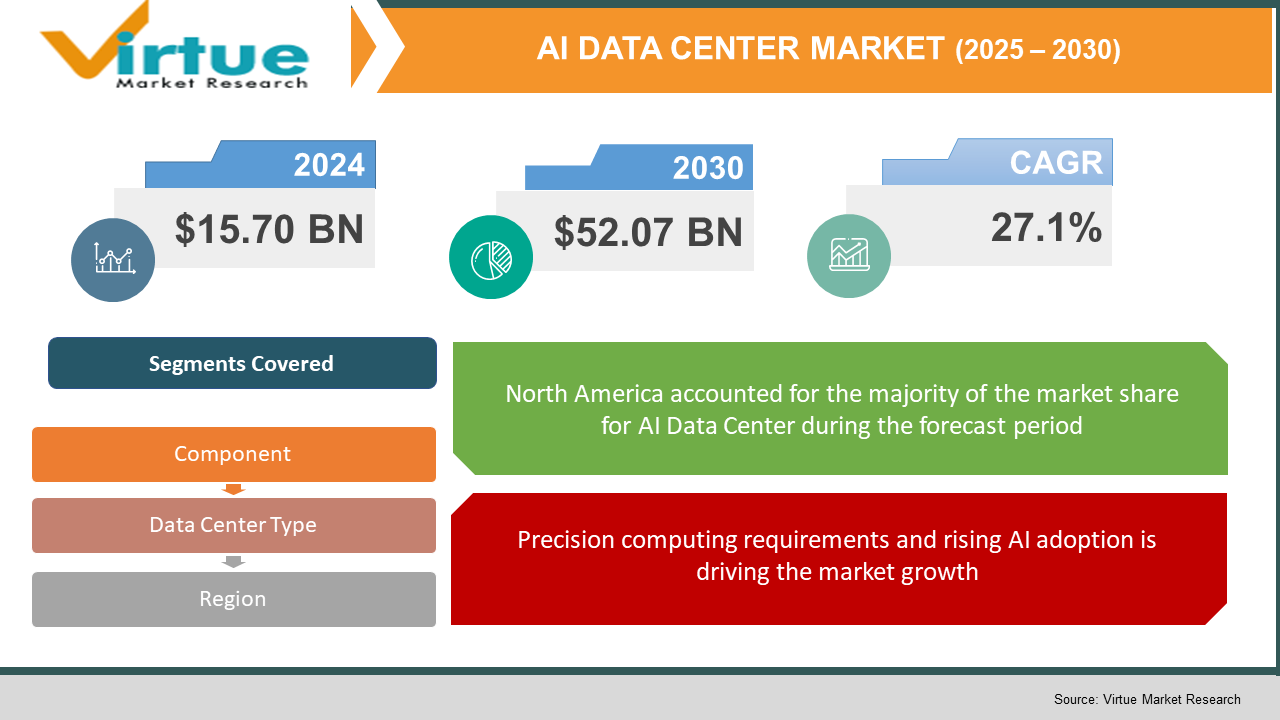

AI Data Center Market Size (2025-2030)

The Global AI Data Center Market was valued at USD 15.70 billion in 2024 and is projected to grow at a CAGR of approximately 27.1% from 2025 to 2030. By 2030, the market is expected to reach USD 52.07 billion.

The AI data center market includes infrastructure, hardware, software, and services specifically tailored to support artificial intelligence workloads, including training and inference using GPUs, TPUs, and related accelerators. This rapid growth is driven by the explosive demand for generative AI, machine learning workloads, cloud-based services, and big data analytics. Hyperscale and enterprise data centers are being upgraded or built from the ground up with capabilities to handle high-density computing, liquid cooling, and power management systems. Major investments by technology giants like Google, Microsoft, Amazon, Meta, NVIDIA, and Oracle are reinforcing the strategic importance of AI data centers. Additionally, sectors such as BFSI are adopting AI at scale, pressing for data center capacity expansion. Overall, this specialized segment of the broader data center ecosystem is rapidly achieving standalone prominence.

Key market insights:

The hardware component dominates revenue, accounting for over 55% of the market in 2024, driven by GPU‑centric systems.

BFSI holds more than 20% of AI data center usage in 2024, reflecting heavy investment in fraud detection, customer analytics, and trading platforms.

North America leads with over 40% global market share in 2024, with revenue around USD 5.7 billion.

Asia‑Pacific is the fastest‑growing region, with revenue in 2024 of USD 3,236.6 million and projected CAGR of 33.2% through 2030.

The US market alone generated USD 3.2 billion in 2024 and is forecast to reach USD 12.3 billion by 2030 at a CAGR of 25.3%.

