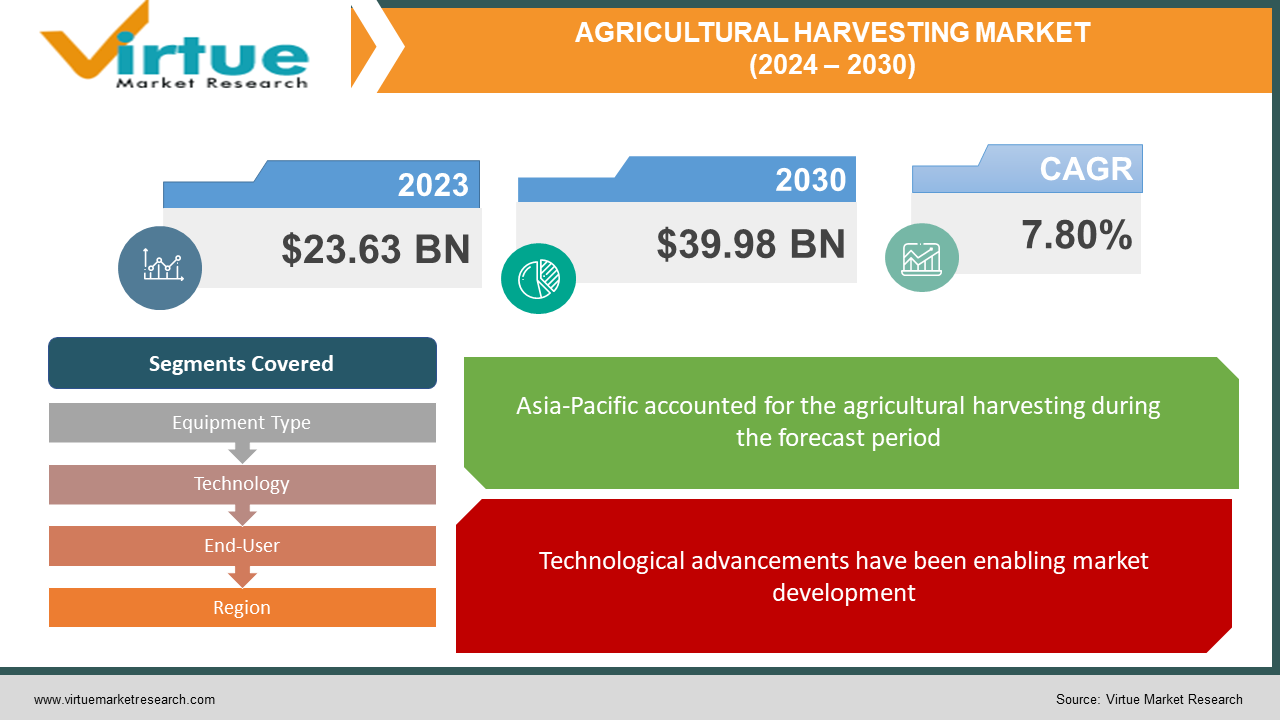

Agricultural Harvesting Market Size (2024 – 2030)

The global agricultural harvesting market was valued at USD 23.63 billion and is projected to reach a market size of USD 39.98 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.80%.

Removing mature plants or profitable portions from a field is called harvesting. The complete plant, seed leaf, root, or grain can all be considered an economic product. Stubble is the portion of the stem that remains in the field after harvest. Harvesting can be accomplished manually with a sickle or mechanically using a harvester. In the past, manual methods were mainly used for harvesting. Over time, there were a lot of innovations that helped produce better yields. Presently, technological advancements have been extremely beneficial for the expansion. This includes GPS, sensors, and other precision agriculture techniques. In the future, with a growing focus on artificial intelligence and robotics, immense growth is anticipated.

Key Market Insights:

According to projections, the market for artificial intelligence in agriculture is likely to expand from USD 1.7 billion to USD 4.8 billion by 2028, with a compound annual growth rate (CAGR) of 23.1% predicted between 2023 and 2028. A reaper's field efficiency is 58.2%, whereas a combine harvester's is 60.8%. Tractors, combined cotton and sugarcane harvesters, crop care equipment, and precision agriculture brought in over $22 billion in sales for John Deere in 2022. Each year, agricultural machinery is responsible for around 11% of greenhouse gas emissions worldwide. To tackle this, fuel efficiency in the equipment is being improved to reduce emissions

Agricultural Harvesting Market Drivers:

Technological advancements have been enabling market development.

