Aircraft Fuel Cells Market Size (2025 – 2030)

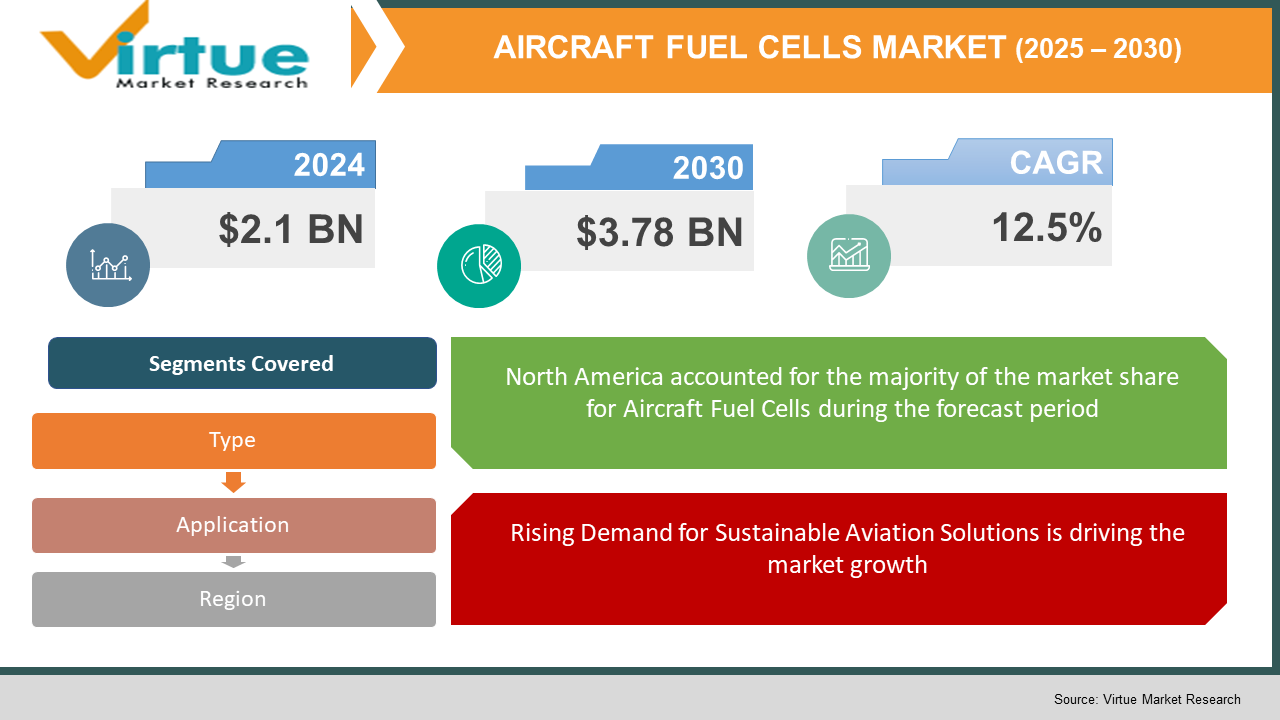

The Global Aircraft Fuel Cells Market was valued at USD 2.1 billion in 2024 and will grow at a CAGR of 12.5% from 2025 to 2030. The market is expected to reach USD 3.78 billion by 2030.

The aircraft fuel cells market focuses on the development and integration of fuel cell technology for aviation applications, offering a cleaner and more efficient energy source compared to traditional fossil fuels. Fuel cells are increasingly being explored as a viable alternative for powering auxiliary systems in aircraft, and in the future, they may serve as the primary propulsion system for electric aircraft. The rising emphasis on sustainable aviation, stringent emission regulations, and advancements in hydrogen fuel cell technology are key factors driving the growth of this market. Aircraft fuel cells offer advantages such as higher energy efficiency, reduced carbon footprint, and lower noise emissions, making them a critical component in the future of aviation.

