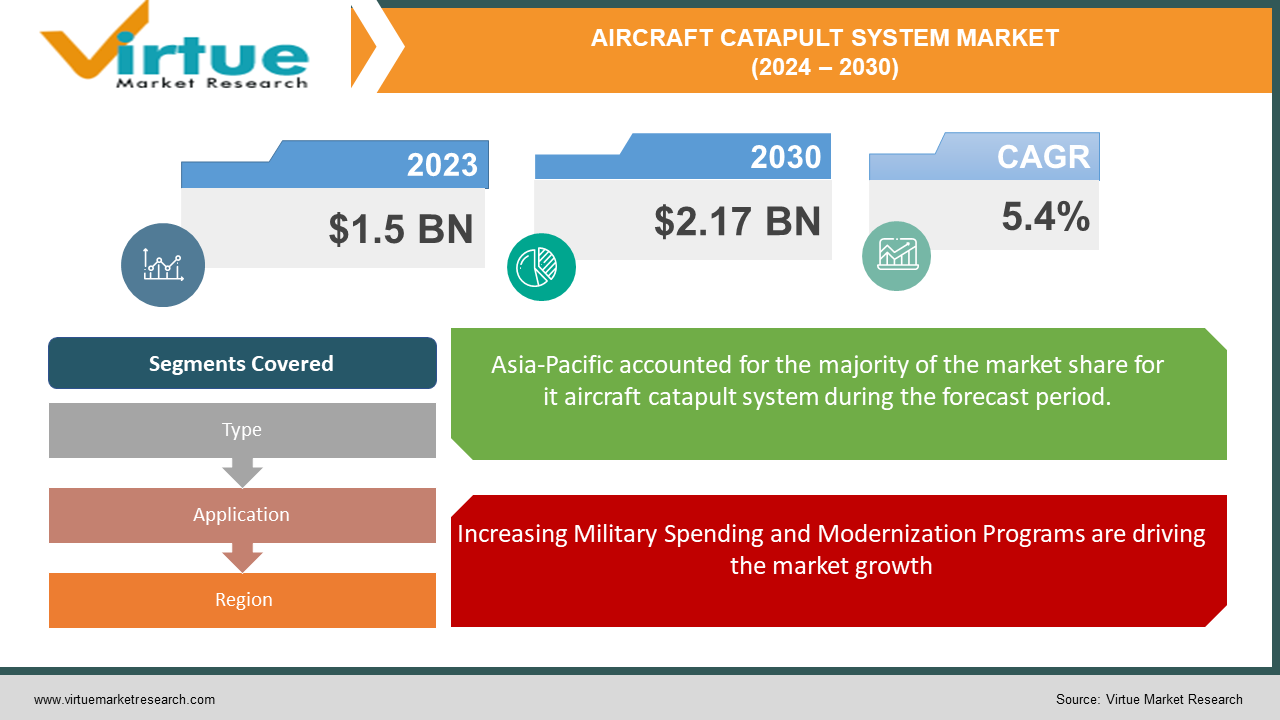

Aircraft Catapult System Market Size (2024 – 2030)

The Global Aircraft Catapult System Market was valued at USD 1.5 billion in 2023 and is projected to grow at a CAGR of 5.4% from 2024 to 2030. The market is expected to reach USD 2.17 billion by 2030.

Aircraft catapult systems are critical for launching aircraft from the deck of an aircraft carrier, and advancements in technology are enhancing their efficiency and effectiveness. The continuous innovation and development of new technologies and solutions to address the evolving needs of the defense sector are shaping the future of the aircraft catapult system market.

Key Market Insights:

Increasing military spending and modernization programs are driving the demand for advanced aircraft catapult systems.

Technological advancements, such as the development of electromagnetic catapult systems, are enhancing the efficiency and performance of aircraft launches.

Asia Pacific holds the largest market share due to substantial investments in defense and the presence of key market players.

Balancing the high development and installation costs with the need for advanced and reliable aircraft catapult systems remains a critical challenge for the market.

