AI Developer Tools Market Size (2025 – 2030)

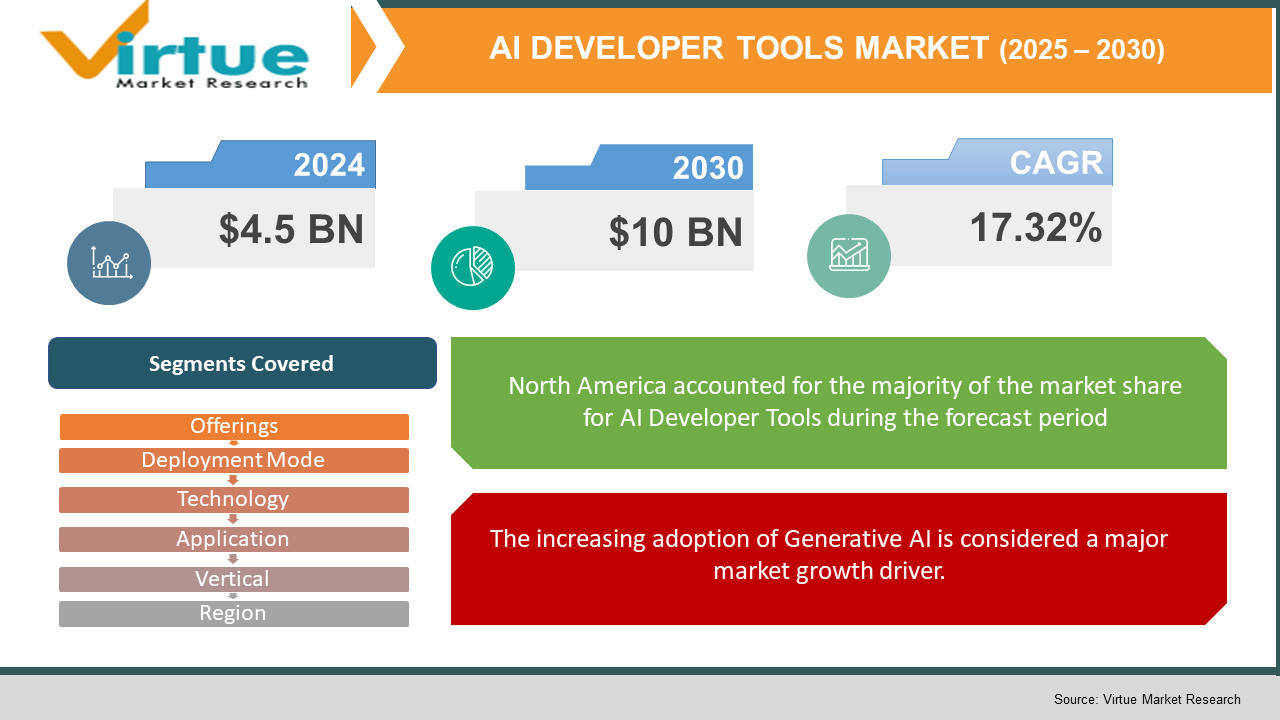

The Global AI Developer Tools Market was valued at USD 4.5 billion and is projected to reach a market size of USD 10 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 17.32%.

This growth reflects companies' drive, aided by AI, to accelerate software development cycles, lower time-to-market, and increase developer output. At about 17 % CAGR, the overall market will more than triple from 2025 to 2030, underscoring how code-level tools are a highly growing subset within the larger AI ecosystem. Integrated into IDEs for function-level suggestions, automated refactoring, and test-generation, generative-AI coding assistants are the fastest-growing segment 54.7% growth reflects the broader generative-AI market. With around 9.7 million developers executing AI workloads in the cloud, making it the main environment for AI code tooling, cloud-based deployments dominate AI developer tool usage. Freeing engineers to concentrate on higher-level design and testing, AI coding assistants can automate up to 40% of regular coding tasks, therefore promoting more thorough enterprise integration of AI dev tools.

Key Market Insights:

- As AI-powered code tools become indispensable in current IDEs, generative-AI frameworks (such as Codex, Code Llama) are the market's fastest-growing technology with an expected 49.7 % CAGR.

