Agricultural Lighting Market Size (2025 – 2030)

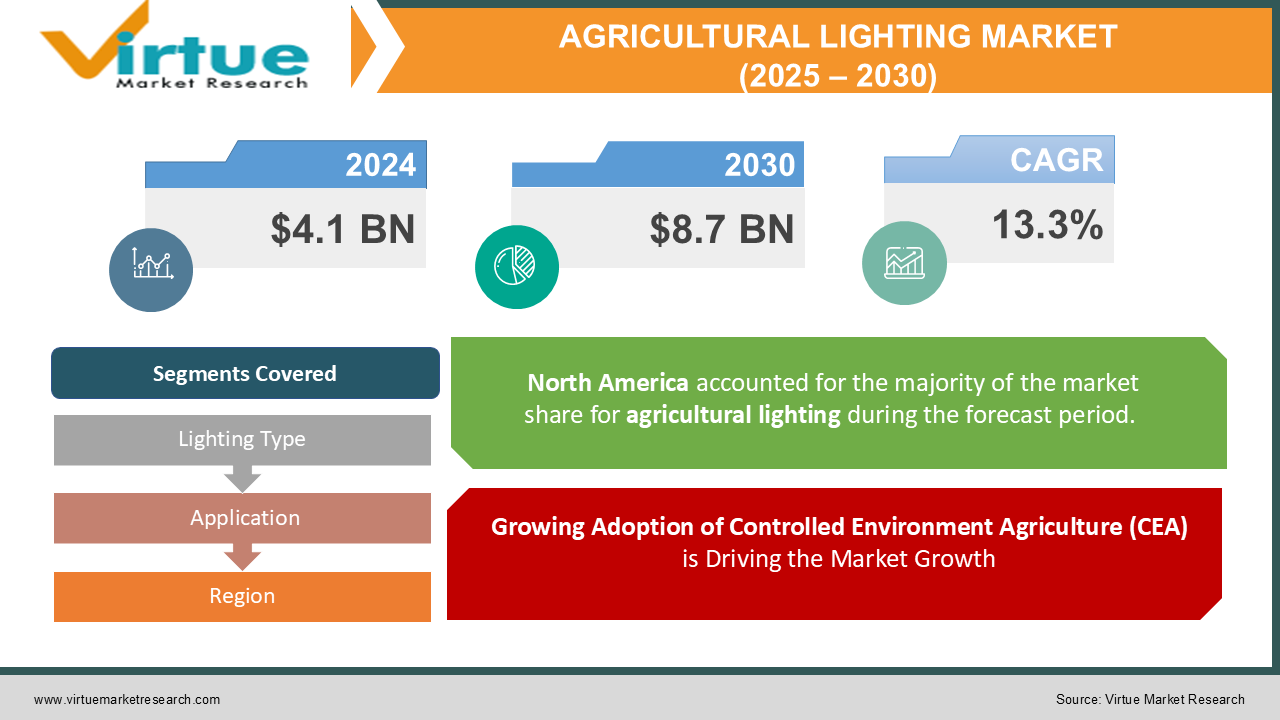

The Global Agricultural Lighting Market was valued at USD 4.1 billion in 2024 and is projected to reach USD 8.7 billion by 2030, growing at a CAGR of 13.3% during the forecast period.

Agricultural lighting solutions are vital for improving productivity in controlled environment agriculture (CEA) settings, such as greenhouses, vertical farms, and livestock facilities.

LED technology dominates the market due to its energy efficiency, long lifespan, and adaptability to various agricultural applications. Rising demand for sustainable farming practices, technological advancements in lighting systems, and the growing adoption of indoor farming techniques are driving the market forward.

Key Market Insights

-

LEDs accounted for over 55% of the market share in 2024, dominating due to their efficiency and customization capabilities.

-

The vertical farming segment is witnessing the fastest growth, driven by increasing urbanization and the need for space-efficient farming solutions.

