Agricultural Pesticide Market Size (2024-2030)

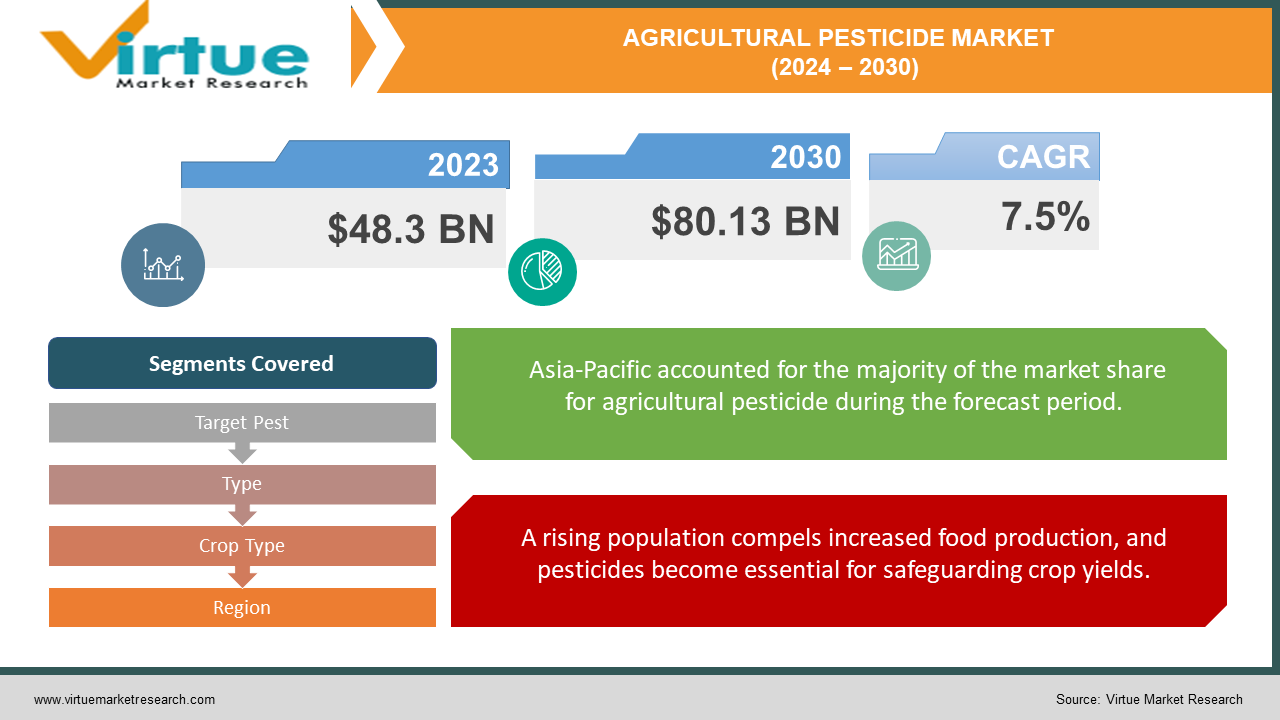

The Agricultural Pesticide Market was valued at USD 48.3 billion in 2023 and is projected to reach a market size of USD 80.13 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 7.5%.

The agricultural pesticide market plays a critical role in protecting crops and ensuring food security for a growing global population. Herbicides, insecticides, and fungicides are the mainstays of this industry, safeguarding crops from weeds, insects, and fungal diseases that threaten yields. However, the market is not without its challenges. Environmental concerns regarding pesticide contamination and potential harm to non-target organisms are on the rise. Additionally, human health risks associated with pesticide exposure for farmers and consumers necessitate stricter regulations.

Key Market Insights:

The agricultural pesticide market navigates a complex landscape of evolving needs and environmental concerns. On the one hand, the demand for effective pest control is undeniable. Traditional pesticides have played a vital role in protecting crops, with herbicides alone comprising nearly half (47%) of the market share. However, the emergence of superweeds and super pests resistant to these chemicals necessitates a shift.

