Aircraft Maintenance, Repair and Overhaul Market Size (2025 – 2030)

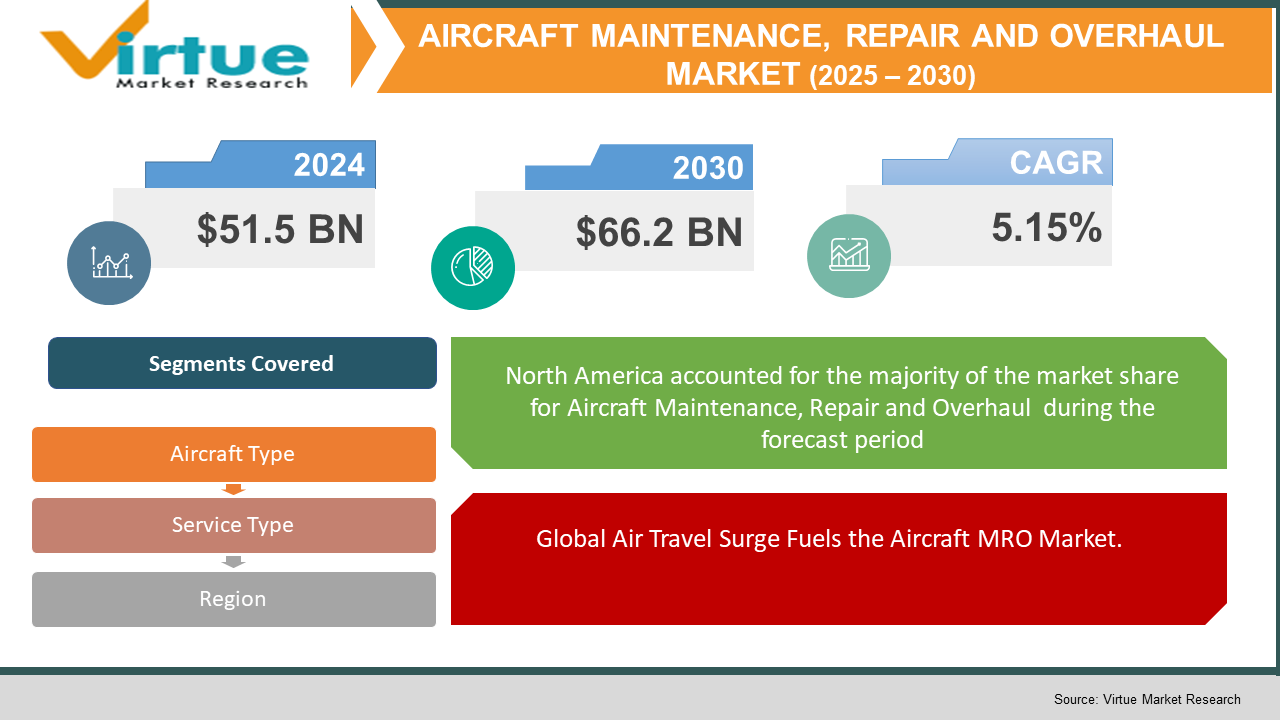

The Global Aircraft Maintenance, Repair and Overhaul Market was valued at USD 51.5 billion in 2024 and is projected to reach a market size of USD 66.2 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.15%.

The expansion of the aircraft MRO market is attributed to various reasons. The global air traffic is on the rise, and higher numbers of passengers and cargo are being moved through the air, which demands repeated and extensive maintenance to ensure safe and efficient operation. Commercial and military fleets of aircraft are growing older and thus need more extensive maintenance and overhauling services to lengthen their life span. Advances in technology, like the use of Iot (Internet of Things) and AI (Artificial Intelligence) for predictive maintenance, have improved the effectiveness and affordability of MRO services. The growth of low-cost carriers and regional airlines has driven the demand for MRO services to support their expanding fleets.

Key Market Insights:

- The increasing integration of advanced technologies such as Artificial Intelligence, Internet of Things (Iot), and predictive maintenance analytics is expected to reduce aircraft downtime by as much as 30%, making operations more efficient and cost-effective for airlines.

- The industry faces a significant skills gap, with forecasts indicating a global shortage of over 600,000 certified aviation maintenance technicians by 2040, highlighting an urgent need for workforce training and automation in MRO operations.

