Air Electrode Battery Market Size (2024 – 2030)

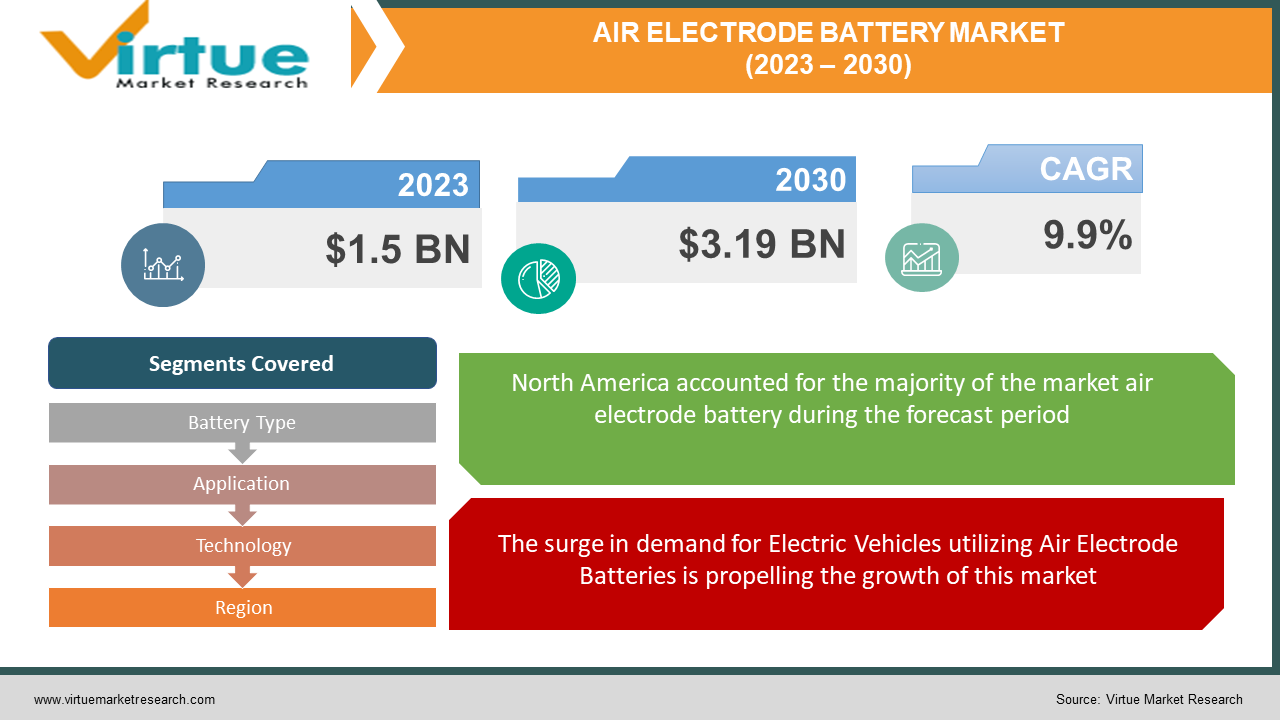

The Global Air Electrode Battery Market was valued at USD 1.5 Billion and is projected to reach a market size of USD 3.19 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.9%.

Market Overview:

The Air Electrode Battery sector has experienced notable growth recently, driven by the escalating demand for sustainable energy storage options and the increasing emphasis on renewable energy sources. These batteries employ air as a cathode, offering a lightweight, eco-friendly, and cost-effective alternative for storing energy. Their applications span across various industries, including electric vehicles, grid energy storage, and portable electronics, owing to their high energy density and extended cycle life. The market expansion is further propelled by technological advancements and ongoing research in materials and design. Additionally, the drive for cleaner energy options and governmental support for electric vehicle adoption are anticipated to sustain this growth trajectory in the foreseeable future.