-

Asia-Pacific is the fastest-growing regional market, with increasing adoption of agricultural lighting systems in countries like China, Japan, and India.

-

Livestock farming applications are emerging, with agricultural lighting improving animal health, reproduction, and productivity.

-

Companies are heavily investing in smart lighting systems, integrating IoT and AI for optimized farming outcomes.

-

Increasing energy costs are further driving the demand for energy-efficient lighting solutions in agriculture.

Global Agricultural Lighting Market Drivers

1. Growing Adoption of Controlled Environment Agriculture (CEA) is Driving the Market Growth

Controlled Environment Agriculture (CEA), including greenhouses and vertical farming, is rapidly gaining traction as a sustainable solution to meet the rising global food demand. These systems rely heavily on artificial lighting to provide plants with the optimal light spectrum and intensity for photosynthesis and growth.

CEA methods allow year-round cultivation, improved yield, and reduced resource consumption compared to traditional farming. Agricultural lighting, especially LED technology, plays a critical role in optimizing crop production in these systems. The rising awareness of food security and urbanization has further boosted the adoption of CEA, driving the agricultural lighting market.

2. Advancements in LED Technology is Driving the Market Growth

LED lighting has revolutionized the agricultural sector with its energy efficiency, durability, and adaptability. Advanced LED systems can emit specific light spectra tailored to different crops, enhancing growth, flowering, and yield.

The ability to control light intensity, duration, and wavelength enables precision farming, reducing energy consumption and improving productivity. Additionally, LED technology’s decreasing cost has made it more accessible to farmers worldwide, fostering its widespread adoption in agricultural lighting.

3. Rising Focus on Livestock Farming Efficiency is driving the market growth

Agricultural lighting is not limited to crop production; it also plays a crucial role in livestock farming. Proper lighting conditions can improve animal health, behavior, and reproduction. For instance, tailored lighting schedules and spectrums can enhance dairy production in cattle and egg-laying efficiency in poultry.

With increasing demand for animal products and the need for sustainable farming practices, agricultural lighting for livestock facilities is gaining prominence, driving market growth.

Global Agricultural Lighting Market Challenges and Restraints

1. High Initial Investment Costs is restricting the market growth

Despite the long-term cost benefits of LED lighting, the high upfront investment required for advanced agricultural lighting systems remains a significant barrier, particularly for small and medium-sized farmers.

Many traditional farmers in developing regions lack access to financial support or subsidies to adopt modern lighting solutions. Additionally, the perception of agricultural lighting as a luxury rather than a necessity hinders its widespread adoption in cost-sensitive markets.

2. Limited Awareness and Technical Knowledge is restricting the market growth

The adoption of agricultural lighting requires a basic understanding of its benefits and operational requirements. In many regions, farmers lack awareness of how tailored lighting solutions can enhance crop and livestock productivity.

Moreover, the complexity of integrating lighting systems into existing farming practices and limited technical expertise pose challenges. Providing adequate training and support to farmers is essential to overcoming this restraint.

Market Opportunities

The Global Agricultural Lighting Market presents numerous opportunities driven by the rising adoption of smart farming practices, technological advancements, and increasing demand for sustainable agricultural solutions. The integration of Internet of Things (IoT) and Artificial Intelligence (AI) in lighting systems is revolutionizing the industry. Smart lighting systems equipped with IoT and AI capabilities enable precise monitoring and control of light intensity, spectrum, and duration. These systems can adapt to crop needs in real-time, optimizing energy usage and maximizing yield while minimizing environmental impact. The expanding trend of urban farming, especially vertical farming, creates significant demand for energy-efficient lighting systems. Vertical farms rely entirely on artificial lighting for plant growth, offering immense potential for LED and smart lighting solutions. Many governments are promoting sustainable farming practices through subsidies and financial support for modern agricultural technologies, including lighting systems. These initiatives create a favorable environment for the growth of the agricultural lighting market by incentivizing farmers to adopt advanced technologies. Emerging markets in Asia-Pacific and Latin America are witnessing rapid growth in the adoption of advanced agricultural practices to enhance productivity and meet food security challenges. Investments in modern farming infrastructure, including agricultural lighting, are growing rapidly in these markets, driven by increasing demand for high-quality produce and government support for agricultural modernization. These factors, combined with ongoing technological advancements in LED lighting technology, are driving significant growth in the global agricultural lighting market.

