Air Compressor Market Size (2024 – 2030)

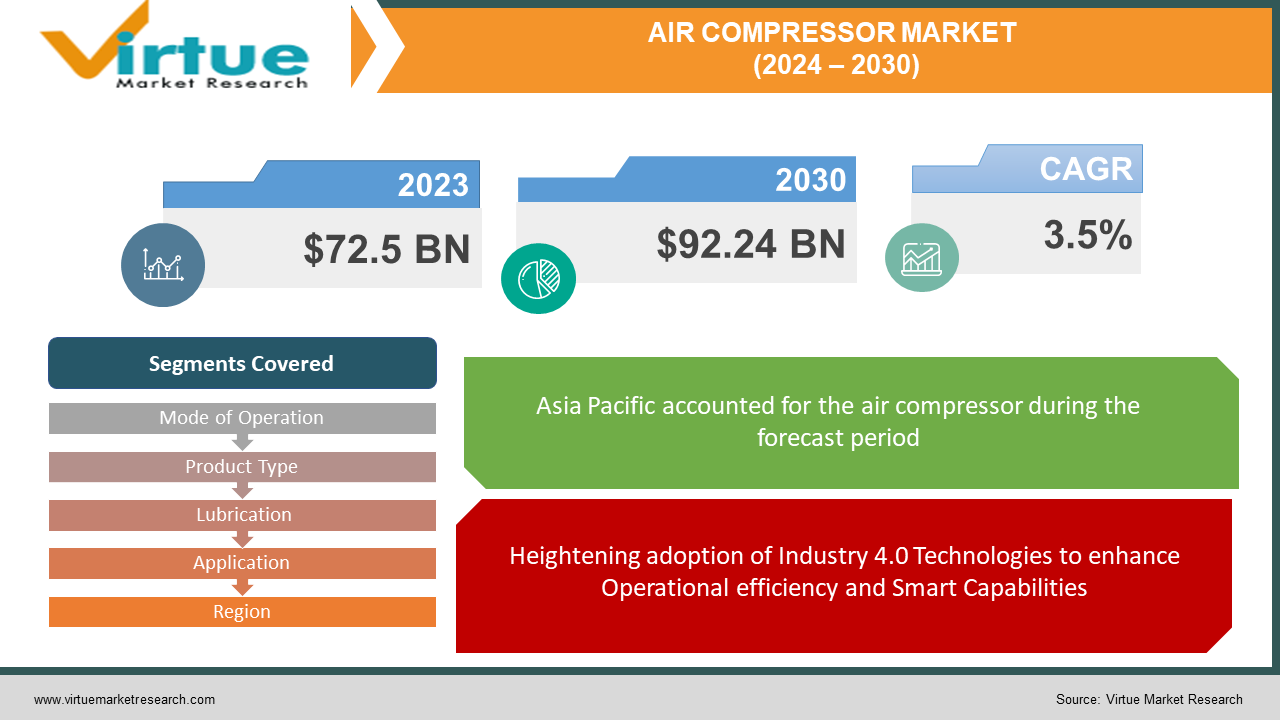

The Air Compressor Market was valued at USD 72.5 billion in 2023 and is projected to reach a market size of USD 92.24 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 3.5%.

The mechanical devices that work on three basic modes - rotary, centrifugal, and reciprocating types are known as Air Compressors. Rotary compressors are varied by design that utilises a screw-type mechanism to compress air. These varieties of compressors are more effective and dominating in the industry due to their comfort of maintenance. Additionally, centrifugal and reciprocating compressors are extensively utilised in many operations such as air filling, gas filling, and others. Commercial manufacturing and industrial sectors, usually install Stationary Compressors which in turn tend to lead the market. In the past few years, the global compressor industry experienced a slight fall, owing to strict norms and less infrastructure development and deployments. However, for the future years, the market is expected to develop progressively. Additionally, oil-filled compressors are extensively used for numerous functions such as cleansing, blowing, sandblasting, etc. This has influenced the usage of compressors in numerous industrial applications such as manufacturing, oil & gas, energy and power, electronics, and semiconductor industries.

