Aircraft Middleware Market Size (2025-2030)

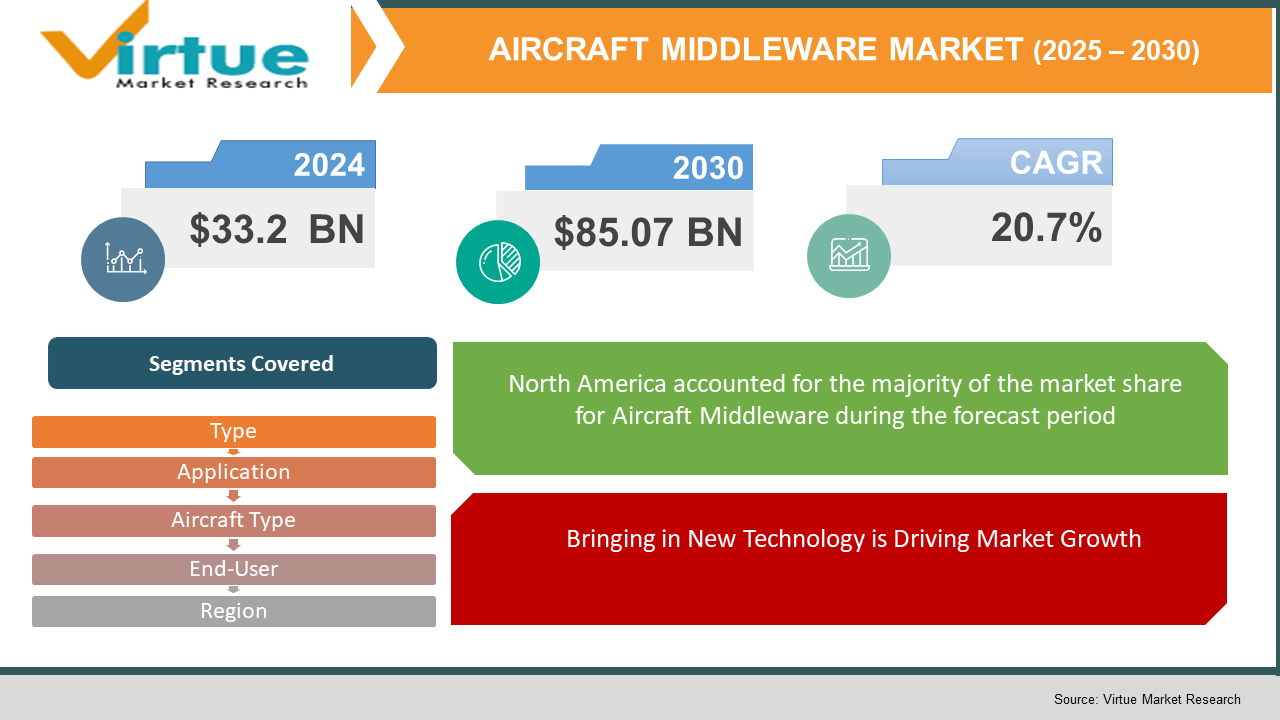

The Aircraft Middleware Market was valued at $33.2 billion and is projected to reach a market size of $85.07 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 20.7%.

The aircraft middleware market is where the software that helps different parts of an airplane, like its avionics and critical systems, talk to each other. It's really important to make sure that all the complex tech on board works smoothly together, handling everything from navigation to communication. As planes get more advanced and connected, middleware has become a key player in processing information in real time, which helps improve safety and efficiency. These middleware solutions are essential for integrating new technologies, like IoT and AI, allowing aircraft systems to handle lots of sensor data quickly. They create the necessary links between different systems, which is crucial for automating tasks and managing flight operations effectively. Middleware isn't just for aviation, though; it's used across various industries like aerospace, defense, automotive, and space exploration where secure communication is crucial. In connected vehicles, it helps with vehicle-to-vehicle and vehicle-to-everything communication, while in space missions, it ensures smooth interactions between spacecraft and ground control. Middleware also plays a big role in helping companies transition to digital by connecting older systems with newer cloud-based applications. It simplifies how IT environments work by making sure different systems can communicate well, whether they're using software, platforms, or infrastructure as a service. As more organizations embrace modern tech, middleware becomes vital for building secure and scalable system architectures. In the aviation field, it boosts data security, aids in predictive maintenance, and enhances decision-making by providing real-time data insights, making it key for modern avionics and the growth of smart systems today.

Key Market Insights:

As planes get more connected, middleware is becoming really important for linking onboard systems and allowing quick data processing and smooth communication. Right now, over 65% of new commercial aircraft are being built with middleware that helps route data between different systems like avionics, surveillance, and communication to make flights run better.

