Aircraft Floor Panel Market Size (2025 – 2030)

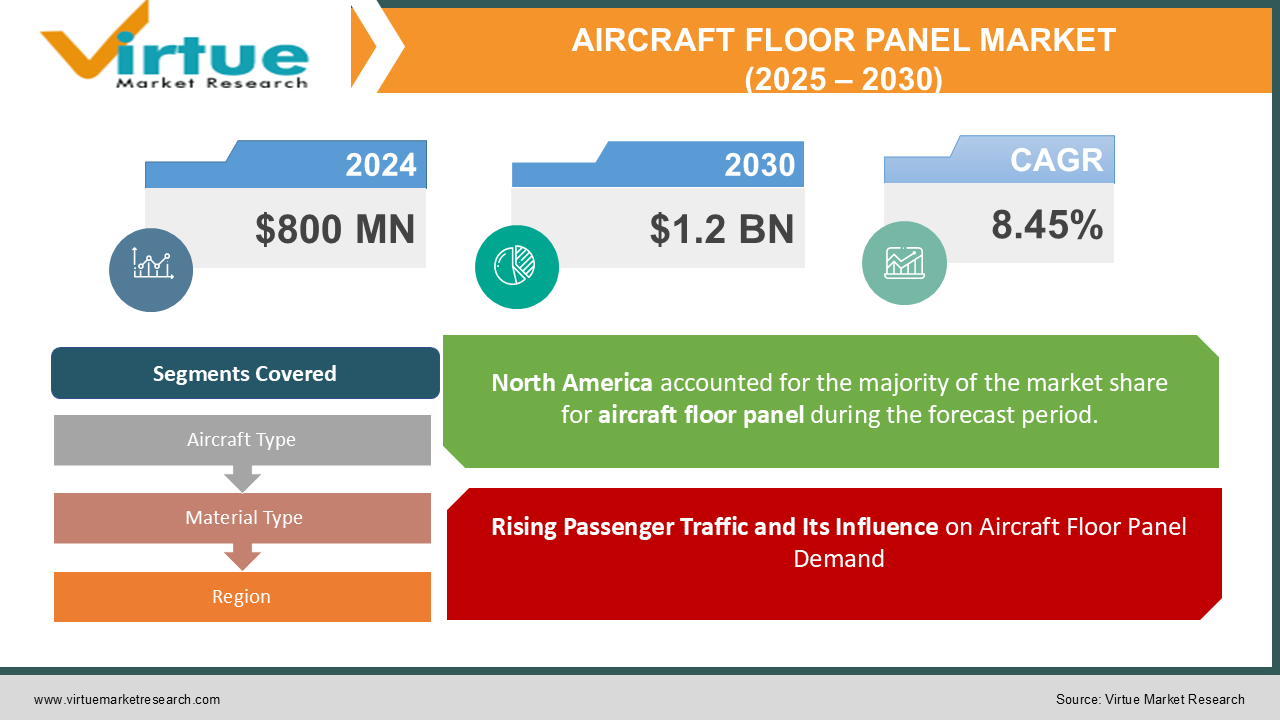

The Aircraft Floor Panel Market was valued at USD 800 million and is projected to reach a market size of USD 1.2 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.45%.

Aircraft floor panels refer to the walking surface inside of an aircraft and the structural components used to make them. These panels are designed to meet strict aviation standards. Global Aviation is expected to keep expanding and adding new innovative technology to its fleets. A fast-paced and more interconnected world has meant that the growth in aviation has been consistent and positive throughout history. The recent emergence of new airlines and legacy airlines upgrading their fleets has meant that the demand for the Aircraft Floor Panel market has increased rapidly in the post-pandemic period. Also, there has been an increase in defence spending by governments worldwide, which has also contributed to the growth in this particular market.

Key Market Insights:

-

Governments and private corporations are also investing in building airports all over the world and especially in the emerging market economies of India, China, Brazil. As a larger share of the population is travelling by air the demand for a more varied list of destinations has also increased.

-

Airlines are putting greater emphasis on cost and fuel efficiency by implementing lightweight floor panels, which lighten planes and improve performance. Because of their strength and low weight, materials like aluminium and Nomex honeycomb are being used more and more.

-

Stringent aviation industry standards necessitate rigorous testing and certification processes, which can result in delays and increased costs for new materials and technologies.

-

Ongoing research and development are leading to the creation of more robust, durable, and lighter floor panels, enhancing overall aircraft efficiency and passenger comfort.

-

The market is dominated by a few players especially American and European firms as the two main airline makers, Boeing and Airbus are in the respective areas.

