Air-dried Food Market Size (2025 – 2030)

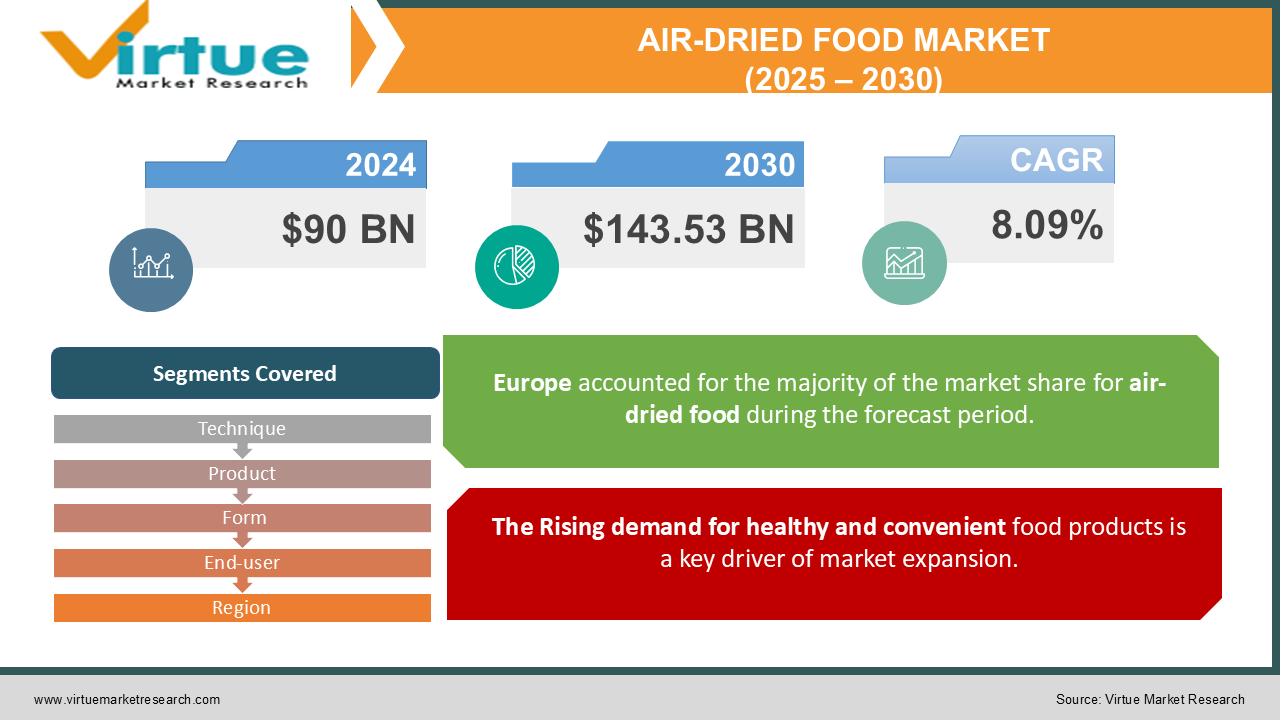

The Air-dried Food Market was valued at USD 90 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 143.53 billion by 2030, growing at a CAGR of 8.09%.

Air-dried food is preserved through the process of removing moisture by exposing it to hot air. Unlike freeze-drying or oven-drying, this method relies on the evaporation of water to preserve the food. The food is subjected to warm air, which gradually evaporates the water molecules, reducing the moisture content to below 0.6%. This helps prevent the growth of bacteria, yeasts, and molds, resulting in a shelf-stable, lightweight, and nutrient-rich product that can be stored without the need for refrigeration or preservatives.

Compared to other drying methods, air-dried foods maintain more of their flavor, texture, and nutritional value, as the gentle evaporation process helps preserve vitamins, minerals, and other essential compounds. Such products are especially favored by health-conscious consumers seeking nutritious and convenient snack options. Additionally, pet food manufacturers utilize air-drying techniques for their products. Air-dried pet food, free from fillers and preservatives, offers high-quality, protein-focused nutrition for dogs and cats.

Air-drying also slows down the activity of enzymes responsible for food ripening, allowing for year-round preservation. As lifestyles continue to evolve, there is a growing demand for healthy, ready-to-cook, and ready-to-eat foods. Market participants are focusing on innovation and new product launches to fuel the growth of air-dried food offerings.

