Agentless Security Market Size (2024 – 2030)

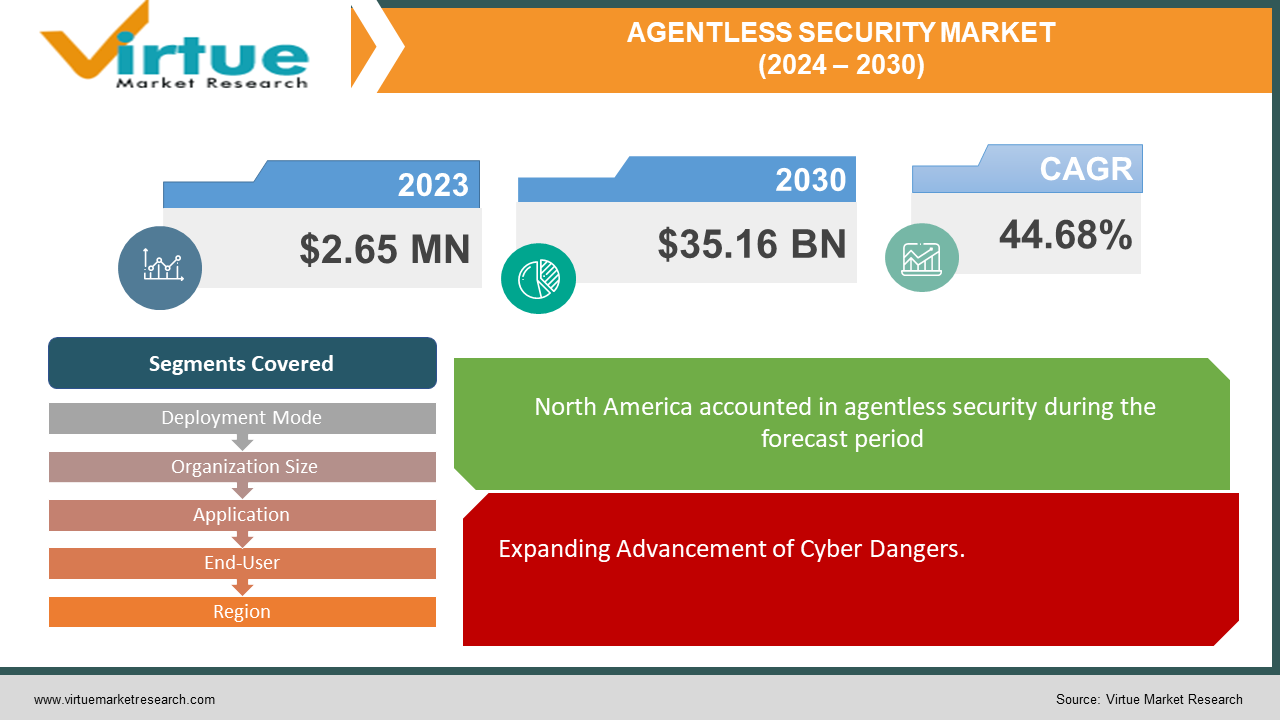

The market for global agentless security market was estimated to be worth 2.65 USD million in 2023 and is expected to increase to 35.16 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 44.68% from 2024 to 2030.

The agentless security showcase is encountering strong development driven by expanding cybersecurity dangers and the requirement for comprehensive security measures over different businesses. Agentless security arrangements offer organizations a proactive approach to shielding their systems, endpoints, and information without the requirements for conventional agent-based organizations. This advertisement is characterized by the selection of cloud-based sending models, catering to the developing request for adaptable and adaptable security arrangements. Businesses such as BFSI, healthcare, and government are driving adopters of agentless security, driven by exacting administrative prerequisites and the ought to secure delicate data from cyberattacks. Also, the showcase is seeing critical advancement in regions such as organized security, endpoint assurance, and cloud security, fueled by progressions in counterfeit insights and machine learning advances. As organizations proceed to prioritize cybersecurity and contribute to strong defense components, the agentless security advertise is anticipated to witness supported development within the coming long time.

Key Insights:

Cloud-based deployment of agentless security solutions is expected to witness significant adoption, with over 60% of organizations opting for cloud-based solutions by 2025.The BFSI sector dominates the market with a share of around 35%, driven by the increasing adoption of digital banking and stringent regulatory requirements.North America accounts for the largest market share, accounting for over 40% of the global agentless security market, attributed to the presence of key market players and high cybersecurity spending.However, approximately 30% of organizations cite interoperability challenges as significant barriers to adopting agentless security solutions. Implementing standardized protocols and leveraging interoperable platforms can address these concerns effectively.

Global Agentless Security Market Drivers:

Expanding Advancement of Cyber Dangers.