AGRICULTURAL LIGHTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

13.3% |

|

Segments Covered |

By Lighting Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Signify Holding (Philips Lighting), Osram Licht AG, General Electric Company,Valoya Oy, Heliospectra AB, LumiGrow, Inc., Illumitex, Inc., Hortilux Schreder B.V., California LightWorks, Thrive Agritech, Inc. |

Agricultural Lighting Market Segmentation - By Lighting Type

-

LEDs

-

High-Pressure Sodium (HPS)

-

Fluorescent

-

Others

LEDs have emerged as the dominant technology in the agricultural lighting market. This dominance is attributed to their numerous advantages over traditional lighting sources. LEDs exhibit significantly higher energy efficiency compared to conventional technologies like High-Pressure Sodium (HPS) lamps, resulting in substantial energy cost savings for growers. Furthermore, LEDs boast a much longer lifespan than HPS lamps, reducing maintenance costs and downtime. Perhaps most significantly, LEDs offer unparalleled flexibility in terms of light spectrum. By carefully controlling the ratio of red, blue, and other wavelengths, growers can optimize light conditions for specific plant species and growth stages, maximizing yield and quality. While HPS lights are still prevalent in traditional greenhouse applications, their market share is gradually diminishing as growers increasingly recognize the superior performance and cost-effectiveness of LED lighting technology. The ongoing advancements in LED technology, including the development of more efficient and cost-effective solutions, are further solidifying the dominance of LEDs in the agricultural lighting market.

Agricultural Lighting Market Segmentation - By Application

-

Greenhouses

-

Vertical Farming

-

Livestock Farming

-

Others

Greenhouses currently dominate the agricultural lighting market, driven by the need for year-round cultivation and the ability to control growing conditions such as temperature, humidity, and light exposure. However, vertical farming is emerging as the fastest-growing segment, driven by several factors. Increasing urbanization and the subsequent decline in available arable land are major drivers, making vertical farming an attractive solution for producing fresh produce in urban and densely populated areas. Furthermore, the need for efficient land use and reduced environmental impact are further propelling the growth of vertical farming. These factors, combined with advancements in lighting technology and increasing consumer demand for locally sourced and sustainably produced food, are driving significant growth in the vertical farming market and consequently, the demand for specialized lighting solutions.

Agricultural Lighting Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America dominates the agricultural lighting market, driven by the widespread adoption of advanced farming practices and strong government support for sustainable agriculture. The U.S. leads the region with significant investments in greenhouse and vertical farming infrastructure. Europe is a significant market due to stringent environmental regulations and the high adoption of energy-efficient technologies. Countries like the Netherlands and Germany are leaders in agricultural lighting, with a strong emphasis on greenhouse farming and smart solutions. The Asia-Pacific region is the fastest-growing market, fueled by rapid urbanization, population growth, and the need for efficient agricultural practices. China, Japan, and India are key contributors, with increasing investments in vertical farms and modern greenhouse systems. Latin America is an emerging market, with countries like Brazil and Mexico focusing on enhancing agricultural productivity. The adoption of agricultural lighting systems is growing as the region shifts toward modern farming methods. The Middle East & Africa region is gradually adopting agricultural lighting solutions to address food security challenges and improve productivity in arid regions, focusing on greenhouse farming to optimize resource use and ensure year-round cultivation.

