Agricultural Tractors Market Size (2025 – 2030)

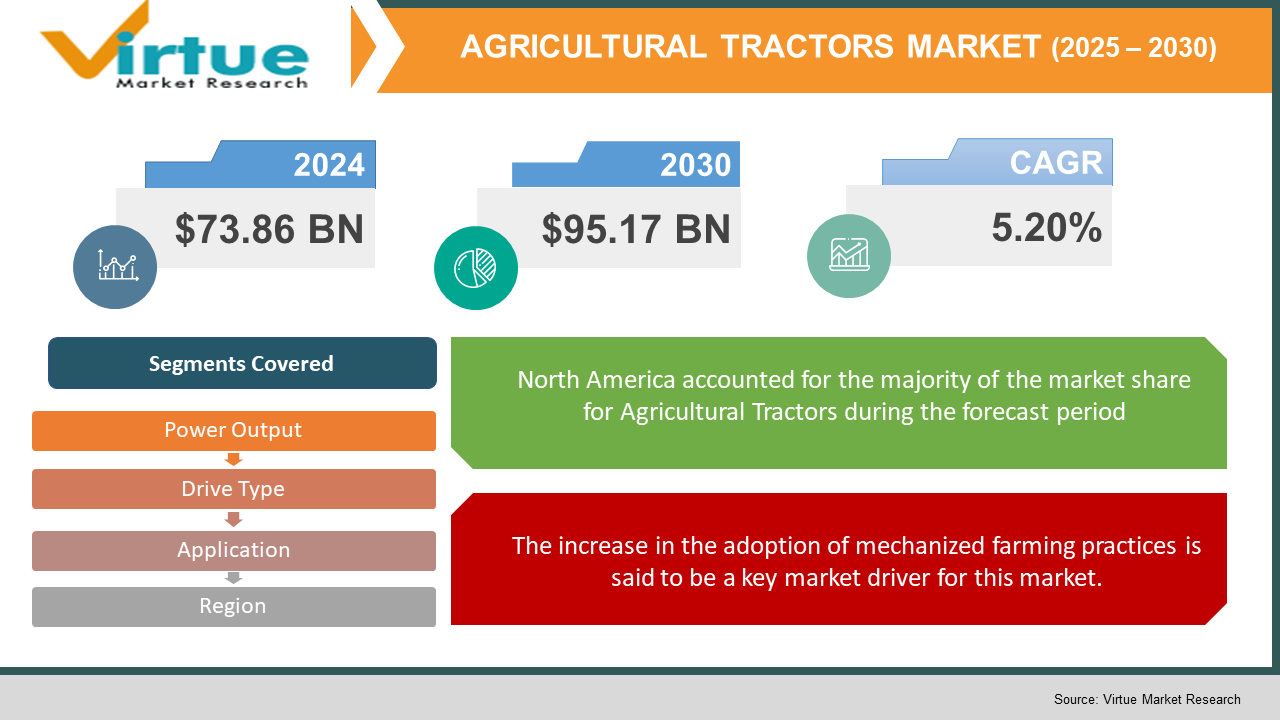

The Global Agricultural Tractors Market was valued at USD 73.86 billion and is projected to reach a market size of USD 95.17 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.20%.

Rising demand for food caused by a fast-growing global population, technical developments, and increasing mechanization in agriculture all contribute to this growth. Labor shortages in agriculture resulting from rural-to-urban migration have caused farmers to turn to machinery like tractors to keep output rising. These workforce deficiencies and environmental effects will be lessened with the advent of independent technology in agriculture. Still, this transformation carries worries about high first costs and possible job loss.

Key Market Insights:

- The use of artificial intelligence (AI) in tractors is improving precision agriculture techniques. For example, artificial intelligence-driven tractors can now map vineyards, analyze data, and assist in intelligent decision-making, hence improving operations and lowering environmental impact.

- Five firms control more than 80% of India's tractor market share; Mahindra and Mahindra lead at 42.5%. This concentration suggests a very competitive market, with major obstacles to entry for fresh participants.

- Government payments and the need to raise agricultural output are driving fast tractor adoption in the Asia-Pacific region, especially in countries like India and China.

- Furthermore, businesses like John Deere are featuring autonomous electric tractors fitted with advanced technology meant to improve output and effectiveness. John Deere introduced a range of autonomous equipment, including battery-electric mowers meant to alleviate labor shortages and lower environmental impact, at the CES 2025 trade event.

