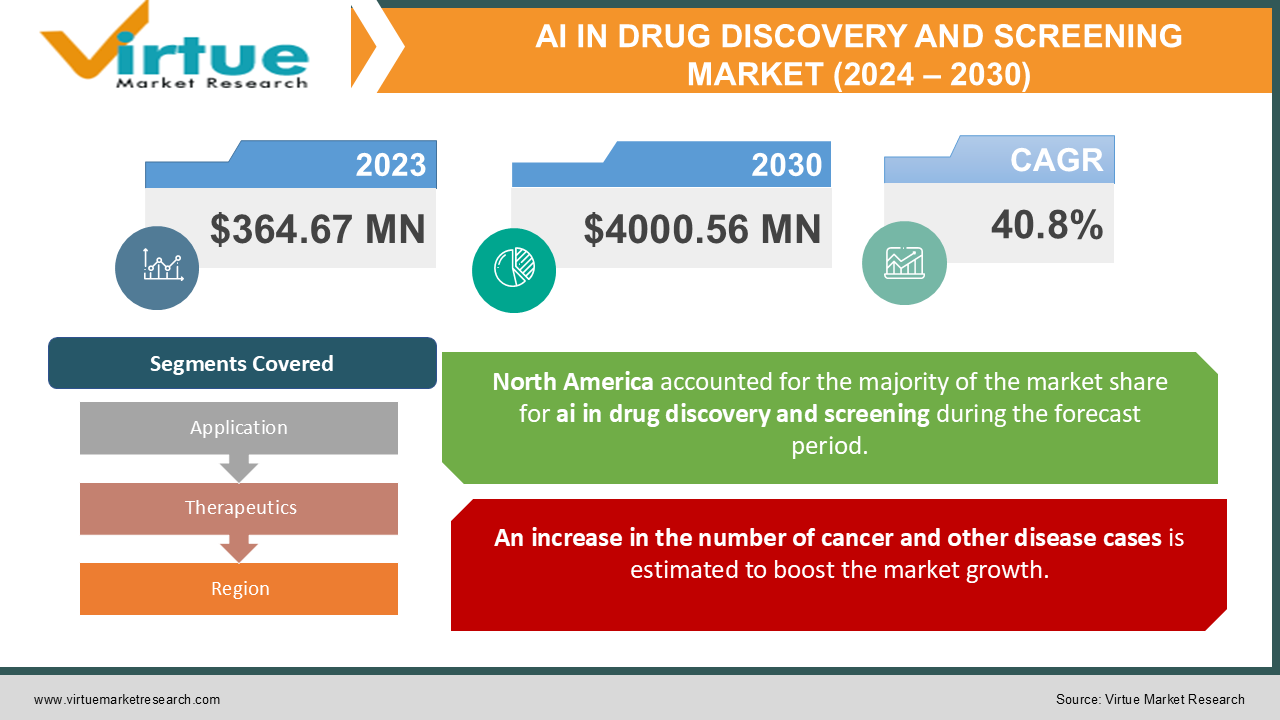

AI Drug Discovery & Screening Market size (2024 – 2030)

Global AI in drug discovery and screening market was valued at USD 364.67 million and is projected to reach a market size of USD 4000.56 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 40.8%.. Factors such as the increasing number of cross-industry collaborations and alliances are propelling artificial intelligence in the drug discovery market forward.

Market Overview

Artificial intelligence is a subfield of computer science concerned with simulating intelligent behavior. It allows computers to think and do tasks in the same way that humans and animals do, while also learning from their mistakes. Artificial intelligence is typically an algorithm designed to allow a computer to do tasks effectively while making minor mistakes. It applies deep learning and machine learning methods to personified knowledge while performing several activities.

Artificial intelligence has numerous applications in the drug development area, including tracking ailments, developing disease remedies, and predicting which animal viruses will change. Artificial intelligence has been shown to help researchers develop chronic disease remedies by enhancing R&D in medication discovery.

Drug discovery and development are processes in medicine, pharmacology, and biotechnology that involve discovering a biological target, such as an enzyme protein, gene, or receptor, and then designing, developing, and procuring a drug. The medications were previously found by determining the active ingredient in traditional treatments. As a result, drug discovery is the initial stage in identifying possible innovative medications and their therapeutic purposes. The bioavailability, effectiveness, potency, and toxicity of pharmaceuticals are now being assessed using new criteria.

