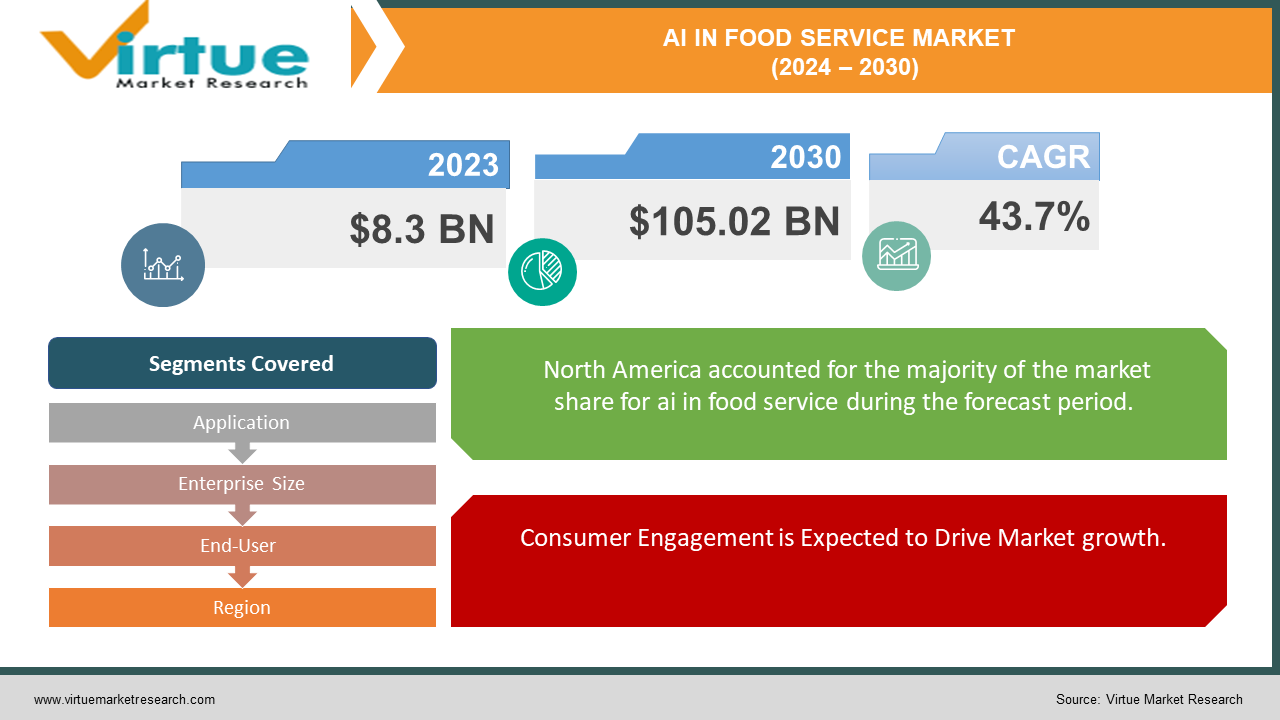

AI in Food Service Market Size (2024 – 2030)

The AI in Food Service Market was valued at USD 8.3 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 105.02 billion by 2030, growing at a CAGR of 43.7%.

Artificial Intelligence (AI) is playing a progressively significant role in the operations and product development processes of food and beverage companies. Numerous methods are being utilized by food and beverage enterprises to enhance their operations and develop superior products through the application of AI.

Key Market Insights:

Notable advancements in the food and beverage (F&B) infrastructure, the growing demand for enhanced supply chain operational efficiency, and the extensive adoption of automated services are key factors contributing to the market's expansion.

Artificial Intelligence (AI) in the food and beverage industry serves as an intelligent assistant, offering support both in kitchen operations and at grocery stores. It involves utilizing computer programs and machines capable of thinking and learning to simplify and enhance food-related tasks. AI aids farmers in increasing food production, makes cooking faster and more flavorful, and can even recommend what to eat next. Essentially, it serves as a virtual food expert, offering assistance with everything from cultivating ingredients to crafting delicious recipes.

AI in Food Service Market Drivers:

Consumer Engagement is Expected to Drive Market growth.

AI is being leveraged to comprehend consumer behavior, leading to more precise predictions. This technology allows marketers and organizations to connect with customers on a personal level, fostering deeper interactions and enhancing their overall brand experience. Additionally, the adoption of chatbots by many consumers is increasing, as these tools can operate effectively even offline. According to an American Express report, over 50% of customers are willing to spend more with companies that provide excellent customer service. This presents a significant opportunity for AI, likely driving its growth in the food and beverage market.

The investment by the former chairman of Tata Sons in Techbin Solutions Pvt Ltd’s Niki.ai exemplifies the increasing investment and growth in chatbot usage. Niki.ai is an AI-powered chatbot that engages in conversations with consumers to help them order a wide range of services through a chat interface.