Over the years, there have been many advancements in improving the equipment that is used for harvesting. This helps in improving the yield by analyzing the weather conditions, soil quality, and crop health. AI, GIS, IoT, and sensor technologies are used in precision agriculture to gather and evaluate data on soil, plants, and animals. This makes it possible to employ labor, water, fertilizer, seeds, insecticides, and other inputs more precisely. Secondly, up to 70% less water is used in vertical farming than in traditional farming, where crops are grown inside on racks. In addition to controlling light, water, and humidity, vertical farming may save labor expenses and boost food output. Thirdly, drones are being used to map farms, track crop development, and enhance irrigation systems. Drones may also be used for airborne surveys to monitor irrigation levels over wide regions, evaluate fallow fields, and provide an overview of the land. Furthermore, R& D activities are being conducted on robotics. This field helps in creating devices that can shear sheep, milk cows, and do other tasks.

An increasing population has been boosting the market.

The market for agricultural harvesting is driven by the elevating demand for agricultural food products due to the growing global population and increased needs for food, feed, fiber, and biofuel. As per the latest statistics, the population in January 2024 was 8.1 billion. The development of harvesting techniques has been made possible by the urbanization of many emerging nations, as well as changes in dietary choices and eating habits. Harvesting machinery and equipment are in high demand due to the growth of cash crops and the expansion of agriculture into previously unexplored locations. Government programs and policies that promote rural lives, food security, and agricultural development encourage investment in mechanization and advanced harvesting methods.

Agricultural Harvesting Market Restraints and Challenges:

High investments, dependency on weather patterns, a shortage of expertise, and limited access to resources are the main issues that the market is currently facing.

The costs that are associated with machinery and other precision agricultural technology are very high. A lot of farmers have limited access to financial options. Small-scale farmers suffer the most. Besides, a few pieces of machinery may require maintenance charges over time. This leads to manual harvesting techniques, causing losses for the market. Secondly, agricultural technologies are entirely dependent on weather conditions. Adverse conditions like drought, floods, and extreme temperatures can reduce crop yield significantly. Thirdly, harvesting operations require a skilled workforce. Farmers need to have the right knowledge about the workings and implementation of heavy machinery. Additionally, understanding the smart crop techniques that are being adopted is also necessary. Moreover, many rural areas lack proper infrastructure for transportation, logistics, and other resources. This limits the ability to have access and gain input.

Agricultural Harvesting Market Opportunities:

Agricultural machinery contributes to the emission of greenhouse gases and global warming. As such, sustainability is being emphasized. Renewable energy is being prioritized. Farmers are being encouraged to use solar panels to power equipment like lighting and ventilation systems. Additionally, wind turbines are being used to generate electricity. Secondly, rainwater harvesting involves utilizing gravity-fed pipes to collect rainwater from rooftops and store it in a tank. This is a long-term solution to the growing demand for freshwater supplies. Thirdly, water harvesting is a sustainable, profitable, and ecologically responsible choice. It has been demonstrated to assist in lessening or overcoming global water shortages. The technique of gathering and storing water runoff from a catchment area is known as water harvesting. The idea behind water harvesting is to collect precipitation that falls in one place and move it to another. As a result, there is more water accessible in the latter location. Furthermore, conservation tillage helps preserve soil nutrients, increase yields, and lessen soil loss from erosion. Conservation tillage is a technique in which the quantity and depth of tillage events are decreased to the absolute minimum required. At least thirty percent of the plant residue from the harvest is left on the field in conservation tillage. Apart from this, governmental policies in the form of schemes and funds are vital. They help the farmers adopt and embrace technological innovations. Labor training programs are another step toward having a skilled workforce.