- Offering elastic compute, continual updates, and pay-as-you-go pricing that fit with agile DevOps workflows, cloud-based AI code tools with over 55% largest deployment share complement

- Driven by big tech incumbents, North America accounted for 43% of total AI-software investment in 2024; Asia-Pacific currently 32.7% of AI revenue, will soar to 39.9% by 2030 as China and India scale enterprise AI programmes.

AI Developer Tools Market Drivers:

The increasing adoption of Generative AI is considered a major market growth driver.

Enterprises all around are embedding generative-AI copilots, such as GitHub Copilot, AWS CodeWhisperer, and Google Codey, straight into their development processes to automate boilerplate code, execute context-aware completions, and create test cases, resulting in significant productivity increases. 97% of enterprise developers use generative-AI coding tools daily, according to a 2024 GitHub survey, so these assistants have become mission-critical infrastructure instead of experimental novelties. Rapid, eager uptake is highlighted by Accenture's internal research, which found that 81.4% of developers installed Copilot immediately upon licensing and 67% use it at least five days per week. Practically speaking, Copilot users, who make 15% more merges and 8.7% more overall pull requests, experience quicker release cycles and more iterative deployments. The mid-2024 adoption of GitHub Copilot by over 50,000 companies, as per Microsoft's financial results, reflects enterprise-scale deployment. Independent field studies (MIT Sloan) show that less-experienced developers benefit most, up to 55% of task completion speed and knowledge gaps closing have implications for onboarding and upskilling. To aid teams catch earlier and preserve great code quality standards, these copilots are now built into CI/CD pipelines to automatically generate unit tests and do refactoring prior to code reviews.

The Low-code/No-code democratization is empowering this market, acting as a great market driver.

Empowering non-technical "citizen developers" and business analysts to compile applications, low-code and no-code platforms with built-in AI code generators is expanding the AI tools addressable market beyond professional developers. Driven mostly by low- and no-code adoption, the generative-AI coding assistants market, from a base of US$ $25.9 million in 2024 to US$ 97.9 million by 2030 at 24.8% CAGR. Operating with AI recommendations, fast integration, and workflow automation, 40% of their Platform clients combine MuleSoft Composer (a low-code tool). For basic applications and proof-of-concepts, these systems 60–70% cut time-to-market by abstracting away difficult syntax and offering drag-and-drop interfaces with AI-driven code snippets. This democratization is broadening AI tool application to lines of business, sales, marketing, and HR, wherein formerly, obstacles to digital transformation were traditional code-centric techniques. The boundary between "developer" and "business user" gets ever hazier as low-code platforms combine deeper AI-model orchestration, therefore inventing new hybrid jobs and speeding up corporate adoption.

Developer productivity imperatives have led to the shift towards this market.

Driven by investments in AI-powered development and DevOps toolchains, global IT spending is predicted to reach US$ $5.44 trillion in 2025, an 8.3% rise year over year. Despite an increasing demand, a terrible developer skills deficit remains: JetBrains projects 19.6 million professional developers globally in 2024, but the State of the Developer Nation report projects 45 million by 2030. Organizations are under pressure to speed software delivery cycles, and 75% of CIOs identify developer productivity as their top priority for digital-transformation success (IDC, 2024). By automating menial chores, such as boilerplate generation, dependency imports, and code formatting, AI developer tools help engineers to focus on architecture and problem-solving by reducing context-switching overhead. Incorporating AI assistants into chat tools (e.g., Slack/Teams) and IDEs has reduced average time to resolution for everyday support tickets by 30%, therefore a 109% productivity increase. AI technologies assist in preserving coding standards and cut onboarding time for new staff by 40% as development teams grow globally, therefore reducing the impact of high turnover rates in aggressive tech industries.

The rapid digital transformation all around is seen as a great market growth driver.

Now inseparable from AI-driven development are legacy modernization and cloud-migration strategies; 67% of digital-transformation leaders cite AI code-review and refactoring as essential de-risking capabilities. Maturing DevOps and MLOps pipelines include AI technologies—automated security scans, performance-tuning bots, and compliance linters—guaranteeing that code satisfies quality and regulatory standards before production deliveries. By 2026, Forrester predicts—40% of businesses will use AI to automatically remediate common security flaws in code, reducing critical security findings by 25% on average. With 55% of worldwide R&D organizations standardizing on such platforms by 2025, the rise of remote and distributed teams has increased demand for collaborative, cloud-native IDEs with integrated AI help. AI code-assistants with integrated policy engines produce audit-ready code snippets as compliance standards (GDPR, HIPAA, PCI-DSS) tighten, therefore reducing preparation time for compliance audits by as much as 50%. Companies that include AI solutions in their CI/CD toolchains have 30% faster average time to deployment for new features, hence proving that AI-driven development is now a critical component of digital-transformation success.

