Agricultural Rotavator Market Size (2024 – 2030)

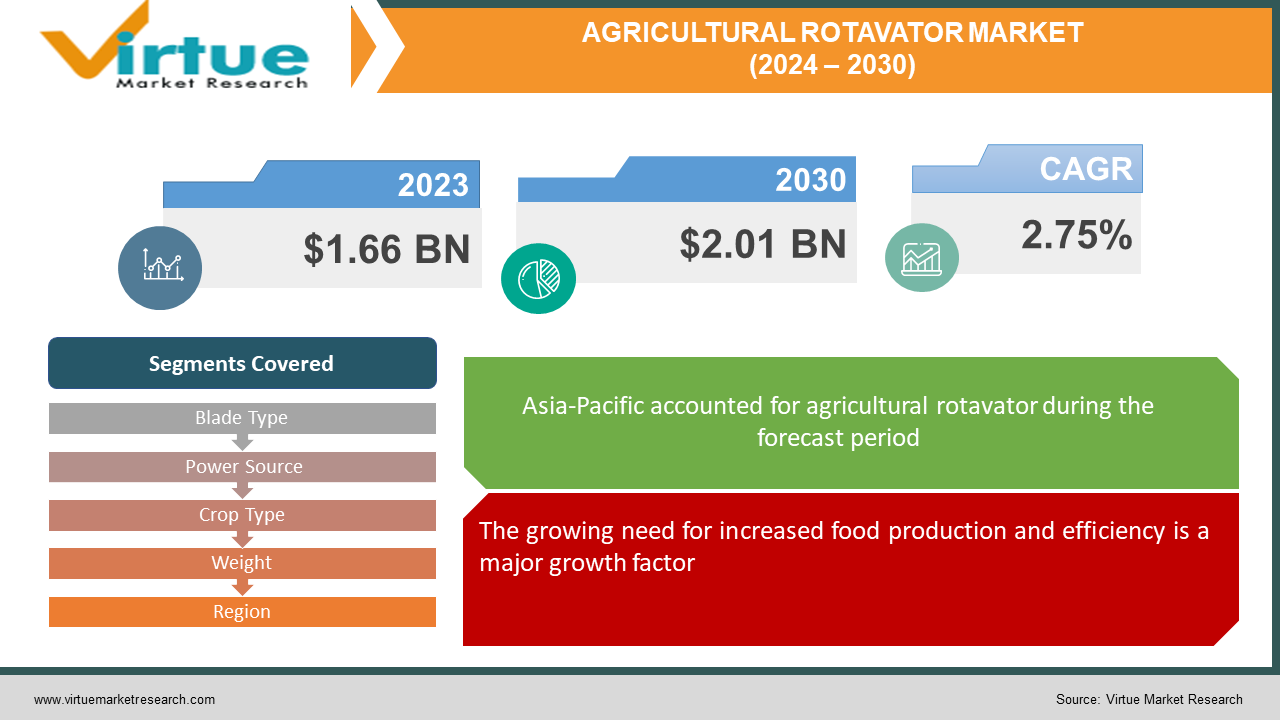

The global agricultural rotavator market was valued at USD 1.66 billion in 2023 and is projected to reach a market size of USD 2.01 billion by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 2.75%.

A tractor-drawn device with spinning blades that prepares soil for planting is an agricultural rotavator, often referred to as a rotary tiller. The area is leveled, has improved drainage, and is planted-ready due to the blades' breaking up, churning, and aerating of the soil. Rotavators are appropriate for a variety of soil types and may be utilized in both primary and secondary tillage.

Key Market Insights:

The global agricultural rotavator market is experiencing significant growth due to the increasing adoption of conservation tillage practices. Rotavators help in preparing seedbeds with minimal soil disturbance, conserving moisture and reducing erosion. The demand for agricultural rotavators is particularly high in developing economies like those in the Asia-Pacific and Africa, where agriculture is a major source of livelihood. These regions are witnessing a rise in the mechanization of agricultural practices due to factors like growing disposable incomes, government initiatives promoting farm mechanization, and a shortage of agricultural labor. There is a growing trend toward multi-functional rotavators that can be used for various agricultural tasks like land preparation, seeding, and weeding. This diversification allows farmers to invest in a single machine for multiple applications, improving efficiency and cost-effectiveness.

Agricultural Rotavator Market Drivers:

The growing need for increased food production and efficiency is a major growth factor.