- Sustainability is becoming a major focus area, as airlines and MRO providers increasingly adopt eco-friendly maintenance practices and carbon-neutral technologies to align with the global aviation industry’s goal of achieving net-zero emissions by 2050.

Global Aircraft Maintenance, Repair and Overhaul Market Drivers:

Global Air Travel Surge Fuels the Aircraft MRO Market.

The consistent increase in international air travel demand has become an intrinsic impetus for the Aircraft Maintenance, Repair, and Overhaul (MRO) Market. With international and regional connectivity increasing, especially in emerging economies such as India, China, and Southeast Asia, airlines face constant pressure to grow and update their fleets to address passenger and cargo demand. With each new aircraft put into service, long-term maintenance demands are placed throughout line, base, component, and engine maintenance. Both the defence and cargo industries, as well as commercial aviation, are increasing the size of their air fleets, again driving demand for sophisticated MRO services. In addition to increasing the quantity of maintenance procedures, fleet growth increases the level of complexity, particularly with more modern models depending increasingly on sophisticated electronics and composites. This consistent growth in fleets guarantees a strong and recurrent need for MRO services as airlines seek both operational efficiency and safety to keep their competitive edge in the international market.

The integration of advanced digital technologies like artificial intelligence (AI), Internet of Things (Iot), and cloud-based platforms is significantly transforming the Aircraft MRO market.

The convergence of cutting-edge digital technologies such as artificial intelligence (AI), Internet of Things (Iot), and cloud-based platforms is radically changing the Aircraft MRO market. Predictive maintenance, based on real-time sensor data and machine learning algorithms, enables airlines to forecast component failures before their occurrence, minimising unscheduled downtimes and reducing maintenance expenses. The transition from scheduled or reactive maintenance to predictive models is assisting airlines in improving fleet availability while reducing disruptions. Technologies like digital twins for aircraft components, 3d scanning, and augmented reality (AR) for remote instruction are also making complex repairs and inspections easier. These technologies not only enhance precision but also lower manual errors, optimise maintenance cycles, and enhance regulatory compliance. With airlines adopting digital transformation for safety assurance and operational excellence, the need for tech-driven MRO services is bound to continue to accelerate in the global aviation industry.

Global Aircraft Maintenance, Repair and Overhaul Market Restraints and Challenges:

One of the major restraints facing the Aircraft MRO market is the rising cost and shortage of skilled labour, combined with the growing complexity of modern aircraft systems.

One of the key constraints in the Aircraft MRO market is the increasing cost and scarcity of skilled labour, coupled with the increasing complexity of new aircraft systems. As aircraft design becomes more complex, with composite materials, digital avionics, and advanced engines, the demand for highly skilled technicians has increased. But the sector is confronted with a growing talent deficit as veteran engineers retire and younger professionals increasingly lose interest in technical professions. Moreover, the implementation of next-generation tools like predictive maintenance systems, AI-driven diagnostics, and automated inspection tools requires a huge investment from MRO providers. Small and medium-sized MRO companies, particularly in emerging markets, tend to find it difficult to enhance their capabilities and develop their staff according to new standards. This develops service delays, inflates operational expenses, and raises reliance on leading worldwide players, creating a challenge to the balanced and timely development of the MRO ecosystem globally.

Global Aircraft Maintenance, Repair and Overhaul Market Opportunities:

The Worldwide Aircraft Maintenance, Repair, and Overhaul (MRO) Market is on the cusp of huge opportunities for growth, driven by growing demand for digital solutions, green aviation, and fleet upgrades. Growing demand for AI- and Iot-driven predictive maintenance provides airlines with the means to minimise downtime, increase asset lifespan, and reduce operating expenses, creating high demand for tech-driven MRO solutions. Moreover, the worldwide drive towards sustainable aviation has created opportunities for green repair techniques, lightweight materials, and carbon-free maintenance centres. The growth markets, particularly in Asia-Pacific, Africa, and the Middle East, are developing their aviation infrastructure at a fast pace, providing a rich soil for local MRO centres and collaborations. With new-generation aircraft coming into service and ageing fleets getting life-extension upgrades, MRO providers who make investments in digital, automation, and sustainability stand to gain long-term value in the changing world of aviation.