AI Developer Tools Market Restraints and Challenges:

The integration of this system is complex, posing a challenge for the market.

In highly regulated sectors like aerospace, finance, and healthcare, where every line of code must comply with industry-specific standards and safety guidelines, AI code-generation tools often find it difficult to meet the exacting demands. In aerospace, for instance, autogenerated code must pass DO-178C certification, necessitating specialized model fine-tuning and manual review by avionics engineers. Similarly, financial services demand exact compliance with MiFID II and Basel III, requiring AI tools trained on proprietary transaction-level datasets that are seldom publicly available. Healthcare deployments face complex FDA and MHRA regulations: AI assistants must guarantee patient-data confidentiality and produce code that aligns with clinical-decision-support validation frameworks. Off-the-shelf copilots lack the requisite ontology knowledge, such as HIPAA privacy rules or SWIFT messaging formats, forcing enterprises into costly professional-services engagements to build custom plugins. Slowing return on investment and discouraging smaller businesses from use, these customized integrations might represent 40–60% of total project costs. Therefore, many leaders in regulated industries create multi-vendor proof-of-concept consortia to help stakeholders share integration burden and distribute risk.

The risk related to data privacy and complex rules and regulations is a challenge faced by this market.

Under GDPR, training on personal data demands either explicit permission or a strong legal basis, therefore complicating generative-AI model retraining processes and vendor selection. Strict global data-protection laws, GDPR in Europe, CCPA in California, and the developing EU AI Act impose severe constraints on AI tool vendors regarding training-data origin, inference-log retention, and IP ownership. Beginning on August 1, 2024, the EU AI Act classifies AI developer tools as "general-purpose AI" liable to transparency rules in 12 months and high-risk applications in 36 months, therefore urging companies to perform risk assessments and revise vendor contracts well before deadlines. As in-house counsel and outside consultants map tool capabilities against regulatory checklists, Osborne Clarke notes that compliance planning and legal reviews now add 8–12 weeks to procurement cycles. In the U.S., CCPA's wide definition of "personal information" covers telemetry logs and code snippets, thereby requiring suppliers of AI tools to incorporate user-opt-out and data-minimization functions. Given that GDPR fines may go up to €20 million or 4% of annual global turnover, whichever is higher, non-compliance has serious consequences, and regulatory risk is a board-level concern in choosing AI partners. Including artificial intelligence code assistants into existing DevOps processes often seems complicated, with compatibility and governance challenges.

The integration with legacy CI/CD Pipelines is difficult and complex, acting as a major challenge for this market.

Custom connectors are needed to connect with cloud-hosted AI services, and many legacy CI/CD configurations depend on on-premise Jenkins, TeamCity, or Azure DevOps servers predating RESTful API best practices. Even small pipeline adjustments, such as branch-naming conventions or build-agent upgrades, can break AI tool interfaces without a centralized API-governance layer, causing cascading failures and mandatory rollbacks. With 65% of integration problems resulting from mismatched data schemas and incorrect authentication configurations, Integrass warns that, per device, more than 100 hours of middleware are required. Additionally complicating matters and adding maintenance burden is the need for security and compliance scans, critical in regulated settings, to be re-orchestrated via AI-aware plugins to prevent bypassing policy gates. Still, ''low-effort'' refactoring bots require wrapping in Docker containers to fit with current container-registry processes, therefore increasing operational friction. Teams usually delay AI-tool rollout until significant pipeline refactors, which contrasts with agile update cadences and reduces the perceived urgency of AI value.

The total cost related to the ownership is very high, posing a huge challenge for the market.

