Agricultural Biosolutions Market Size (2025 – 2030)

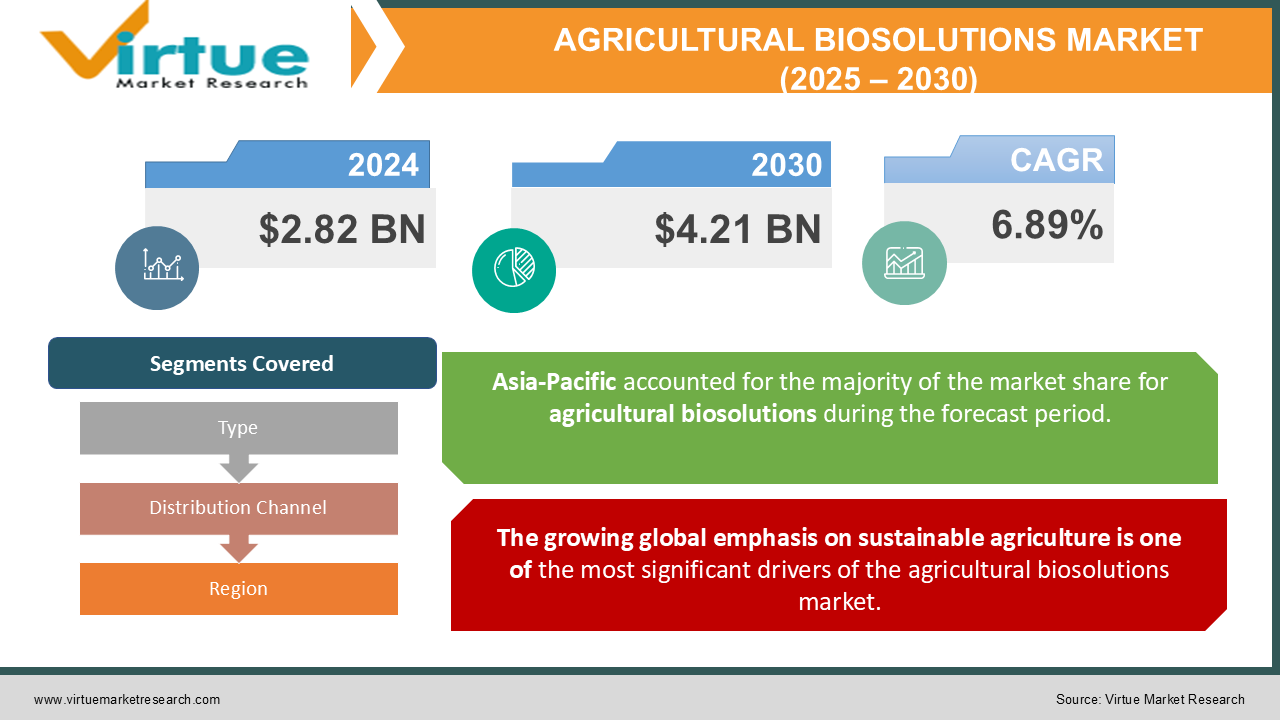

The Agricultural Biosolutions Market was valued at USD 2.82 Billion in 2024 and is projected to reach a market size of USD 4.21 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6.89%.

The Agricultural Biosolutions Market has rapidly emerged as a vital segment within the agriculture industry, addressing the growing need for sustainable and eco-friendly farming practices. Agricultural biosolutions encompass a wide range of products, including biopesticides, biofertilizers, biostimulants, and other naturally derived inputs that enhance crop productivity while minimizing the ecological footprint. These solutions are gaining popularity as they offer alternatives to synthetic chemicals, which have been associated with soil degradation, water pollution, and negative impacts on biodiversity. By focusing on harnessing natural processes, agricultural biosolutions align with the increasing global emphasis on organic and regenerative agriculture, making them a cornerstone of modern agricultural practices.