To address this challenge, the market is witnessing a surge in demand for alternative solutions. Biopesticides, derived from natural sources, are gaining traction as an eco-friendlier option. Additionally, precision agriculture techniques are enabling targeted application of traditional pesticides, reducing waste by up to 30% according to some studies. This minimizes environmental impact and promotes responsible use of these chemicals.

Agricultural Pesticide Market Drivers:

A rising population compels increased food production, and pesticides become essential for safeguarding crop yields.

The global population is projected to continue its steady rise, placing immense pressure on food production systems. Pesticides play a critical role in ensuring food security by protecting crops from a multitude of threats. These threats include insects that devour crops directly, fungal diseases that can significantly reduce yields, and weeds that compete with crops for vital resources like water and nutrients. By safeguarding crops, pesticides help maximize yields and ensure sufficient food supplies to nourish a growing global population.

Shifting crop patterns introduce new pests, demanding specific pesticides for effective protection.

The agricultural landscape is undergoing a dynamic transformation. Farmers are constantly adapting their planting strategies, introducing new and more diverse crop varieties to meet evolving consumer preferences and market demands. However, these new crops can attract unfamiliar pests that haven't encountered them before. This necessitates the development and utilization of specific pesticides tailored to address these emerging threats. The ability of the pesticide market to adapt to these shifting crop patterns is crucial for ensuring the success of new agricultural ventures and protecting crop yields.

Expanding agricultural activity in developing regions drives demand for pesticides to support rising crop production.

As economies in regions like India, Africa, and Latin America experience significant growth, their agricultural sectors are undergoing a period of rapid expansion. This surge in agricultural activity translates to a heightened demand for pesticides. Farmers in these developing economies require effective solutions to protect their crops from the various pests and diseases that can devastate their yields. The agricultural pesticide market plays a vital role in supporting the growth of these agricultural sectors and contributing to food security in these regions.

The emergence of pest resistance necessitates continuous innovation in pesticide development to combat evolving threats.

In the ongoing battle between farmers and pests, a constant arms race is taking place. Unfortunately, the overuse of traditional pesticides can inadvertently lead to the emergence of superweeds and super pests that have developed resistance to these chemicals. This necessitates the development of new and more potent solutions to combat these evolving threats. The agricultural pesticide market is driven by the need for continuous innovation in pest control solutions to stay ahead of this resistance phenomenon and safeguard crop yields for future generations.

Agricultural Pesticide Market Restraints and Challenges:

The agricultural pesticide market grapples with several challenges besides the ongoing battle with pest resistance. Environmental concerns are a major point of contention. Pesticide runoff can contaminate water sources, disrupt ecosystems, and potentially harm human health. Additionally, improper use can devastate beneficial insect populations like pollinators, crucial for a healthy environment.

Another challenge lies in the evolving landscape of consumer preferences. The public is increasingly concerned about the safety of conventionally grown food, driving demand for organic produce and fostering a market for eco-friendly pest control solutions. This shift in consumer behavior puts pressure on the industry to develop and adopt more sustainable practices.

Finally, stricter regulations are a growing hurdle for the market. Governments worldwide are enacting stricter laws to ensure the safe use of pesticides and minimize environmental impact. This can lead to limitations on certain chemicals, pushing the industry towards safer alternatives. While these regulations are necessary to safeguard public health and the environment, they can also impact production costs and necessitate innovation in pesticide development.

Agricultural Pesticide Market Opportunities:

The agricultural pesticide market isn't without its opportunities for innovation. A growing focus on Integrated Pest Management (IPM) signifies a shift towards a more holistic approach. IPM combines various methods like cultural practices, biological controls, and judicious use of pesticides to manage pest populations effectively and in an environmentally conscious way. This strategy minimizes reliance on traditional chemical solutions and promotes long-term sustainability.