Cloud-native SaaS pricing reduces initial capital expenditures; yet, the compute-intensive character of AI developer tools pushes Opex from per-user licenses, subscription fees, and metered inference charges. Advanced LLMs' inference expenses can run over US$ 3,500 every single benchmark query on high-end versions, according to Business Insider. This forces companies to use usage-based pricing to remain profitable. Small businesses and startups without volume discounts encounter subscription levels combining AI-model licenses with professional-services retainers, therefore increasing yearly expenditure for small teams to USD 250K–500 K. Every new AI-model upgrade might also double GPU-hour usage and spur significant overage fees for bursty CI/CD pipelines. Organizations also have to plan for continuous model-retraining sessions, which use cloud credits and data-science personnel, usually not recorded in the first TCO estimates. In reaction, some companies provide community editions and tiered usage limits, but these usually lack business features, therefore, users must weigh cost versus usefulness in mission-critical contexts.

AI Developer Tools Market Opportunities:

The emerging economies, like the Asia-Pacific region, present a great growth opportunity for the market.

Currently accounting for 32.7 % of world AI software sales, the Asia-Pacific area is projected to capture 39.9 % by 2030, with China alone expected to provide two-thirds (US$ $156.18 billion). Government initiatives, China's AI development plans, and India's Digital India programme that subsidize AI research, incubators, and startup accelerators drive this boom. They help to create local ecosystems ready for specialized developer tools. With a 42.6 % CAGR, China's larger AI market is forecast to reach US$ $206.6 billion by 2030, therefore supporting demand for developer platforms geared at artificial intelligence. The region's focus on multilingual support and local data regulations has produced custom-made AI-dev solutions, such as Japanese-language code analyzers and Korean-optimized test-case generators, promoting greater company involvement throughout Southeast Asia. Additionally, UNCTAD forecasts the global AI industry to reach US$ $4.8 trillion by 2033, implying that developing nations may use frontier-tech investments to grab a significant portion of this expansion. Localized SaaS AI-dev offerings will guarantee low-latency, data-sovereign deployments for startups and government initiatives alike as hyperscalers grow cloud and edge-AI infrastructure in areas such as India, Thailand, and Indonesia.

Startup adoption via SaaS is seen as an opportunity for the market to expand its operations.

In small and new businesses, subscription-based, partner-delivered IT models are pushing AI developer tools penetration. Canalys projects worldwide IT spending of US$ 5.44 trillion in 2025, with partner-delivered IT-SaaS-and-managed services accounting for 70 % of total budgets. Small companies can now choose pay-as-you-go pricing that scales with developer headcount and onboard AI code assistants (e.g., Copilot, DeepCode) without large upfront investments. Canalys also forecasts a 19 % annual increase in worldwide cloud-infrastructure spending in 2025, driven mostly by AI workloads, further emphasizing how cloud-native SaaS solutions fit with startup-friendly Opex models. SaaS AI-dev platforms remove the need for in-house GPU clusters by offloading compute-intensive model inference to hyperscalers, therefore lowering TCO and technical complexity. Furthermore, providing turnkey solutions that speed time-to-value for resource-constrained teams, partner ecosystems comprising ISVs, system integrators, and MSPs, are combining AI-tool licensing with integration and training services. In areas with active startup ecosystems (e.g., Tel Aviv, Bengaluru, Berlin), these trends are especially strong since incubators and VCs promote fast prototyping using AI-powered code generation and MLOps toolkits.

Open-source and innovation in the community have helped the market to grow.

Open-source LLMs—especially Meta's Code Llama—have democratized access to advanced code-generation capabilities. Released free for research and commercial usage, fine-tuned for Python and instruction prompts, Meta released Code Llama, challenging proprietary incumbents. With 20 million downloads in a single recent month and 350 million total downloads since its introduction, Llama models clearly show great community adoption. Plugin architectures (e.g., Llama-Code-Plugins) addressing niche developer demands, from PHP code snippets to domain-specific static analysis, encourage rapid feature innovation under the open-source ethos. Universities and research laboratories use Code Llama for experiments, intake improvements back into the community, and accelerate model-fine-tuning cycles. Large-model architectures are preserved while ensuring data-sovereign training by ecosystem projects, like open-source LLM-ops frameworks, that enable teams to deploy on-premises. Community-driven benchmarks and interoperable toolkits reduce vendor lock-in, allowing startups to switch seamlessly between hosted and self-managed deployments based on project needs.

Vertical-specific solutions for important industries have given this market a new value.