As cyber dangers proceed to advance in complexity and recurrence, organizations are progressively turning to agentless security arrangements to support their guards. These arrangements use progressed danger location calculations and machine learning capabilities to identify and moderate rising dangers in real-time, giving organizations proactive assurance against modern cyberattacks such as ransomware, zero-day misuses, and progressed determined dangers (APTs).

Adaptability and Adaptability of Cloud-based Sending.

The versatility and adaptability advertised by cloud-based arrangement models are driving the selection of agentless security arrangements over differing businesses. Cloud-based agentless security arrangements empower organizations to quickly send and scale security measures agreeing to advance commerce needs and energetic risk scenes. This nimbleness is especially beneficial for organizations with fluctuating workloads or disseminated IT situations, permitting them to consistently adjust their security foundation to changing prerequisites without the requirement for broad equipment speculations or foundation overhauls.

Compliance Prerequisites and Administrative Commands.

Exacting administrative prerequisites and compliance commands are driving the appropriation of agentless security arrangements among organizations looking for to defend delicate information and guarantee administrative compliance. Businesses such as healthcare, funds, and government are subject to strict information security controls, such as HIPAA, GDPR, and PCI DSS, which command the execution of vigorous security measures to ensure private data. Agentless security arrangements offer organizations the devices and capabilities required to realize compliance with administrative prerequisites, counting information encryption, get to controls, and review trails, subsequently relieving the hazard of non-compliance punishments and information breaches.

Global Agentless Security Market Restraints and Challenges:

Within the agentless security market, numerous barriers hinder its broad acceptance and efficient functioning. A key challenge arises from the limited awareness among potential users about the advantages and functionalities of agentless security solutions. This lack of comprehension regarding how these solutions can bolster their security defenses may lead organizations to hesitate in adopting them. Furthermore, the integration process poses a substantial obstacle, as seamlessly integrating agentless security measures into current IT systems can prove to be a complex endeavor.

Global Agentless Security Market Opportunities:

Rising Selection of DevOps and Cloud-native Designs.

The expanding appropriation of DevOps hones and cloud-native structures presents critical openings for the agentless security showcase. As organizations grasp spry improvement techniques and move to cloud-based foundations, there's a developing requirement for security arrangements that are consistently coordinated with DevOps pipelines and give nonstop assurance over energetic cloud situations. Agentless security arrangements, with their lightweight impression and cloud-native capabilities, are well-positioned to meet this request, advertising organizations' versatile and robotized security measures that adjust with advanced computer program improvement and arrangement hones.

Extension of IoT and Edge Computing.

The expansion of Web of Things (IoT) gadgets and edge computing advances is driving requests for inventive security arrangements competent in ensuring disseminated and interconnected frameworks. Agentless security arrangements offer a compelling approach to securing IoT gadgets and edge computing situations without the requirement for resource-intensive operators or endpoint specialists. By leveraging network-based observing and behavioral investigation methods, agentless security arrangements can give comprehensive permeability and assurance over IoT environments, making a difference in organizations that moderate the dangers related to IoT-related cyber dangers and vulnerabilities.

Integration with Security Organization and Mechanization Stages.

The integration of agentless security arrangements with security organization and computerization stages (Take off) presents openings for upgraded danger discovery, reaction, and remediation capabilities. By leveraging off stages to coordinate and robotize security workflows, organizations can streamline occurrence location and response forms, quicken danger remediation, and progress in general security pose. Agentless security arrangements, with their capacity to coordinate consistently with off-stages and other security innovations, empower organizations to make coordinated and computerized security operations that improve proficiency, deftness, and adequacy in combating cyber dangers.

AGENTLESS SECURITY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

44.68% |

|

Segments Covered |

By Deployment Mode, Organization Size, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

CrowdStrike Holdings, Inc., Carbon Black, Inc. (VMware), Palo Alto Networks, Inc., FireEye, Inc., Symantec Corporation (Broadcom Inc.), Trend Micro Incorporated, McAfee, LLC, Cisco Systems, Inc., Fortinet, Inc., Sophos Group plc, SentinelOne, Inc., Bitdefender SRL |

Agentless Security Market Segmentation: By Deployment Mode

-

Cloud-based

-

On-premises

When considering the sending mode for agentless security arrangements, cloud-based sending rises as the foremost successful choice for numerous organizations. Cloud-based sending offers various points of interest, including adaptability, adaptability, and cost-effectiveness. With cloud-based arrangements, organizations can quickly convey agentless security measures over their whole framework without the requirement for broad equipment speculations or framework overhauls. In addition, cloud-based sending empowers consistent integration with other cloud administrations and stages, encouraging centralized administration and permeability of security operations. Also, cloud-based arrangements give programmed upgrades and patches, guaranteeing that organizations have gotten to the most recent security highlights and assurances without the burden of manual support assignments. By and large, cloud-based arrangement offers organizations the deftness and adaptability required to adjust to advancing risk scenes and trade prerequisites, making it the favored choice for numerous organizations looking for viable agentless security arrangements.