Key Market Insights:

-

Over 67% of consumers prefer air-dried snacks over freeze-dried alternatives due to better texture retention.

-

Approximately 45% of air-dried food products in 2023 were used in ready-to-eat meals.

-

The market saw a 12% increase in demand for air-dried fruits compared to the previous year.

-

Air-dried vegetable sales accounted for 34% of total market revenue in 2023.

-

Nearly 20% of the market's revenue came from the pet food industry.

-

The commercial use of air-dried spices grew by 18% in 2023.

-

Organic air-dried food products constituted 28% of market offerings in 2023.

-

Lightweight packaging for air-dried foods contributed to a 14% rise in exports in 2023.

-

72% of surveyed consumers in 2023 associated air-dried foods with clean-label products.

Air-dried Food Market Drivers:

The Rising demand for healthy and convenient food products is a key driver of market expansion.

The growing health awareness among consumers is a major factor driving the air-dried food market. Air-drying helps preserve vital nutrients without the need for preservatives, aligning with the clean label trend. A survey conducted by the International Food Information Council (IFIC) revealed that 63% of consumers prioritize healthfulness in their food choices.

Air-dried foods, with their long shelf life and ease of storage, cater to the convenience sought by busy urban dwellers and professionals. As the demand for nutritious, ready-to-eat snacks and meal options rises, more individuals are looking for balanced diets that do not compromise on convenience. The shift towards healthier lifestyles, along with the increasing number of dual-income households, is further fueling the market. These trends highlight a strong preference for air-dried foods, offering a practical alternative to both fresh and processed options, while preserving nutritional value and convenience.

Air-dried Food Market Restraints and Challenges:

High production costs and limited consumer awareness restrain the growth of the air-dried food market.

High production costs and limited consumer awareness are key challenges in the air-dried food market. The advanced technologies required for air drying, such as vacuum and microwave-assisted drying, involve significant investment, leading to higher production costs compared to traditional drying methods. These costs are often passed on to consumers, making air-dried products less competitive, particularly in price-sensitive markets.

Additionally, many consumers are not fully aware of the advantages of air-dried foods compared to freeze-dried or dehydrated alternatives, which hinders market growth. The lack of widespread understanding regarding the nutritional and preservative benefits of air drying limits consumer adoption. To overcome these challenges, educational efforts and strategies to reduce production costs are essential. As production technologies evolve and economies of scale improve, lowering costs and enhancing consumer awareness will be crucial for expanding market reach and increasing the acceptance of air-dried food products.

Air-dried Food Market Opportunities:

Technological advancements create opportunities in the air drying market.

Technological advancements in air-drying methods present substantial growth opportunities for the global air-dried food market. Innovations such as vacuum drying, microwave-assisted air drying, and hybrid drying techniques are improving product quality by more effectively preserving nutrients, color, and flavor compared to traditional methods. These advancements also lead to reduced energy consumption and processing time, generating cost savings for manufacturers. The adoption of these state-of-the-art technologies is attracting investments from leading food companies eager to provide premium air-dried products to health-conscious consumers.

A study published in the Journal of Food Engineering found that microwave-assisted air drying can reduce drying time by up to 50%, enhancing both the efficiency and environmental sustainability of the process. As these technologies become more affordable and accessible, they are expected to drive market expansion by broadening the variety of air-dried products available, including fruits, vegetables, meats, and ready-to-eat meals, thus meeting the growing demand for convenient and nutritious food choices.

AIR-DRIED FOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.09% |

|

Segments Covered |

By Technique, Product, Form, End-user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nestlé S.A., Ajinomoto Co., Inc., Unilever Group, Asahi Group Holdings, Ltd. , Dehydrates Inc., Freeze-Dry Foods GmbH , Nissin Foods Holdings Co., Ltd. , Harmony House Foods, Inc., Ting Hsin International Group Honeyville, Inc. |

Air-dried Food Market Segmentation: By Technique

-

Freeze-dried Food

-

Hot Air-dried Food

Freeze-dried food leads the segment due to its effective preservation capabilities. Freeze-drying involves freezing the food and then placing it in a vacuum environment to remove ice through sublimation, thereby maintaining the food's structure and nutrients. This process results in a lightweight, shelf-stable product with minimal nutrient loss, making it ideal for preserving a wide range of foods, including fruits, vegetables, and meats. Freeze-dried foods are particularly favored by health-conscious consumers and outdoor enthusiasts because of their long shelf life, portability, and ability to retain flavor and nutritional content. The dominance of this segment can be attributed to the superior preservation qualities, convenience, and versatility of freeze-drying, which make it an attractive method for producing high-quality, nutritious, and long-lasting food products.

