AI & Machine Learning Operationalization (MLOps) Software Market Size (2024 – 2030)

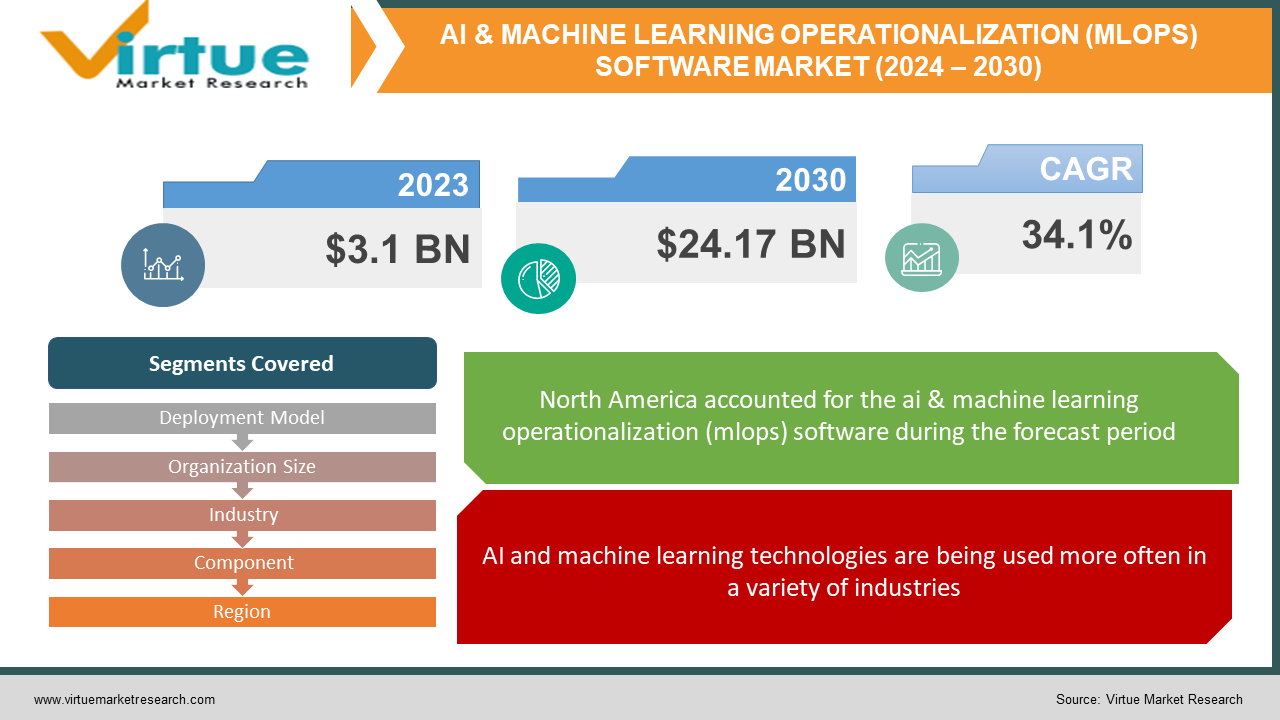

The Global AI & Machine Learning Operationalization (MLOps) Software Market was valued at USD 3.1 billion in 2023 and is projected to reach a market size of USD 24.17 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 34.1%.

The deployment, management, and optimization of machine learning models in operational contexts are made possible using AI and Machine Learning Operationalization (MLOps) software. The entire lifecycle of AI and ML projects is streamlined by MLOps systems, which handle duties like data preparation, model training, testing, deployment, and monitoring. These solutions make it easier for operations, development, and data science teams to collaborate, resulting in a workflow that is more effective and repeatable. MLOps software facilitates the deployment and upkeep of machine learning models at a scale for organizations by addressing issues with scalability, model governance, and version control. MLOps systems improve the dependability and nimbleness of AI applications by utilizing automation and continuous integration/continuous deployment (CI/CD) concepts. This, in turn, helps to successfully integrate machine learning into actual business operations.