Key Market Insights:

-

The British Compressed Air Society (UK) and British Retail Consortium (UK) have cumulatively designed and designed a Code of Practice for compressed air utilised in the food & beverages industry, to help food manufacturers. This facilitates minimum quality standards for compressed air and also defines allowable levels for dirt, water, and oil along with air quality benchmarks as specified in ISO8573-1, the International Standard for Compressed Air purity.

-

Growth in demand for rental air compressors is estimated to limit the sale/purchase of new air compressors, thus affecting the market growth. Key sellers for rental air compressors consist of Cramo, Blueline, ACME fab-con, Sunbelt, and Coates Hire. Strategic maneuvers and contributions by these primary market players have fallen the demand for new air compressors.

-

Commodities such as nail guns, paint sprayers, pressure washers cutting tools, polishers, impact wrenches, socket wrenches screwdrivers, and tire inflators are employed more for domestic purposes. All equipment utilize some type of portable air compressor. Portability is another major advantage associated with air compressors. Portable tools are needed in multiple sectors such as construction, and mining for performing numerous tasks.

Air Compressor Market Drivers:

Heightening adoption of Industry 4.0 Technologies to enhance Operational efficiency and Smart Capabilities

Compressors are a key equipment applied in small-scale industries as well as large manufacturing facilities. Each pneumatic or advanced device in the industry needs the cleanest air for operation purposes in industries. Nowadays, each company spends about 15-40% on the energy cost that is being utilized by compressors that faces a gap that is to be filled by such efficient air compressors. In the widening compressor industry, it is very significant to manage the airflow. Many major players in the air equipment sector offer solutions to solve complex industrial issues and enhance their operations through industry 4.0 abilities such as IIoT, cloud, Big Data, and others. This has aided in expanding the smart capabilities of compressors, further propelling the global air compressor market development in the forecast period.

Air Compressor Market Restraints and Challenges:

Decline of Compressor Efficiency and Loss of energy

End-users in the industry are demanding equipment that can efficiently utilise energy as compressors that take in nearly 40-50% of the facility’s energy. While only 10% is transformed to use for energy, the balance 90% is a loss in the form of heat. Hence, measurements and product development are significant to reduce the loss of energy and heat. Another major economic loss factor in the compressor industry is maintenance, which includes the high cost of parts replacement, filters, and lubricants, particularly in the oil-filled compressor, which is affecting the adoption. In response, major players are upgrading their products to aid solve the concern of damping elements, raise the output, and lower operation costs. However, the detrimental factors are prominent and will slightly decline the market over the forecast term.

Air Compressor Market Opportunities:

Growing demand for energy-efficient air compressors

With the adoption of the Paris Agreement, the world is required to harness low-carbon energy sources to reduce greenhouse gas (GHG) emissions and restrict the growth of global mean surface temperature to lower than 2°C relative to pre-industrial levels by the end of the century. With an increasing focus on energy charges and rising greenhouse gas emissions, the focus has transformed toward the usage of energy-efficient compressed air solutions. The European Union (EU) has proposed the 2030 Climate Target Plan, which proposes to stress the EU's ambition of lowering greenhouse gas emissions to at least 55% below 1990 levels by 2030.

A compressed air system is one of the primary industry devices that has to comply with this energy policy. Meantime, the comfortable and protected generation of compressed air is enhancing the use of air compressors in numerous industrial applications. As per the US DOE, half of industrial plant air systems harbor opportunities for large energy savings with relatively fewer project expenses. To achieve energy preservation, compressed air systems need proper maintenance and high-level control. This results in an increased life cycle of pneumatic equipment and facilitates higher reliability of compressed air systems.

AIR COMPRESSOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.5% |

|

Segments Covered |

By Mode of Operation, Product Type, Lubrication, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ELGi Equipment Limited (India),. Atlas Copco AB (Sweden), Sulzer Ltd. (Switzerland), Hitachi Ltd. (Japan), Ingersoll Rand (U.S.), Campbell Hausfeld (U.S.), Mitsubishi Heavy Industries Ltd. (Japan), Doosan Infracore Portable Power (South Korea), Siemens AG (Germany) |

Air Compressor Market Segmentation: By Mode of Operation

-

Rotary

-

Centrifugal

-

Reciprocating

The Rotary segment is expected to develop at 6.2% CAGR and is dominating the mode of operation sector. The basic technique they use is two rotating screws to produce compressed air but their modern operational capabilities and dependability make the compressors the chosen solution for professional and industrial uses across the globe. Therefore, centrifugal air compressors are the latest equipment that turns kinetic energy into potential energy in the form of air pressure. These compressors are mostly applied in manufacturing sectors for air process operations. Additionally, reciprocating compressors work on the mechanism of reciprocating motion, which means that positive displacement made by the piston in reciprocating equipment enhances and compresses air pressure.