AIRCRAFT MAINTENANCE, REPAIR AND OVERHAUL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.15% |

|

Segments Covered |

By air craft Type, service type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Collins Aerospace, Boeing Company, Bell Helicopter Textron, AAR Corporation, Bombardier Inc, AirNet II, Etihad Airways |

Global Aircraft Maintenance, Repair and Overhaul Market Segmentation:

Aircraft Maintenance, Repair and Overhaul Market Segmentation: By Aircraft Type

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Regional Aircraft

- Military Aircraft

- Helicopters

The aircraft-type segmentation of the MRO market is led by diverse operational needs and technological specifications for each group. Narrow-body aircraft, frequently utilised for short to medium-range flights, are a major segment of the market as they are utilised by low-cost carriers as well as major airlines across the globe. Wide-body aircraft, intended for long-haul flights, are essential for extensive commercial airline fleets. As global travel picks up, the need for MRO services in wide-body aeroplanes will increase. Regional aircraft play an important role in the coverage of small markets and possess special maintenance needs, with specialised services that address their operational factors. Military planes are subject to stringent maintenance schedules because of their complexity and the nature of their use in national defence. Finally, helicopters, which cater to numerous sectors such as transport, rescue, and defence, need recurrent and sometimes expert maintenance to ensure reliability and safety, especially in vertical take-off and landing modes. The expanding fleet in these segments will majorly contribute to MRO market growth during the period 2025-2030.

Aircraft Maintenance, Repair and Overhaul Market Segmentation: By Service Type

- Engine Overhaul

- Airframe Maintenance

- Line Maintenance

- Modification

- Components Maintenance

Service type segmentation points to the wide variety of maintenance needs across various models of aircraft. Engine overhaul is a central service within the MRO sector because of the importance of engines in ensuring flight safety and performance. Engine parts, such as turbofans and turboprops, must be periodically serviced, ensuring long-term fleet sustainability. Airframe maintenance, encompassing structural overhauls, repairs, and refurbishments, is necessary to ensure an aircraft's safety and airworthiness. As airframes increasingly feature composite materials, this area will also develop, with sophisticated methods necessary to work on these newer designs. Line maintenance is the periodic inspections and minor overhauls performed between flights, and it is crucial to reducing downtime and improving operating efficiency. Modification services are essential for the upgrade, retrofits, and incorporation of new technologies to fulfil new regulatory requirements or enhance fuel efficiency. Last but not least, component maintenance includes repair and overhaul of equipment like landing gear, avionics, and control systems that are essential in maintaining aircraft performance. All of these services will help ensure the safety, compliance, and operational efficiency of fleets throughout the forecast period.

Aircraft Maintenance, Repair and Overhaul Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East & Africa

The Global Aircraft MRO Market in 2024 exhibits a dynamic and geographically diversified nature. North America is the leading region, driven significantly by the presence of a mature aviation environment, robust defence contracts, and a dense concentration of commercial and cargo fleets. The region is supported by well-established MRO service providers, leading technical capabilities, and a strong culture of safety compliance. Asia-Pacific is emerging as a primary growth centre, fueled by a surging aviation industry, urbanisation, and growing air travel among the middle class. Airlines in this region are growing their fleets at an unprecedented pace, and this has increased demand for scheduled and unscheduled maintenance services. Europe has a consistent presence in the market, bolstered by rigorous regulatory requirements, a high density of airlines, and emphasis on sustainability and digitalisation in aviation operations. South America is consistently growing its presence, as carriers upgrade fleets and improve regional connectivity. The Middle East & Africa, although smaller in percentage, are seeing more investments, particularly with the Middle East positioning itself as a transit hub globally and African countries increasingly modernising their aviation facilities. This dispersed pattern reflects the international nature of aircraft maintenance demand based on regional growth dynamics, fleet growth, and the requirement for more advanced operational safety and efficiency.

COVID-19 Impact Analysis on the Global Aircraft Maintenance, Repair and Overhaul Market:

The pandemic of COVID-19 significantly impacted the Global Aircraft Maintenance, Repair, and Overhaul (MRO) Market, with overall disruption in the aviation sector across the globe. With global as well as local flights suspended and travel restrictions put in place everywhere, airlines were compelled to put a large majority of their aircraft into storage, resulting in declining demand for scheduled maintenance and repair services. Most MRO operations were postponed or suspended as airlines diverted attention towards cost-reduction and survival measures. But the pandemic also underscored the need for predictive maintenance, digital inspection technologies, and aircraft storage services, which gained wider usage. As the industry slowly returned to normal, the attention moved towards efficiency, automation, and robust supply chains, which enabled the MRO industry to reform itself for a post-pandemic world.