Fueled by a rising global population and changing dietary patterns, the demand for food production is constantly increasing. This puts pressure on farmers to cultivate more land and improve yields. Agricultural rotavators play a crucial role in this aspect by enabling faster and more efficient land preparation, allowing for multiple cropping cycles in a year. The market is expected to witness steady growth due to factors like increasing mechanization in agriculture and the need for efficient land preparation techniques. This translates to a rise in demand for rotavators as farmers seek solutions to boost productivity.

Government initiatives promoting farm mechanization are driving market growth

Many governments around the world are actively promoting farm mechanization through various initiatives. This includes subsidies for purchasing agricultural equipment, training programs for farmers on how to use machinery effectively, and infrastructure development to support mechanized farming practices. The Indian agriculture equipment market is projected to grow at a CAGR of 7.2% during the forecast period of 2024–2030, primarily driven by the government's push towards mechanization in agriculture. Such initiatives create a favorable environment for the adoption of rotavators, leading to market growth.

Shifting labor dynamics and focusing on sustainable practices are giving the market a boost.

The agricultural sector is facing a shortage of skilled labor, particularly in developed economies. Additionally, there is a growing emphasis on sustainable farming practices that minimize environmental impact. Rotavators address both these concerns. They reduce reliance on manual labor, allowing farmers to manage larger areas with fewer workers. Furthermore, rotavators promote soil health by facilitating minimal tillage techniques, leading to better water retention and reduced erosion. This focus on sustainability is driving the demand for rotavators as farmers seek eco-friendly solutions for land preparation.

Market Restraints and Challenges:

High initial investment and replacement costs are a challenge for the market.

Agricultural rotavators, particularly those with advanced features and higher power outputs, can be expensive for small and marginal farmers. The initial investment cost can be a significant barrier to entry, especially in developing economies. Additionally, the cost of replacing worn-out blades and other parts can add to the overall operational expenditure. Expensive replacement costs are considered a major hurdle in the growth of the rotavator market. Manufacturers need to address this challenge by offering financing options, extended warranties, and cost-effective replacement parts to make rotavators more accessible to a wider range of farmers.

Limited access to financing and credit facilities is a major challenge.

In many developing regions, farmers have limited access to financing and credit facilities, making it difficult for them to afford to purchase agricultural machinery like rotavators. This restricts the overall market penetration of rotavators and hinders agricultural mechanization efforts.

Lack of awareness and training on efficient use is restricting market growth.

There can be a lack of awareness among some farmers, particularly in developing economies, about the benefits and proper use of agricultural rotavators. Without proper training, farmers might not be able to utilize the full potential of rotavators and achieve optimal results. This can lead to inefficient use of the equipment and hinder the overall adoption rate. Manufacturers and agricultural extension services can play a crucial role in addressing this challenge by organizing training programs and demonstrations to educate farmers on the benefits and proper operation of rotavators.

Market Opportunities:

Precision agriculture integration is opening new doors for the market.

The integration of precision agriculture technologies with rotavators presents a significant market opportunity. This could involve features like GPS guidance systems enabling precise and efficient operation, reducing overlaps, and minimizing fuel consumption. Also, sensors can collect real-time data on soil moisture, compaction, and nutrient levels. This data can be used to adjust rotavator settings for optimal tillage and improve overall crop yields. By controlling the depth and intensity of tillage based on specific soil conditions, farmers can optimize resource use and minimize environmental impact. By incorporating these precision agriculture technologies, manufacturers can create next-generation rotavators that cater to the growing demand for data-driven and sustainable farming practices.

Focus on Rental and Leasing Services is a major opportunity

Rotavator ownership can be a significant financial burden for small and marginal farmers. Offering rental and leasing services for rotavators can be a lucrative opportunity to expand market reach and cater to this segment. This model allows farmers to access the benefits of rotavators temporarily, reducing upfront costs and increasing operational flexibility. Additionally, it provides a source of recurring revenue for manufacturers and dealers. This service model can be particularly successful in regions with a high concentration of small and medium-sized farms.

AGRICULTURAL ROTAVATOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

2.75% |

|

Segments Covered |

By Blade Type, Power Source, Crop Type, Weight, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AGCO Corporation, CNH Industrial, Deere & Company, Kubota Corporation, Kuhn Group, Lemken, Mahindra & Mahindra, Preet Agro Industries |

Agricultural Rotavator Market Segmentation: By Blade Type

-

L Type

-

C Type

L-type blades, known for their aggressive tilling action, are ideal for breaking up tough soil, managing heavy residue, and preparing seedbeds for crops like corn and soybeans. The demand for L-type blades is expected to remain steady, particularly in regions with prevalent practices of intensive tillage. However, the growing focus on conservation tillage practices to minimize soil erosion might lead to a gradual shift in preference toward C-type blades in the long run. C-type blades, on the other hand, offer a gentler tilling action, promoting minimal soil disturbance and improved moisture retention. This aligns well with the rising trend toward sustainable farming practices. Additionally, the design of C-blades allows for better residue management, making them suitable for a wider range of crops and soil conditions. This versatility, coupled with the growing focus on sustainability, is expected to drive the market for C-type blades in the coming years.