Global Aircraft Catapult System Market Drivers:

Increasing Military Spending and Modernization Programs are driving the market growth

The rising global military spending and the ongoing modernization programs of naval forces are significant drivers of the aircraft catapult system market. Countries are increasingly investing in advanced defense technologies to enhance their military capabilities and maintain a strategic edge. According to the Stockholm International Peace Research Institute (SIPRI), global military expenditure reached USD 2.1 trillion in 2022, reflecting a 4% increase compared to the previous year. This surge in defense spending is primarily driven by geopolitical tensions, regional conflicts, and the need to replace aging military equipment. Aircraft carriers play a crucial role in modern naval warfare, providing a strategic advantage by enabling the rapid deployment of air power. As a result, the demand for advanced aircraft catapult systems is on the rise, as they are essential for launching fixed-wing aircraft from the deck of aircraft carriers. Modernization programs, such as the procurement of next-generation aircraft carriers and the upgrading of existing ones, are further propelling the market growth. For instance, the U.S. Navy's Ford-class aircraft carriers are equipped with the Electromagnetic Aircraft Launch System (EMALS), a state-of-the-art catapult system that replaces the traditional steam catapults. The growing emphasis on enhancing naval aviation capabilities is expected to drive the adoption of advanced aircraft catapult systems in the coming years.

Technological Advancements in Aircraft Launch Systems is driving the market growth

Technological advancements in aircraft launch systems are significantly driving the growth of the aircraft catapult system market. The development of innovative technologies, such as electromagnetic catapult systems, is revolutionizing the way aircraft are launched from aircraft carriers. Electromagnetic Aircraft Launch System (EMALS) is a notable advancement in this field, offering several advantages over traditional steam catapults. EMALS utilizes electromagnetic technology to propel aircraft, providing smoother and more controlled launches. This technology enhances the launch efficiency, reduces wear and tear on the aircraft, and increases the operational flexibility of the aircraft carrier. Additionally, EMALS is more energy-efficient and requires less maintenance compared to steam catapults, making it a preferred choice for modern aircraft carriers. The adoption of advanced launch systems is not limited to new aircraft carriers; several navies are also upgrading their existing carriers with electromagnetic catapults to improve their operational capabilities. For example, the Indian Navy is considering the integration of EMALS in its future aircraft carriers to enhance their launch capabilities. The continuous research and development efforts by key market players to innovate and improve aircraft launch systems are expected to drive market growth. The advancements in launch technology are not only improving the performance of aircraft carriers but also contributing to the overall effectiveness of naval aviation operations.

Strategic Collaborations and Defense Contracts is driving the market growth

Strategic collaborations and defense contracts are playing a crucial role in driving the aircraft catapult system market. Governments and defense organizations are increasingly partnering with key market players to develop and deploy advanced aircraft launch systems. These collaborations are aimed at leveraging the expertise and technological capabilities of industry leaders to enhance the defense capabilities of naval forces. For instance, General Atomics, a leading player in the aircraft catapult system market, has been awarded multiple contracts by the U.S. Navy for the development and installation of the Electromagnetic Aircraft Launch System (EMALS) on Ford-class aircraft carriers. Such contracts not only provide significant revenue opportunities for market players but also reinforce their position in the market. Moreover, international collaborations are also contributing to market growth. Countries are partnering with foreign defense contractors to procure advanced aircraft catapult systems for their naval forces. For example, the Indian Navy's collaboration with the United States for the acquisition of EMALS technology is expected to bolster the market growth in the Asia-Pacific region. These strategic partnerships and defense contracts are driving the adoption of advanced aircraft catapult systems and expanding the market's reach. The continuous engagement of market players with government agencies and defense organizations is expected to create new growth opportunities and drive the market forward.

Global Aircraft Catapult System Market Challenges and Restraints:

High Development and Installation Costs are restricting the market growth

One of the significant challenges faced by the aircraft catapult system market is the high development and installation costs associated with advanced launch systems. The development of innovative technologies, such as electromagnetic catapult systems, requires substantial investments in research and development, advanced manufacturing processes, and testing. These costs are further compounded by the need for specialized infrastructure and facilities for installation and maintenance. For instance, the development and integration of the Electromagnetic Aircraft Launch System (EMALS) in the U.S. Navy's Ford-class aircraft carriers involved significant financial investments. The high costs associated with these advanced systems can be a barrier for countries with limited defense budgets, impacting the adoption of aircraft catapult systems. Additionally, the installation of these systems on existing aircraft carriers may require significant modifications and upgrades to the carrier's infrastructure, further adding to the overall costs. The high initial investment and ongoing maintenance costs can be a deterrent for some countries, limiting the market growth. To address this challenge, market players are focusing on developing cost-effective solutions and optimizing their manufacturing processes to reduce costs. The implementation of advanced technologies and materials that offer better performance and durability at lower costs is also being explored.