AI data center investments are part of a larger trend; global spend on data center systems reached nearly USD 293 billion in 2024, up 24.1% year‑on‑year.

Hyperscale data centers are expanding to 100+ MW capacity, with some planned facilities up to 1 GW to support AI workloads

Cooling and energy management systems are becoming key focus areas, with innovations in immersion and free‑cooling technologies ranking second in attractiveness after compute solutions

Global AI Data Center Market Drivers

Precision computing requirements and rising AI adoption is driving the market growth

The rapid proliferation of AI models, especially generative large‑language models, has vastly increased demand for robust data center infrastructure. Traditional data centers cannot support the massive parallel processing required for large-scale AI training and inference, pushing organizations to invest in specialized facilities. GPUs and TPUs, which dominate AI workloads, require high power density and performance optimization. Enterprises across industries increasingly rely on AI for tasks ranging from fraud detection to automated manufacturing, prompting hyperscalers and cloud providers to expand capacity. The scale of this expansion is monumental: Bain estimates data center and AI‑related infrastructure will reach USD 1.4 trillion by 2027, with facilities scaled from 50–200 MW to over 1 GW. Gartner forecasts data center system spend hit USD 293 billion in 2024, driven by generative AI demand. This precision computing requirement is compelling all players, from hyperscalers to niche providers, to develop data centers tailored for AI workloads, accelerating market growth.

Energy efficiency and sustainability demands is restricting the market growth

AI data centers consume vast amounts of power and generate significant heat, resulting in rising concerns about energy use, water consumption, and carbon emissions. In 2022, global data center electricity use reached 460 terawatt‑hours—on par with national power consumption by France. Cooling systems, including water‑intensive techniques and direct chip liquid cooling, are being reengineered to reduce environmental impact. Emphasis on renewable energy sourcing, carbon neutrality targets, and sustainable certifications are reshaping design priorities. Companies like Meta and Google are expanding facilities in cooler climates or marine environments to leverage free cooling techniques. Moreover, policymaking in the EU and US is beginning to reflect environmental directives—e.g., EU’s InvestAI includes energy‑focused funding, and some US states now mandate water and energy reporting for data centers. These pressures are prompting sectors to innovate in power‑efficient IT architectures, immersed cooling, and intelligent energy management—all driving market evolution.

Cloudification and enterprise digital transformation is driving the market growth

As enterprises move critical AI workloads to the cloud, demand for third‑party AI data centers is accelerating. Cloud providers like AWS, Azure, Google Cloud, and Oracle Cloud are expanding hyperscale facilities equipped with AI‑optimized hardware to meet enterprise SLAs for AI model deployment. Growth in cloud‑based AI mirrors increased IT modernization—capex for data center systems is projected to exceed USD 293 billion in 2024. Businesses in healthcare, manufacturing, retail, telecom, and government sectors are migrating to cloud AI services, necessitating global data center infrastructure. The U.S. alone had USD 5.38 billion in AI data center revenue in 2024. Moreover, edge AI deployments are driving demand for smaller regional facilities, while private AI data centers serve sovereign and regulated sectors. Overall, the accelerating adoption of AI in enterprise transformation is fuelling a sustained need for AI-ready cloud infrastructure.

Global AI Data Center Market Challenges and Restraints

Escalating operational costs and infrastructure complexity is restricting the market growth

Building and operating AI data centers involves substantial financial commitments. Hyperscale facilities require 100 MW+ power envelopes, sophisticated cooling systems, and redundant infrastructure which significantly increases capex and opex. Deployments with direct‑to‑chip and immersion cooling, liquid networking, and dynamic temperature control technologies—not standard in legacy data centers—raise costs further. Energy bills are surging; data centers consumed 460 TWh in 2022. Moreover, extended grid connection timelines—up to seven years in Northern Virginia—delay deployments and heighten financial risk. The complexity of integrating power management, sustainable energy sourcing, and AI load balancing together with IT operations requires multidisciplinary expertise. Smaller cloud providers and enterprise operators may find it difficult to justify the scale and cost, constraining new entrants and segment expansion.

Regulatory and environmental compliance burdens is restricting the market growth

The environmental footprint of AI data centers, in terms of energy, water usage, and carbon emissions, is attracting attention from policymakers. Freshwater requirements for cooling—potentially billions of cubic meters annually—are prompting restrictions and reporting mandates in regions like Virginia and the EU . In the EU, InvestAI allocates funds specifically for green facilities but accompanying regulations may raise compliance burdens. AI data center builders face evolving frameworks governing energy efficiency, carbon accounting, and waste heat disposal. Failure to comply can lead to fines, construction delays, or facility shutdowns. As governments emphasize sustainable infrastructure, data center operators must invest in renewables, onsite solar and battery storage, green certifications, and carbon offsets. This regulatory complexity introduces uncertainty and raises entry barriers for new players, making regulatory alignment essential for future expansion.