Air Compressor Market Segmentation: By Product Type

-

Stationary

-

Portable

Based on Product Type, the market is divided into stationary and portable. The Stationary segment is set to develop at 5.7% CAGR over the estimated period. This is on account of the emerging demand for stationary compressors for heavy commercial manufacturing of air and the growth of in-house facilities. Stationary compressors are heavy-weight and not easily portable. Their increased productivity and electric-saving features are attracting traction in end-user industries.

Air Compressor Market Segmentation: By Lubrication

-

Oil Filled

-

Oil Free

The Oil-filled segment is set to strengthen at a CAGR of 6% over the future period. In light of developing heavy-duty and commercial applications, lubrication is the only technique for avoiding high maintenance concerns. Oil-filled compressors offer the user the required operational potentialities without affecting the continuity.

Oil-free compressors are utilised in the hospitality sector and oxygen plants owing to clean operating scenarios, hygiene environment issues, and stable compressed air necessities. This is expected to strengthen the global air compressor market share at a stable growth rate during the estimated period.

Air Compressor Market Segmentation: By Application

-

Manufacturing

-

Oil and Gas

-

Energy and Power

-

Electronic and Semiconductor

-

Healthcare

-

Food and Beverages

-

Others

The Energy & Power segment is anticipated to record appreciable enhancement over the study period. In power generation uses, like gas turbines and air blowers, compressors are utilized to ensure product maintenance, influencing product demand over the upcoming years. Moreover, in markets such as electronics, semiconductors, and healthcare, compressors are applied for operations such as cleaning, air blowing, pneumatic equipment, and gas generation. Multiple applications such as blowing, cleansing, and sandblasting, have enhanced the demand for Compressors in the manufacturing industry. Owing to their heavy load functions and continuity, air compressors are the key elements utilised in production and manufacturing plants.

Air Compressor Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia Pacific is analyzed to exhibit significant growth in the market due to strong demand for smart IIoT-facilitated compressors from primary nations such as China, Japan, and India. Additionally, gas lines and medical infrastructure for extra essential resources such as oxygen, nitrogen, hydrogen, and carbon dioxide are enormously growing. Research on substitute gasoline items, such as ethylene, and propylene, and deployments to expand LPG (infrastructure) and CNG (infrastructure) are propelling the global market growth.

COVID-19 Impact Analysis on the Air Compressor Market:

The global market experienced a small fall during the COVID-19 pandemic. However, the market revived in 2021 owing to positive demand from the health sector post-pandemic. Air compressing is a key component of production lines in numerous industry verticals such as manufacturing, automotive, and electronics & semiconductors. Additionally, industrial air compressors are utilised in the petrochemical 7 gas, manufacturing, and other industries. This compressed air device was comfortably regulated and set up to clean the air even in extreme scenarios and environments. During the pandemic, main players in the air compression industry were stressed about crafting trustworthy strategies to endure the different effects of the dangerous coronavirus and market dynamics.

Latest Trends:

Enhancing Capital Expenditure, growing Hybrid Fuel Infrastructure, and Big Data Analytics

In the expanding digitalization world of the Industrial Internet of Things (IIoT), communication is the primary element that facilitates customers to store and capture real-time essential parameters such as pressure, moisture, and temperature. This is estimated to aid manufacturers in developing functional strategies and expenditure methods for product portfolio expansion.

The market has further recorded the utilization of hybrid fuels such as hydrogen which is developing very quickly and setting trends in the market with a systematic framework. Hydrogen is a possible answer that facilitates a quicker and more robust energy transition in Europe and all over the world. Compressors are supplements that aid in regulating and transporting this modern fuel, boosting market growth over the future period. In addition, smart compressors that ensure capabilities, such as planned predictive maintenance through Big Data analytics and a capacity to remotely control the equipment parameters through cloud technology, are lead in the market.