Key Market Insights

- Hydrogen fuel cells accounted for 48% of the market share in 2024 due to their high energy density and zero-emission properties.

- Commercial aircraft applications represented the largest market segment, holding 55% of the market share, as airlines and manufacturers seek greener energy solutions.

- The North American region dominated the market with a 40% share, driven by significant investments in sustainable aviation technology and government support for hydrogen-powered aircraft.

- Major aircraft manufacturers, including Boeing and Airbus, are actively investing in fuel cell technology to develop hybrid and fully electric aircraft. Governments and regulatory bodies are implementing stricter emission standards, encouraging the aviation industry to transition toward fuel cell-based power solutions.

Global Aircraft Fuel Cells Market Drivers

Rising Demand for Sustainable Aviation Solutions is driving the market growth

The aviation industry is under immense pressure to reduce carbon emissions and transition toward sustainable energy solutions. Conventional jet fuels contribute significantly to greenhouse gas emissions, prompting the need for cleaner alternatives. Aircraft fuel cells, particularly hydrogen fuel cells, offer a viable pathway toward achieving net-zero emissions in aviation. With growing investments in hydrogen infrastructure and fuel cell research, airlines and aircraft manufacturers are actively exploring fuel cell integration for auxiliary power units (APUs) and even primary propulsion systems. Leading aerospace companies are partnering with fuel cell developers to accelerate commercialization, with prototype flights already being conducted to test fuel cell efficiency and performance. The push for sustainability, coupled with increasing regulatory mandates, is expected to drive the widespread adoption of fuel cells in the aviation industry.

Technological Advancements in Fuel Cell Efficiency and Durability is driving the market growth

Significant advancements in fuel cell technology are improving the efficiency, durability, and performance of these systems in aircraft applications. Innovations in proton exchange membrane (PEM) fuel cells, solid oxide fuel cells (SOFCs), and hybrid fuel cell-battery systems are enabling higher energy output with reduced weight and size. Researchers are developing more robust fuel cell membranes and catalysts that can withstand extreme aviation conditions, such as rapid temperature changes and high-altitude operations. Additionally, the integration of fuel cell technology with advanced battery storage systems is enhancing the overall energy density and reliability of electric aviation solutions. As fuel cell technology matures, its potential applications in both commercial and military aircraft continue to expand.

Government Support and Regulatory Push for Green Aviation is driving the market growth

Governments worldwide are implementing policies and funding initiatives to accelerate the development of fuel cell-powered aircraft. Regulatory bodies such as the International Civil Aviation Organization (ICAO) and the European Union Aviation Safety Agency (EASA) are establishing stricter emissions targets, pushing the aviation sector toward alternative energy solutions. Countries like Germany, the United States, and Japan have launched hydrogen strategies to support fuel cell technology in multiple industries, including aerospace. The European Union’s "Clean Aviation" initiative is funding projects focused on fuel cell-powered aircraft, while NASA and Boeing are exploring fuel cell propulsion for future air mobility solutions. These policy measures and financial incentives are expected to play a crucial role in driving the adoption of aircraft fuel cells in the coming years.

Global Aircraft Fuel Cells Market Challenges and Restraints

High Costs and Infrastructure Limitations is restricting the market growth

One of the primary challenges in the adoption of aircraft fuel cells is the high cost of fuel cell systems and the infrastructure required to support them. Hydrogen fuel cells, in particular, require specialized storage and refueling infrastructure, which is still in the early stages of development. The cost of producing and storing liquid hydrogen is significantly higher than conventional jet fuels, posing economic barriers for widespread adoption. Additionally, the integration of fuel cell systems into existing aircraft designs requires significant modifications and investment, further increasing operational costs. While advancements in fuel cell technology and economies of scale are expected to reduce costs over time, the current financial barriers remain a key challenge for market growth.