Key Market Insights:

Conventional lithium-ion batteries typically provide a range of around 100 miles on a single charge, rendering them costly for electric vehicle production. Consequently, emerging lithium-air batteries have garnered attention in the automotive industry due to their superior qualities offered at a reduced cost. In January 2022, Japanese scientists from Japan's National Institute of Materials (NIMS) and Softbank Corporation introduced a lithium-air battery boasting an impressive energy density exceeding 500 Wh/kg, a substantial leap compared to existing lithium-ion batteries.

MIT's research underscores that lithium-air and zinc-air batteries stand out as the most viable alternatives for the next generation of secondary batteries for electric vehicles.

Air Electrode Battery Market Drivers:

The surge in demand for Electric Vehicles utilizing Air Electrode Batteries is propelling the growth of this market.

The increasing global inclination toward electric vehicles, recognized as a more environmentally friendly mode of transport, acts as a substantial driver for the Air Electrode Battery market. These batteries emerge as a promising solution for EVs owing to their superior energy density, extended cycle life, and lighter weight compared to traditional lithium-ion batteries. As governments and consumers prioritize carbon emission reduction, the adoption of EVs continues to escalate, fostering a significant market for air electrode batteries within the automotive sector.

The escalating integration of renewable energy sources, such as wind and solar power, into the grid amplifies the need for Air Electrode Batteries.

As the grid incorporates more renewables, energy storage solutions become crucial for ensuring a stable and dependable power supply. Air electrode batteries prove instrumental in storing excess energy generated from renewables and releasing it as needed, facilitating grid balance and supporting the shift toward cleaner energy sources. This demand for grid energy storage, driven by environmental concerns and regulatory backing for renewable energy, stands as another substantial driver for the Air Electrode Battery market.

Air Electrode Battery Market Restraints and Challenges:

The energy density and performance of Air Electrode Batteries could impede market demand and growth.

Notably, challenges relating to energy density and overall performance are encountered by air electrode batteries, such as metal-air batteries. These batteries typically exhibit lower energy densities than conventional lithium-ion batteries, limiting their efficiency in energy storage and delivery. Enhancing the energy density and performance of air electrode batteries remains pivotal to position them as competitive and viable solutions across various applications, especially in electric vehicles where energy storage capacity holds significant importance.

Ensuring the durability and lifespan of air electrode batteries is critical to avoid hindrances to market growth.

The durability and lifespan of air electrode batteries pose another challenge. During battery operation, the air cathode remains exposed to oxygen and moisture, leading to potential corrosion and electrode degradation over time. This degradation can result in reduced battery lifespan and performance, emphasizing the need to develop materials and designs capable of withstanding environmental factors and maintaining consistent performance across numerous charge-discharge cycles. Addressing this challenge becomes imperative for enhancing the reliability and cost-effectiveness of air electrode batteries, particularly in applications where longevity is a critical factor, such as grid energy storage.

Air Electrode Battery Market Opportunities:

The Air Electrode Battery market presents promising opportunities, including the potential to revolutionize energy storage and meet the ever-growing demand for sustainable solutions. These batteries offer eco-friendly and lightweight energy storage options, making them well-suited for electric vehicles, portable electronics, and renewable energy integration. Ongoing research and development offer prospects for breakthroughs in energy density enhancement, cost reduction, and lifespan improvement, paving the way for broader adoption and integration across various industries. The heightened focus on clean energy and the global drive for decarbonization provide fertile ground for the growth of the Air Electrode Battery market.

