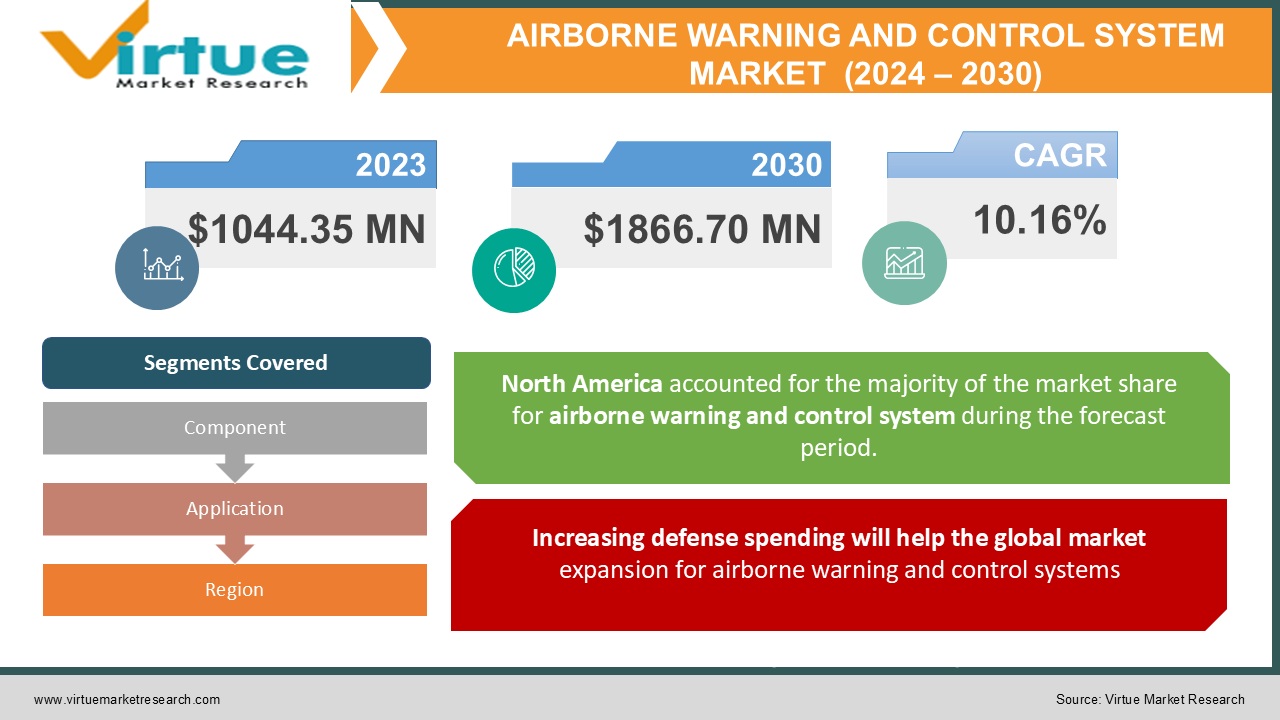

The Airborne Warning and Control System Market Size (2024 – 2030)

The Airborne Warning and Control System Market was valued at USD 1044.35 million in 2023 and is projected to reach USD 1866.70 million by 2030. The market is anticipated to expand at a CAGR of 10.16% over the forecast period.

INDUSTRY OVERVIEW

Airborne Warning & Control Set (AW&C) is a collection of equipment for locating and monitoring hostile or unmanned aerial vehicles (UAVs), as well as other enemies. Operators both aboard and on the ground are also able to recognize and evaluate the threat. The market for airborne warning and control systems is expanding as a result of the growing defense budget and increased research and development in defense technologies. For instance, SIPRI estimates that in 2020 US military spending increased to an estimated USD 778 billion, up 4.4% from 2019, and that China's military spending, the second-highest in the world, reached an estimated USD 252 billion. This implies a rise of 1.9% from 2019 and 76% over the years 2011 to 2020. Additionally, according to The Commonwealth Scientific and Industrial Research Organization, in December 2021, Boeing and CSIRO, Australia's national science agency, initiated a new five-year, USD 41 million research program with strategic priorities incorporating boosting aviation sustainability, digital twin and model-based engineering, space, and using technologies to increase factory safety and productivity. Additionally, with the increased emphasis on security issues, the adoption and demand for Airborne Warning and Control systems are projected to boost market growth throughout the course of the forecast year. However, throughout the projection period of 2022–2030, the market's growth is hindered by high research costs and supply chain disruption brought on by the COVID 19 pandemic.