Latest Trends/ Developments:

The Global Aircraft Maintenance, Repair, and Overhaul (MRO) Market is also experiencing swift transformation through digitalisation, automation, and sustainability ambitions. AI-powered predictive maintenance supported by data analytics is picking up steam strongly, allowing airlines to reduce downtime and prolong aircraft life cycles. Take-up of cutting-edge technologies such as the use of drones for visual inspections, 3d printing for on-demand spares, and cloud-based MRO management systems is rationalising operations and enhancing turnaround times. Also, green MRO practices, such as the use of eco-friendly materials and energy-efficient maintenance processes, are increasingly being emphasised as the industry aligns with international carbon reduction goals. Strategic partnerships among OEMS, airlines, and third-party MRO vendors are becoming more prevalent, too, increasing flexibility and service excellence throughout the aviation supply chain.

Key Players:

- Collins Aerospace

- Boeing Company

- Bell Helicopter Textron Inc.

- AAR Corporation

- Bombardier Inc.

- AirNet II

- Etihad Airways

- Aviation Repair Technologies

- Barfield Inc.

- Denel Aeronautics

- Alpine Aerotech

Chapter 1. AIRCRAFT MAINTENANCE, REPAIR AND OVERHAUL MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. AIRCRAFT MAINTENANCE, REPAIR AND OVERHAUL MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. AIRCRAFT MAINTENANCE, REPAIR AND OVERHAUL MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. AIRCRAFT MAINTENANCE, REPAIR AND OVERHAUL MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. AIRCRAFT MAINTENANCE, REPAIR AND OVERHAUL MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. AIRCRAFT MAINTENANCE, REPAIR AND OVERHAUL MARKET – By Aircraft Type

6.1 Introduction/Key Findings

6.2 Narrow-Body Aircraft

6.3 Wide-Body Aircraft

6.4 Regional Aircraft

6.5 Military Aircraft

6.6 Helicopters

6.7 Y-O-Y Growth trend Analysis By Aircraft Type

6.8 Absolute $ Opportunity Analysis By Aircraft Type , 2025-2030

Chapter 7. AIRCRAFT MAINTENANCE, REPAIR AND OVERHAUL MARKET – By Service Type

7.1 Introduction/Key Findings

7.2 Engine Overhaul

7.3 Airframe Maintenance

7.4 Line Maintenance

7.5 Modification

7.6 Components Maintenance

7.7 Y-O-Y Growth trend Analysis By Service Type

7.8 Absolute $ Opportunity Analysis By Service Type , 2025-2030

Chapter 8. AIRCRAFT MAINTENANCE, REPAIR AND OVERHAUL MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Service Type

8.1.3. By Aircraft Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Aircraft Type

8.2.3. By Service Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Aircraft Type

8.3.3. By Service Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Aircraft Type

8.4.3. By Service Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Aircraft Type

8.5.3. By Service Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. AIRCRAFT MAINTENANCE, REPAIR AND OVERHAUL MARKET – Company Profiles – (Overview, Product , Portfolio, Financials, Strategies & Developments)

9.1 Collins Aerospace

9.2 Boeing Company

9.3 Bell Helicopter Textron Inc.

9.4 AAR Corporation

9.5 Bombardier Inc.

9.6 AirNet II

9.7 Etihad Airways

9.8 Aviation Repair Technologies

9.9 Barfield Inc.

9.10 Denel Aeronautics

9.11 Alpine Aerotech

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Aircraft Maintenance, Repair and Overhaul Market was valued at USD 51.5 billion in 2024 and is projected to reach a market size of USD 66.2 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.15%.

The market is driven by the rising global air traffic and the growing focus on aircraft safety and operational efficiency. Additionally, fleet expansion and ageing aircraft are boosting demand for regular maintenance services

Based on Service Provider, the Global Aircraft Maintenance, Repair and Overhaul Market is segmented into material manufacturers, Raw Material Suppliers, Lab information management systems, Distributors & Wholesalers, End-to-End Solution Providers.

North America is the most dominant region for the Global Aircraft Maintenance, Repair and Overhaul Market

Collins Aerospace, Boeing Company, Bell Helicopter Textron, AAR Corporation, Bombardier Inc, AirNet II, Etihad Airways are the key players in the Global Aircraft Maintenance, Repair and Overhaul Market