The growth of IoT and AI in aviation has led to a big increase in the need for middleware. About 72% of people in the aviation industry say that AI-driven middleware is key for predictive maintenance and making quick decisions. These connections help cut down on downtime and enable better analysis of flight systems.

With more drones being used in civilian and military roles, the use of middleware in drone platforms has increased. Over 58% of new drones launched since 2023 now come with adaptive middleware to handle real-time data, important commands, and autonomous navigation.

As aviation systems get more modular, there's a stronger push for standardized middleware setups. More than 60% of manufacturers and top suppliers are focusing on middleware that allows different hardware and software to work better together, making updates and scaling easier across different aircraft.

Partnerships are growing, too. Over 45% of aircraft manufacturers are forming long-term deals with middleware companies to create scalable, secure software solutions together. These partnerships are helping to develop middleware frameworks that meet new rules for cybersecurity, data safety, and system reliability in both commercial and military aviation.

Aircraft Middleware Market Key Drivers:

Bringing in New Technology is Driving Market Growth.

The aviation industry is quickly adopting new tech like the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML). This shift calls for smart middleware solutions that help process data in real time, keep planes running smoothly, and improve overall operations. Middleware connects different aircraft systems, which helps with performance and safety.

Following the Rules for Safety.

Aviation authorities like the FAA and EASA have strict rules about what communication and navigation systems should be in planes. Middleware solutions are key to checking that these rules are followed by providing standard ways for systems to talk to each other and boosting flight safety. With middleware, it’s easier to monitor systems, diagnose issues, and keep everything up to date.

Need for Real-Time Data Insights.

Airlines and defense groups are leaning more on real-time data analytics to make better decisions, improve flight operations, and create better experiences for passengers. Middleware solutions collect data from different sensors and systems, process it, and offer useful insights. This ability is important for predicting maintenance needs, managing fuel efficiently, and finding the best flight paths, which can lower costs and boost efficiency.

Aircraft Middleware Market Restraints and Challenges:

Dealing with Integration, Security, and Cost Issues.

The aircraft middleware market is facing several tough challenges that could slow down its use in the aviation industry. One major issue is the struggle to get modern middleware to work with older aircraft systems that rely on outdated tech. This mismatch often leads to pricey customizations and a complex setup process, making everything more expensive. On top of that, cybersecurity is a big worry since the increasing interconnection of systems raises the chance of cyberattacks. It's really important for middleware to have good security features, but this adds to the already heavy development costs and regulations. Small operators and regional carriers can find the high costs of research, development, certification, and implementation of new middleware technologies too much to handle. These financial challenges are made worse by long integration timelines, which can postpone upgrades. Another issue is the shortage of skilled workers who know how to develop middleware and integrate systems. This makes it hard for companies to find the right people for successful implementation and ongoing support. All these challenges—dealing with older systems, security worries, high costs, and a lack of talent—make it tough for the aircraft middleware market to grow. Finding ways to tackle these issues is important for improving connectivity, automation,

Aircraft Middleware Market Opportunities:

Opportunities in Connectivity, Data Analysis, and New Aviation Tech.

The aircraft middleware market is set to grow, thanks to several key trends in the aviation industry. A big opportunity is the rising need for in-flight connectivity and real-time data sharing. Airlines want to improve passenger experiences and boost operational efficiency, so they need middleware that ensures smooth communication between aircraft systems and ground stations. This need is getting stronger with the rise of tech like the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML), which depend on good middleware to handle complex data and analytics. Plus, the move towards cloud-based models gives airlines the flexibility to use middleware that fits their changing needs. The focus on predictive maintenance and real-time analytics also opens more chances for middleware, helping airlines make smart decisions and reduce downtime. Additionally, as the aviation industry grows in emerging markets and military aircraft modernize, there are more opportunities for middleware providers. With safety, efficiency, and better passenger services becoming a priority, middleware is playing a bigger role in connecting various systems, offering plenty of chances for innovation and growth.

AIRCRAFT MIDDLEWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

20.7% |

|

Segments Covered |

By Type, application, aircraft type, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Collins Aerospace, Thales Group, Honeywell International Inc., L3Harris Technologies, UTC Aerospace Systems, Jeppesen Sanderson (Boeing), SAP SE, Oracle Corporation, Microsoft, Ramco Systems |

Aircraft Middleware Market Segmentation:

Aircraft Middleware Market Segmentation: By Type

- Platform Middleware

- Communication Middleware

- Integration Middleware

- Others

Integration Middleware is becoming the fastest-growing part of the aircraft middleware market. This rise is due to the need for smooth communication among various onboard systems like avionics and passenger info systems. It helps these systems work together seamlessly, allowing for real-time data sharing and better efficiency. With more technologies like IoT and AI in aviation, there's a greater need for Integration Middleware, as it connects new digital tools with existing aircraft setups. The focus on predictive maintenance and real-time analytics also highlights the need for solid integration solutions, boosting this segment's growth.