Agricultural Tractors Market Drivers:

The increase in the adoption of mechanized farming practices is said to be a key market driver for this market.

To help meet the rising food demand and improve output, farmers all over are increasingly embracing mechanical farming methods. Mechanization speeds up agricultural processes, lowers labor reliance, and improves efficiency. Significantly, economist Hans Binswanger-Mkhize's examination of induced innovation points to the idea that changes in relative factor prices frequently drive technical advances in farming, hence causing improved mechanization.

Rapid innovation in the technical field is considered an important market driver helping the market to grow.

Advanced agricultural tools such as GPS-enabled tractors and autonomous farming equipment are drawing farmers to purchase modern devices. These tools enhance accuracy, effectiveness, and cost-effective labor. For example, precision agriculture methods reduce input dependencies and increase outputs. Studies have shown that significant yield increases are connected with guidance systems, therefore emphasizing the need to introduce them.

Initiatives taken up by governments are a very important market driver.

To encourage modern farming methods, many governments are providing farmers with grants and financial help to buy agricultural equipment, including tractors. Policy reforms, though, could influence these plans. A halt on U. S. federal loans and grants, for instance. Highlighting the sensitivity of the market to government policies inflicted financial disturbances for countryside companies that had invested in machinery based on guaranteed rebates.

Agricultural Tractors Market Restraints and Challenges:

The high levels of initial investment are a great challenge that is faced by the market.

Buying new farm tractors calls for serious funds, which might be a major impediment, especially for small-scale farmers. Modern tractors fitted with sophisticated technology are now more expensive, therefore challenging low-income farmers to buy such machinery. Prolonged use of obsolete equipment caused by this financial obstacle can slow down farming activities and lower output and efficiency.

Modern tractors demand high maintenance costs, acting as a huge market restraint.

Ongoing maintenance and operating costs characterize modern tractors, particularly those linked to advanced technologies. The intricacy of these devices sometimes calls for specialized maintenance work, hence increasing maintenance expenses. Furthermore, under discussion is "right-to-repair," which is gaining visibility as companies like John Deere are criticized for limiting access to repair information, hence forcing farmers to trust authorized service centers, which may be more costly. For example, John Deere has been charged with leaving right-to-repair language out of their manuals, therefore impeding farmers from doing self-repair.

The use of diesel-based tractors raises concerns regarding the environment, hence acting as a great market challenge.

Diesel-powered tractors produce nitrogen oxides and particulate matter, among other pollutants, therefore adding to global warming and environmental degradation. Regulatory agencies have reacted by setting tighter emissions criteria to lessen these effects. For instance, the 2008 Statewide Truck and Bus Rule from the California Air Resources Board (CARB) mandated that heavy-duty diesel trucks retrofit or replace engines to lower emissions. Almost all relevant automobiles must, by January 1, 2023, have engines comparable to those of the 2010 model year, as directed by this rule. For farmers, following these rules can be expensive, so they must invest in updated, less pollutant machinery or retrofit already installed machinery.

The frequent fluctuations in the prices of the commodity are considered a major market challenge.

Fluctuations in commodity prices, driven by variables such as trade policies, worldwide market demand, and weather conditions, may have a profound impact on the agricultural industry. Significant changes in prices could seriously affect the income of farmers and, therefore, their capacity to purchase new equipment, such as tractors. Low commodity prices sometimes cause farmers to postpone or abandon buying new equipment, therefore reducing demand in the agricultural machinery sector. On the other side, high goods prices might justify investment but might also result in higher tool expenses because of growing demand.

Agricultural Tractors Market Opportunities:

The development of electric tractors presents an opportunity for the market to expand as it reduces emission and operational costs.

Electric tractors offer great chances to cut emissions and operational expenditures, therefore supporting worldwide goals of sustainability, so their introduction and growth are in line with this. Companies that produce tractors are instead actively investing in alternative energy sources. New Holland Agriculture, for example, has created the NH2 hydrogen-powered tractor, which offers a sustainable alternative to conventional diesel-powered equipment by releasing just heat, vapor, and water. This development is one of their Energy Independent Farm project meant to help farmers produce their energy from clean sources.

The establishment of rental services has helped small-scale farmers to afford these modern trucks, thereby helping the market to grow.

Starting tractor rental businesses can help small farmers contingent on expanding market size who cannot buy new machinery. Sharing equipment is becoming easier on digital platforms, therefore maximizing machinery usage. Agriculture equipment-sharing platforms like Hello Tractor and WeFarmUp let farmers rent hardware as necessary, therefore lessening the financial weight of purchase. This approach encourages the prudent use of resources within the farming industry as well as raises access to sophisticated technology.