Aircraft Floor Panel Market Drivers:

Rising Passenger Traffic and Its Influence on Aircraft Floor Panel Demand

Rising disposable incomes globally have significantly boosted air travel, making it more accessible to a broader segment of the population. As people experience greater financial flexibility, leisure and business travel have surged, particularly in emerging economies like China, India, and Southeast Asia. This increase in passenger traffic directly drives airlines to expand their fleets and modernize existing aircraft to meet the growing demand. The market for aeroplane floor panels is also affected by this trend. The need for strong, lightweight, and reasonably priced floor panels has increased as more aeroplanes are being built and older types are being upgraded. As air travel becomes more frequent and accessible, wear and tear on aircraft interiors, including floor panels, accelerates. This pushes airlines to seek high-quality, easily maintainable panels to minimize downtime and reduce operational costs. As global disposable incomes continue to rise and urbanization accelerates, the aviation industry is projected to sustain robust growth.

Rising military spending and increased airport construction are driving demand in the aircraft floor panel market.

The increase in military spending by governments worldwide has significantly contributed to the expansion of the aerospace industry, including the demand for aircraft floor panels. Défense budgets have grown as nations prioritize modernizing their air fleets, enhancing aerial combat capabilities, and improving logistics for military operations. This surge in military aircraft procurement—ranging from fighter jets and transport planes to surveillance drones and refuelling aircraft—has driven demand for high-performance aircraft components, including floor panels. At the same time, governments globally are giving importance to the development of air travel infrastructure by building and renovating airports in various locations, especially in developing nations. Commercial airlines and private operators are encouraged to invest in new aircraft because of the increased air traffic made possible by the expansion of airport networks. Moreover, the establishment of new airports fosters regional connectivity, encouraging airlines to deploy more aircraft on domestic and international routes.

Aircraft Floor Panel Market Restraints and Challenges:

The manufacturing and material cost to make these aircraft floor panels is high and the industry cannot sustain a demand shock, also the price of raw materials has been inflationary which has led to delays and cost overruns.

The high manufacturing and material costs associated with aircraft floor panels pose a significant challenge to the industry. The production of these materials is complex and resource-intensive, leading to elevated costs that make floor panels an expensive component of aircraft interiors. The aircraft floor panel industry operates within a highly cyclical market, where demand is closely tied to airline profitability, fleet expansion, and global air travel trends. Any sharp drop in demand, such as those witnessed during the pandemic, can severely impact production levels. The aerospace industry relies on specialized materials such as aluminium, carbon fibre, and resin-based composites, which are subject to volatile pricing.

Aircraft Floor Panel Market Opportunities:

The market for aviation floor panels has a lot of potential to grow due to developments in lightweight and high-performance materials, increasing production of commercial aircraft, and the increasing number of regional and low-cost carriers (LCCs). The demand for strong, impact-resistant floor panels has also increased as a result of increased spending on military and defence aircraft. Manufacturers are also being pushed to create eco-friendly and fire-resistant materials by more stringent fire safety laws and sustainability programs. The growing aftermarket segment, including aircraft retrofits and cabin upgrades, further drives demand for replacement floor panels, especially in premium and luxury aircraft interiors.

AIRCRAFT FLOOR PANEL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.45% |

|

Segments Covered |

By Aircraft Type, Material Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Aerofloor Ltd, Cooper – standard, Encore Group, Comtek Advanced Structures, Collins Aerospace, Hexcel Corporation, Hutchinson, Triumph , NORDAM Grp LLC, Gill Corporation |

Aircraft Floor Panel Market Segmentation: By Aircraft Type

-

Commercial

-

Private

-

Military

-

Helicopter

The commercial aircraft segment holds the largest share among the four as it has the largest demand. Lightweight and durable floor panels are given priority by airlines to improve passenger comfort and fuel efficiency while adhering to the fire resistance and safety standards established by the FAA and EASA. Additionally, the demand for affordable, long-lasting floor panels that can handle heavy passenger traffic has increased due to the growth of low-cost carriers (LCCs) and long-haul flights.

The Private jet segment is also expanding rapidly as new routes to the Middle East and emerging economies of India and China are being opened. High-net-worth individuals and corporate clients seek customized, high-end floor panels with aesthetic appeal, premium materials, and enhanced durability. On the other hand, the military aircraft segment requires high-strength, impact-resistant, and lightweight floor panels that can withstand extreme conditions, heavy equipment loads, and combat environments.

Aircraft Floor Panel Market Segmentation: By Material Type

-

Honeycomb (Nomex, Aluminium)

-

Composite

-

Nylon

-

Others

The lightweight and high-strength properties of the honeycomb segment, which comprises Nomex and aluminium honeycomb, make it popular. Nomex honeycomb panels are highly prized for their ability to withstand fire, which makes them perfect for commercial aeroplanes where strict safety standards apply. Aluminium honeycomb panels are frequently utilized because of their affordability, rigidity, and low weight—all of which are essential for lowering fuel consumption in large aircraft.