Market opportunities

The AI data center market offers several compelling avenues for growth and disruption. First, scalable and modular edge AI data centers are poised to meet the rising demand for low-latency applications in sectors such as autonomous vehicles, public safety, telecom, and manufacturing. These micro-data centers, often 10–50 MW in size, allow enterprises to deploy AI compute closer to end-users and IoT devices, unlocking new use cases from real-time analytics to robotics. Secondly, the opportunity for carbon-neutral AI data centers is substantial. Combining renewable power procurement, onsite solar installations, immersion cooling, and waste heat recycling can transform high-energy data hubs into sustainable infrastructure. Studies estimate data centers could cut emissions by up to 80% using advanced design methods and digital twin frameworks. Next, investments in AI-optimized power and thermal management solutions—from lithium-ion BESS, UPS systems integrating renewables to plate-based liquid cooling—represent multi-billion dollar adjacencies. Enterprises and hyperscalers are also exploring bespoke AI chips and rack-scale architectures to improve efficiency. Finally, sovereign and regulated sectors in Europe, North America, and Asia are launching public-key AI data centers to ensure secure, compliant local compute—backed by government funding programs like InvestAI . With confluence of demand, regulatory favors, and sustainability pressures, AI data centers are positioned as critical macro infrastructure in the digital economy.

AI DATA CENTER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

27.1% |

|

Segments Covered |

By component, data centre type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AWS, Microsoft, Google, NVIDIA, Intel, Oracle, Equinix, Digital Realty, CyrusOne, and QTS |

AI Data Center Market segmentation

AI Data Center Market segmentation By Component:

• Hardware (GPUs, TPUs, networking, storage)

• Software (AI orchestration, data management, analytics)

• Services (installation, maintenance, consulting)

Hardware is the leading segment in the AI data center market. AI workloads demand high computational power for both training and inference—much of which is dependent on GPUs, TPUs, accelerators, and high-performance networking and storage infrastructure. In 2024, hardware comprised over 55% of the market share. The hardware emphasis is underscored by ongoing enhancements in chip performance and GPU architectures, reflecting both hyperscaler focus and enterprise needs. Investment in immersion cooling, dense rack builds, and custom chip integration further solidifies hardware's primacy. As AI models scale, hardware refresh cycles shorten and compute density climbs. Consequently, hardware spending holds substantial dominance in this burgeoning market.

AI Data Center Market segmentation By Data Center Type:

• Hyperscale AI data centers

• Colocation AI data centers

• Edge AI data centers

• Enterprise and sovereign AI data centers

Hyperscale AI data centers lead in global market value and capacity expansion. Constructed by cloud providers like Amazon, Microsoft, Google, Meta, and Oracle, these facilities typically exceed 100 MW—some reaching 1 GW scale—to manage training and inference workloads across thousands of GPUs. The demand is driven by enterprises migrating AI operations to the cloud and by the hyperscalers’ own internal AI initiatives. Governments and large institutions also sign long-term leases in hyperscale facilities for capacity and resilience. While other types are growing, hyperscale centers account for the bulk of AI-enabled compute, capex, and global footprint, making them the dominant type in this segment.

AI Data Center Market Regional segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Among all regions, North America is the dominant region in the AI data center market. North America captured more than 40% of global market revenue in 2024, with the United States alone generating approximately USD 5.38 billion in AI data center revenue. This leadership is supported by advanced technological infrastructure, comprehensive hyperscale ecosystems, deep capital investment, and a flourishing AI research community centered around Silicon Valley, Seattle, and other tech hubs. The region’s hyperscale operators—AWS, Microsoft, Google, Meta, and others—continue to aggressively expand capacity to meet demand for generative AI services and enterprise ML workloads. Regulatory favorability in many states, supplemented by tax incentives and power purchase agreements like Microsoft’s 20-year deals and Constellation Energy tie-up, further reinforces suitability for large AI data centers. Moreover, digital transformation across BFSI, healthcare, retail, and government sectors in North America is rapidly accelerating AI compute usage. While Asia-Pacific is experiencing the highest growth rates at 33.2% CAGR, it started from a lower base and thus remains smaller in absolute value. Europe, Latin America, and the Middle East are also growing but lack the scale and capital of North America. Consequently, North America maintains its dominance in both revenue and influence in the AI data center domain.