Technical Complexities and Reliability Issues are restricting the market growth

The technical complexities and reliability issues associated with advanced aircraft catapult systems pose significant challenges to the market. The development and operation of electromagnetic catapult systems, such as EMALS, involve intricate engineering and precise control mechanisms. Ensuring the reliable performance of these systems under various operational conditions is a critical requirement. Technical glitches and failures can lead to significant operational disruptions and safety concerns, impacting the effectiveness of naval aviation operations. For example, during the initial testing phase, the EMALS system experienced several technical issues, including software glitches and hardware malfunctions, which raised concerns about its reliability. The complexity of these systems also necessitates specialized training for personnel involved in their operation and maintenance. Ensuring that the crew is adequately trained to handle these advanced systems is crucial for their successful deployment and operation. Addressing these technical complexities and reliability issues requires continuous monitoring, testing, and improvements. Manufacturers are investing in research and development to enhance the reliability and performance of their systems. The integration of advanced diagnostic and monitoring tools to identify and rectify potential issues in real time is also being explored. Ensuring the technical robustness and reliability of aircraft catapult systems is essential for gaining the confidence of defense organizations and driving market adoption.

Market Opportunities:

The Aircraft Catapult System Market presents several significant opportunities for growth and innovation. One of the key opportunities lies in the increasing demand for unmanned aerial vehicles (UAVs) and unmanned combat aerial vehicles (UCAVs) in military operations. UAVs and UCAVs are becoming integral components of modern warfare, offering capabilities such as surveillance, reconnaissance, and precision strikes. The deployment of these unmanned systems from aircraft carriers requires efficient and reliable catapult launch systems. The development of specialized catapult systems designed for UAVs and UCAVs presents a significant growth opportunity for market players. Additionally, the expansion of naval forces and the increasing procurement of aircraft carriers by emerging economies offer lucrative opportunities for the aircraft catapult system market. Countries in the Asia-Pacific region, such as China and India, are investing heavily in the expansion and modernization of their naval fleets, including the acquisition of new aircraft carriers. The demand for advanced aircraft catapult systems to equip these carriers is expected to drive market growth. Furthermore, the adoption of hybrid and electric propulsion systems in naval vessels is creating new opportunities for the development of innovative aircraft launch systems. Hybrid and electric propulsion systems offer advantages such as reduced emissions, improved fuel efficiency, and lower operational costs. The integration of advanced catapult systems with these propulsion technologies can enhance the overall performance and sustainability of aircraft carriers. Market players are focusing on developing catapult systems that are compatible with hybrid and electric propulsion systems, offering enhanced operational efficiency and environmental benefits. The continuous innovation and development of new technologies and solutions to address the evolving needs of the defense sector present significant growth opportunities for the aircraft catapult system market. Overall, the market is poised for substantial growth, driven by the increasing demand for UAVs and UCAVs, the expansion of naval forces, and the adoption of advanced propulsion technologies.

AIRCRAFT CATAPULT SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.4% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

General Atomics, Northrop Grumman Corporation, The Boeing Company, Lockheed Martin Corporation, BAE Systems, Raytheon Technologies Corporation, Saab AB, Thales Group, Leonardo S.p.A., L3Harris Technologies |

Aircraft Catapult System Market Segmentation: by Type

-

Steam Catapult

-

Electromagnetic Catapult (EMALS)

-

Others

Steam catapults have dominated the market. They are a mature technology, well-understood and reliable. However, they are complex to operate and require significant maintenance. On the other hand, Electromagnetic Aircraft Launch Systems (EMALS) represent a more advanced approach. EMALS offer greater efficiency, can handle a wider range of aircraft weights, and require less maintenance.

Aircraft Catapult System Market Segmentation: by Application

-

Military

-

Commercial

The Military segment is the most dominant, driven by the significant investments in defense and the critical role of aircraft carriers in military operations. Aircraft carriers are considered vital assets for national defense, projecting power globally, and protecting vital sea lanes. The military's strategic dependence on aircraft carriers and dedicated defense spending solidify its position as the absolute leader in the aircraft catapult system market.