The composite segment is gaining traction as an alternative to traditional materials due to its lightweight nature and superior strength-to-weight ratios. Composites like carbon fibre and glass fibre-reinforced polymers are used to create more fuel-efficient, durable, and customizable floor panels. They offer enhanced performance in both commercial and military aircraft by reducing weight and increasing the lifespan of floor panels. Nylon, another material used for flooring, is known for its resilience, abrasion resistance, and ability to withstand heavy foot traffic. It is often found in smaller aircraft and helicopters, where cost-effectiveness and ease of maintenance are essential.

Aircraft Floor Panel Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East and Africa

The North American and the European Markets hold the largest share of manufacturing of these aircraft floor panels. The United States is an important player in North America, home to major aircraft manufacturers like Boeing and several airline operators that fuel demand for floor panels. The region's robust defence industry and cutting-edge aerospace technology generate steady demand for both military and commercial aircraft, boosting the floor panel market.

Similarly, Europe hosts aerospace giants like Airbus and numerous tier-1 suppliers specializing in advanced aircraft components. The demand for floor panels in Europe is also driven by the growth of commercial aviation and defence contracts with a significant number of military aircraft fleets requiring high-quality floor panels. The region's emphasis on sustainability has also encouraged the development of eco-friendly materials and energy-efficient solutions, further pushing market growth. Together North America and Europe hold over 70% of the market.

While Asia – Pacific is another growing region it does not have the same infrastructure and building capacity yet, but is projected to ramp up development immensely in the upcoming 5 years. South America does experience some spillover effects of the US but otherwise still is a minor market.

COVID-19 Impact Analysis on the Aircraft Floor Panel Market:

The pandemic had a deep negative impact on the industry. As travel collapsed overnight so did the demand for the floor panels. Airlines grounded fleets, reduced flight schedules, and deferred aircraft orders, leading to a sharp decline in the demand for new aircraft and, consequently, aircraft floor panels. The supply chain was severely impacted as well, with global transportation disruptions, factory shutdowns, and labour shortages making it difficult for manufacturers to secure raw materials and components. This resulted in delays in production timelines and cost overruns, further straining the financial stability of companies in the aircraft floor panel sector.

Trends/ Developments:

Honeywell has partnered with aerospace manufacturers to supply high-performance honeycomb composite panels, leveraging its extensive research and development capabilities to create fire-resistant, lightweight materials for both commercial and military applications.

Advanced manufacturing methods like additive manufacturing and 3D printing are being adopted by the aeroplane floor panel business. With increased accuracy and less material waste, these technologies enable producers to produce highly tailored, lightweight, and long-lasting floor panels.

Safran acquired Zodiac Aerospace, strengthening its position in the aircraft interiors segment, including floor panel manufacturing. Similarly, Collins Aerospace (a subsidiary of Raytheon Technologies) has expanded its market footprint through acquisitions of smaller suppliers that specialize in lightweight composite materials and innovative floor panel solutions.

Key Players:

-

Aerofloor Ltd

-

Cooper – standard

-

Encore Group

-

Comtek Advanced Structures

-

Collins Aerospace

-

Hexcel Corporation

-

Hutchinson

-

Triumph

-

NORDAM Grp LLC

-

Gill Corporation

Chapter 1. Aircraft Floor Panel Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aircraft Floor Panel Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aircraft Floor Panel Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aircraft Floor Panel Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aircraft Floor Panel Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aircraft Floor Panel Market – By Aircraft Type

6.1 Introduction/Key Findings

6.2 Commercial

6.3 Private

6.4 Military

6.5 Helicopter

6.6 Y-O-Y Growth trend Analysis By Aircraft Type

6.7 Absolute $ Opportunity Analysis By Aircraft Type, 2025-2030

Chapter 7. Aircraft Floor Panel Market – By Material Type

7.1 Introduction/Key Findings

7.2 Honeycomb (Nomex, Aluminium)

7.3 Composite

7.4 Nylon

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Material Type

7.7 Absolute $ Opportunity Analysis By Material Type, 2025-2030

Chapter 8. Aircraft Floor Panel Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Aircraft Type

8.1.3 By Material Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Aircraft Type

8.2.3 By Material Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Aircraft Type

8.3.3 By Material Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Aircraft Type

8.4.3 By Material Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Aircraft Type

8.5.3 By Material Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Aircraft Floor Panel Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Aerofloor Ltd

9.2 Cooper – standard

9.3 Encore Group

9.4 Comtek Advanced Structures

9.5 Collins Aerospace

9.6 Hexcel Corporation

9.7 Hutchinson

9.8 Triumph

9.9 NORDAM Grp LLC

9.10 Gill Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The market is driven by rising air travel demand, military aircraft expansion, and lightweight material innovations for fuel efficiency.

Commercial aircraft dominate the market due to increasing airline fleet expansion, passenger traffic growth, and safety regulations.

Honeycomb (Nomex & Aluminium), composites, and nylon are widely used due to their lightweight, fire resistance, and durability.

The market saw a sharp decline due to grounded fleets, reduced aircraft orders, and supply chain disruptions, but is now recovering.

North America and Europe hold over 70% of the market, driven by Boeing, Airbus, and a strong aerospace manufacturing presence.