AIR ELECTRODE BATTERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.9% |

|

Segments Covered |

By Battery Type, Application, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Phinergy, NantEnergy, Log 9 Materials, PPG Industries, Energizer Holdings, Inc., Daimler AG, PATHION, PolyJoule AB, Arotech Corporation, Sion Power |

Air Electrode Battery Market: By Battery Type

-

Zinc-Air Batteries

-

Lithium-Air Batteries

-

Aluminum-Air Batteries

-

Other Metal-Air Batteries

The Lithium-Air Battery segment emerges as the largest in market share, constituting over 76%. This dominance primarily roots in the well-established prevalence of lithium-ion battery technology across various applications, notably in electric vehicles and portable electronics. Leveraging the extensive research and development investments within the broader lithium battery industry, Lithium-Air batteries stand to offer higher energy density and prolonged power storage. These attributes make them an appealing choice, catering to the escalating demand for more efficient energy solutions in today's landscape heavily reliant on mobile devices and electric vehicles. Forecasts indicate the Lithium-Air Batteries category as the fastest-growing segment, expected to grow by 23.2%. This growth is propelled by the robust demand for energy-dense and lightweight battery solutions, specifically in electric vehicles and portable electronics. The potential of Lithium-air batteries to notably enhance energy density positions them as an attractive option for electric vehicles requiring extended driving ranges. Consequently, the pursuit of greener and more efficient energy storage drives significant research and development efforts in this segment, aimed at augmenting the performance and practicality of lithium-air batteries across multiple industries.

Air Electrode Battery Market: By Application

-

Electric Vehicles

-

Grid Energy Storage

-

Portable Electronics

-

Medical Devices

-

Military and Defense

-

Aerospace

-

Others

Within the application segment, Grid Energy Storage commands the largest market share at 56%. This prevalence is attributed to the necessity for long-duration energy storage solutions in grid energy storage systems. These systems play a pivotal role in balancing the intermittency of renewable energy sources like wind and solar power. Air electrode batteries, with their ability to sustain extended discharge periods, aptly fit this requirement, enabling grid operators to store surplus energy and release it during high-demand periods. Their cost-effectiveness and eco-friendly characteristics further bolster their preference in grid energy storage solutions. Electric Vehicles emerge as the fastest-growing segment at a rate of 25.8%, propelled by the global shift toward sustainable transportation and the increasing demand for electric cars. The advantages offered by air electrode batteries, including potential for long-range capabilities and reduced charging time, make them an appealing choice. Their safety features, environmental sustainability, and cost-effectiveness contribute to their rapid growth in the electric vehicle sector.

Air Electrode Battery Market: By Technology

-

Liquid Electrolyte Air Electrode Batteries

-

Solid-State Air Electrode Batteries

The Liquid Electrolyte Air Electrode Batteries segment commands a substantial revenue share of 86%, primarily owing to the mature status of this technology and its relatively lower production costs. These batteries have undergone extensive development and are commercially available, making them a preferred choice across various applications. Conversely, while Solid-State Air Electrode Batteries offer advantages in safety and energy density, they remain in early developmental stages. Scaling up production and cost reduction are pivotal challenges limiting their market share. However, Solid-State Air Electrode Batteries are projected to be the fastest-growing segment in the market, expected to grow by 21.9%. Their superior safety features, higher energy density, and extended cycle life make them a favored choice, especially with the increasing emphasis on energy storage solutions in electric vehicles, portable electronics, and renewable energy applications.

Air Electrode Battery Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America holds the largest share in the Air Electrode Battery market, accounting for approximately 36% of the market. This dominance is primarily attributed to the United States' forefront position in adopting electric vehicles and integrating renewable energy. Government incentives, stringent environmental regulations, and a growing preference for sustainable energy solutions have fueled the demand for air electrode batteries in this region. Additionally, the presence of key industry players, substantial research and development initiatives, and a robust manufacturing infrastructure contribute to North America's leadership. Asia-Pacific emerges as the fastest-growing region, projected to grow at a CAGR of 26.8%. Factors driving this growth include the escalating adoption of electric vehicles and renewable energy projects, especially in countries like China and India. Government policies favoring clean energy and electric mobility have accelerated the demand for air electrode batteries. The burgeoning consumer electronics industry further fuels the market's expansion in Asia-Pacific.