On the other hand, Platform Middleware leads the aircraft middleware market. It acts as a key software layer that supports the creation and running of different applications across various hardware and systems in an aircraft. By simplifying the underlying systems, Platform Middleware ensures reliable performance and application compatibility. Its popularity is thanks to its role in making app development easier, cutting costs, and improving system reliability. As aircraft systems get more complex, the importance of Platform Middleware keeps growing.

Aircraft Middleware Market Segmentation: By Application

- Aircraft Manufacturers (OEMs)

- Airlines

Original Equipment Manufacturers (OEMs) are quickly becoming a key player in the aircraft middleware market. This growth comes from the rising demand for better avionics and modern technology in new planes. OEMs aim to create aircraft with better connectivity, real-time data handling, and smoother system cooperation, which all depend on strong middleware solutions. The shift toward more electric planes and new propulsion systems also needs advanced middleware for handling complex integrations. To keep up, OEMs are pouring money into research for customizable middleware that works across different aircraft models.

Airlines are the biggest users in the aircraft middleware market due to their need for operational efficiency and fleet management. Middleware is crucial for airlines, allowing real-time communication between onboard systems, enabling predictive maintenance, and improving passenger experiences with better in-flight entertainment and connectivity. The focus on efficiency, cost-cutting, and safety has pushed airlines to use advanced middleware that supports data analysis and seamless ground system connections. Plus, the move towards digital transformation, including cloud services and IoT tech, strengthens airlines’ reliance on middleware solutions.

Aircraft Middleware Market Segmentation: By Aircraft Type

- Fixed-Wing Aircraft

- Rotary-Wing Aircraft

- Unmanned Aerial Vehicles (UAVs)

The UAV segment is growing the fastest in the aircraft middleware market. This rise is due to more UAVs being used in military, commercial, and logistics sectors. In the military, UAVs help with intelligence, surveillance, and reconnaissance, needing middleware for real-time data and secure communication. In commercial use, the demand for drone deliveries, agricultural monitoring, and infrastructure inspections is pushing the need for middleware that can handle complex data and automation. The use of AI and machine learning in UAVs increases the need for strong middleware to support these features.

On the other hand, Fixed-Wing Aircraft leads the middleware market because they're widely used in commercial aviation, military, and cargo transport. These aircraft rely on middleware for smooth communication between systems, improved flight safety, and better performance. The rise of advanced avionics and efficient flight management systems in fixed-wing aircraft shows how important middleware has become. Ongoing upgrades in military fleets and the growth of commercial air travel also keep this segment strong in the market.

Aircraft Middleware Market Segmentation: By End-User

- Airlines

- Original Equipment Manufacturers (OEMs)

- Maintenance Repair and Overhaul (MRO) Organizations

- Defense Organizations

In the aircraft middleware market, airlines are quickly becoming the biggest users. They're ramping up their need for real-time data analysis, predictive maintenance, and better passenger services. To keep up, airlines are investing in middleware solutions to streamline their operations and cut down on downtime. This technology helps different aircraft systems communicate smoothly, improving flight operations and maintenance schedules. Cloud-based middleware is gaining traction too, offering flexible solutions that meet the changing demands of airline operations. As airlines modernize and go digital, the demand for these solutions will keep growing.

On the other hand, Original Equipment Manufacturers (OEMs) lead the middleware market because they're key players in aircraft design and production. They use middleware during manufacturing to ensure all the avionics and communication systems work well together. Their strong knowledge of aircraft systems helps them create customized middleware that boosts performance and safety. Plus, OEMs offer support and maintenance, using middleware for diagnostics and updates. Their strong ties with airlines and commitment to innovation help them maintain their top spot in the market.

Aircraft Middleware Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

North America leads the aircraft middleware market with about 35% of its share, thanks to its well-established aerospace industry and the use of modern avionics. Europe comes next at around 25%, benefiting from a strong manufacturing background and strict regulations. The Asia-Pacific area makes up about 20%, as countries there are quickly expanding and updating their fleets. Latin America the Middle East & Africa each hold about 10% of the market, seeing growth from better aviation infrastructure and more investment in their airlines.

COVID-19 Impact Analysis on the Aircraft Middleware Market:

The COVID-19 pandemic really shook up the aircraft middleware market. With air travel becoming a huge hit, airlines struggled to stay afloat. They had grounded planes and fewer passengers, which meant lower revenues and less money to invest in things like middleware systems. Many flights were canceled, and the delivery of new aircraft was put on hold, making the need for advanced avionics solutions drop even more. On top of that, the supply chain issues, and worker shortages made it tough for manufacturers to keep developing and rolling out middleware technologies. Production delays and lack of resources held things back. The shift to remote work and the need for social distancing also made it harder for teams to work together on integrating and testing these systems. Now that the aviation industry is slowly getting back on its feet, there's a new focus on improving efficiency and safety. This shift is likely to boost the demand for more advanced middleware solutions. The pandemic has shown just how important it is to have adaptable and reliable systems. With the industry pushing for digital upgrades and better technology to meet changing needs, the aircraft middleware market looks set to recover and grow in the future.

