Agricultural Sanitizing Market Size (2024 –2030)

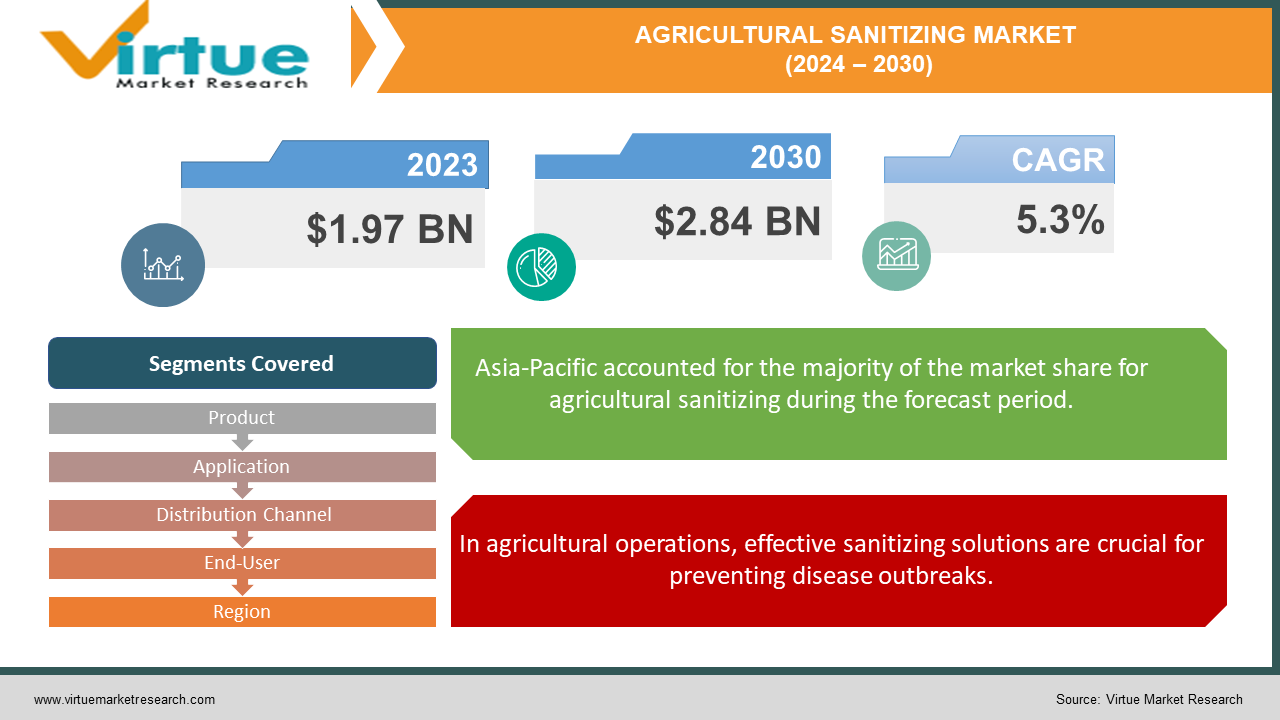

The Global Agricultural Sanitizing Market was valued at USD 1.97 billion in 2023 and is projected to reach a market size of USD 2.84 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.3%.

Effective sanitizing solutions are becoming more and more necessary in the agricultural sector as a result of the need to adhere to international hygiene and safety standards for the global trade of agricultural products. This increase is driven by safety regulations, as well as a greater awareness of biosecurity precautions brought on, in part, by recent disease outbreaks. The advancement of agricultural technology leads to the creation of sanitizing products and techniques that are more effective, which in turn allows for the growth of agricultural operations. The need for effective sanitization increases as farms get larger in order to maintain output and stop the spread of disease. Furthermore, the need for sustainable and environmentally friendly sanitizing products is driven by growing concerns about the effects on the environment, underscoring the significance of ethical farming practices.

Key Market Insights:

The global agricultural sanitizing market is estimated to be around $1.9 billion in value, driven by the increasing focus on food safety, prevention of foodborne illnesses, and the adoption of advanced sanitization techniques in the agriculture industry.

North America accounts for nearly 30% of the global agricultural sanitizing market share, attributed to stringent food safety regulations, high consumer awareness, and the presence of major market players in the region.