The services provided post sales is another market opportunity that can help the market to grow.

Offering spare parts, maintenance, and repair support may strengthen consumer loyalty and help to generate more income. The need for expert maintenance and repair solutions is growing in line with the technological advancement of agricultural equipment. By providing thorough aftermarket support, companies guarantee equipment longevity and excellent performance for their consumers and, thus, set themselves apart in the marketplace. This strategy not only builds trust but also stimulates repeat trade and great word-of-mouth references.

Expansion into the developing regions can be a good opportunity for the market to increase its reach.

Growing into developing nations with significant agriculture provides great growth possibilities, especially where mechanization is yet to be mature. Often, these areas show an increasing need for contemporary farming techniques to enhance output and satisfy food security requirements. Affordable and flexible tractor solutions introduced by businesses will enable them to explore these markets, thus driving agricultural growth and building a robust market presence. Successful market entry and acceptance depend on partnerships with local actors and knowledge of local agriculture practices.

AGRICULTURAL TRACTORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.20% |

|

Segments Covered |

By poer output, application, drive type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

John Deere, CNH Industrial, Kubota Corporation, AGCO Corporation, Mahindra & Mahindra Ltd., Class KGaA mbH, SDF Group, Yanmar Co., Ltd., Escorts Limited, Massey Ferguson |

Agricultural Tractors Market Segmentation:

Agricultural Tractors Market Segmentation: By Power Output

- Low Power

- Mid Power

- High Power

The mid-power segment is the dominant one, and the high-power segment is the fastest-growing one. Middle Power (40-100 HP) tractors command the market owing to their adaptability and fit for a broad spectrum of farming operations. Usually employed for small-scale farming, gardening, and light work, these tractors have less than 40 horsepower. They have regional popularity in places with divided land holdings. Driven by farm consolidation and the need for effective large-scale operations, high-power (above 100 HP) tractors are the fastest-growing segment. Ideal for medium to large farming enterprises, these tractors, ranging from 40 to 100 horsepower, handle planting, harrowing, and plowing, among other chores. Their acceptance is quite general, and their usefulness is great.

Intended for large-scale commercial agriculture, high-power tractors are used for heavy applications, including deep plowing and large-scale harvesting. This tilling is done by tractors.

Agricultural Tractors Market Segmentation: By Drive Type

- 2-Wheel Drive

- 4-Wheel Drive

The 2-Wheel Drive is the dominant segment of the market, and the 4-Wheel Drive is the fastest-growing segment. Presently, two-wheel drive (2WD) tractors dominate the scene since they are cost-effective and suitable for many farming conditions. Their market share is provided by this. Generally, two-wheel-drive tractors are more economical and appropriate for dry and less challenging terrain. Generally, they find application in areas having level topography. Particularly in areas needing more power and flexibility, four-wheel drive (4WD) tractors are the fastest growing. Ideal for demanding terrain and heavy-duty work, four-wheel drive (4WD) tractors provide superior traction and power. Preferred in regions with hilly topography or strong soil qualities.

Agricultural Tractors Market Segmentation: By Application

- Plowing and Cultivation

- Irrigation

The plowing and Cultivation segment is considered the dominant one, whereas the irrigation segment is the fastest-growing segment. Two basic agricultural methods required to prepare soil and control weeds are plowing and cultivation. These activities make this sector prevalent in the market as tractors fitted with tools such as plows and harrows are widely used. Mechanization's broad acceptance in agriculture has resulted in more need for tractors in plowing and cultivation operations. Increasing demand for effective water management in agriculture is driving rapid expansion of the irrigation industry. By driving pumps, carrying water, and running irrigation machinery, tractors are essential for irrigation. Further driving the need for specialized tractors has been the acceptance of modern irrigation methods like drip and sprinkler systems. The rising popularity of the use of tractors in irrigation systems that helps growers to best use water and increase crop yields has driven the sector's fast growth.

Agricultural Tractors Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is leading in this market, followed by Europe and the Asia-Pacific region. Whereas the South America and MEA regions are considered emerging markets. Large-scale agriculture and extensive use of sophisticated equipment define North America. Nations like India and China are rapidly developing as a result of their agricultural mechanization projects. Africa is experiencing fast development from growing investments in agricultural mechanization intended to improve productivity.