Key Market Insights:

-

The agricultural biosolutions market reached a valuation of $12.7 billion in 2023. Biopesticides accounted for 40% of the total market revenue in 2023.

-

The global adoption rate of biofertilizers increased by 28% compared to the previous year. Over 65% of organic farms incorporated biostimulants into their crop management systems in 2023. Biostimulants contributed $3.8 billion to the overall market value in 2023.

-

75% of farmers who adopted biosolutions reported a 15–20% increase in crop yield.

-

Nearly 70% of bio solution users cited environmental sustainability as their primary reason for adoption.

-

90% of global biosolutions production facilities adopted green manufacturing practices in 2023.

-

Over 45 million hectares of agricultural land were treated with biosolutions during the year 2022.

Market Drivers:

The growing global emphasis on sustainable agriculture is one of the most significant drivers of the agricultural biosolutions market.

As concerns about climate change, soil degradation, and water scarcity intensify, governments, agricultural organizations, and consumers are pushing for environmentally friendly farming methods. Biosolutions offer an effective and eco-conscious alternative to chemical fertilizers and pesticides, which have long been associated with harmful environmental impacts. The shift toward organic farming is a direct result of this trend, with consumers increasingly demanding organic produce that is free from synthetic chemicals. Farmers are also recognizing the long-term benefits of using biosolutions. Products like biofertilizers and biopesticides improve soil fertility and microbial diversity while reducing dependency on chemical inputs. This not only supports better crop health and yield but also helps farmers comply with stringent environmental regulations. Biosolutions' ability to restore soil health, enhance nutrient uptake, and reduce water usage aligns perfectly with the principles of regenerative agriculture, which aims to restore and maintain the natural ecosystem. Advances in biotechnology and microbiology have further strengthened the capabilities of biosolutions, making them more effective and accessible. Enhanced formulations now offer better shelf life, application flexibility, and compatibility with various crop types, encouraging wider adoption. The increasing availability of educational resources and extension services has also helped farmers understand the value of integrating biosolutions into their practices, further fueling market growth.

Stringent government regulations aimed at minimizing the ecological footprint of agriculture have significantly bolstered the adoption of agricultural biosolutions.

Many countries have imposed bans or restrictions on the use of synthetic chemicals in agriculture due to their adverse effects on the environment and human health. For instance, the prohibition of certain high-residual pesticides has created a substantial market opportunity for biopesticides, which provide an effective and safer alternative. Regulatory bodies are increasingly promoting the use of biosolutions as part of national agricultural policies and subsidy programs. For example, subsidies and incentives are being offered to farmers who adopt sustainable practices, including the use of biosolutions. Certification programs for organic and sustainable farming further encourage the adoption of these products, as they are a key component of meeting organic farming standards. Large-scale agricultural corporations and food producers are also under pressure to meet environmental, social, and governance (ESG) goals, which include reducing chemical inputs in their supply chains. The integration of biosolutions helps these organizations align with regulatory frameworks and consumer expectations for sustainable practices. This trend is expected to intensify, as global policymakers continue to prioritize sustainable agriculture to combat climate change and promote food security.