Chemical sanitizers hold a market share of over 45% in the agricultural sanitizing market, owing to their effectiveness in eliminating a wide range of microorganisms and their widespread use in various agricultural applications.

Fruit and vegetables contribute to around 35% of the overall agricultural sanitizing market, driven by the need to maintain the quality and extend the shelf life of fresh produce by eliminating harmful microbes.

Organic sanitizers are expected to grow at a rate of around 7% annually, driven by the increasing demand for eco-friendly and sustainable sanitization solutions in the agriculture industry.

Global Agricultural Sanitizing Market Drivers:

In agricultural operations, effective sanitizing solutions are crucial for preventing disease outbreaks.

Diseases that infect crops and livestock on farms can lead to serious issues like crop failures and expensive animal deaths. Good cleaning supplies aid in halting the spread of these illnesses and maintaining the health of farms. They ensure that farms can continue operating efficiently by eliminating dangerous bacteria and dirt that can sicken crops and animals.

The agricultural sector is subject to stringent regulations and is required to adopt effective sanitation practices.

To keep farming safe and clean, governments and industry associations impose strict regulations. To maintain hygienic conditions on their farms, farmers must abide by these regulations. These regulations are essential because they safeguard public health and ensure that the food we eat is of a high caliber. Farmers contribute to everyone's safety and the quality of the food we eat by adhering to these regulations, which cover things like cleaning procedures.

Technological Developments in Sanitization Techniques Are Critical to Improving Farm Productivity and Hygiene.

Farmers are able to maintain a very clean environment thanks to the ongoing advancements in agricultural technology. This improves farm productivity by enabling them to raise more livestock and produce more crops. Cleaning is now simpler and uses less water thanks to new technology like automated sprayers and precise techniques. Furthermore, cleaning is made even more efficient by the availability of cleaning solutions designed specifically for farms.

Modern agriculture's growing environmental problems are addressed by environmentally friendly and sustainable sanitizing products.

Concerns regarding the environmental impact of cleaning products are growing among the public. They seek high-performing cleaning products that do not damage the environment. Because these environmentally friendly products are better for the environment, modern farming also aims to be sustainable. Farmers are increasingly opting for environmentally friendly cleaning products because traditional ones may harm the environment. These goods are designed to be safe for aquatic environments, ecosystems, and other living things. Utilizing environmentally friendly cleaning supplies allows farmers to lessen their environmental footprint and promote sustainable farming practices. Consumer preferences are being met by this change, as they are drawn to eco-friendly products.

Agricultural Sanitizing Market Challenges and Restraints:

It can be difficult for smaller farms or those with fewer resources to afford the sophisticated cleaning technology or specialized equipment required. Some farmers might not understand the significance of cleaning correctly, or they might not know how to do it. They may continue to farm in the traditional manner because it is what they are accustomed to. Cleaning is essential to preventing disease, but improper use of certain chemicals can have negative environmental effects. In fact, overuse can increase microbial resistance to them. It can be difficult to find high-quality cleaning supplies or technology in some areas. It can also be costly to implement new technology in older farms. In order to address these issues in the farming cleaning market, farmers must be receptive to fresh perspectives and approaches.

Agricultural Sanitizing Market Opportunities:

There are many opportunities for businesses to expand and develop new concepts in the market for cleaning products used in agriculture. Organic farming presents a significant opportunity. Producing cleaning products that are organic could be successful because consumers like natural products. Enhancing the functionality of cleaning products is another opportunity for development. More research can help companies produce more environmentally friendly, more affordable, and better products. Another innovative approach to farming is the use of smart technology. Creating automated cleaning machines can help farmers save time and money. Businesses can also sell cleaning products abroad because farm products are sold all over the world. Collaborating with agricultural associations can aid businesses in expanding their farmer base and increasing sales.

AGRICULTURAL SANITIZING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.3% |

|

Segments Covered |

By Product, Application, Distribution Channel, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Neogen Corporation, BASF SE, Diversey Holdings, Ltd., Ecolab Inc., The Dow Chemical Company (DowDupont), Syngenta AG, Kemin Industries, Inc., Zoetis Inc., Chr. Hansen Holding A/S, Bayer AG |

Agricultural Sanitizing Market Segmentation - By Product Type

-

Sanitizing Agents (chemicals, solutions, etc.)

-

Sanitizing Equipment (sprayers, foggers, etc.)