COVID-19 IMPACT ON THE AIRBORNE WARNING AND CONTROL SYSTEM MARKET

The COVID-19 pandemic hindered the growth of the airborne warning and control system market because of the significant interruption in supply chain and production operations as well as the ban on international trade. Government-imposed social restrictions meant to prevent the spread of SARS-CoV-2 severely interrupted supply chain operations and decreased production of a range of products and services. The pandemic's effects on the aviation sector's development in 2020 were further limited by a lack of innovations, component production, and aircraft acquisition. The lockdowns had a direct effect on the market for airborne warning and control systems by affecting the production of helicopters, commercial and military aircraft, and both. Additionally, throughout the pandemic and post-pandemic recovery phases, businesses in the aerospace & military sector had to make difficult choices about their supply chains. In important areas of aircraft manufacture, the pandemic temporarily halted operations. As a result, several significant technologies and component suppliers switched their attention to lowering costs and scaling back production. In 2020, these elements had a detrimental effect on the market participants for airborne fading systems. Major military sector companies saw a disturbance in the supply chain at the start of the COVID-19 outbreak as a result of the closure of manufacturing sites and limitations on international transportation. For instance, BAE Systems encountered delays in both industry-wide procurement and government calls for bids. However, several defense projects progressively became available as a result of the government’s urgent need to secure a powerful defense force. For instance, from the start of the epidemic and January 31, 2021, the US government invested $4.6 billion in the defense-industrial base. In addition, despite the rise in geopolitical tensions and the enhanced air defense assistance provided by airborne warning and control systems, the defense budgets of major countries were unaffected in 2021. Because of the interruptions in the worldwide supply chain caused by the COVID-19 pandemic, the industry initially suffered, but in 2021 the market is beginning to recover as a result of governments' eagerness to fund crucial defense programs.

MARKET DRIVERS:

Increasing defense spending will help the global market expansion for airborne warning and control systems

The worldwide market for airborne warning and control systems has been driven by the rapid advancement of military technologies and the adoption of better security measures by both emerging and developed nations. The airborne warning and control systems are challenging to follow because of their increased movement, especially at higher altitudes. This industry has been under focus because of the growing necessity to monitor adversary activity to be prepared, particularly for nations involved in the conflict. Market expansion has recently been aided by rising defense spending and investments in the creation of advanced technology.

Successful Integration of IoT, Artificial Intelligence (AI), and Machine Learning is a Vital Industry Trend that is promoting the market growth

Drones are an emerging trend in business that is attracting interest from a variety of industries for surveillance purposes. Technology upgrades to cameras, microcontrollers, sensors, CPUs, etc. have improved the drone product line. In-built measuring and annotation tools that can compute volume, area, and distance are being developed by the firms. The UAVs can store and analyze a significant quantity of data thanks to machine learning, IoT, and AI. Therefore, the integration of modern technology such as Artificial Intelligence and Machine Learning is paving way for market growth

Growing Use of Unmanned Aerial Systems (UAS) for Military Purposes Will Promote Growth

Traditionally, rotary- and fixed-wing aircraft have been used for aerial surveillance. These procedures cost money and take a lot of time. In comparison to conventional aircraft, drones operate more quickly and at a lower cost. As a consequence of their affordability and effective outcomes, drone purchases for surveillance purposes have increased. Additionally, the cost of producing drones has fallen due to the manufacturing sector's increased industrialization and automation. As a result, drones are widely available and inexpensive, which is anticipated to accelerate market expansion. With the use of their intelligence, surveillance, and reconnaissance (ISR) capabilities, military drones collect data regarding combat missions in real-time. The expansion of the airborne warning and control system market is anticipated to be fueled by an increase in the purchase of UAVs to improve defense capabilities. Additionally, the market expansion is anticipated to be boosted by the rising defense budget due to the increased demand for improved intelligence collection and analysis capabilities.

MARKET RESTRAINTS:

Deploying an airborne warning and control system is expensive, which will restrain the growth

There are sensors, radars, cameras, and other parts that make up the aerial warning and control system. Accurate data can be provided by sophisticated sensors. But because of their intricate design, sensors are expensive to build. The design is complex since the components are subjected to harsh weather conditions, which drives up the cost. Due to its exceptional investigative capabilities, the light detection and ranging (LiDAR) sensor is frequently used. The sensors, however, have a significant development cost. impedes market expansion as a result.

AIRBORNE WARNING AND CONTROL SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

10.16% |

|

Segments Covered |

By Component, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BOEING, DELCO, TELEDYNE RYAN, ROCKWELL-COLLINS , RF PRODUCTS , E-SYSTEMS, SINGER-KEARFOTT , IBM, (CC-2 COMPUTER), NORTHROP, HAZELTINE/SIEMENS AG , AIL DIV., EATON CORP, Others |

This research report on the Airborne Warning and Control System Market has been segmented and sub-segmented based on Component, Application and By Region.

AIRBORNE WARNING AND CONTROL SYSTEM MARKET – BY COMPONENT

- RADAR

- Command and Control System

- Communication Support System

Based on the component, the airborne warning and control system market is segmented into RADAR, Command and Control System, Communication Support System and others. Among these, the RADAR system is likely to capture a significant portion of the market share. The market growth can be attributed to the reason that radar systems are increasingly being used for surveillance in security, defense, and military applications, which Is fueling the market expansion.