AGRICULTURAL HARVESTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.80% |

|

Segments Covered |

By Equipment Type, Technology, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

John Deere, CNH Industrial, AGCO Corporation, CLAAS Group, Kubota Corporation, Mahindra & Mahindra Ltd., Deutz-Fahr, Yanmar Co., Ltd., SDF Group, Preet Agro Industries |

Agricultural Harvesting Market Segmentation: By Equipment Type

-

Combine Harvesters

-

Forage Harvesters

-

Harvesting Machinery Attachments

Combine harvesters have the largest market share and is dominating in the year 2023. They are multifunctional devices that may efficiently harvest crops while lowering the labor requirements for harvesting. The productivity and yields of crops can be increased by using combined harvesters, which can quickly harvest huge regions of crops. Secondly, they reduce the volatility that might arise with manual labor and can give a uniform degree of quality to the harvested crops. Thirdly, grain and straw can be separated at the same time using combined harvesters. Furthermore, they can handle delicate seeds more gently due to modern features. Forage harvesters are the fastest-growing. Precise cutting mechanisms in forage harvesters guarantee that crops are the proper length for silage, enhancing the nutritional value of the crop. Besides, particles that are uniformly chopped preserve silage better, resulting in decreased feed loss and increased animal voluntary intake. Moreover, farmers may increase the value of their harvest by reducing waste due to the effectiveness of forage harvesters in cutting, threshing, and sorting crops. They are essential to sustainable agricultural methods since they increase crop output. Apart from this, electric actuator solutions may save maintenance, extend longevity, and enhance safety for forage harvesters.

Agricultural Harvesting Market Segmentation: By Technology

-

Conventional Harvesting Equipment

-

Precision Harvesting Equipment

Conventional harvesting equipment is the largest category by technology type. It comprises machinery like grain headers, forage harvesters, and traditional combine harvesters. Traditional harvesting tools can save labor costs, enhance crop quality, and boost production and efficiency. Additionally, they can aid in the separation of weeds from grain, leading to cleaner grains. Precision harvesting equipment is the fastest-growing type. Accurate plant development, prompt interventions, and ideal harvest timing may all be achieved with the use of precision harvesting technology. Farmers may cut expenses and waste by using precision harvesting technology to apply inputs like herbicides, fertilizers, and seeds to certain regions. Furthermore, with the use of precision harvesting technology, farmers may increase crop quality and save water waste by precisely measuring soil moisture levels, minimizing runoff, and scheduling irrigation. Besides, by reducing the chance of crop loss, remote sensing technology can assist farmers in engaging in more sustainable agricultural practices.

Agricultural Harvesting Market Segmentation: By End-User

-

Large-Scale Commercial Farms

-

Small and Medium-Sized Farms

Large-scale commercial farms are the largest end-users. They are distinguished by their huge land holdings and high output volumes. These farms frequently invest in equipment and technology to increase productivity and yields throughout their extensive operations. The fastest-growing section is small and medium-sized farms. Government assistance initiatives, the increased emphasis on efficiency and sustainability, and the expanding use of mechanization and precision agricultural technology are some of the drivers driving this expansion. They are more flexible and responsive to shifts in consumer preferences and market trends.

Agricultural Harvesting Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific has both the largest and fastest-growing market. Agriculture is one of the main occupations in this region, providing employment opportunities to millions of people. It contributes tremendously to strengthening the economy in regions like India, China, and Japan. There is a growing demand for agricultural goods due to factors such as rising incomes and increasing urbanization. Consequently, to increase productivity, efficiency, and crop yields, farmers are implementing contemporary agricultural techniques and making investments in harvesting machinery and technology. Growth in the region is further stimulated by government efforts that assist agricultural mechanization and advances in precision agriculture technology. The adoption of creative harvesting techniques is also fueled by the need to improve food security and satisfy the nutritional needs of an expanding population in Asia-Pacific.

COVID-19 Impact Analysis on the Global Agricultural Harvesting Market:

The market was negatively impacted by the viral outbreak. Among the new norms were social isolation, movement restrictions, and lockdowns. This affects supply chain management, logistics, and transportation. Import-export activities suffered as a result. To stop the virus from spreading, all businesses and production facilities had to close. This resulted in the suspension of production and other activities. Remote work was prioritized to stop the virus from spreading. There was economic uncertainty. Due to various guidelines, there wasn't enough labor to carry out the activities. The majority of the funds were used for healthcare-related applications. This caused delays in collaborations and launches. A lot of farmers had to store their crops as they were unable to sell them. As per many reports, 60% of the farmers suffered yield losses, and 10% were unable to harvest. However, the market has slowly begun to pick up. COVID-19 acted as a catalyst for digital adoption. Remote monitoring solutions have gained prominence for monitoring crops and land. Relaxation of rules and regulations has led to normal functioning.