AI in Food Service Market Restraints and Challenges:

Data Security hinders market growth.

Despite the advantages of AI, concerns regarding data privacy and security have presented challenges for businesses. These issues necessitate the implementation of stringent data protection measures and adherence to regulatory compliance protocols to maintain consumer trust and ensure data integrity.

Integration Complexities restraint market growth.

The integration of AI technologies into existing operational frameworks, along with the shortage of skilled professionals proficient in AI implementation, has posed challenges for businesses. These factors have hindered the seamless adoption and effective implementation of AI solutions.

AI in Food Service Market Opportunities:

Startup Growth Potential creates opportunities.

North America offers promising opportunities for the growth of AI-driven food tech startups, promoting innovation in product development, supply chain optimization, and personalized consumer engagement. This diversification enhances the competitive landscape and fosters industry-wide innovation.

Progress in AI Algorithms creates more opportunities for market growth.

Ongoing advancements in AI algorithms and machine learning techniques present opportunities for businesses to create more sophisticated and customized AI solutions. These innovations address the unique operational needs and consumer preferences within the North American food and beverage market.

AI IN FOOD SERVICE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

43.7% |

|

Segments Covered |

By Application, Enterprise Size, End-User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Oracle Corporation, Honeywell International Inc., ABB Ltd., IBM Corporation, Rockwell Automation, Inc., Aboard Software, Nvidia Corporation, Analytical Flavor Systems, TOMRA, Staqu Technologies |

AI in Food Service Market Segmentation - By Application

-

Quality Control & Inspection

-

Demand Forecasting

-

Customer Service & Engagement

-

Menu Optimization

-

Other Applications

Quality Control & Inspection has secured a dominant market position in the Artificial Intelligence (AI) segment of the Food and Beverage industry. This prominent market share is largely due to AI's essential role in maintaining stringent quality standards and streamlining inspection processes. Advanced AI-powered systems have transformed quality control by employing sophisticated image recognition and data analysis techniques. These innovations enable real-time detection and correction of potential product defects and discrepancies, thereby ensuring product integrity. This crucial function has increased the demand for AI-driven quality control solutions, bolstering consumer trust and brand reliability within the food and beverage sector.

Demand Forecasting, another significant application segment, closely follows, accounting for a substantial market share in 2023. Given the ever-changing nature of consumer preferences and market trends, accurate demand forecasting is vital for optimizing production and inventory management. AI’s predictive analytics capabilities utilize historical data, consumer behavior insights, and market dynamics to deliver precise demand forecasts, facilitating efficient resource allocation and reducing operational costs.

AI in Food Service Market Segmentation - By Enterprise Size

-

Small and Medium-Sized Enterprises (SMEs)

-

Large Enterprises

Large Enterprises have maintained a dominant market position, capturing over 68.3% share in the Artificial Intelligence (AI) segment of the Food and Beverage market. This significant market presence stems from the substantial resources and robust infrastructure that large enterprises possess, enabling them to invest heavily in advanced AI technologies and implementations. As cost-effective and scalable AI solutions become more accessible to Small and Medium-Sized Enterprises (SMEs), an increasing number are adopting AI applications in their production processes and customer engagement strategies to gain a competitive edge in the dynamic food and beverage market.

On the other hand, SMEs have been slower in recognizing the transformative potential of AI, mainly due to resource constraints and budget limitations. Nonetheless, growing awareness of AI's benefits has spurred SMEs to explore and integrate AI solutions tailored to their specific operational needs. With the availability of affordable and scalable AI tools, SMEs are gradually leveraging AI-driven applications to optimize production processes, enhance customer engagement, and compete effectively in the evolving food and beverage landscape.

AI in Food Service Market Segmentation - By End-User

-

Food & Beverage Manufacturers

-

Restaurants & Food Service Providers

-

Other End-Users

Food & Beverage Manufacturers have secured a leading market position in Artificial Intelligence (AI) within the Food and Beverage industry. This significant market share underscores the pivotal role of AI in revolutionizing production methods, stimulating product innovation, and enforcing rigorous quality control standards across the manufacturing sector.

AI-driven technologies have enabled food and beverage manufacturers to enhance production efficiency, ensure product safety and regulatory compliance, and introduce novel product offerings that align with evolving consumer preferences.

Restaurants & Food Service Providers, another critical end-user segment, have increasingly embraced AI's transformative potential to enrich customer experiences and operational efficiency. Through AI-driven solutions, these establishments can streamline order management processes, personalize customer interactions, and optimize menu offerings to cater to diverse consumer preferences effectively.

AI in Food Service Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America is poised to dominate the AI in the food and beverage market, with the United States leading the region. This year, North America has already captured a substantial market share, solidifying its position as one of the largest regions for AI adoption in this sector. The region's readiness for adoption and significant projected growth in AI replacement technologies are key economic drivers, highlighting its leading role in AI implementation and anticipated automation advancements through 2030.