Emerging markets in Asia, Africa, and Latin America present another exciting opportunity. As their agricultural sectors experience significant growth, the demand for pesticides rises. This creates a chance for the market to cater to this growing need with a strong emphasis on responsible use and the development of sustainable solutions. By focusing on eco-friendly alternatives and promoting responsible practices, the pesticide market can ensure food security while safeguarding the environment for future generations.

AGRICULTURAL PESTICIDE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Target Pest, Type, Crop Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Bayer AG, Corteva Agriscience, FMC Corporation, Syngenta Group, Dow Inc., Nufarm Limited, ADAMA Agricultural Solutions Ltd., UPL Limited |

Agricultural Pesticide Market Segmentation: By Target Pest

-

Herbicides

-

Insecticides

-

Fungicides

-

Other Pesticides

Herbicides are the most dominant segment in the target pest sector, comprising nearly half of the market share. This is because weeds compete directly with crops for resources, significantly impacting yields. The fastest-growing segment is biopesticides, driven by increasing environmental concerns and consumer demand for organic produce. These eco-friendly alternatives offer a more sustainable approach to pest control.

Agricultural Pesticide Market Segmentation: By Type

-

Chemical Pesticides

-

Biopesticides

The agricultural pesticide market is segmented by Type, with Chemical Pesticides being the dominant segment, accounting for a significant market share. However, Biopesticides are the fastest-growing segment driven by growing environmental concerns and consumer demand for organic produce. This trend is likely to continue as regulations and consumer preferences push the market towards more sustainable pest control solutions.

Agricultural Pesticide Market Segmentation: By Crop Type

-

Cereals & Grains

-

Fruits & Vegetables

-

Oilseeds & Pulses

-

Plantation Crops

-

Other Crops

The agricultural pesticide market is segmented by crop type, with cereals and grains dominating the market share. This segment, encompassing wheat, rice, and corn, accounts for nearly half of the market due to the vast cultivated areas dedicated to these staple food crops. On the other hand, the fastest-growing segment is not a specific crop type, but rather the Asia-Pacific region. This region's agricultural sector is experiencing significant growth, driven by factors like rising populations and economic development, leading to a surge in demand for pesticides across various crop types.

Agricultural Pesticide Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America is a mature agricultural pesticide market with a strong focus on regulation and innovation. Due to established agricultural practices and a high level of technological adoption, North America relies heavily on advanced and often high-cost synthetic pesticides. However, growing environmental concerns are prompting a shift towards more sustainable solutions, with biopesticides gaining some traction. Stringent regulations ensure the safe use of pesticides, potentially impacting production costs but safeguarding human health and the environment.

Asia-Pacific holds the title of the largest and fastest-growing agricultural pesticide market globally. This growth is fueled by factors like rising populations, increasing disposable incomes, and expanding agricultural activity. However, the level of regulation varies considerably across countries within the region. While some nations are adopting stricter measures, others still rely heavily on traditional, often less expensive, chemical pesticides. This creates a market with significant growth potential but also necessitates a focus on responsible use and the development of sustainable solutions.

COVID-19 Impact Analysis on the Agricultural Pesticide Market:

The COVID-19 pandemic's disruptive influence extended to the agricultural pesticide market, creating a wave of challenges and unforeseen opportunities. Lockdowns and stringent travel restrictions significantly disrupted global supply chains, hindering the movement of essential raw materials needed for pesticide production and the finished products themselves. This disruption resulted in temporary shortages and price fluctuations for certain pesticides in specific regions, creating a period of uncertainty for farmers relying on these chemicals to protect their crops. Additionally, labor shortages arose due to concerns about safety and movement restrictions. This could have potentially impacted the application of pesticides in some areas, raising anxieties about potential crop yield losses.