Latest Trends/ Developments:

Companies in this industry use a range of strategies, including acquisitions, joint ventures, and investments, to increase their market share. Businesses are spending a lot of money creating techniques to keep their prices competitive. This has caused more growth.

The digital revolution is an emerging trend in this market. This facilitates greater connection and data exchange. To manage field operations, track crop health, and get market data, farmers are using mobile applications, cloud-based platforms, and farm management software. The goal of the digitization trend is to increase agricultural harvesting operations' traceability, efficiency, and transparency.

Key Players:

-

John Deere

-

CNH Industrial

-

AGCO Corporation

-

CLAAS Group

-

Kubota Corporation

-

Mahindra & Mahindra Ltd.

-

Deutz-Fahr

-

Yanmar Co., Ltd.

-

SDF Group

-

Preet Agro Industries

-

In October 2023, the grain-cutting and threshing machine Daedong, a South Korean manufacturer of agricultural machinery, debuted the DH6135, the nation's first autonomous combine harvester. Efficiency and harvest quality are the design goals of the combine. Farmers can save time and money by combining the three primary harvesting tasks of reaping, threshing, and winnowing into a single process with combined harvesters.

-

In August 2023, Mahindra & Mahindra's subsidiary Swaraj Tractors introduced the Swaraj 8200 Smart Harvester. The company's service and product support staff can keep an eye on the harvester's performance and health due to its intelligent harvesting system. Health alerts, individualized help via a dedicated relationship manager, and app-based video chatting are all included in the service. AdBlue level indicators, engine alarms, and vehicle servicing and health alerts are further features of the harvester that allow farmers, equipment owners, and rental business owners to monitor their vehicles in real time.

-

In April 2022, the Pune-based business KhetiGaadi introduced KhetiGuru, a free farmer consulting portal. The platform's primary goal is to minimize crop loss while providing adequate nutrition to minimize pest- or disease-related crop damage. To maximize crop yield, the platform helps farmers with everything from land preparation to harvesting, offering technical and scientific support. Additionally, KhetiGuru assists farmers in comprehending soil micronutrition and addressing its deficiency more thoroughly.

Chapter 1. Agricultural Harvesting Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Agricultural Harvesting Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Agricultural Harvesting Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Agricultural Harvesting Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Agricultural Harvesting Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Agricultural Harvesting Market – By Equipment Type

6.1 Introduction/Key Findings

6.2 Combine Harvesters

6.3 Forage Harvesters

6.4 Harvesting Machinery Attachments

6.5 Y-O-Y Growth trend Analysis By Equipment Type

6.6 Absolute $ Opportunity Analysis By Equipment Type, 2024-2030

Chapter 7. Agricultural Harvesting Market – By Technology

7.1 Introduction/Key Findings

7.2 Conventional Harvesting Equipment

7.3 Precision Harvesting Equipment

7.4 Y-O-Y Growth trend Analysis By Technology

7.5 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Agricultural Harvesting Market – By End-User

8.1 Introduction/Key Findings

8.2 Large-Scale Commercial Farms

8.3 Small and Medium-Sized Farms

8.4 Y-O-Y Growth trend Analysis By End-User

8.5 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Agricultural Harvesting Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Equipment Type

9.1.3 By Technology

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Equipment Type

9.2.3 By Technology

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Equipment Type

9.3.3 By Technology

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Equipment Type

9.4.3 By Technology

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Equipment Type

9.5.3 By Technology

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Agricultural Harvesting Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 John Deere

10.2 CNH Industrial

10.3 AGCO Corporation

10.4 CLAAS Group

10.5 Kubota Corporation

10.6 Mahindra & Mahindra Ltd.

10.7 Deutz-Fahr

10.8 Yanmar Co., Ltd.

10.9 SDF Group

10.10 Preet Agro Industries

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global agricultural harvesting market was valued at USD 23.63 billion and is projected to reach a market size of USD 39.98 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.80%.

Technological advancements and an increasing population are the main factors propelling the global agricultural harvesting market.

Based on technology, the global agricultural harvesting market is segmented into conventional harvesting equipment and precision harvesting equipment.

Asia-Pacific is the most dominant region for the global agricultural harvesting market.

John Deere, CNH Industrial, and AGCO Corporation are the key players operating in the global agricultural harvesting market.