New value is being found through tailored AI developer tools for important sectors. The BFSI vertical led all others, with AI in finance markets projected to be US$ $38.36 billion in 2024 and rising at 30.6 % CAGR, therefore driving appetite for secure-by-design code assistants and compliance linters. AI-in-testing platforms report that BFSI accounts for 25.7 % of global usage, reflecting banking and insurance firms' reliance on rigorous functional, performance, and security testing. More broadly, the vertical AI market, spanning healthcare, automotive, and manufacturing, was valued at US$ $10.2 billion in 2024 and is slated to expand at 21.6 % CAGR, therefore underscoring strong demand for domain-specialized tooling. Vendors differentiate by embedding rule engines, such as AML-specific patterns for finance or safety-critical templates for aerospace, that ensure auto-generated code meets sector regulations and reduces manual audit efforts by 30 %. For healthcare, AI dev tools incorporate HIPAA-aware data anonymization pipelines and medical-terminology linters, while manufacturing solutions include code generators optimized for PLC programming languages. Vertical-focused AI development suites are set to take the majority of corporate spending by 2030 as businesses want turnkey, compliance-guaranteed deployments.

AI DEVELOPER TOOLS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

17.32% |

|

Segments Covered |

By Product, Type, Consumption, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Google, Microsoft, Amazon Web Services, Salesforce, Meta, OpenAI, Datadog, Tabnine, and CodiumAI. |

AI Developer Tools Market Segmentation:

AI Developer Tools Market Segmentation: By Offerings

- Tools

- Services

The tools segment dominates the market, with revenues of US$ 3,728.1 million (≈ 76.7 % of the US$ 4.86 B total). Tools combine AI-powered optimization tools, analysis, debugging, and code generation. Fast adoption of stand-alone code-review bots and IDE-embedded copilots (e.g., GitHub Copilot). The services segment is the fastest-growing. Complex enterprise deployments and continuous consulting demands will drive the services segment's expected 27.9% CAGR, outpacing tools at 24.4%. Integration, customisation, training, and assistance with professional and managed services. Bespoke model fine-tuning, compliance validation, and end-to-end MLOps implementations are in great demand.

AI Developer Tools Market Segmentation: By Deployment Mode

- Cloud-based

- On-premises

The cloud-based segment dominates this market, driven by simple scaling and low IT overhead; over 55% of AI code-tool deployments were cloud-based. SaaS systems provide subscription pricing, elastic compute, and simple upgrades. Matches agile DevOps approaches and Opex-friendly budgeting. The On-premises segment is the fastest-growing segment of the market. Forecast to capture 11.35 % share by 2030 (up from a low base), as regulated industries seek data sovereignty and bespoke integrations. Installed within customer firewalls for maximal security/control. Heightened privacy regulations (GDPR, HIPAA) and corporate mandates drive on-premises adoption.

AI Developer Tools Market Segmentation: By Technology

- Machine Learning

- Natural Language Processing

- Generative AI

Here, the Machine Learning segment dominates the market, ML holds the largest share, underpinning most current AI-assisted coding features. Traditional predictive models and algorithmic code analysis tools. Whereas the Generative AI segment is the fastest-growing segment, directly driving AI code-tool adoption, the broader AI-software industry is projected to have a 49.7% CAGR. LLM-based copilots that autonomously produce code, refactor, and generate tests. Breakthroughs in LLMs (e.g., Code Llama, GPT-4) greatly enhance recommendation relevance and lower manual coding.

The NLP market is defined by moderate CAGR, usually combined with ML or generative solutions. Natural Language Processing (NLP) is a tool that interprets human prompts for documentation and code comments.

AI Developer Tools Market Segmentation: By Application

- Data Science & Machine Learning

- Cloud Services & DevOps

- Web Development

- Mobile App & Gaming

The Data Science & ML section dominates the market, and the Cloud Services & DevOps segment is the fastest-growing in the market. Data science and machine learning automate data preprocessing, model prototyping, and Jupyter-style notebook coding. As data teams use AI tools for quick experimentation and augmentation, this captures the largest revenue share. Driven by DevOps adoption, CI/CD tool integrations are projected to grow fastest, aligning with the rise in cloud-native development and automation needs. Integrations with CI/CD pipelines, automated testing, and infrastructure-as-code generation. Demand for end-to-end automation pushes teams to embed AI within build/test/deploy workflows.

AI-assisted generation of frontend/backend code snippets, REST-API scaffolding is strong, but outpaced by data-science and DevOps use cases. Mobile App and Gaming segment includes niche adoption for UI prototyping and scripting; lesser percentages with medium growth.