-

Cleaning Agents (detergents, soaps, etc.)

Chemicals and other "Sanitizing Agents" make up the majority of the agricultural cleaning market. These are used to clean farms, machinery, crops, and animals. They account for approximately 40% of the market due to their critical role in maintaining agricultural cleanliness. The "Sanitizing Equipment" market is expanding rapidly. Better and more effective equipment, such as foggers and sprayers, are highly sought after for the application of cleaning agents on farms. This segment of the market is growing as a result of consumer demand for better farm maintenance tools.

Agricultural Sanitizing Market Segmentation – By Application

-

Crop Sanitizing (for fruits, vegetables, etc.)

-

Livestock Sanitizing (animal pens, equipment, etc.)

-

Equipment Sanitizing (tractors, tools, etc.)

The largest segment of the agricultural cleaning market is dedicated to crop (such as fruits and vegetables) cleaning. This is because there is a high demand for products and methods of cleaning crops because it is crucial to maintain their health and quality. It is vital for farmers to ensure that fruits and vegetables are clean and nutritious. The fastest-growing sector is cleaning up after livestock, which includes cleaning animal pens and equipment. The need for products that clean up after animals is growing because it's critical to modern farming practices to keep animals healthy and hygienic. This segment of the cleaning market is growing rapidly because farms place a high value on keeping animals clean and healthy.

Agricultural Sanitizing Market Segmentation -By Distribution Channel

-

Direct Sales

-

Distributors and Wholesalers

-

Online Retailers

Distributors and wholesalers own the largest portion of the agricultural cleaning product market, approximately 60%. They are crucial because they purchase a large quantity of goods directly from producers and resell them to retailers or wholesalers, expanding the market for goods. The fastest growth rate is in the "Online Retailers" sector. Online shopping is becoming more and more popular, even for farming supplies. This industry is growing because online retailers can sell goods to customers anywhere in the world and are very convenient. To increase their consumer base, a lot of businesses that produce or market cleaning supplies for agriculture have begun selling online.

Agricultural Sanitizing Market Segmentation -By End-User

-

Farms and Agricultural Estates

-

Greenhouses

-

Food Processing Plants

-

Nurseries

Large agricultural estates and farms purchase 70% of the cleaning products used in agriculture. This covers all sizes of farms—from tiny family farms to enormous industrial ones. The industries using these products to process food are expanding at the quickest rate. To ensure that the food they process is safe to consume, these plants require cleaning supplies. They handle a lot of food, so they use a lot of cleaning supplies. Nurseries also use a lot of cleaning products because they grow plants that are sold or transplanted. For their plants to grow well, they must maintain them clean and healthy.

Agricultural Sanitizing Market Segmentation -By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

30% or more of the world's sales of agricultural cleaning products occur in North America, which consists of the US and Canada. These products are heavily used by both large and small farms because farming is very important in that area. The "Asia-Pacific" area is expanding at the quickest rate. This region has a large population and a wide variety of farming practices, which increases the demand for cleaning supplies. Due to their extensive farming industries, countries like China, India, and Australia purchase a lot of cleaning supplies. Another significant market for these goods is Europe. European farmers use a lot of cleaning products because they are very concerned about the safety and quality of their food.

COVID-19 Impact on the Global Agricultural Sanitizing Market:

Farming was one of the many industries impacted by the COVID-19 pandemic. People became aware of how crucial cleaning is in all fields, including agriculture. In an effort to stop diseases from spreading, farmers began to place more emphasis on maintaining a clean farm. Purchasing cleaning supplies in large quantities at the start of the pandemic was necessary to protect workers, animals, and crops. However, due to supply chain disruptions, there were some issues getting enough cleaning supplies. An increasing number of people wanted to use environmentally friendly cleaning products during this time. Thus, there was a greater need for natural or organic cleaning supplies. Farmers are also using more technology, such as automated cleaning systems, as a result of the pandemic. People are still paying more attention to maintaining farm cleanliness even after the pandemic. During this difficult period, businesses had the opportunity to develop new and improved cleaning products. Businesses that could quickly adjust and provide efficient, user-friendly, and environmentally friendly products performed well.