However, amidst the disruption, the pandemic also presented some unexpected opportunities. The heightened focus on hygiene during COVID-19 may have led to an increase in demand for certain pesticides used for sanitation purposes. More importantly, the pandemic served as a stark reminder of the critical need for food security. This renewed focus on food self-sufficiency could potentially lead to increased investment in agriculture in the long run. This, in turn, could drive future demand for pesticides. However, a growing emphasis on sustainable practices is likely to emerge in response to heightened environmental and public health concerns. This could translate into a rise in demand for biopesticides and other eco-friendly pest control solutions, shaping the future trajectory of the agricultural pesticide market.

Latest Trends/ Developments:

The agricultural pesticide market is embracing a wave of innovation focused on sustainability and targeted application. Nanopesticides are emerging, offering controlled release of the active ingredient to minimize environmental impact and reduce overall pesticide use. Additionally, advancements in precision agriculture technologies like drone applications and sensor-based monitoring systems are revolutionizing how pesticides are used. These technologies allow for highly targeted applications, reducing waste and optimizing the effectiveness of pest control. This focus on minimizing environmental impact is further bolstered by a growing trend towards Integrated Pest Management (IPM) strategies. IPM incorporates various methods like biological controls and cultural practices alongside the judicious use of pesticides, promoting a holistic approach to managing pest populations. As consumer preferences shift towards organic produce and eco-friendly solutions, the market is under pressure to develop and adopt more sustainable options. These trends signal a promising future for the agricultural pesticide market, where innovation and environmental responsibility go hand-in-hand to ensure food security for generations to come.

Key Players:

-

BASF SE

-

Bayer AG

-

Corteva Agriscience

-

FMC Corporation

-

Syngenta Group

-

Dow Inc.

-

Nufarm Limited

-

ADAMA Agricultural Solutions Ltd.

-

UPL Limited

Chapter 1. Agricultural Pesticide Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Agricultural Pesticide Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Agricultural Pesticide Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Agricultural Pesticide Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Agricultural Pesticide Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Agricultural Pesticide Market – By Target Pest

6.1 Introduction/Key Findings

6.2 Herbicides

6.3 Insecticides

6.4 Fungicides

6.5 Other Pesticides

6.6 Y-O-Y Growth trend Analysis By Target Pest

6.7 Absolute $ Opportunity Analysis By Target Pest, 2024-2030

Chapter 7. Agricultural Pesticide Market – By Type

7.1 Introduction/Key Findings

7.2 Chemical Pesticides

7.3 Biopesticides

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Agricultural Pesticide Market – By Crop Type

8.1 Introduction/Key Findings

8.2 Cereals & Grains

8.3 Fruits & Vegetables

8.4 Oilseeds & Pulses

8.5 Plantation Crops

8.6 Other Crops

8.7 Y-O-Y Growth trend Analysis By Crop Type

8.8 Absolute $ Opportunity Analysis By Crop Type, 2024-2030

Chapter 9. Agricultural Pesticide Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Target Pest

9.1.3 By Type

9.1.4 By By Crop Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Target Pest

9.2.3 By Type

9.2.4 By Crop Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Target Pest

9.3.3 By Type

9.3.4 By Crop Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Target Pest

9.4.3 By Type

9.4.4 By Crop Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Target Pest

9.5.3 By Type

9.5.4 By Crop Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Agricultural Pesticide Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BASF SE

10.2 Bayer AG

10.3 Corteva Agriscience

10.4 FMC Corporation

10.5 Syngenta Group

10.6 Dow Inc.

10.7 Nufarm Limited

10.8 ADAMA Agricultural Solutions Ltd.

10.9 UPL Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Agricultural Pesticide Market was valued at USD 48.3 billion in 2023 and is projected to reach a market size of USD 80.13 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 7.5%.

Rising Food Demand, Shifting Crop Patterns, Developing Economies, Pest Resistance.

Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Plantation Crops, Other Crops.

The Asia-Pacific region currently holds the title of the largest and fastest-growing market for agricultural pesticides due to factors like rising populations and expanding agricultural activity.

BASF SE, Bayer AG, Corteva Agriscience, FMC Corporation, Syngenta Group, Dow Inc., Nufarm Limited, ADAMA Agricultural Solutions Ltd., UPL Limited.