Artificial intelligence has been widely used in the healthcare industry, particularly in the discovery of new medications. This can discover therapeutic targets, and it plays a key role in quickly identifying, producing, detecting, and screening small compounds. Furthermore, due to the advantages of adopting sophisticated techniques over traditional procedures, the market is predicted to increase at an exponential rate during the forecast period. Furthermore, an increasing number of industry alliances and partnerships are driving the market. Furthermore, artificial intelligence minimizes the cost and time spent in the drug discovery process, boosting the market growth. However, the market's expansion is hampered by a scarcity of trained individuals and data sets in the field of drug discovery. On the contrary, as people become more aware of artificial intelligence, manufacturers in the artificial intelligence for medication discovery and development market are projected to benefit significantly.

Covid-19 Impact on AI Drug Discovery & Screening Market

The ongoing Covid-19 epidemic has put a strain on existing healthcare systems and fuelled demand for new medicine remedies, prompting pharmaceutical companies to use AI-powered solutions in clinical trials and accelerate drug development both during and after the pandemic.

The COVID-19 pandemic has altered the landscape of the pharmaceutical industry, with substantial consequences for the full innovation and manufacturing value chain. During the epidemic, the number of patents has substantially decreased. The pharma industry's revenue has decreased substantially, and the number of employees has decreased overall.

MARKET DRIVERS

An increase in the number of cancer and other disease cases is estimated to boost the market growth.

Today Cancer has become one of the most common causes of mortality worldwide. Artificial Intelligence can assist researchers to understand how cancer cells acquire resistance to anticancer treatments in this area. Findings like these can assist researchers in creating and developing medications that are appropriate for the market. Furthermore, the significant need for medications to treat serious cancer is a factor that is helping AI in drug discovery grow.

Increased AI research and development activities are propelling market growth.

The market for artificial intelligence in drug research and development is booming, thanks to an increase in collaborations and cross-industry alliances. The importance of AI in medication discovery, as well as substantial financing for AI research and development, are anticipated to drive market expansion. Another factor boosting market demand is rising awareness of artificial intelligence and the significant potential in markets such as China and India.

MARKET RESTRAINTS

Market expansion in low-income countries is hampered by a lack of advanced instruments.

Artificial intelligence techniques may not be able to deal with the massive data sets available for drug development in pharmaceutical corporations, which contain millions of chemicals. Soon, this is predicted to stifle the growth of artificial intelligence in the drug discovery business.

The expensive cost of AI integration is limiting market expansion.

Artificial intelligence (AI) in the drug development market would be challenged by high costs associated with technology and technological restrictions. During the projection period of 2023 - 2030, however, a scarcity of skilled professionals and a lack of awareness will serve as a restraint, slowing the market's growth pace.

AI Drug Discovery & Screening MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

40.8% |

|

Segments Covered |

By Application, Therapeutics, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

IBM, Microsoft, Atomwise Inc., Cloud pharmaceuticals, Benevolent AI, BIO AGE |

This research report based on AI Drug Discovery & Screening Market is segmented and sub-segmented by application, Therapeutics, and region.

AI Drug Discovery & Screening by application

- Drug Optimization & Repurposing

- Preclinical Testing

- Other

In 2021, the drug optimization and repurposing segment had the highest revenue share of nearly 50.0 percent, based on application. To evaluate undesirable drug effects and the overall efficacy of the drug, advanced AI systems such as Deep Learning (DL) and drug modeling can be applied. Advances in AI technology have also made it easier to research and compare medications, as well as repurpose them into more effective forms with fewer adverse effects and increased overall efficacy. This strategy is being utilized by the pharmaceutical industry to improve existing pharmaceuticals and to use them for different indications than they were previously used for, lowering development costs.

Another application of AI in drug development that is emerging at a rapid rate in preclinical testing. Manually selecting individuals based on their medical history and appropriateness for the trial can take a long time, but AI algorithms and associated technologies can shorten the drug's total clinical timeline. Based on genome-specific data, predictive machine learning algorithms can also help identify lead compounds and patient populations. Amplion employs its AI technology to carefully select biomarkers and assist its researchers in recruiting relevant patients and selecting the appropriate biomarkers, decreasing clinical study timelines.

AI Drug Discovery & Screening by therapeutics

- Oncology

- Neurodegenerative Diseases

- Cardiovascular Diseases

- Metabolic Diseases

- Infectious Diseases

- Others

In 2021, the oncology sub-segment had the highest revenue share of more than 20.0 percent. Because human mistake is common in disease diagnosis, AI systems can help with disease detection early on. In recent years, AI has improved its accuracy in detecting diseases. In this circumstance, earlier identification with the help of AI systems can prove to be an asset. Lung cancer is typically identified at later stages when survival rates are very low. A Northwestern University researcher was able to accurately detect lung cancer in scans that radiologists would have missed. By building on existing AI systems, which are meant to scan through massive data sets and generate relevant conclusions, AI can be utilized to give individualized treatments to patients. Scans, in combination with genetic sequences and patient histories, can be used to detect tumors early and to administer therapy tailored to the patients' needs.