Latest Trend/Development:

An increasing number of farmers are requesting to use environmentally friendly products. Their preference for environmentally friendly cleaning products stems from their concern for sustainable farming practices. Farm cleaning is becoming better and easier thanks to new technology. Farmers can clean more effectively with the aid of automation, smart farming devices, and precise farming techniques. Cleaning is now incorporated into larger plans to keep everything safe because it is crucial to prevent diseases from spreading to crops and animals. It's also critical that cleaning supplies are suitable for a range of crops and animals. It's becoming more crucial than ever to abide by the law and obtain certifications in order to ensure the safety of cleaning supplies used on farms. The increasing globalization of farming presents prospects for cleaning product manufacturers to market their goods abroad while adhering to the hygienic requirements necessary for agricultural product exports.

Key Players:

-

Neogen Corporation

-

BASF SE

-

Diversey Holdings, Ltd.

-

Ecolab Inc.

-

The Dow Chemical Company (DowDupont)

-

Syngenta AG

-

Kemin Industries, Inc.

-

Zoetis Inc.

-

Chr. Hansen Holding A/S

-

Bayer AG

Market News:

-

The large chemical company Univar Solutions Inc. announced in September 2023 that it had acquired FloChem Ltd., a company that specializes in chemical distribution and dispensing systems in eastern Canada.

-

A chemical manufacturer by the name of Solenis made the decision to acquire Diversey Holdings, a disinfectant manufacturer, in October 2023. The $4.6 billion deal was completed entirely with cash. Before the stock market opened, Diversey's shares increased by nearly 40% in response to this news, reaching $8.28.

Chapter 1. Agricultural Sanitizing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Agricultural Sanitizing Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Agricultural Sanitizing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Agricultural Sanitizing Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Agricultural Sanitizing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Agricultural Sanitizing Market – By Application

6.1 Introduction/Key Findings

6.2 Crop Sanitizing (for fruits, vegetables, etc.)

6.3 Livestock Sanitizing (animal pens, equipment, etc.)

6.4 Equipment Sanitizing (tractors, tools, etc.)

6.5 Y-O-Y Growth trend Analysis By Application

6.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Agricultural Sanitizing Market – By Product

7.1 Introduction/Key Findings

7.2 Sanitizing Agents (chemicals, solutions, etc.)

7.3 Sanitizing Equipment (sprayers, foggers, etc.)

7.4 Cleaning Agents (detergents, soaps, etc.)

7.5 Y-O-Y Growth trend Analysis By Product

7.6 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 8. Agricultural Sanitizing Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Distributors and Wholesalers

8.4 Online Retailers

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Agricultural Sanitizing Market – By End-use

9.1 Introduction/Key Findings

9.2 Farms and Agricultural Estates

9.3 Greenhouses

9.4 Food Processing Plants

9.5 Nurseries

9.6 Y-O-Y Growth trend Analysis By End-use

9.7 Absolute $ Opportunity Analysis By End-use, 2024-2030

Chapter 10. Agricultural Sanitizing Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Application

10.1.3 By End-use

10.1.4 By Distribution Channel

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Application

10.2.3 By Type

10.2.4 By Distribution Channel

10.2.5 By End-use

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Application

10.3.3 By Type

10.3.4 By Distribution Channel

10.3.5 By End-use

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Application

10.4.3 By Type

10.4.4 By Distribution Channel

10.4.5 By End-use

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Application

10.5.3 By Type

10.5.4 By Distribution Channel

10.5.5 By End-use

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Agricultural Sanitizing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Neogen Corporation

11.2 BASF SE

11.3 Diversey Holdings, Ltd.

11.4 Ecolab Inc.

11.5 The Dow Chemical Company (DowDupont)

11.6 Syngenta AG

11.7 Kemin Industries, Inc.

11.8 Zoetis Inc.

11.9 Chr. Hansen Holding A/S

11.10 Bayer AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Agricultural Sanitizing Market was valued at USD 1.97 billion in 2023 and is projected to reach a market size of USD 2.84 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.3%.

Prevention of Disease Outbreaks and Technological Advancements in Sanitizing Methods are the main market drivers of the Global Agricultural Sanitizing Market.

Direct Sales, Distributors and Wholesalers, and Online Retailers are the segments under the Global Agricultural Sanitizing Market by distribution channel.

North America is the most dominant region for the Global Agricultural Sanitizing Market

Asia-Pacific is the fastest-growing region in the Global Agricultural Sanitizing Market.