Energy Density and Range Limitations is restricting the market growth

Although fuel cells offer a cleaner alternative to traditional jet fuels, their energy density and range capabilities are still limited compared to fossil fuel-powered engines. Hydrogen fuel cells, while highly efficient, require large storage tanks, which can add weight and impact the aerodynamics of aircraft. Solid oxide fuel cells (SOFCs) operate at high temperatures and provide stable power but require longer startup times, making them less suitable for certain aviation applications. The challenge of achieving higher power output while maintaining lightweight and compact designs remains a critical area of focus for fuel cell researchers. Until significant breakthroughs in fuel cell energy density are achieved, conventional jet fuel may continue to dominate long-haul aviation.

Market Opportunities

The rapid expansion of the urban air mobility (UAM) market presents significant opportunities for aircraft fuel cell adoption. Electric vertical takeoff and landing (eVTOL) aircraft, air taxis, and small commuter aircraft are increasingly being designed with fuel cell-based propulsion systems to enhance efficiency and reduce emissions. Additionally, the defense sector is exploring fuel cell technology for unmanned aerial vehicles (UAVs) and stealth aircraft due to its quiet operation and extended flight capabilities. As hydrogen production technologies improve and fuel cell costs decline, commercial airlines may adopt fuel cell-based auxiliary power units (APUs) and hybrid propulsion systems. Collaborations between aerospace companies, energy firms, and research institutions are expected to accelerate innovation in this sector.

AIRCRAFT FUEL CELLS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

12.5% |

|

Segments Covered |

By Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Airbus, Boeing, Ballard Power Systems, Plug Power, Honeywell Aerospace, Safran, Hydrogenics Corporation, Rolls-Royce, AeroVironment, and General Electric Aviation |

Aircraft Fuel Cells Market Segmentation

Aircraft Fuel Cells Market Segmentation By Type

- Hydrogen Fuel Cells

- Solid Oxide Fuel Cells (SOFCs)

- Proton Exchange Membrane (PEM) Fuel Cells

- Others

Hydrogen fuel cells are the dominant segment due to their zero-emission properties, high energy efficiency, and potential for long-term use in commercial aircraft propulsion.

Aircraft Fuel Cells Market Segmentation By Application

- Commercial Aircraft

- Military Aircraft

- Unmanned Aerial Vehicles (UAVs)

- Others

Commercial aircraft lead the market, with airlines and manufacturers investing heavily in sustainable aviation technology. The demand for cleaner and more efficient energy sources in passenger and cargo aircraft is driving fuel cell adoption in this sector.

Aircraft Fuel Cells Market Segmentation Regional Analysis:

• North America

• Asia-Pacific

• Europe

• South America

• Middle East and Africa

North America dominates the market, with strong investments in hydrogen infrastructure, research programs, and collaborations between government agencies and aerospace companies. The United States, in particular, is leading in fuel cell-powered aircraft development, with NASA and major aerospace firms testing prototype designs. Europe is another key region, with the European Union investing heavily in sustainable aviation initiatives and hydrogen-powered aircraft research. The Asia-Pacific market is also witnessing growth, driven by increasing government initiatives in China, Japan, and South Korea to promote hydrogen fuel cell technology. Emerging markets in the Middle East and Latin America are exploring fuel cell applications, particularly in UAVs and military aircraft.

COVID-19 Impact Analysis on the Aircraft Fuel Cells Market

The COVID-19 pandemic temporarily slowed down investments in new aircraft technologies due to reduced air travel demand and financial constraints on airlines. However, the crisis also highlighted the need for a more resilient and sustainable aviation sector. Governments and aerospace companies have since intensified efforts to develop low-emission aircraft, with a growing focus on fuel cell technology. The post-pandemic recovery has accelerated research in alternative propulsion systems, with major players securing funding for hydrogen and fuel cell-powered aviation projects. The long-term impact of COVID-19 has reinforced the aviation industry's commitment to sustainability and fuel-efficient innovations.