Air-dried Food Market Segmentation: By Product

-

Herbs & Spices

-

Meat & Seafood

-

Fruits & Vegetables

Fruits and vegetables hold a dominant position in the product segment of the air-dried food market. Air-dried tomatoes, bell peppers, and carrots are also widely used to enhance the flavor and nutritional value of soups, stews, and salads. The increasing adoption of plant-based diets, the health advantages of fruits and vegetables, and the convenience of air-dried products further strengthen the dominance of fruits and vegetables in this market. As consumers continue to prioritize health, convenience, and sustainability in their food choices, the demand for air-dried fruits and vegetables is expected to grow, further solidifying their leading position in the market.

Air-dried Food Market Segmentation: By Form

-

Flakes

-

Granules

-

Powder

Granules lead the form segment in the air-dried food market due to their versatility and convenience in a wide range of culinary applications. The granules offer an ideal balance of texture and ease of use, making them perfect for both cooking and snacking. Their small, uniform size ensures that air-dried foods are easy to rehydrate and incorporate into various dishes. Granules are particularly popular among consumers seeking nutritious and easy-to-prepare meals, as they are well-suited for use in soups, stews, salads, and snacks. The dominance of granules in the air-dried food market is attributed to their practicality, adaptability, and ability to meet the growing demand for convenient, healthy, and flavorful food options among modern consumers.

Air-dried Food Market Segmentation: By End-user

-

HoReCa Sector

-

Household

-

Processed Food Industry

The Household segment dominates the end-user category in the air-dried food market. Individual consumers purchase air-dried foods for home use, driven by several key factors that have positioned this segment as the market leader. Air-dried foods are favored among households due to the growing demand for convenient, nutritious snacks. Consumers increasingly seek foods that are easy to store, have a long shelf life, taste good, and offer health benefits.

Rising health awareness among consumers has further boosted the demand for air-dried foods in households. These products are perceived as healthier alternatives to snacks laden with preservatives, aligning with the increasing consumer focus on food ingredients and processing methods. Additionally, the growing trend of outdoor activities and travel has contributed to the dominance of the household segment, as air-dried foods provide a convenient, nutritious option for on-the-go consumption. They are becoming increasingly popular as snacks for camping, outdoor adventures, and emergency food supplies.

Air-dried Food Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

Europe holds the largest share of the global air-dried food market and is expected to experience significant growth throughout the forecast period. Europe's strict food safety regulations and a growing preference for clean-label products further encourage the adoption of air-dried options. For example, European Union regulations on food additives and preservatives promote consumer choice for products with fewer artificial ingredients, making air-dried foods an attractive alternative. In Germany, the demand for air-dried fruits and vegetables is particularly strong, especially within the snack segment. According to a report by the German Federal Ministry of Food and Agriculture, around 43% of German consumers purchase organic food products, with air-dried items gaining popularity due to their natural preservation techniques. France also shows a strong market for air-dried foods, driven by its rich culinary culture and a focus on quality ingredients. French consumers appreciate the flavor and nutritional benefits of air-dried foods, often incorporating them into gourmet recipes and enjoying them as healthy snacks. Additionally, the growing popularity of vegan and vegetarian diets in France is contributing to increased demand for plant-based air-dried products, such as vegetables and legumes.

The Asia-Pacific region is poised for significant growth in the air-dried food market, driven by factors such as rapid urbanization, increasing disposable incomes, and evolving dietary preferences. As the middle class in many countries grows, there is a rising demand for healthier and more convenient food options. The region's flourishing e-commerce sector further supports market expansion, making air-dried foods more accessible to consumers.

COVID-19 Pandemic: Impact Analysis

Government restrictions and guidelines imposed in response to the COVID-19 pandemic have the potential to disrupt supply chains, significantly hindering the growth of the air-dried food market. These disruptions can slow production and distribution processes, affecting the availability and delivery of air-dried food products, ultimately limiting market expansion during this period.