AI Developer Tools Market Segmentation: By Vertical

- BFSI

- IT & Telecom

- Healthcare & Life Sciences

- Manufacturing

The BFSI segment is said to dominate the market. Vertical-wise, BFSI has the biggest share (≈ 17–25 %) due to heavy digital-banking automation and strict security/regulatory demands. Code tools used for fraud-detection scripts, compliance linters, and high-frequency-trading algorithm generation. The IT & Telecom segment is the fastest-growing segment, surging demand for telecom-automation scripts and 5 G-network management code. High volumes of new software projects and network-automation code generation are the reasons for this. Ongoing code-tool integration is driven by network upgrades and microservices adoption.

Strong tailwinds for healthcare-specific code tools are indicated by the broader AI in Healthcare market growth at 38.5 % CAGR. Tools for medical-coding macros, data-pipeline scripts, and compliance audit code come under this segment. Moderate ownership; adoption is linked to vertical-specific compliance and automation requirements that come under the manufacturing segment.

AI Developer Tools Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America has emerged as the leading region for this market, over 33% of the market, driven by strong R&D investment and well-established DevOps ecosystems. The U.S. and Canada account for the lion's share. The Asia-Pacific region is the fastest-growing for this market, which is due to governments strongly subsidizing cloud-AI infrastructure with a 23.2% CAGR in APAC AI code-tools. Rapid hyperscaler expansion, localised language support, and developer-community investments.

When it comes to Europe, there is a high emphasis on data privacy, particularly in the UK, Germany, and the Nordics. Growth is steady (≈ 21–24 % CAGR), supported by EU AI Act compliance. South America and the MEA regions are emerging markets with less current share but good double-digit growth outlooks.

COVID-19 Impact Analysis on the Global AI Developer Tools Market:

The COVID-19 epidemic is driving remote work and cloud adoption, which forces companies to fast-track digital-transformation roadmaps, stressing DevOps and collaboration tools, essential prerequisites for AI developer tools integration. Early budget freezes resulted from hardware and software lockdown-related delays in Q2 2020, but by Q3, remote-development productivity tools, including AI-code assistants, had 25 % higher adoption rates as dispersed teams sought automated debugging and code-review capabilities. Driven by Microsoft's remote-work incentives, leading platforms like GitHub Copilot reported 30 % install-base development in 2021. The epidemic made clear the need for scalable, cloud-native DevOps pipelines, which spurred long-term investments in AI-driven developer productivity suites that outdistance pre-COVID budgets.

Latest Trends/ Developments:

Embed LLMs straight into IDEs using platforms like GitHub Copilot, AWS CodeWhisperer, and Google Codey to provide function-level recommendations and automated refactoring.

Advanced code-generation is democratised by Meta's Code Llama and other community-driven models, which also drive plugin ecosystems and joint fine-tuning.

AI technologies today include Jenkins, GitHub Actions, and Kubernetes to automate testing, security scans, and performance profiling within continuous-integration pipelines.

To satisfy tough industry standards and speed time-to-value, vendors are introducing sector-specific code-assistants (e.g., secure-by-design for BFSI, compliance linters for healthcare).

Key Players:

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Amazon Web Services, Inc.

- Salesforce, Inc.

- Meta Platforms, Inc.

- OpenAI, L.L.C.

- Datadog, Inc.

- Tabnine Inc.

- CodiumAI

Chapter 1 AI Developer Tools Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2 AI Developer Tools Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3 AI Developer Tools Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4 AI Developer Tools Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5 AI Developer Tools Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6 AI Developer Tools Market – By Offerings

6.1 Introduction/Key Findings

6.2 Tools

6.3 Services

6.4 Y-O-Y Growth trend Analysis By Offerings

6.5 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7 AI Developer Tools Market – By Application

7.1 Introduction/Key Findings

7.2 Data Science & Machine Learning

7.3 Cloud Services & DevOps

7.4 Web Development

7.5 Mobile App & Gaming

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8 AI Developer Tools Market – By Vertical