From 2023 - 2030, the infectious diseases category is predicted to be the fastest-growing application segment. Artificial intelligence (AI) and related platforms such as the Internet of Things (IoT) are being used to better understand infectious illnesses, their transmission, and infection mechanisms, as well as to improve vaccine creation. These platforms rely on a network of linked devices, such as smartphones and other medical devices, to collect data that may be used to better understand lifestyle trends and anomalies, as well as to research diseases. In light of the current scenario, developing strategies for detecting infectious diseases has become increasingly important.

AI Drug Discovery & Screening by region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

In 2021, North America had the highest revenue share of over 55.0 percent. The United States has been at the forefront of AI technology since its inception. IBM won a quiz game called 'Jeopardy' using their supercomputer 'Watson,' which led to the business development of the idea of AI since then. AI has become a big component of the IT industry, and it's being used all over the place, including in the pharmaceutical industry. Major American IT companies have partnered with prestigious institutes to accelerate medication discovery, design, and repurposing. They're also utilizing AI to research diseases and draw useful conclusions that will help with disease management.

From 2023 - 2030, the APAC market is predicted to grow at the quickest rate. AI is also being used by developing countries in the Asia Pacific to better understand diseases and improve drug research. Intuition Systems, an AI firm based in India, has partnered with Lantern Pharma on medication discovery and biomarker identification. Other AI businesses like Niramai and Sigtuple are working to improve healthcare by speeding up drug research and better identifying target proteins and biomarkers.

AI Drug Discovery & Screening by company

The need to find better treatments faster is boosting AI adoption in the pharmaceutical industry for illness research and drug development in general. Major IT companies are stepping up their efforts to speed up medication discovery. Corporations such as

- IBM

- Microsoft

- Atomwise Inc.

- Cloud pharmaceuticals

- Benevolent AI

- BIO AGE

control the majority of the global market share. Collaborations between tech businesses and academic and research institutions are providing the impetus for AI adoption in the pharmaceutical industry as a whole to grow. Better pharmaceuticals with less adverse effects can be developed, and diseases can be researched more quickly and thoroughly to uncover essential solutions with AI and related platforms. IBM Watson, Exscientia, GNS Healthcare, Alphabet (DeepMind), Benevolent AI, BioSymetrics, Euretos, Berg Health, Atomwise Intro, Cyclica, and others are some of the leading competitors in the worldwide artificial intelligence in the drug development industry.

RECENT DEVELOPMENTS IN THE AI Drug Discovery & Screening MARKET IN THE RECENT PAST.

- PRODUCT LAUNCH

In December 2021, Insilico Medicine, a medication development business driven by artificial intelligence (AI), stated that it had dosed the first healthy volunteer in a microdose trial of ISM 001-005. The medication is a small-molecule inhibitor of a biological target discovered by Pharma.AI and designed with AI. The experiment is currently underway in Australia.

In July 2021, Chief.AI, a machine learning platform, announced the launch of a pay-as-you-go AI platform for drug discovery. This platform enables SMEs to acquire affordable access to cutting-edge technology, reducing the hit-or-miss aspect of drug development and allowing for faster and more precise identification of breakthrough therapies.

- COLLABORATIONS

In July 2021, Sanofi, the Paris-based pharmaceutical giant, entered into a research agreement with Exscientia, a company that utilizes artificial intelligence to find novel medication candidates and could be valued at up to $5.2 billion. The agreement represents a watershed moment for artificial intelligence-based drug discovery approaches, which have attracted billions of dollars in investment

in recent years on the promise of searching for novel medications far more efficient and risk-free, but have yet to deliver.

Chapter 1.AI Drug Discovery & Screening Market– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.AI Drug Discovery & Screening Market– Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-13 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.AI Drug Discovery & Screening Market– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.AI Drug Discovery & Screening Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. AI Drug Discovery & Screening Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.AI Drug Discovery & Screening Market– By Application

6.1. Drug Optimization & Repurposing

6.2. Preclinical Testing

6.3. Other

Chapter 7.AI Drug Discovery & Screening Market– By Therapeutics

7.1. Oncology

7.2. Neurodegenerative Diseases

7.3. Cardiovascular Diseases

7.4. Metabolic Diseases

7.5. Infectious Diseases

7.6. Others

Chapter 8.AI Drug Discovery & Screening Market– By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9.AI Drug Discovery & Screening Market– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9. 1. IBM Watson

9.2. Exscientia

9.3. GNS Healthcare

9.4. Alphabet (DeepMind),

9.5. Benevolent AI)

9.6. BioSymetrics

9.7. Euretos

9.8. Berg Health

9.8. Atomwise Intro

9.9. Cyclica

Download Sample

Choose License Type

2500

4250

5250

6900