Key Players:

-

ELGi Equipment Limited (India)

-

Atlas Copco AB (Sweden)

-

Sulzer Ltd. (Switzerland)

-

Hitachi Ltd. (Japan)

-

Ingersoll Rand (U.S.)

-

Campbell Hausfeld (U.S.)

-

Mitsubishi Heavy Industries Ltd. (Japan)

-

Doosan Infracore Portable Power (South Korea)

-

Siemens AG (Germany)

Recent Developments

-

August 2022: Sauer Compressors, a world-level compressor service provider, added a modern feature to the 6000 series. The product's property is hermetic gas tightness with the combination of magnetic coupling between the electric motor and compressor.

-

July 2022: Atlas Copco launched ZR/ZT series compressors devised with rotary screw compressor technology and provides 100% or complete oil-free certification. These also arrive with Z seal technology that offers extra cooling and energy efficiency.

-

June 2022: Elgi introduced its LD Series two-stage smart, direct-drive reciprocating air compressor with a modern Neuron XT Controller. The 15 HP and 10 duplex controller versions constitute three intelligent compressor modes. These can be utilized to better user experience, where they can be chosen based on their utilization design and compressed air demand.

Chapter 1. Air Compressor Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Air Compressor Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Air Compressor Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Air Compressor Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Air Compressor Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Air Compressor Market – By Mode of Operation

6.1 Introduction/Key Findings

6.2 Rotary

6.3 Centrifugal

6.4 Reciprocating

6.5 Y-O-Y Growth trend Analysis By Mode of Operation

6.6 Absolute $ Opportunity Analysis By Mode of Operation, 2024-2030

Chapter 7. Air Compressor Market – By Product Type

7.1 Introduction/Key Findings

7.2 Stationary

7.3 Portable

7.4 Y-O-Y Growth trend Analysis By Product Type

7.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 8. Air Compressor Market – By Lubrication

8.1 Introduction/Key Findings

8.2 Oil Filled

8.3 Oil Free

8.4 Y-O-Y Growth trend Analysis By Lubrication

8.5 Absolute $ Opportunity Analysis By Lubrication, 2024-2030

Chapter 9. Air Compressor Market – By Application

9.1 Introduction/Key Findings

9.2 Manufacturing

9.3 Oil and Gas

9.4 Energy and Power

9.5 Electronic and Semiconductor

9.6 Healthcare

9.7 Food and Beverages

9.8 Others

9.9 Y-O-Y Growth trend Analysis By Application

9.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 10. Air Compressor Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Mode of Operation

10.1.2.1 By Product Type

10.1.3 By Lubrication

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Mode of Operation

10.2.3 By Product Type

10.2.4 By Lubrication

10.2.5 By Application

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Mode of Operation

10.3.3 By Product Type

10.3.4 By Lubrication

10.3.5 By Application

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Mode of Operation

10.4.3 By Product Type

10.4.4 By Lubrication

10.4.5 By Application

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Mode of Operation

10.5.3 By Product Type

10.5.4 By Lubrication

10.5.5 By Application

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Air Compressor Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 ELGi Equipment Limited (India)

11.2 Atlas Copco AB (Sweden)

11.3 Sulzer Ltd. (Switzerland)

11.4 Hitachi Ltd. (Japan)

11.5 Ingersoll Rand (U.S.)

11.6 Campbell Hausfeld (U.S.)

11.7 Mitsubishi Heavy Industries Ltd. (Japan)

11.8 Doosan Infracore Portable Power (South Korea)

11.9 Siemens AG (Germany)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Air Compressor Market was valued at USD 72.5 billion in 2023 and is projected to reach a market size of USD 92.24 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 3.5%.

The heightened penetration of Industry 4.0 technologies and Smart Capabilities is propelling the Air Compressor Market.

The Air Compressor Market is segmented based on Mode of Operation, Product Type, Lubrication, Application, and Region.

Asia-Pacific is the most dominant region for the Air Compressor Market.

Ingersoll Rand (U.S.), Campbell Hausfeld (U.S.), Mitsubishi Heavy Industries Ltd. (Japan), Doosan Infracore Portable Power (South Korea), Siemens AG (Germany) are a few of the key players operating in the Air Compressor Market.