COVID-19 Impact Analysis on the Global Agricultural Tractors Market:

The coronavirus outbreak had a big influence on the market for agricultural tractors, which resulted in long-term industry changes as well as short-term disruptions. The effect depended on a number of elements, including supply chain disturbances, labor scarcity, financial pressures, and changing consumer demand, as well as on location. Mostly obtained from China, India, and Europe, vital tractor components, including engines, transmissions, hydraulics, and electronics, saw distribution disruptions worldwide due to the epidemic. Lockdown measures resulted in limited staff availability and brief factory closures. Delays in manufacturing schedules affected businesses like CNH Industrial, John Deere, and Kubota. Limitations on travel and commerce left tractors and replacement components hard to ship and distribute, so length times for deliveries were raised. Labor shortages caused by migration policies and social distancing rules affected farming operations. Reduced farm worker numbers in nations like India and the United States raised the need for mechanization, hence somewhat offsetting demand loss. Rising understanding of the value of automation, precision farming, and sustainable agriculture by governments and private investors resulted in renewed interest in high-tech tractors, GPS-enabled gear, and electric models. The pandemic sped up developments toward electrification, smart tractors, and automation, therefore positioning the business for long-term technological evolution.

Latest Trends/ Developments:

Seeking to lower labor dependency and improve accuracy in farming activities, the advancement of autonomous tractors is gaining velocity.

Telematics in tractors enable real-time monitoring and data analysis, therefore enhancing maintenance planning and efficiency by means of rebalance.

To lower carbon footprints in agriculture, an increasing number of people are turning to greener tractors, including electric and hybrid varieties.

Key Players:

- John Deere

- CNH Industrial

- Kubota Corporation

- AGCO Corporation

- Mahindra & Mahindra Ltd.

- Class KGaA mbH

- SDF Group

- Yanmar Co., Ltd.

- Escorts Limited

- Massey Ferguson

Chapter 1. Agricultural Tractors Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Agricultural Tractors Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Agricultural Tractors Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Drive Type Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Agricultural Tractors Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Agricultural Tractors Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Agricultural Tractors Market – By Power Output

6.1 Introduction/Key Findings

6.2 Low Power

6.3 Mid Power

6.4 High Power

6.5 Y-O-Y Growth trend Analysis By Power Output

6.6 Absolute $ Opportunity Analysis By Power Output , 2025-2030

Chapter 7. Agricultural Tractors Market – By Drive Type

7.1 Introduction/Key Findings

7.2 2-Wheel Drive

7.3 4-Wheel Drive

7.4 Y-O-Y Growth trend Analysis By Drive Type

7.5 Absolute $ Opportunity Analysis By Drive Type , 2025-2030

Chapter 8. Agricultural Tractors Market – By Application

8.1 Introduction/Key Findings

8.2 Plowing and Cultivation

8.3 Irrigation

8.4 Y-O-Y Growth trend Analysis Application

8.5 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 9. Agricultural Tractors Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Drive Type

9.1.3. By Application

9.1.4. By Power Output

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Drive Type

9.2.3. By Application

9.2.4. By Power Output

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Drive Type

9.3.3. By Application

9.3.4. By Power Output

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By APPLICATION

9.4.3. By Drive Type

9.4.4. By Power Output

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By APPLICATION

9.5.3. By Drive Type

9.5.4. By Power Output

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Agricultural Tractors Market – Company Profiles – (Overview, Power Output Portfolio, Financials, Strategies & Developments)

10.1 John Deere

10.2 CNH Industrial

10.3 Kubota Corporation

10.4 AGCO Corporation

10.5 Mahindra & Mahindra Ltd.

10.6 Class KGaA mbH

10.7 SDF Group

10.8 Yanmar Co., Ltd.

10.9 Escorts Limited

10.10 Massey Ferguson

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

Rising mechanization in agriculture, technical innovations, official subsidies, and the need to improve productivity to satisfy increasing food demand are driving the growth of this market.

Tractor manufacturing and delivery were slowed by the epidemic's disturbance of supply chains and labour availability. Nevertheless, the focus on food security has revitalized interest in agricultural mechanization.

Rising trends are the advancement of autonomous (self-driving) tractors, the incorporation of telematics for real-time monitoring, and the transition to electric and hybrid designs in support of sustainability.

Government campaigns encouraging mechanization should cause the Asia-Pacific area to experience notable development; North America is also growing quickly, thanks to technological advances and big farming operations.

High initial investment costs, operating expenditures, emission-related environmental issues, and variable commodity prices impacting the buying power of farmers are among the difficulties faced by the market.