Trends/Developments:

In February 2025, Advanced Technology Services (ATS) rolled out a new guarantee that promises a 3x return on investment for its Reliability 360 Machine Health Monitoring service. This service focuses on predictive analytics and real-time monitoring to help companies manage maintenance better.

In November 2024, Hyderabad-based startup Monitra Healthcare announced that they received a US patent for their Wireless Cardiac Monitoring Device, which is a big step forward in health monitoring tech.

In July 2024, I-care picked up assets and licenses from Sensirion AG's predictive maintenance product line. This move strengthens its position in Germany and boosts its global presence in the industrial predictive maintenance space.

In June 2024 SPM Instrument AB acquired Status Pro Maschinenmesstechnik GmbH, a company known for its expertise in condition monitoring. This deal aims to improve SPM's presence in Germany and enhance its services to customers.

In March 2024, KCF Technologies launched Piezo Sensing as part of its SMARTsensing suite. This addition aims to improve machine health monitoring using high-resolution data and better fault detection, which should help with operational efficiency and safety.

Key Players:

- Collins Aerospace

- Thales Group

- Honeywell International Inc.

- L3Harris Technologies

- UTC Aerospace Systems

- Jeppesen Sanderson (Boeing)

- SAP SE

- Oracle Corporation

- Microsoft

- Ramco Systems

Chapter 1. Aircraft Middleware Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Aircraft Middleware Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Aircraft Middleware Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Aircraft Middleware Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Aircraft Middleware Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Aircraft Middleware Market– By Type

6.1 Introduction/Key Findings

6.2 Platform Middleware

6.3 Communication Middleware

6.4 Integration Middleware

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. Aircraft Middleware Market– By Application

7.1 Introduction/Key Findings

7.2 Aircraft Manufacturers (OEMs)

7.3 Airlines

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. Aircraft Middleware Market– By End-User

8.1 Introduction/Key Findings

8.2 Airlines

8.3 Original Equipment Manufacturers (OEMs)

8.4 Maintenance Repair and Overhaul (MRO) Organizations

8.5 Defense Organizations8.6 Y-O-Y Growth trend Analysis End-User

8.7 Absolute $ Opportunity Analysis End-User , 2025-2030

Chapter 9. Aircraft Middleware Market– By Aircraft Type

9.1 Introduction/Key Findings

9.2 Fixed-Wing Aircraft

9.3 Rotary-Wing Aircraft

9.4 Unmanned Aerial Vehicles (UAVs)

9.5 Y-O-Y Growth trend Analysis Aircraft Type

9.6 Absolute $ Opportunity Analysis Aircraft Type , 2025-2030

Chapter 10. Aircraft Middleware Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Type

10.1.3. By End-User

10.1.4. By Application

10.1.5. Aircraft Type

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Type

10.2.3. By End-User

10.2.4. By Application

10.2.5. Aircraft Type

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Type

10.3.3. By Aircraft Type

10.3.4. By Application

10.3.5. End-User

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By Aircraft Type

10.4.3. By Application

10.4.4. By Type

10.4.5. End-User

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By End-User

10.5.3. By Aircraft Type

10.5.4. By Application

10.5.5. Type

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. AIRCRAFT MIDDLEWARE MARKET– Company Profiles – (Overview, Portfolio, Financials, Strategies & Developments)

11.1 Collins Aerospace

11.2 Thales Group

11.3 Honeywell International Inc.

11.4 L3Harris Technologies

11.5 UTC Aerospace Systems

11.6 Jeppesen Sanderson (Boeing)

11.7 SAP SE

11.8 Oracle Corporation

11.9 Microsoft

11.10 Ramco Systems

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market is growing because more people want integrated avionic systems, connected aircraft tech, and real-time data analysis to boost efficiency.

Commercial airlines, defense groups, and maintenance providers are the main users, using middleware to better integrate systems, improve maintenance, and streamline flight operations.

AI helps with predictive maintenance, quick decision-making, and better data processing, which leads to safer flights and more efficient operations.

North America is at the top because of its strong aviation infrastructure and tech advancements, followed by Europe and Asia-Pacific, where they’re quickly adopting middleware solutions to upgrade their aviation systems

New trends include the use of edge computing, a greater focus on cybersecurity, a shift to cloud-based solutions, and applying AI and machine learning for better data analysis.