8.1 Introduction/Key Findings

8.2 BFSI

8.3 IT & Telecom

8.4 Healthcare & Life Sciences

8.5 Manufacturing

8.6 Y-O-Y Growth trend Analysis Vertical

8.7 Absolute $ Opportunity Analysis Vertical , 2025-2030

Chapter 9 AI Developer Tools Market – By Technology

9.1 Introduction/Key Findings

9.2 Machine Learning

9.3 Natural Language Processing

9.4 Generative AI

9.5 Y-O-Y Growth trend Analysis Technology

9.6 Absolute $ Opportunity Analysis Technology , 2025-2030

Chapter 10 AI Developer Tools Market – By Deployment Mode

10.1 Introduction/Key Findings

10.2 Cloud-based

10.3 On-premises

10.4 Y-O-Y Growth trend Analysis Deployment Mode

10.5 Absolute $ Opportunity Analysis Deployment Mode , 2025-2030

Chapter 11 AI Developer Tools Market, By Geography – Market Size, Forecast, Trends & Insights

11.1. North America

11.1.1. By Country

11.1.1.1. U.S.A.

11.1.1.2. Canada

11.1.1.3. Mexico

11.1.2. By Deployment Mode

11.1.3. By Technology

11.1.4. By Vertical

11.1.5. Application

11.1.6. Offerings

11.1.7. Countries & Segments - Market Attractiveness Analysis

11.2. Europe

11.2.1. By Country

11.2.1.1. U.K.

11.2.1.2. Germany

11.2.1.3. France

11.2.1.4. Italy

11.2.1.5. Spain

11.2.1.6. Rest of Europe

11.2.2. By Deployment Mode

11.2.3. By Technology

11.2.4. By Vertical

11.2.5. Application

11.2.6. Offerings

11.2.7. Countries & Segments - Market Attractiveness Analysis

11.3. Asia Pacific

11.3.1. By Country

11.3.1.2. China

11.3.1.2. Japan

11.3.1.3. South Korea

11.3.1.4. India

11.3.1.5. Australia & New Zealand

11.3.1.6. Rest of Asia-Pacific

11.3.2. By Deployment Mode

11.3.3. By Technology

11.3.4. By Vertical

11.3.5. Application

11.3.6. Offerings

11.3.7. Countries & Segments - Market Attractiveness Analysis

11.4. South America

11.4.1. By Country

11.4.1.1. Brazil

11.4.1.2. Argentina

11.4.1.3. Colombia

11.4.1.4. Chile

11.4.1.5. Rest of South America

11.4.2. By Deployment Mode

11.4.3. By Technology

11.4.4. By Vertical

11.4.5. Application

11.4.6. Offerings

11.4.7. Countries & Segments - Market Attractiveness Analysis

11.5. Middle East & Africa

11.5.1. By Country

11.5.1.1. United Arab Emirates (UAE)

11.5.1.2. Saudi Arabia

11.5.1.3. Qatar

11.5.1.4. Israel

11.5.1.5. South Africa

11.5.1.6. Nigeria

11.5.1.7. Kenya

11.5.1.11. Egypt

11.5.1.11. Rest of MEA

11.5.2. By Deployment Mode

11.5.3. By Technology

11.5.4. By Vertical

11.6.5. Application

11.5.6. Offerings

11.5.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12 AI Developer Tools Market – Company Profiles – (Overview, Offerings Portfolio, Financials, Strategies & Developments)

12.1 IBM Corporation

12.2 Microsoft Corporation

12.3 Google LLC

12.4 Amazon Web Services, Inc.

12.5 Salesforce, Inc.

12.6 Meta Platforms, Inc.

12.7 OpenAI, L.L.C.

12.8 Datadog, Inc.

12.9 Tabnine Inc.

12.10 CodiumAI

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

At a 17.32 % CAGR, the market is expected to increase from US$ $ 4.5 billion in 2025 to US$ $10 billion by 2030.

Data Science and Machine Learning, Cloud Services and DevOps, Web Development, Mobile App Development, and Gaming and Embedded Systems are among the major application scenarios.

With 43% of AI-software investments in 2024, North America leads; Asia-Pacific will grow fastest from 32.7% of income in 2024 to 39.9% by 2030.

Driven by ease of use and quick prototyping, low-code/no-code platforms with AI code-generating capabilities have democratized development; the Generative AI Coding Assistants segment is projected to reach US$ 97.9 billion by 2030.

Key competitors for this market include Google, Microsoft, Amazon Web Services, Salesforce, Meta, OpenAI, Datadog, Tabnine, and CodiumAI.