Key Market Insights:

The market for AI and Machine Learning Operationalization (MLOps) software is expanding rapidly due to the increasing use of AI and ML technologies in various industries. Important findings show that MLOps solutions are in high demand because of their ability to automate and optimize the whole lifetime of machine learning models. The market is growing as more and more businesses realize how important it is to deploy, maintain, and monitor models effectively. Furthermore, the adoption of MLOps platforms is being driven by the emphasis on streamlined processes, scalability, and collaboration. MLOps software emerges as a crucial facilitator, guaranteeing the successful integration of machine learning capabilities into operational processes and decision-making, as organizations endeavor to extract value from their AI investments.

AI & Machine Learning Operationalization (MLOps) Software Market Drivers:

AI and machine learning technologies are being used more often in a variety of industries.

The growing integration of AI and machine learning across many sectors is driving the market for AI & Machine Learning Operationalization (MLOps) Software. Businesses are using these technologies to streamline operations, improve decision-making, and create unique goods and individualised experiences that give them a competitive edge. The broad use of AI and ML is facilitated by the increase in data volumes and the trend towards data-driven decision-making. These technologies find applications in fraud detection, personalised marketing, predictive maintenance, and the manufacturing, healthcare, and finance industries. This acceptance is further fuelled by ongoing technology developments and increased accessibility to AI and ML. The need for MLOps solutions is growing as more sectors adopt these disruptive technologies, indicating the necessity of operationalizing and managing machine learning models in a variety of operational scenarios.

Acknowledging MLOps software as a vital facilitator to optimise the effectiveness and influence of AI and machine learning endeavours.

The recognition of MLOps software as a vital facilitator for optimising the effectiveness and influence of artificial intelligence and machine learning endeavours highlights its essential function in modern technological environments. Organisations that make significant investments in AI and machine learning understand how critical it is to have a unified, efficient strategy for implementing, overseeing, and growing models. The key to creating this synergy is MLOps software, which provides the instruments and procedures needed for data scientists, developers, and operations teams to work together more easily. MLOps software improves the repeatability and dependability of AI systems by automating operations, maintaining version control, and tackling governance-related issues. Its acknowledgement as a crucial facilitator denotes a deliberate effort to maximise machine learning projects' whole lifecycle.

AI & Machine Learning Operationalization (MLOps) Software Market Restraints and Challenges

It encounters some obstacles and limitations. The difficulty of incorporating MLOps into the current IT architecture is one major obstacle. The smooth implementation of MLOps methods may be impeded by organizations’ inability to match them with conventional software development practices. The changing regulatory environment surrounding data privacy and ethical issues in AI is another barrier that prevents machine learning models from being deployed and monitored. Another major obstacle is the lack of qualified individuals who are proficient in both operations and data science. The MLOps environment is made more difficult by the need to strike a balance between comprehensive governance and the need for agility. It is imperative that these obstacles be overcome if MLOps solutions are to grow sustainably and be widely adopted in the rapidly evolving AI and machine learning market.

AI & Machine Learning Operationalization (MLOps) Software Market Opportunities:

There are many of chances for development and innovation in the market for AI and Machine Learning Operationalization (MLOps) software. The need for MLOps platforms that make it easier to install and maintain machine learning models is growing, which gives software developers a chance to create solutions that are easy to understand. The need for specialised MLOps tools catered to certain industries is increasing as AI and ML applications become more widespread across industries, creating a niche market for industry-focused solutions. Furthermore, MLOps software providers have chances to offer solutions that effectively manage and deploy models on edge devices due to the growing adoption of edge computing and IoT devices. The increased significance of safeguarding AI and ML models is expected to spur further collaboration between MLOps and cybersecurity technologies.

AI & MACHINE LEARNING OPERATIONALIZATION (MLOPS) SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

34.1% |

|

Segments Covered |

By Deployment Model, Organization Size, Industry, Component, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amazon Alexa, Azure Machine Learning Studio, Condeco, Cortana, Google, H2O.AI, IBM Watson, Infosys Nia, Robin |

AI & Machine Learning Operationalization (MLOps) Software Market Segmentation: By Deployment Model

-

On-premises

-

Cloud-based

-

Hybrid

The deployment model-based market for AI & Machine Learning Operationalization (MLOps) software meets the needs and preferences of a wide range of organisational configurations. By putting the MLOps software on internal servers and infrastructure, on-premises implementation gives businesses total control over their systems. Using cloud platforms, cloud-based deployment provides accessibility, scalability, and flexibility without requiring a large on-premises infrastructure. By combining on-premises and cloud technologies, hybrid deployment enables businesses to tailor control and flexibility to their unique set of requirements. The MLOps software's flexibility and adaptability are reflected in this segmentation, which allows organisations to select the model that best suits their infrastructure, security, and operational needs while accommodating a variety of deployment preferences.