Market Restraints and Challenges

The Agricultural Biosolutions Market, while flourishing, faces several constraints that hinder its widespread adoption and growth. One of the primary challenges is the high initial cost associated with biosolution products compared to conventional chemical inputs. Farmers, especially in developing regions, often operate under tight budgets and may prioritize short-term cost savings over long-term sustainability. Biosolutions, although cost-effective over time, require an upfront investment that may be prohibitive for small and medium-scale farmers. Another critical challenge lies in the limited awareness and technical knowledge about biosolutions among the farming community. Despite the growing popularity of these products, a significant portion of the global farming population remains unfamiliar with their benefits, proper application methods, and potential to enhance yields. This lack of awareness is compounded by insufficient extension services and inadequate training programs in many regions. The variability in efficacy of biosolutions under different climatic and soil conditions also poses a challenge. Unlike synthetic chemicals, which often deliver consistent results, biosolutions can exhibit inconsistent performance depending on environmental factors. This variability may lead to skepticism among farmers, particularly those who prioritize reliability and immediate results. Additionally, the regulatory landscape for biosolutions is complex and inconsistent across regions. While some governments actively promote the use of biosolutions, others have stringent approval processes that can delay the launch of new products. The lack of harmonized regulations makes it challenging for manufacturers to expand their reach and comply with varying standards. The short shelf life and storage requirements of certain biosolutions also act as barriers. Many products, such as biofertilizers and biopesticides, contain live microorganisms that require specific storage conditions to maintain their efficacy. This necessitates a robust cold chain infrastructure, which is often lacking in rural and remote areas. Lastly, competition from synthetic inputs remains a significant restraint. Despite the environmental and long-term economic benefits of biosolutions, synthetic fertilizers and pesticides dominate the market due to their established supply chains, lower costs, and immediate results. Overcoming this entrenched preference requires substantial efforts in education, marketing, and policy support.

Market Opportunities:

The Agricultural Biosolutions Market is brimming with opportunities that promise significant growth in the coming years. One of the most prominent opportunities lies in the increasing adoption of precision agriculture technologies, which enable the targeted application of biosolutions. Precision agriculture tools, such as drones, GPS-guided machinery, and IoT-enabled sensors, allow farmers to optimize the use of biosolutions, ensuring maximum efficacy and cost savings. This synergy between biosolutions and digital agriculture is expected to unlock new possibilities for efficiency and sustainability. The rising demand for organic food represents another significant opportunity. Consumers worldwide are gravitating towards organic products due to growing health awareness and concerns about chemical residues in food. This shift in consumer preference is driving farmers to adopt biosolutions, which are integral to organic farming practices. The expansion of organic food markets, both in developed and emerging economies, provides a robust platform for the growth of biosolutions. The increasing investment in research and development (R&D) is also creating avenues for innovation in the market. Advances in biotechnology, microbiology, and nanotechnology are leading to the development of next generation biosolutions with enhanced efficacy, stability, and compatibility. For instance, encapsulation technologies are improving the shelf life and controlled release of active ingredients, making biosolutions more practical and appealing to farmers. Another opportunity lies in the integration of biosolutions into sustainable supply chains. Major food corporations and retailers are emphasizing sustainable sourcing to meet ESG goals and cater to environmentally conscious consumers. Collaborations between biosolution manufacturers and large agribusinesses can facilitate the adoption of sustainable practices on a global scale, further expanding the market. Additionally, the expansion of government subsidies and incentives for sustainable farming practices is expected to accelerate the adoption of biosolutions. Many countries are introducing financial support programs and policy frameworks to encourage farmers to transition to eco-friendly inputs. These initiatives not only reduce the financial burden on farmers but also create a favorable business environment for biosolution providers. Lastly, the untapped potential in emerging markets offers a promising growth avenue. Regions with high agricultural activity and increasing awareness of sustainability, such as Africa, Southeast Asia, and South America, represent significant opportunities for market penetration. Tailoring products to meet the specific needs of these regions, such as affordability and adaptability to local conditions, can drive adoption and revenue growth.

AGRICULTURAL BIOSOLUTIONS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.89% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bayer AG, BASF SE, Syngenta AG, UPL Limited, Corteva Agriscience, Marrone Bio Innovations, Koppert Biological Systems, Valent BioSciences, Certis USA, Novozymes, Bio Works Inc., Agrinos |

Agricultural Biosolutions Market Segmentation: by Type

-

Biopesticides

-

Biofertilizers

-

Biostimulants

-

Biological Seed Treatments

-

Natural Growth Regulators

The most dominant type in the market is biopesticides, which accounted for the largest revenue share in 2023 due to their effectiveness in pest management and compatibility with organic farming standards. On the other hand, biostimulants are the fastest-growing segment, driven by their ability to enhance crop resilience against abiotic stresses such as drought and salinity.