COVID-19 Impact Analysis on the Global Air Electrode Battery Market:

The COVID-19 pandemic presented a mixed impact on the Global Air Electrode Battery Market. While initial disruptions were witnessed in the supply chain and manufacturing due to lockdowns and restrictions, the market rebounded as the pandemic accelerated the transition to cleaner energy sources and electric vehicles. The increased demand for renewable energy and sustainable storage solutions, coupled with investments from governments and industries in green technologies, served as growth stimuli. The pandemic underscored the significance of energy resilience and reliable storage solutions, highlighting the potential for air electrode batteries in the post-pandemic recovery and addressing long-term environmental concerns.

Latest Trends/Developments:

An emerging trend in the Air Electrode Battery market is the heightened focus on solid-state air electrode batteries. These batteries promise enhanced safety, energy density, and longer lifespans compared to their liquid electrolyte counterparts. Researchers and manufacturers are actively exploring and advancing solid-state air electrode batteries for varied applications, including electric vehicles and grid energy storage.

Another significant development in the Air Electrode Battery market involves the integration of advanced materials and nanotechnology. Researchers are employing nanomaterials in air electrodes to enhance performance and efficiency. Continuous efforts in designing and incorporating nanostructured materials aim to improve energy density, charge-discharge rates, and overall durability of air electrode batteries. These advancements have the potential to elevate the competitiveness of air electrode batteries in the energy storage sector.

Key Players:

-

Phinergy

-

NantEnergy

-

Log 9 Materials

-

PPG Industries

-

Energizer Holdings, Inc.

-

Daimler AG

-

PATHION

-

PolyJoule AB

-

Arotech Corporation

-

Sion Power

Chapter 1. Air Electrode Battery Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Air Electrode Battery Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Air Electrode Battery Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Air Electrode Battery Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Air Electrode Battery Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Air Electrode Battery Market – By Battery Type

6.1 Introduction/Key Findings

6.2 Zinc-Air Batteries

6.3 Lithium-Air Batteries

6.4 Aluminum-Air Batteries

6.5 Other Metal-Air Batteries

6.6 Y-O-Y Growth trend Analysis By Battery Type

6.7 Absolute $ Opportunity Analysis By Battery Type, 2024-2030

Chapter 7. Air Electrode Battery Market – By Application

7.1 Introduction/Key Findings

7.2 Electric Vehicles

7.3 Grid Energy Storage

7.4 Portable Electronics

7.5 Medical Devices

7.6 Military and Defense

7.7 Aerospace

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Air Electrode Battery Market – By Technology

8.1 Introduction/Key Findings

8.2 Liquid Electrolyte Air Electrode Batteries

8.3 Solid-State Air Electrode Batteries

8.4 Y-O-Y Growth trend Analysis By Technology

8.5 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 9. Air Electrode Battery Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Technology

9.1.4 By Battery Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Technology

9.2.4 By Battery Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Technology

9.3.4 By Battery Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Technology

9.4.4 By Battery Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Technology

9.5.4 By Battery Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Air Electrode Battery Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Phinergy

10.2 NantEnergy

10.3 Log 9 Materials

10.4 PPG Industries

10.5 Energizer Holdings, Inc.

10.6 Daimler AG

10.7 PATHION

10.8 PolyJoule AB

10.9 Arotech Corporation

10.10 Sion Power

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Air Electrode Battery Market was valued at USD 1.64 Billion in 2023 and is projected to reach a market size of USD 3.19 Billion by the end of 2030 growing at a CAGR of 9.9%.

Rising Demand for Electric Vehicles and Growing Renewable Energy Integration are drivers of the Air Electrode Battery market.

Based on technology, the Air Electrode Battery Market is segmented into Liquid Electrolyte Air Electrode Batteries and Solid-State Air Electrode Batteries.

North America is the most dominant region for the Global Air Electrode Battery Market.

Phinergy, NantEnergy, Log 9 Materials and PPG Industries are a few of the key players operating in the Global Air Electrode Battery Market.