AI & Machine Learning Operationalization (MLOps) Software Market Segmentation: By Organization Size

-

Large enterprises

-

Small and medium-sized enterprises (SMEs)

Businesses with different operational scales have different needs, which are addressed by the market segmentation of AI & Machine Learning Operationalization (MLOps) Software based on organisation size. MLOps solutions help large organisations, which are known for their sophisticated structures and vast resource bases, manage and optimise their complex machine learning operations. Small and medium-sized businesses (SMEs), who have relatively smaller organisational structures, use MLOps software to improve and expedite their machine learning procedures. They frequently look for scalable solutions that meet their unique needs. By providing MLOps solutions that are in line with the traits and goals of each organisational size, this segmentation acknowledges the disparities in the operational dynamics and issues faced by SMEs and large organisations.

Ai & Machine Learning Operationalization (Mlops) Software Market Segmentation: By Industry

-

IT and telecom

-

Healthcare

-

Finance

-

Retail

-

Manufacturing

MLOps solutions are widely used in a variety of industries, each of which gains from specially designed applications that improve decision-making and operational efficiency. MLOps is essential for fraud detection, network optimisation, and customer churn prediction in the telecom and IT industries. While the finance sector uses MLOps for algorithmic trading, fraud detection, and risk assessment, the healthcare sector uses them for drug discovery, medical imaging analysis, and personalised treatment. Tasks like demand forecasting, customer segmentation, and personalised suggestions are supported by MLOps in the retail arena. Furthermore, MLOps is essential to process optimisation, quality assurance, and predictive maintenance in the manufacturing industry. The multifarious uses of MLOps highlight its adaptability in tackling sector-specific issues and promoting innovation in the IT, healthcare, finance, retail, and manufacturing domains.

Ai & Machine Learning Operationalization (Mlops) Software Market Segmentation: By Component

-

Model Management

-

Data management

-

Workflow automation

-

Monitoring and governance

Segmented into components, the AI & Machine Learning Operationalization (MLOps) Software market includes essential features required for efficient machine learning operations. To guarantee a smooth transition into production, model management entails the tracking, deployment, and version control of machine learning models. The main goals of data management are to clean, process, organise, and integrate data such that it is relevant and of high quality for model training. During the machine learning lifecycle, workflow automation is essential for simplifying jobs and automating repetitive operations to increase productivity and speed up development. To evaluate model performance, identify anomalies, and guarantee adherence to established standards all of which support the continuous optimisation and dependability of AI applications monitoring and governance are essential elements. The complete nature of MLOps software in controlling and optimising machine learning activities is shown in this division.

Ai & Machine Learning Operationalization (Mlops) Software Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Due in large part to early technological adoption, significant providers such as Domino Data Lab, Databricks, and H2O.ai, as well as a strong emphasis on AI and ML innovation, North America dominates the market for AI & Machine Learning Operationalization (MLOps) software. Europe follows suit, helped along by strong data protection laws, MLOps awareness, and official backing. Growth is expected in the Asia Pacific region due to government expenditures in AI infrastructure, a large tech talent pool, and quick digital transformation. Africa's growing internet penetration and tech focus, the Middle East's government initiatives and adoption of oil and gas, Latin America's agriculture and banking sectors, and the Middle East are all positioned for consistent growth, even though the rest of the world now has a lower proportion.

COVID-19 Impact Analysis on the Global AI & Machine Learning Operationalization (MLOps) Software Market:

The use of AI and ML technologies has accelerated due to the rising reliance on digital solutions and remote work. This has raised demand for MLOps software, which streamlines and optimizes these sophisticated operations. Businesses understand how important it is to have effective machine learning workflows to deal with the changing business environment. However, some companies have had to review their budgets because of economic worries brought on by the pandemic, which could hold down the adoption of cutting-edge technologies like MLOps solutions. The development and execution of AI and ML initiatives have been hampered by supply chain interruptions and labour shortages, among other issues. As organizations work to improve operational efficiency and resilience in the face of continuous uncertainty, the overall trend points to a continued need for MLOps solutions.