Additionally, food processing stands out as a pivotal sector within the US manufacturing landscape. According to the United States Department of Agriculture, food processing plants contribute significantly, accounting for 16% of the total value of shipments from all US manufacturing plants. This underscores the importance of the food and beverage industry in the US and its potential for further integration of AI technologies to enhance operational efficiency and innovation.

Asia Pacific is projected to experience the fastest compound annual growth rate (CAGR) during the forecast period. As the world's fastest-growing economy with a burgeoning population, the region is witnessing rapid urbanization and an expanding middle class. These demographic shifts are fueling a rising demand for convenient and high-quality food and beverage products.

AI technologies are poised to play a crucial role in addressing these demands by optimizing production, distribution, and marketing processes efficiently. This adoption of AI solutions is expected to facilitate the region's ability to meet growing consumer expectations and enhance operational efficiencies across the food and beverage sector in Asia Pacific.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has accelerated the adoption of AI in the food service market. Various robotic frameworks are being deployed to ensure food safety by minimizing the transmission of microorganisms through human contact. Amid the fourth industrial revolution, data-driven autonomous decision-making is increasingly pivotal, particularly in production settings. Automation presents an opportunity to boost productivity by up to 25%, effectively handling tasks such as loading/unloading, placement, and packaging more efficiently than human counterparts.

Latest Trends/ Developments:

In May 2022, FANUC America introduced the DR-3iB/6 STAINLESS delta robot, specifically designed for primary food handling and packaging of food products. This launch was intended to improve production efficiencies while upholding rigorous food safety standards.

In April 2022, Pudu Robotics, a leading global supplier of commercial service robots, introduced the PUDU A1, its inaugural compound delivery robot designed for restaurant environments. Equipped with food recognition, positioning, and grasping technologies, the robot features a mechanical arm that facilitates seamless interaction between the kitchen and dining areas. It ensures precise dish placement on tables using real-time obstacle avoidance path planning, enhancing service efficiency and customer experience.

Key Players:

These are top 10 players in the AI in Food Service Market: -

-

Oracle Corporation

-

Honeywell International Inc.

-

ABB Ltd.

-

IBM Corporation

-

Rockwell Automation, Inc.

-

Aboard Software

-

Nvidia Corporation

-

Analytical Flavor Systems

-

TOMRA

-

Staqu Technologies

Chapter 1. AI in Food Service Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. AI in Food Service Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. AI in Food Service Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. AI in Food Service Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. AI in Food Service Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. AI in Food Service Market – By Application

6.1 Introduction/Key Findings

6.2 Quality Control & Inspection

6.3 Demand Forecasting

6.4 Customer Service & Engagement

6.5 Menu Optimization

6.6 Other Applications

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. AI in Food Service Market – By Enterprise Size

7.1 Introduction/Key Findings

7.2 Small and Medium-Sized Enterprises (SMEs)

7.3 Large Enterprises

7.4 Y-O-Y Growth trend Analysis By Enterprise Size

7.5 Absolute $ Opportunity Analysis By Enterprise Size, 2024-2030

Chapter 8. AI in Food Service Market – By End-User

8.1 Introduction/Key Findings

8.2 Food & Beverage Manufacturers

8.3 Restaurants & Food Service Providers

8.4 Other End-Users

8.5 Y-O-Y Growth trend Analysis By End-User

8.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. AI in Food Service Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Enterprise Size

9.1.4 By By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Enterprise Size

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Enterprise Size

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Enterprise Size

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Enterprise Size

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. AI in Food Service Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Oracle Corporation

10.2 Honeywell International Inc.

10.3 ABB Ltd.

10.4 IBM Corporation

10.5 Rockwell Automation, Inc.

10.6 Aboard Software

10.7 Nvidia Corporation

10.8 Analytical Flavor Systems

10.9 TOMRA

10.10 Staqu Technologies

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Notable advancements in the food and beverage (F&B) infrastructure, the growing demand for enhanced supply chain operational efficiency, and the extensive adoption of automated services are key factors contributing to the market's expansion.

The top players operating in the AI in Food Service Market are - Oracle Corporation, Honeywell International Inc., ABB Ltd., IBM Corporation, Rockwell Automation, Inc., Aboard Software, Nvidia Corporation, Analytical Flavor Systems, TOMRA, Staqu Technologies.

The COVID-19 pandemic has accelerated the adoption of AI in the food service market. Various robotic frameworks are being deployed to ensure food safety by minimizing the transmission of microorganisms through human contact.

In May 2022, FANUC America introduced the DR-3iB/6 STAINLESS delta robot, specifically designed for primary food handling and packaging of food products. This launch was intended to improve production efficiencies while upholding rigorous food safety standards.

Asia Pacific is projected to experience the fastest compound annual growth rate (CAGR) during the forecast period.