AIRBORNE WARNING AND CONTROL SYSTEM MARKET - BY APPLICATION

- Surveillance

- Communications

- Battle Management

- Others

Based on the application, the airborne warning and control system market is segmented into Surveillance, Communications, Battle Management and Others. Among these, the Surveillance category dominated the market. Monitoring activities and behavior in the immediate area are done via airborne surveillance. Airborne early warning and control (AEW&C) aircraft, helicopters, and unmanned aerial vehicles (UAVs) are used to conduct the investigation. The market is expanding quickly as a result of the development of aerial surveillance tools including Forward-Looking Infrared (FLIR), high-resolution imaging, and Micro Aerial Vehicles (MAVs) that can recognize things at a great distance. The U.S., China, India, and other nations, among others, have an expanding demand for border security and safety, which is why the surveillance category is so dominant. The military and government sector are making use of these systems in search and rescue, law enforcement, border surveillance, and ISR & targeting. Governments of numerous nations are being prompted to improve the surveillance capabilities of military defense and security due to rising transnational conflicts and geopolitical tensions which are further fueling the market demand.

AIRBORNE WARNING AND CONTROL SYSTEM MARKET - BY REGION

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East

- Africa

By region, the Airborne Warning and Control System Market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. In 2021, the North American market was the prominent region contributing significantly to market growth. Due to the presence of significant companies like Lockheed Martin Corporation, Northrop Grumman Corporation, L3 Harris Technologies Inc., and others in the area, North America is predicted to occupy a larger proportion of the worldwide market. The United States has a sizable defense budget, which is driving up demand from the defense industry for aerial warning and control equipment. The market for airborne warning and control systems is predicted to develop at the quickest rate in the Asia Pacific. The development is a result of people being more aware of the advantages that UAVs may provide. Additionally, it is anticipated that the market in the area would be driven by the rising need for aerial investigation from the military and defense sectors of nations like China and India. Due to increased investment in UAV LiDAR technology by European nations like France and Germany, Europe is predicted to experience tremendous growth. The market share of airborne warning and control systems in the Europe area is anticipated to increase gradually throughout the forecast period. Similarly, due to the growing need for aerial investigation systems brought on by the expanding infrastructure, South America, the Middle East, and Africa are also likely to see significant market growth.

AIRBORNE WARNING AND CONTROL SYSTEM MARKET - BY COMPANIES

Some of the major players operating in the Airborne Warning and Control System Market include:

- BOEING, DELCO

- TELEDYNE RYAN

- ROCKWELL-COLLINS

- RF PRODUCTS

- E-SYSTEMS

- SINGER-KEARFOTT

- IBM (CC-2 COMPUTER)

- NORTHROP

- HAZELTINE/SIEMENS AG

- AIL DIV.

- EATON CORP

- Others

NOTABLE HAPPENING IN THE AIRBORNE WARNING AND CONTROL SYSTEM MARKET

- PRODUCT LAUNCH- In March 2021, TerraSense Analytics received a contract of USD 977,439 from the Department of National Defence's Innovation for Defence Excellence and Security (IDEaS) program for the creation of the Multimodal Input Surveillance & Tracking (MIST) sophisticated airborne surveillance system.

- PRODUCT LAUNCH- In March 2021, the sensor manufacturer HENSOLDT announced that their brand-new PrecISR airborne multi-mission surveillance radar has passed the Factory Acceptance Test.

- PRODUCT LAUNCH- Saab Ab was given a five-year extension on a contract for USD 1.018 billion in January 2021 to provide the United Arab Emirates with two GlobalEye systems.

- PRODUCT LAUNCH- In July 2020, Skydio Inc. released the Skydio X2, a drone with AI capabilities that is capable of situational awareness, security patrol, and asset assessment.

Chapter 1.AIRBORNE WARNING AND CONTROL SYSTEM MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.AIRBORNE WARNING AND CONTROL SYSTEM MARKET – Executive Summary

2.1. Market Size & Forecast – (2022 – 2026) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2022 - 2026

2.3.2. Impact on Supply – Demand

Chapter 3.AIRBORNE WARNING AND CONTROL SYSTEM MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.AIRBORNE WARNING AND CONTROL SYSTEM MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. AIRBORNE WARNING AND CONTROL SYSTEM MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.AIRBORNE WARNING AND CONTROL SYSTEM MARKET – By Component

6.1. RADAR

6.2. Command and Control System

6.3. Communication Support System

Chapter 7.AIRBORNE WARNING AND CONTROL SYSTEM MARKET – By Application

7.1. Surveillance

7.2. Communications

7.3. Battle Management

7.4. Others

Chapter 8.AIRBORNE WARNING AND CONTROL SYSTEM MARKET – By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9.AIRBORNE WARNING AND CONTROL SYSTEM MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1.BOEING, DELCO

9.2. TELEDYNE RYAN

9.3. ROCKWELL-COLLINS

9.4. RF PRODUCTS

9.5. E-SYSTEMS

9.6. SINGER-KEARFOTT

9.7. IBM (CC-2 COMPUTER)

9.8. NORTHROP

9.9. HAZELTINE/SIEMENS AG

9.10. AIL DIV.

9.11. EATON CORP

9.12. Others

Download Sample

Choose License Type

2500

4250

5250

6900