Latest Trends/ Developments:

May 2022: Saraf Foods Pvt. Ltd., a licensed company, specializes in producing freeze-dried, air-dried, and IQF (Individually Quick Frozen) fruits & vegetables, sprouts, poultry, spices & herbs, and lentils. The company has built a strong reputation globally by consistently supplying high-quality ingredients.

March 2024: Ziwi, a leading manufacturer of premium pet food, is making waves in the ultra-premium market with the launch of a new product line featuring functional ingredients, ethically sourced raw animal proteins, and cutting-edge proprietary technology. The ZiwiPeak Steam & Dried line offers a range of formulations and sizes for both dogs and cats, setting a new standard in the pet food industry.

Key Players:

These are top 10 players in the Air-dried Food Market :-

-

Nestlé S.A.

-

Ajinomoto Co., Inc.

-

Unilever Group

-

Asahi Group Holdings, Ltd.

-

Dehydrates Inc.

-

Freeze-Dry Foods GmbH

-

Nissin Foods Holdings Co., Ltd.

-

Harmony House Foods, Inc.

-

Ting Hsin International Group

-

Honeyville, Inc.

Chapter 1. Air-dried Food Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Air-dried Food Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Air-dried Food Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Air-dried Food Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Air-dried Food Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Air-dried Food Market – BY TECHNIQUE

6.1 Introduction/Key Findings

6.2 Freeze-dried Food

6.3 Hot Air-dried Food

6.4 Y-O-Y Growth trend Analysis BY TECHNIQUE

6.5 Absolute $ Opportunity Analysis BY TECHNIQUE, 2025-2030

Chapter 7. Air-dried Food Market – BY PRODUCT

7.1 Introduction/Key Findings

7.2 Herbs & Spices

7.3 Meat & Seafood

7.4 Fruits & Vegetables

7.5 Y-O-Y Growth trend Analysis BY PRODUCT

7.6 Absolute $ Opportunity Analysis BY PRODUCT, 2025-2030

Chapter 8. Air-dried Food Market – BY FORM

8.1 Introduction/Key Findings

8.2 Flakes

8.3 Granules

8.4 Powder

8.5 Y-O-Y Growth trend Analysis BY FORM

8.6 Absolute $ Opportunity Analysis BY FORM, 2025-2030

Chapter 9. Air-dried Food Market – By End-user

9.1 Introduction/Key Findings

9.2 HoReCa Sector

9.3 Household

9.4 Processed Food Industry

9.5 Y-O-Y Growth trend Analysis By End-user

9.6 Absolute $ Opportunity Analysis By End-user, 2025-2030

Chapter 10. Air-dried Food Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Component

10.1.2.1 By Light Type

10.1.3 By Power System

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Component

10.2.3 By Light Type

10.2.4 By Power System

10.2.5 By By End-user

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Component

10.3.3 By Light Type

10.3.4 By Power System

10.3.5 By By End-user

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Component

10.4.3 By Light Type

10.4.4 By Power System

10.4.5 By By End-user

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Component

10.5.3 By Light Type

10.5.4 By Power System

10.5.5 By By End-user

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Air-dried Food Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Nestlé S.A.

11.2 Ajinomoto Co., Inc.

11.3 Unilever Group

11.4 Asahi Group Holdings, Ltd.

11.5 Dehydrates Inc.

11.6 Freeze-Dry Foods GmbH

11.7 Nissin Foods Holdings Co., Ltd.

11.8 Harmony House Foods, Inc.

11.9 Ting Hsin International Group

11.10 Honeyville, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

As consumers increasingly prioritize healthier and more convenient food choices, the demand for air-dried foods has surged, driven by their nutritional benefits, minimal processing, and ease of portability.

The top players operating in the Air-dried Food Market are - Nestlé S.A., Ajinomoto Co., Inc., Unilever Group, Asahi Group Holdings, Ltd. and Dehydrates Inc.

Government restrictions and guidelines imposed in response to the COVID-19 pandemic have the potential to disrupt supply chains, significantly hindering the growth of the air-dried food market.

Technological advancements in air-drying methods present substantial growth opportunities for the global air-dried food market. Innovations such as vacuum drying, microwave-assisted air drying, and hybrid drying techniques are improving product quality by more effectively preserving nutrients, color, and flavor compared to traditional methods.

The Asia-Pacific region is the fastest-growing region in the Air-dried Food Market.