Agricultural Rotavator Market Segmentation: By Power Source

-

Engine

-

Tractor-mounted

Tractor-mounted rotavators are the largest and fastest-growing power source, accounting for over 80% of the global share. This dominance is attributed to their high-power output, making them suitable for large-scale operations and handling demanding tasks like breaking up hard soil or managing extensive crop residue. Additionally, their compatibility with existing tractors reduces the need for additional capital investment for farmers who already own tractors. However, the high upfront cost of tractor-mounted rotavators can be a barrier for small and marginal farmers. Engine-driven rotavators, on the other hand, offer a more compact and maneuverable option. This makes them ideal for smaller farms, uneven terrain, and tasks requiring precise operation. Their lower initial investment cost compared to tractor-mounted models is another advantage, particularly for resource-constrained farmers. The rising demand for engine-driven rotavators in developing economies and applications like horticulture and cash crop farming. Looking ahead, technological advancements like engine efficiency improvements and the development of more powerful engine-driven models are expected to further propel their market share in the coming years.

Agricultural Rotavator Market Segmentation: By Crop Type

-

Vegetable

-

Fruit

-

Row Crop

-

Others

Row crops like corn, soybeans, and cotton typically require aggressive tillage for proper seedbed preparation. This aligns well with the functionalities of L-type blades and tractor-mounted rotavators with their high power output. The demand for such configurations remains high in regions with dominant row crop production. On the other hand, vegetable and fruit crops often thrive in environments with a finer tilt and minimal soil disruption. This makes C-type blades a popular choice due to their gentle tilling action. Additionally, the smaller field sizes and maneuverability requirements associated with these crops favor the use of engine-driven rotavators. Furthermore, the other categories within the crop type segmentation can encompass specialty crops like vineyards and nut orchards, which might have unique soil preparation needs that influence the choice of blade type and power source.

Agricultural Rotavator Market Segmentation: By Weight

-

Light

-

Standard

-

Heavy-Duty

Light-weight rotavators, typically weighing under 350 kg, are ideal for small farms, greenhouses, and vegetable plots. Their maneuverability makes them perfect for navigating tight spaces and performing precise tilling tasks. They often utilize engine-driven power sources due to their lower horsepower requirements. The rising focus on organic farming and the growth of small-scale agriculture operations are driving the demand for lightweight rotavators, reflecting the increasing popularity of these compact and versatile machines. Standard-weight and heavy-duty rotavators, typically ranging from 350 kg to above 1000 kg, cater to medium- and large-scale farms. These robust machines often utilize tractor-mounted power sources for the high power output required for tasks like breaking up hard soil or managing extensive crop residue. L-type blades are frequently preferred for these models due to their aggressive tilling action, making them suitable for row crop cultivation. However, the high upfront cost of standard and heavy-duty rotavators can be a barrier for smaller farms.

Agricultural Rotavator Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Asia-Pacific is the largest and fastest-growing market, accounting for over 35% of the global share. This dominance is attributed to the region's vast agricultural landscape, growing populations demanding increased food production, and rising government support for farm mechanization. The focus on crops like rice and wheat, which often benefit from minimal tillage practices, is driving the demand for C-type blades in this region.

COVID-19 Impact Analysis on the Global Agricultural Rotavator Market:

The global COVID-19 pandemic caused a temporary disruption to the agricultural rotavator market. Lockdowns and restrictions on movement hampered the manufacturing and transportation of rotavators and their parts. This led to shortages in some regions and delays in fulfilling orders. The pandemic caused economic downturns, leading to cautious spending among farmers. This resulted in a decline in demand for new rotavators, particularly for high-end models. Lockdowns and travel restrictions also disrupted the agricultural workforce, impacting farmers' ability to operate and maintain their machinery. However, the agricultural sector was deemed essential during the pandemic. As the situation progressed, some positive trends emerged. The pandemic highlighted the importance of food security, prompting governments to prioritize agricultural production. This led to increased investments in the sector, with some governments offering subsidies or promoting farm mechanization to boost efficiency. The labor shortages encouraged farmers to seek mechanized solutions for land preparation, leading to a renewed interest in rotavators as they reduced reliance on manual labor. The pandemic accelerated the adoption of e-commerce platforms for agricultural equipment, providing farmers with alternative channels to purchase rotavators despite movement restrictions. While the initial impact of COVID-19 was negative, the market has shown signs of recovery due to the aforementioned factors. The long-term impact of the pandemic on the agricultural rotavator market remains to be seen, but it has undeniably influenced buying patterns and highlighted the importance of rotavators for ensuring agricultural resilience.