COVID-19 Impact Analysis on the AI Data Center Market

The COVID-19 pandemic triggered a swift shift in enterprise operations, underlining the importance of resilient digital infrastructure and accelerating investment in data centers. Early lockdowns and remote work surges increased demand for cloud services dramatically, pushing hyperscalers to expand data center capacity to meet online learning, telehealth, and remote business continuity needs. This spike in demand spread to specialized AI workloads used for video conferencing enhancements, contact tracing analytics, and telemedicine AI applications—propelling hyperscalers to prioritize AI hardware expansion. Gartner reported a global 24% increase in data center systems spending in 2024, driven partly by AI . While lockdowns briefly slowed on-premises hardware deployments, hyperscale and cloud-centric builds rebounded quickly, with AI capabilities becoming central to enterprise digital strategies. Telecommunication investments in Edge AI data centers also entered the pipeline, as service providers looked to support 5G‑enabled smart cities. The pandemic compelled enterprises to accelerate digital transformation, cementing AI and cloud infrastructure as indispensable. As a result, while COVID-19 introduced initial disruptions, it ultimately accelerated the long‑term trajectory of the AI data center market and reinforced its criticality to business resilience, healthcare, and urban innovation.

Latest trends/Developments

Several key trends are shaping the future trajectory of AI data centers. Liquid immersion cooling is rapidly gaining traction, with major hyperscalers deploying direct-to-chip cooling systems that improve power efficiency and reduce cooling costs—second only to compute hardware in market attractiveness. Renewable energy sourcing is intensifying: YTL Power’s Green Data Center Park in Malaysia is being co-powered by 500 MW of onsite solar to support AI supercomputing. Sovereign AI data centers, built with government backing in the EU through InvestAI and EuroHPC, aim for GPU scale facilities across Europe totaling over 100,000 GPUs per site. Edge data centers (10–50 MW) are gaining momentum to support telecom 5G and autonomous applications requiring low-latency AI at the network edge, complementing the hyperscale narrative. CoreWeave’s expansion into Europe and North America and a USD 1.6 billion Nvidia supercomputer center highlight infrastructure specialization for AI workloads. Investment in AI‑optimized power management and BESS, sustainable cooling, and digital twins for thermal and energy optimization is becoming mainstream. Finally, custom chip architectures and rack-scale systems designed for large-scale AI inference are driving next-generation data center differentiation.

Key Players:

- Amazon Web Services

- Microsoft Corporation

- Google (Alphabet Inc)

- NVIDIA Corporation

- Intel Corporation

- Oracle Corporation

- Equinix, Inc.

- Digital Realty Trust, Inc.

- CyrusOne

- QTS Realty Trust, LLC

Chapter 1. AI Data Center Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. AI DATA CENTER MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. AI DATA CENTER MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. AI DATA CENTER MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. AI DATA CENTER MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. AI DATA CENTER MARKET – By Component

6.1 Introduction/Key Findings

6.2 Hardware (GPUs, TPUs, networking, storage)

6.3 Software (AI orchestration, data management, analytics)

6.4 Services (installation, maintenance, consulting)

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Technology, 2025-2030

Chapter 7. AI DATA CENTER MARKET – By Data Center Type

7.1 Introduction/Key Findings

7.2 Hyperscale AI data centers

7.3 Colocation AI data centers

7.4 Edge AI data centers

7.5 Enterprise and sovereign AI data centers

7.6 Y-O-Y Growth trend Analysis By Data Center Type

7.7 Absolute $ Opportunity Analysis By Data Center Type , 2025-2030

Chapter 8. AI DATA CENTER MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Data Center Type

8.1.3. By Component

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Component

8.2.3. By Data Center Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Component

8.3.3. By Data Center Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Component

8.4.3. By Data Center Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Component

8.5.3. By Data Center Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. AI DATA CENTER MARKET – Company Profiles – (Overview, Component Type , Portfolio, Financials, Strategies & Developments)

9.1 Amazon Web Services

9.2 Microsoft Corporation

9.3 Google (Alphabet Inc)

9.4 NVIDIA Corporation

9.5 Intel Corporation

9.6 Oracle Corporation

9.7 Equinix, Inc.

9.8 Digital Realty Trust, Inc.

9.9 CyrusOne

9.10 QTS Realty Trust, LLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global AI Data Center Market was valued at USD 15.70 billion in 2024 and is projected to grow at a CAGR of approximately 27.1% from 2025 to 2030. By 2030, the market is expected to reach USD 52.07 billion.

Key drivers include AI workload growth, energy efficiency demands, and enterprise cloud transformation

Segments include hardware, software, services by component and hyperscale, colocation, edge, and enterprise by type

North America is dominant, contributing over 40% of global AI data center revenue.

Top players include AWS, Microsoft, Google, NVIDIA, Intel, Oracle, Equinix, Digital Realty, CyrusOne, and QTS.