Latest Trends/Developments

The aviation industry is undergoing a significant transformation with a clear trajectory towards more sustainable propulsion systems, prominently featuring the adoption of hybrid-electric and fuel cell technologies as key trends. Recognizing the urgent need to reduce carbon emissions and mitigate environmental impact, aerospace companies are actively exploring and investing in fuel cell-battery hybrid systems that synergistically combine the high energy density of fuel cells with the high power density of batteries. This hybrid approach aims to optimize energy efficiency across different phases of flight, enhance overall performance, and significantly extend the flight range achievable compared to purely battery-electric or standalone fuel cell systems. A crucial enabler for the widespread adoption of hydrogen fuel cells in aviation is the parallel rise of green hydrogen production methods, such as electrolysis powered by renewable energy sources like solar and wind. This sustainable production of hydrogen is essential to realize the full environmental benefits of fuel cell technology, ensuring that the entire energy lifecycle, from fuel production to aircraft operation, is significantly cleaner. Aerospace firms are also strategically focusing on the development of modular fuel cell systems that offer scalability and flexibility, with the potential to be retrofitted into existing aircraft platforms. This modularity would facilitate a more gradual and cost-effective transition to fuel cell-powered aviation, allowing airlines to upgrade their fleets incrementally. Furthermore, substantial advancements in cryogenic hydrogen storage technology are critical for improving the feasibility of fuel cells, particularly for long-haul flights that demand significant fuel capacity. Innovations in lightweight and highly insulated tanks capable of storing liquid hydrogen at extremely low temperatures are crucial for maximizing energy density and minimizing weight penalties, thereby making long-distance hydrogen-powered flight a more viable prospect. These converging trends, encompassing hybrid propulsion architectures, sustainable hydrogen production, modular system design, and advanced fuel storage, collectively indicate a promising and increasingly tangible future for fuel cell-powered aviation, paving the way for quieter, cleaner, and more environmentally responsible air travel in the years to come.

Key Players

- Airbus

- Boeing

- Ballard Power Systems

- Plug Power

- Honeywell Aerospace

- Safran

- Hydrogenics Corporation

- Rolls-Royce

- AeroVironment

- General Electric Aviation

Chapter 1. AIRCRAFT FUEL CELLS MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. AIRCRAFT FUEL CELLS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. AIRCRAFT FUEL CELLS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. AIRCRAFT FUEL CELLS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. AIRCRAFT FUEL CELLS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. AIRCRAFT FUEL CELLS MARKET – By Type

6.1 Introduction/Key Findings

6.2 Hydrogen Fuel Cells

6.3 Solid Oxide Fuel Cells (SOFCs)

6.4 Proton Exchange Membrane (PEM) Fuel Cells

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. AIRCRAFT FUEL CELLS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Commercial Aircraft

7.3 Military Aircraft

7.4 Unmanned Aerial Vehicles (UAVs)

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. AIRCRAFT FUEL CELLS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. AIRCRAFT FUEL CELLS MARKET – Company Profiles – (Overview, Packaging Type, Portfolio, Financials, Strategies & Developments)

9.1 Airbus

9.2 Boeing

9.3 Ballard Power Systems

9.4 Plug Power

9.5 Honeywell Aerospace

9.6 Safran

9.7 Hydrogenics Corporation

9.8 Rolls-Royce

9.9 AeroVironment

9.10 General Electric Aviation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Aircraft Fuel Cells Market was valued at USD 2.1 billion in 2024 and is expected to reach USD 3.78 billion by 2030, growing at a CAGR of 12.5%.

Key drivers include rising demand for sustainable aviation solutions, technological advancements in fuel cell efficiency, and strong government support for green aviation initiatives

The market is segmented by product (hydrogen fuel cells, solid oxide fuel cells, proton exchange membrane fuel cells, and others) and by application (commercial aircraft, military aircraft, UAVs, and others).

North America is the dominant region due to significant investments in hydrogen infrastructure, strong R&D programs, and collaborations between aerospace manufacturers and government agencies

Key players include Airbus, Boeing, Ballard Power Systems, Plug Power, Honeywell Aerospace, Safran, Hydrogenics Corporation, Rolls-Royce, AeroVironment, and General Electric Aviation.