Agricultural Biosolutions Market Segmentation: by Distribution Channel

-

Direct-to-Farm

-

Agricultural Cooperatives

-

Online Platforms

-

Retail Stores

-

Wholesale Distributors

The most dominant channel is direct-to-farm distribution, as it ensures timely delivery and technical support for farmers. However, online platforms are emerging as the fastest-growing channel, reflecting the increasing digitization of agriculture and the convenience of e-commerce for rural farmers.

Agricultural Biosolutions Market Segmentation: by Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

North America accounted for 30% of the global market share in 2023, driven by advanced farming technologies and strong regulatory support.

Asia-Pacific was the fastest-growing region, with a growth rate of 18% in 2023, driven by increasing awareness and government initiatives in countries like India and China.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a mixed impact on the Agricultural Biosolutions Market. Initially, disruptions in supply chains and labor shortages affected the production and distribution of biosolutions. However, the pandemic also highlighted the importance of food security and sustainable agriculture, leading to a surge in demand for eco-friendly inputs. Farmers sought resilient and cost-effective solutions to cope with supply chain uncertainties, boosting the adoption of biosolutions. Government initiatives to support the agriculture sector during the pandemic further accelerated this trend.

Latest Trends and Developments:

Recent trends in the Agricultural Biosolutions Market include the integration of artificial intelligence (AI) and machine learning (ML) to optimize biosolution application, the development of multi-functional biosolutions that combine pest control and nutrient enhancement, and the rise of public-private partnerships to promote sustainable farming practices. Another noteworthy development is the increasing adoption of subscription-based models by biosolution providers, enabling farmers to access customized solutions and support services.

Key Players in the Market:

-

Bayer AG

-

BASF SE

-

Syngenta AG

-

UPL Limited

-

Corteva Agriscience

-

Marrone Bio Innovations

-

Koppert Biological Systems

-

Valent BioSciences

-

Certis USA

-

Novozymes

-

Bio Works Inc.

-

Agrinos

Chapter 1. Agricultural Biosolutions Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Agricultural Biosolutions Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Agricultural Biosolutions Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Agricultural Biosolutions Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Agricultural Biosolutions Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Agricultural Biosolutions Market – By Type

6.1 Introduction/Key Findings

6.2 Biopesticides

6.3 Biofertilizers

6.4 Biostimulants

6.5 Biological Seed Treatments

6.6 Natural Growth Regulators

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Agricultural Biosolutions Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct-to-Farm

7.3 Agricultural Cooperatives

7.4 Online Platforms

7.5 Retail Stores

7.6 Wholesale Distributors

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Agricultural Biosolutions Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Agricultural Biosolutions Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Bayer AG

9.2 BASF SE

9.3 Syngenta AG

9.4 UPL Limited

9.5 Corteva Agriscience

9.6 Marrone Bio Innovations

9.7 Koppert Biological Systems

9.8 Valent BioSciences

9.9 Certis USA

9.10 Novozymes

9.11 Bio Works Inc.

9.12 Agrinos

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Key factors driving the growth of the Agricultural Biosolutions Market include rising demand for sustainable farming practices, increasing adoption of organic agriculture, advancements in biotechnology, and growing consumer awareness about chemical-free food. Additionally, supportive government policies, environmental concerns, and the need to improve crop resilience against climate change further propel market expansion.

The Agricultural Biosolutions Market faces concerns such as high initial costs, limited farmer awareness, inconsistent efficacy under varying environmental conditions, short shelf life requiring specialized storage, and complex regulatory frameworks. Additionally, competition from well-established synthetic inputs and insufficient infrastructure in emerging regions hinder the widespread adoption of these sustainable solutions.

Prominent players in the Agricultural Biosolutions Market continue to innovate to maintain their competitive edge. Companies like Bayer AG, BASF SE, Syngenta AG, UPL Limited, Corteva Agriscience, Marrone Bio Innovations have strengthened their positions through robust product portfolios and strategic partnerships. The competition is fierce, with firms focusing on consumer-centric strategies to enhance brand loyalty.

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.