high-risk missions and the rising demand for modern warfare techniques are anticipated to further accelerate market growth. Moreover, the expanding use of UAVs in civil and commercial sectors, including agriculture, real estate, engineering, and security, is expected to further bolster the growth of the market.

Aircraft Sensors Market Restraints and Challenges:

Regulations imposed by aviation safety agencies are expected to pose challenges to market growth.

The aviation industry adheres to rigorous rules and regulations concerning the use of electronic components within its operations. Manufacturers are required to comply with specific safety and design standards set by the Federal Aviation Administration (FAA). These regulations, while ensuring safety, may create obstacles for market growth by increasing the complexity and cost of compliance, thereby slowing down the adoption of new technologies.

Aircraft Sensors Market Opportunities:

Temperature sensors are expected to present significant opportunities in the market.

Temperature sensors are essential for aircraft operations, integrated into various components such as cabins, brakes, air ducts, inter-stage turbines, and hydraulic lines. Aircraft temperature sensor manufacturers must adhere to industry standards and regulations to bring their products to market.

Additionally, with the rise in air passenger traffic, aircraft original equipment manufacturers (OEMs) are expanding their production capabilities to meet the increasing demand for new aircraft. This growth will significantly drive the need for temperature sensors, particularly in commercial aircraft, to ensure passenger safety and comfort. As a result, the growing demand for temperature sensors in the aviation sector is expected to accelerate market growth in the coming years.

AIRCRAFT SENSORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.01% |

|

Segments Covered |

By Platform, Sensor Type, Application, Connectivity, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profile |

Honeywell International, Inc., Lockheed Martin Corporation , General Electric Company, Ametek, Inc., Schneider Electric SE , Meggitt PLC, Woodward Inc., Zodiac Aerospace , Thales Group, Curtiss-Wright Corporation |

Aircraft Sensors Market Segmentation: By Platform

-

Rotary Blade Aircraft

-

Fixed-Wing Aircraft

-

UAV

The fixed-wing aircraft segment is expected to dominate the market due to the growth of the global aircraft fleet. Meanwhile, the UAV segment is projected to be the fastest-growing, driven by the increasing adoption of UAVs in military applications such as intelligence, surveillance, reconnaissance (ISR), and combat missions. The fixed-wing segment is further subdivided into commercial and military aircraft. The demand for commercial aircraft is rising, fueled by an increase in aircraft deliveries and growing air passenger traffic, which is expected to drive the growth of the aircraft sensor market.

The rotary-blade segment is divided into commercial and military helicopters, with military helicopters anticipated to experience a higher compound annual growth rate (CAGR). This growth is attributed to ongoing modernization programs worldwide.

Aircraft Sensors Market Segmentation: By Sensor Type

-

Temperature

-

Force

-

Pressure

-

Speed

-

Others

Position sensors, pressure sensors, and temperature sensors are expected to lead the market throughout the forecast period, driven by their increasing use in flight control and cockpit control systems. These sensors are integrated into various aircraft components, including the cabin, air ducts, brakes, turbines, hydraulic lines, and more. The rapid growth in the production of new aircraft is likely to drive the demand for temperature, pressure, and position sensors, thereby fueling market expansion during the forecast period.

Aircraft Sensors Market Segmentation: By Application

-

Engine Turbine & APU

-

Landing Gear & Brakes

-

Flight Control & Actuation

-

others

The cockpit control and flight control & actuation systems are expected to remain the dominant applications in the market throughout the forecast period, driven by the increase in aircraft deliveries and the growing integration of advanced avionics in next-generation aircraft. The engine, turbine & APU, and landing gear & brakes segments are also anticipated to grow, fueled by the rising need for maintenance as aircraft flight hours increase, leading to a higher demand for MRO (Maintenance, Repair, and Overhaul) services. Additionally, the cabin, galley & cargo segment is expected to play a crucial role in market growth, driven by the increasing demand for passenger safety and environmental control.

Aircraft Sensors Market Segmentation: By Connectivity

-

Wired Sensors

-

Wireless Sensors

The wired sensor segment is expected to be the largest due to its high reliability. However, the wireless sensor segment is projected to be the fastest-growing during the forecast period, driven by the increasing demand for lightweight aircraft. Additionally, wireless sensors offer lower installation and maintenance costs, further contributing to their market growth.

The wireless sensor segment is anticipated to emerge as the fastest-growing segment, fueled by advancements in IoT connectivity and the increasing need for improved data accessibility and flexibility in aerospace applications. Unlike wired sensors, wireless sensors enable remote monitoring and data transmission, eliminating the need for physical wiring, reducing installation complexity, and minimizing weight on the aircraft. In commercial aviation, wireless sensors are being increasingly adopted for real-time monitoring of aircraft health, performance metrics, and operational parameters. They are critical for structural health monitoring, cabin environment control, and cargo monitoring, supporting proactive maintenance strategies and enhancing operational efficiency.

Aircraft Sensors Market Segmentation: By End Use

-

OEMs

-

Aftermarket

The OEM (Original Equipment Manufacturer) segment is expected to be both the largest and the fastest-growing throughout the forecast period, driven by the rising demand for commercial airlines. As the number of flight passengers continues to grow, the manufacturing of commercial aircraft is expanding rapidly across the globe.

The aftermarket segment is also projected to experience healthy growth, primarily due to the increase in aircraft flight hours. Given that electronic devices, including sensors, typically require replacement after 1,000 flight hours, there is a substantial demand for aftermarket services. Additionally, the aging of commercial aircraft will further drive the growth of the aftermarket segment, as older aircraft require more frequent sensor replacements and maintenance.