Latest Trends/Developments:

The focus on rental and leasing services is a significant trend.

Recognizing the financial burden of rotavator ownership for small and marginal farmers, a trend toward rental and leasing services is emerging. This model allows farmers access to the benefits of rotavators temporarily, reducing upfront costs and increasing operational flexibility. It also provides manufacturers and dealers with a recurring revenue stream. This service model is expected to be particularly successful in regions with a high concentration of small and medium-sized farms.

The rise of electric and hybrid rotavators is facilitating the expansion.

Driven by the growing focus on environmental sustainability and energy efficiency, electric and hybrid rotavators are gaining traction. Electric models offer zero emissions and reduced noise pollution, while hybrid models combine electric power with traditional fuel sources, aiming to achieve a balance between performance and environmental impact. While this technology is still in its early stages, advancements in battery technology and increasing government support for clean energy solutions are expected to propel the growth of electric and hybrid rotavators in the coming years.

Key Players:

-

AGCO Corporation

-

CNH Industrial

-

Deere & Company

-

Kubota Corporation

-

Kuhn Group

-

Lemken

-

Mahindra & Mahindra

-

Preet Agro Industries

In March 2024, a collaboration agreement was announced by Ag Leader, Kinze, and John Deere to improve customer experience through data integration and improved technology.

Chapter 1. Agricultural Rotavator Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Agricultural Rotavator Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Agricultural Rotavator Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Agricultural Rotavator MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Agricultural Rotavator Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Agricultural Rotavator Market– By Blade Type

6.1 Introduction/Key Findings

6.2 L Type

6.3 C Type

6.4 Y-O-Y Growth trend Analysis By Blade Type

6.5 Absolute $ Opportunity Analysis By Blade Type, 2024-2030

Chapter 7. Agricultural Rotavator Market– By Power Source

7.1 Introduction/Key Findings

7.2 Engine

7.3 Tractor-mounted

7.4 Y-O-Y Growth trend Analysis By Power Source

7.5 Absolute $ Opportunity Analysis By Power Source, 2024-2030

Chapter 8. Agricultural Rotavator Market– By Weight

8.1 Introduction/Key Findings

8.2 Light

8.3 Standard

8.4 Heavy-Duty

8.5 Y-O-Y Growth trend Analysis By Weight

8.6 Absolute $ Opportunity Analysis By Weight, 2024-2030

Chapter 9. Agricultural Rotavator Market– Crop Type

9.1 Introduction/Key Findings

9.2 Vegetable

9.3 Fruit

9.4 Row Crop

9.5 Others

9.6 Y-O-Y Growth trend Analysis Crop Type

9.7 Absolute $ Opportunity Analysis Crop Type, 2024-2030

Chapter 10. Agricultural Rotavator Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Blade Type

10.1.3 Crop Type

10.1.4 By Weight

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Blade Type

10.2.3 By Power Source

10.2.4 By Weight

10.2.5 Crop Type

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Blade Type

10.3.3 By Power Source

10.3.4 By Weight

10.3.5 Crop Type

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Blade Type

10.4.3 By Power Source

10.4.4 By Weight

10.4.5 Crop Type

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Blade Type

10.5.3 By Power Source

10.5.4 By Weight

10.5.5 Crop Type

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Agricultural Rotavator Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 AGCO Corporation

11.2 CNH Industrial

11.3 Deere & Company

11.4 Kubota Corporation

11.5 Kuhn Group

11.6 Lemken

11.7 Mahindra & Mahindra

11.8 Preet Agro Industries

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global agricultural rotavator market was valued at USD 1.66 billion in 2023 and is projected to reach a market size of USD 2.01 billion by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 2.75%.

Key drivers include the growing need for business agility and scalability and advancements in cloud computing and connectivity.

Asia-Pacific dominates the market with a significant share of over 35%.

AGCO Corporation, CNH Industrial, Deere & Company, Kubota Corporation, Kuhn Group, Lemken, Mahindra & Mahindra, and Preet Agro Industries are some leading players in the Global Agricultural Rotavator Market.

Offering rental and leasing services for rotavators can be a lucrative opportunity to expand market reach and cater to this segment.