Aircraft Catapult System Market Segmentation: by Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region is anticipated to be the dominant market for aircraft catapult systems in the coming years. This is driven by several factors: the booming economies and rising military budgets of countries like China and India, leading to increased investment in naval modernization and aircraft carrier development. Additionally, established players like Japan and South Korea already possess aircraft carriers, and are likely to continue upgrading their capabilities

COVID-19 Impact Analysis on the Aircraft Catapult System Market:

The COVID-19 pandemic has had a mixed impact on the aircraft catapult system market. On one hand, the pandemic led to disruptions in the global supply chain, affecting the production and delivery of critical components required for the manufacturing of aircraft catapult systems. The restrictions on international trade and transportation caused delays in the procurement of raw materials and equipment, impacting the overall production timeline. Additionally, the pandemic resulted in the postponement of several defense projects and the reallocation of defense budgets to address immediate healthcare needs, affecting the funding for new aircraft catapult systems. On the other hand, the pandemic highlighted the importance of maintaining robust defense capabilities and ensuring national security, leading to continued investments in defense modernization programs. The need for operational readiness and the ability to respond to potential threats remained a priority for many countries, driving the demand for advanced military technologies, including aircraft catapult systems. Moreover, the pandemic accelerated the adoption of digital technologies and remote monitoring solutions in the defense sector, enabling manufacturers to enhance their production processes and ensure the timely delivery of critical systems. Overall, while the COVID-19 pandemic posed challenges to the aircraft catapult system market, the resilience of the defense sector and the continued focus on modernization and technological advancements have helped mitigate the impact and support market growth.

Latest Trends/Developments:

One of the latest trends in the aircraft catapult system market is the increasing focus on developing environmentally sustainable and energy-efficient launch systems. The traditional steam catapult systems, while effective, have a significant environmental footprint due to their high energy consumption and emissions. In contrast, the Electromagnetic Aircraft Launch System (EMALS) offers a more sustainable alternative with lower energy consumption and reduced emissions. The adoption of EMALS is part of a broader trend towards greener and more sustainable defense technologies. Another notable trend is the growing integration of advanced data analytics and artificial intelligence (AI) in aircraft catapult systems. These technologies are being used to enhance the performance, reliability, and operational efficiency of catapult systems. For instance, AI-driven predictive maintenance solutions are being implemented to monitor the health of catapult systems in real-time, identify potential issues, and optimize maintenance schedules, thereby reducing downtime and extending the lifespan of the systems. Additionally, the development of modular and scalable catapult systems is gaining traction. These systems are designed to be easily integrated into different types of aircraft carriers, offering flexibility and cost-effectiveness for naval forces. The modular design allows for the quick installation and replacement of components, ensuring operational readiness and reducing the overall lifecycle costs. Furthermore, the increasing demand for unmanned aerial vehicles (UAVs) and unmanned combat aerial vehicles (UCAVs) is driving the development of specialized catapult systems for these platforms. The integration of advanced launch technologies for UAVs and UCAVs is expected to expand the applications of aircraft catapult systems and drive market growth.

Key Players:

-

General Atomics

-

Northrop Grumman Corporation

-

The Boeing Company

-

Lockheed Martin Corporation

-

BAE Systems

-

Raytheon Technologies Corporation

-

Saab AB

-

Thales Group

-

Leonardo S.p.A.

-

L3Harris Technologies

Chapter 1. Aircraft Catapult System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aircraft Catapult System Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aircraft Catapult System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aircraft Catapult System Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aircraft Catapult System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aircraft Catapult System Market – By Type

6.1 Introduction/Key Findings

6.2 Steam Catapult

6.3 Electromagnetic Catapult (EMALS)

6.4 Others

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Aircraft Catapult System Market – By Application

7.1 Introduction/Key Findings

7.2 Military

7.3 Commercial

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Aircraft Catapult System Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Aircraft Catapult System Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 General Atomics

9.2 Northrop Grumman Corporation

9.3 The Boeing Company

9.4 Lockheed Martin Corporation

9.5 BAE Systems

9.6 Raytheon Technologies Corporation

9.7 Saab AB

9.8 Thales Group

9.9 Leonardo S.p.A.

9.10 L3Harris Technologies

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Aircraft Catapult System Market was valued at USD 1.5 billion in 2023 and is projected to reach USD 2.17 billion by 2030, growing at a CAGR of 5.4% from 2024 to 2030.

The market drivers include increasing military spending and modernization programs, technological advancements in aircraft launch systems, and strategic collaborations and defense contracts.

The market segments include type (Steam Catapult, Electromagnetic Catapult (EMALS), and Others) and application (Military and Commercial).

Asia Pacific is the most dominant region due to substantial investments in defense and the presence of key market players.

The leading players include General Atomics, Northrop Grumman Corporation, The Boeing Company, Lockheed Martin Corporation, BAE Systems, Raytheon Technologies Corporation, Saab AB, Thales Group, Leonardo S.p.A., and L3Harris Technologies