Aircraft Sensors Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America dominates the global aircraft sensors market, driven by several key factors. The region is home to major aircraft manufacturers like Boeing and benefits from a strong adoption of advanced aviation technologies. Additionally, the U.S. government's significant defense spending and investments in the aerospace sector further strengthen its market leadership. Extensive research and development in sensor technologies also contribute to North America's dominance. The demand for new-generation aircraft, along with the upgrade and retrofitting of existing fleets, fuels market growth. Furthermore, the rise in air travel and cargo transportation plays a critical role in boosting the market in the region.

The Asia Pacific region is the fastest-growing market for aircraft sensors, propelled by rapid economic growth and an expanding middle class, which drives increased air travel. Significant investments in aviation infrastructure and the rise of regional aircraft manufacturers such as COMAC are further stimulating market expansion. Countries like China and India are boosting their defense budgets, resulting in higher demand for aircraft sensors. Additionally, the growth of low-cost carriers (LCCs) and regional airlines is contributing to market growth, while government initiatives to develop the aviation sector are playing a vital role in this expansion.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic had a profound impact on the aircraft sensors market, primarily due to a sharp decline in air travel and aircraft production. Travel restrictions and lockdowns led to a reduced demand for new aircraft, which in turn affected the production and installation of sensors. Additionally, airlines faced significant financial pressure, causing delays in maintenance and upgrade programs that rely on advanced sensor systems. However, as the industry begins to recover, there is renewed focus on safety and operational efficiency, which is driving the demand for sensor upgrades. The pandemic also accelerated the adoption of digital technologies, prompting manufacturers to innovate and adapt their sensor offerings to meet the evolving needs of the post-COVID aviation sector.

Latest Trends/ Developments:

February 2023: Northrop Grumman Corporation initiated the integration and testing of its new ultra-wideband Electronically-Scanned Multifunction Reconfigurable Integrated Sensor (EMRIS), designed to enable military forces to accelerate decision-making timelines and act collaboratively. The EMRIS architecture is highly scalable and reconfigurable, offering various mounting configurations, making it suitable for a broad range of platforms and domains, including aircraft.

Key Players:

These are top 10 players in the Aircraft Sensors Market :-

-

Honeywell International, Inc.

-

Lockheed Martin Corporation

-

General Electric Company

-

Ametek, Inc.

-

Schneider Electric SE

-

Meggitt PLC

-

Woodward Inc.

-

Zodiac Aerospace

-

Thales Group

-

Curtiss-Wright Corporation

Chapter 1. Aircraft Sensors Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aircraft Sensors Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aircraft Sensors Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aircraft Sensors Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aircraft Sensors Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aircraft Sensors Market – By Platform

6.1 Introduction/Key Findings

6.2 Rotary Blade Aircraft

6.3 Fixed-Wing Aircraft

6.4 UAV

6.5 Y-O-Y Growth trend Analysis By Platform

6.6 Absolute $ Opportunity Analysis By Platform, 2025-2030

Chapter 7. Aircraft Sensors Market – By Sensor Type

7.1 Introduction/Key Findings

7.2 Temperature

7.3 Force

7.4 Pressure

7.5 Speed

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Sensor Type

7.8 Absolute $ Opportunity Analysis By Sensor Type, 2025-2030

Chapter 8. Aircraft Sensors Market – By Application

8.1 Introduction/Key Findings

8.2 Engine Turbine & APU

8.3 Landing Gear & Brakes

8.4 Flight Control & Actuation

8.5 others

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 9. Aircraft Sensors Market – By Connectivity

9.1 Introduction/Key Findings

9.2 Wired Sensors

9.3 Wireless Sensors

9.4 Y-O-Y Growth trend Analysis End-User

9.5 Absolute $ Opportunity Analysis End-User, 2025-2030

Chapter 10. Aircraft Sensors Market – By End Use

10.1 Introduction/Key Findings

10.2 OEMs

10.3 Aftermarket

10.4 Y-O-Y Growth trend Analysis Construction

10.5 Absolute $ Opportunity Analysis Construction, 2025-2030

Chapter 11. Aircraft Sensors Market , By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Platform

11.1.2.1 By Sensor Type

11.1.3 By By Application

11.1.4 By End Use

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Platform

11.2.3 By Sensor Type

11.2.4 By By Application

11.2.5 By Connectivity

11.2.6 By End Use

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Platform

11.3.3 By Sensor Type

11.3.4 By By Application

11.3.5 By Connectivity

11.3.6 By End Use

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Platform

11.4.3 By Sensor Type

11.4.4 By By Application

11.4.5 By Connectivity

11.4.6 By End Use

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Platform

11.5.3 By Sensor Type

11.5.4 By Application

11.5.5 By Connectivity

11.5.6 By End Use

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Aircraft Sensors Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Honeywell International, Inc.

12.2 Lockheed Martin Corporation

12.3 General Electric Company

12.4 Ametek, Inc.

12.5 Schneider Electric SE

12.6 Meggitt PLC

12.7 Woodward Inc.

12.8 Zodiac Aerospace

12.9 Thales Group

12.10 Curtiss-Wright Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Technological innovations, including the development of smart sensors and the miniaturization of components, play a crucial role in advancing the market by improving real-time data acquisition and enabling predictive maintenance, all while ensuring optimal aircraft performance.

The top players operating in the Aircraft Sensors Market are - Honeywell International, Inc., Lockheed Martin Corporation, General Electric Company and Ametek, Inc.

The COVID-19 pandemic had a profound impact on the aircraft sensors market, primarily due to a sharp decline in air travel and aircraft production.

The growing demand for temperature sensors in the aviation sector is expected to accelerate market growth in the coming years.

Asia-Pacific is the fastest-growing region in the Aircraft Sensors Market.