COVID-19 Impact Analysis

The COVID-19 pandemic significantly impacted the Agricultural Lighting Market, with disruptions in supply chains and project delays in the early stages. However, the crisis also highlighted the importance of resilient food production systems, driving investments in modern agricultural practices.

The shift toward local food production and the rising adoption of vertical farming during the pandemic accelerated demand for agricultural lighting systems. Governments and private players are increasingly focusing on sustainable agriculture to ensure food security in the post-pandemic era, creating long-term growth opportunities for the market.

Latest Trends/Developments

The agricultural lighting market is witnessing significant advancements, driven by technological innovations and a growing emphasis on sustainable and efficient agricultural practices. The integration of Internet of Things (IoT) and Artificial Intelligence (AI) in lighting systems is revolutionizing the industry. Smart lighting systems enable real-time monitoring and control of light intensity, spectrum, and duration, allowing growers to optimize energy use, adapt to changing crop needs, and maximize yield while minimizing environmental impact. The rising popularity of vertical farming, particularly in urban areas, is creating a significant demand for efficient and high-performance lighting solutions. Vertical farms rely entirely on artificial light for plant growth, making the selection and optimization of lighting systems crucial for successful cultivation. Manufacturers are continuously developing advanced LED systems with higher energy efficiency and customizable light spectrums. These advancements allow for precise control over the light environment, enabling growers to fine-tune light conditions to meet the specific needs of different crops and growth stages. Furthermore, the development of livestock-specific lighting solutions is gaining traction. These systems, tailored to the specific needs of different animal species, can improve animal health, enhance productivity, and improve overall farm efficiency. Finally, collaborative research and development initiatives between lighting manufacturers, research institutions, and agricultural stakeholders are fostering innovation and accelerating the development of cutting-edge lighting technologies for diverse agricultural applications. These partnerships facilitate knowledge sharing, accelerate product development, and drive the adoption of sustainable and efficient lighting solutions across the agricultural landscape.

Key Players

-

Signify Holding (Philips Lighting)

-

Osram Licht AG

-

General Electric Company

-

Valoya Oy

-

Heliospectra AB

-

LumiGrow, Inc.

-

Illumitex, Inc.

-

Hortilux Schreder B.V.

-

California LightWorks

-

Thrive Agritech, Inc.

Chapter 1. Agricultural Lighting Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Agricultural Lighting Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Agricultural Lighting Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Agricultural Lighting Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Agricultural Lighting Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Agricultural Lighting Market – By Lighting Type

6.1 Introduction/Key Findings

6.2 LEDs

6.3 High-Pressure Sodium (HPS)

6.4 Fluorescent

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Lighting Type

6.7 Absolute $ Opportunity Analysis By Lighting Type, 2025-2030

Chapter 7. Agricultural Lighting Market – By Application

7.1 Introduction/Key Findings

7.2 Greenhouses

7.3 Vertical Farming

7.4 Livestock Farming

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Agricultural Lighting Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Lighting Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Lighting Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Lighting Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Lighting Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Lighting Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Agricultural Lighting Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Signify Holding (Philips Lighting)

9.2 Osram Licht AG

9.3 General Electric Company

9.4 Valoya Oy

9.5 Heliospectra AB

9.6 LumiGrow, Inc.

9.7 Illumitex, Inc.

9.8 Hortilux Schreder B.V.

9.9 California LightWorks

9.10 Thrive Agritech, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 4.1 billion in 2024 and is projected to reach USD 8.7 billion by 2030, growing at a CAGR of 13.3%.

Key drivers include the adoption of controlled environment agriculture, advancements in LED technology, and the rising focus on livestock farming efficiency.

Segments include Lighting Type (LEDs, High-Pressure Sodium, Fluorescent) and Application (Greenhouses, Vertical Farming, Livestock Farming).

North America dominates the market, accounting for over 35% share in 2024, driven by advanced farming practices and government support.

Key players include Signify Holding, Osram Licht AG, General Electric Company, Valoya Oy, and Heliospectra AB.