Latest Trends/ Developments:

There are various new developments in the global AI & Machine Learning Operationalization (MLOps) software market. First off, automated machine learning solutions that can simplify and expedite the whole MLOps process are in greater demand. Second, to facilitate the easy deployment and management of AI models, enterprises are finding that the combination of AI and DevOps is essential. Thirdly, because cloud based MLOps solutions are affordable, flexible, and scalable, their use is growing. In conclusion, there is an increasing emphasis on explainable AI, as businesses look for software that can offer comprehensible and transparent insights to foster confidence in AI systems.

Key Players:

-

Amazon Alexa

-

Azure Machine Learning Studio

-

Condeco

-

Cortana

-

Google

-

H2O.AI

-

IBM Watson

-

Infosys Nia

-

Robin

Chapter 1. AI & Machine Learning Operationalization (MLOps) Software Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. AI & Machine Learning Operationalization (MLOps) Software Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. AI & Machine Learning Operationalization (MLOps) Software Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. AI & Machine Learning Operationalization (MLOps) Software Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. AI & Machine Learning Operationalization (MLOps) Software Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. AI & Machine Learning Operationalization (MLOps) Software Market – By Deployment Model

6.1 Introduction/Key Findings

6.2 On-premises

6.3 Cloud-based

6.4 Hybrid

6.5 Y-O-Y Growth trend Analysis By Deployment Model

6.6 Absolute $ Opportunity Analysis By Deployment Model, 2024-2030

Chapter 7. AI & Machine Learning Operationalization (MLOps) Software Market – By Organization Size

7.1 Introduction/Key Findings

7.2 Large enterprises

7.3 Small and medium-sized enterprises (SMEs)

7.4 Y-O-Y Growth trend Analysis By Organization Size

7.5 Absolute $ Opportunity Analysis By Organization Size, 2024-2030

Chapter 8. AI & Machine Learning Operationalization (MLOps) Software Market – By Industry

8.1 Introduction/Key Findings

8.2 IT and telecom

8.3 Healthcare

8.4 Finance

8.5 Retail

8.6 Manufacturing

8.7 Y-O-Y Growth trend Analysis End-Use Industry

8.8 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. AI & Machine Learning Operationalization (MLOps) Software Market – By Component

9.1 Introduction/Key Findings

9.2 Model Management

9.3 Data management

9.4 Workflow automation

9.5 Monitoring and governance

9.6 Y-O-Y Growth trend Analysis End-User

9.7 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. AI & Machine Learning Operationalization (MLOps) Software Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Deployment Model

10.1.2.1 By Organization Size

10.1.3 By Industry

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Deployment Model

10.2.3 By Organization Size

10.2.4 By Industry

10.2.5 By Component

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Deployment Model

10.3.3 By Organization Size

10.3.4 By Industry

10.3.5 By Component

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Deployment Model

10.4.3 By Organization Size

10.4.4 By Industry

10.4.5 By Component

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Deployment Model

10.5.3 By Organization Size

10.5.4 By Industry

10.5.5 By Component

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. AI & Machine Learning Operationalization (MLOps) Software Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Amazon Alexa

11.2 Azure Machine Learning Studio

11.3 Condeco

11.4 Cortana

11.5 Google

11.6 H2O.AI

11.7 IBM Watson

11.8 Infosys Nia

11.9 Robin

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global AI & Machine Learning Operationalization (MLOps) Software Market was valued at USD 3.1 billion and is projected to reach a market size of USD 24.17 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 34.1%.

Growing Recognition of the Advantages of MLOps and the Adoption of AI and Machine Learning are the market drivers of the Global AI & Machine Learning Operationalization (MLOps) Software Market.

By Deployment Model (On-premises, Cloud-based, Hybrid); By Organization Size (Large enterprises, Small and medium sized enterprises (SMEs)); By Industry (IT and telecom, Healthcare, Finance, Retail, Manufacturing); By Component (Model Management, Data management, Workflow automation, Monitoring and governance ); Region are the segments under the Global AI & Machine Learning Operationalization (MLOps) Software Market.

North America is the most dominant region for the Global AI & Machine Learning Operationalization (MLOps) Software Market.

Amazon Alexa, Azure Machine Learning Studio, Condeco, Cortana, Google, H2O.AI, IBM Watson, Infosys Nia, Robin are the key players in the Global AI & Machine Learning Operationalization (MLOps) Software Market.