Agentless Security Market Segmentation: By Organization Size

-

Small and Medium-sized Enterprises (SMEs)

-

Large Enterprises

When considering organization estimates within the setting of agentless security arrangements, the adequacy of sending frequently changes between small and medium-sized undertakings (SMEs) and huge endeavors. Whereas both SMEs and expansive endeavors advantage of agentless security arrangements, SMEs ordinarily discover them more successful due to a few components. Firstly, agentless arrangements are frequently more cost-effective for SMEs, as they kill the requirement for sending and overseeing different endpoint specialists over a dispersed organization. This streamlined approach diminishes operational overheads and permits SMEs to designate assets more effectively. Moreover, agentless arrangements are frequently simpler to send and oversee, making them well-suited for SMEs with restricted IT assets and abilities. Besides, the adaptability of agentless arrangements empowers SMEs to adjust to changing security needs and trade prerequisites without noteworthy ventures in foundation or faculty. Generally, agentless security arrangements offer SMEs viable and compelling implies of upgrading their cybersecurity pose while minimizing costs and operational complexity.

Agentless Security Market Segmentation: By Application

-

Network Security

-

Endpoint Security

-

Cloud Security

-

Application Security

-

Others

When considering the division by application within the domain of agentless security arrangements, endpoint security develops as especially viable and impactful. Endpoint security is foremost in shielding organizations' systems and frameworks against a large number of dangers, extending from malware and ransomware to insider dangers and information breaches. Agentless endpoint security arrangements offer comprehensive security without the requirement for resource-intensive endpoint specialists, subsequently minimizing execution overhead and disentangling sending and administration. By leveraging network-based checking and behavioral examination strategies, agentless endpoint security arrangements give organizations with real-time permeability and control over endpoint action, empowering proactive risk location and reaction. In addition, agentless endpoint security arrangements are well-suited for securing further and versatile gadgets, guaranteeing steady security over different endpoints and situations. In general, the adequacy and flexibility of agentless endpoint security make it a significant component of organizations' cybersecurity procedure, moderating dangers and defending basic resources against advancing cyber dangers.

Agentless Security Market Segmentation: By End-User

-

BFSI (Banking, Financial Services, and Insurance)

-

Healthcare

-

Government

-

IT and Telecommunications

-

Retail

-

Manufacturing

-

Others

When considering end-users within the agentless security advertise, the Keeping Money, Monetary Administrations, and Protections (BFSI) segment stands out as especially successful in leveraging agentless security arrangements. The BFSI segment handles tremendous sums of touchy information and is subject to exacting administrative necessities, making strong cybersecurity measures basic. Agentless security arrangements offer the BFSI division comprehensive assurance against a bunch of cyber dangers, including malware, phishing assaults, and information breaches, without the execution effect related to conventional endpoint operators. With agentless arrangements, BFSI organizations can screen and secure their systems, endpoints, and information resources proficiently, guaranteeing compliance with administrative measures such as PCI DSS, GDPR, and FFIEC. Additionally, the adaptability and adaptability of agentless security arrangements empower BFSI to adjust to advancing dangerous scenes and energetic commerce prerequisites, making them irreplaceable apparatuses in shielding money-related frameworks and ensuring client belief and secrecy.

Agentless Security Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

Within the agentless security advertise, territorial dispersion of advertise share uncovers unmistakable designs of appropriation and development over distinctive geographies. North America commands the biggest share, bookkeeping for roughly 40% of worldwide advertising. This dominance can be credited to variables such as the nearness of key advertise players, tall cybersecurity investing, and exacting administrative necessities driving the appropriation of progressed security measures. Taking after North America, Europe holds a significant 20% share, characterized by a solid center on information security and compliance, which powers requests for agentless security arrangements. The Asia-Pacific locale captures 25% of the advertising share, driven by fast computerized change, expanding cyber dangers, and the appropriation of cloud-based security arrangements. South America and the Center East and Africa districts contribute 9% and 6% of the showcase share, separately, with developing openings in the midst of advancing administrative scenes and developing mindfulness of cybersecurity. In general, territorial incongruities in showcase share reflect assorted advertise elements and openings for development and extension over diverse districts.

COVID-19 Impact Analysis on the Global Agentless Security Market:

The COVID-19 widespread has had a critical effect on the worldwide agentless security advertise, reshaping the scene of cybersecurity hones and quickening the appropriation of imaginative security arrangements. Agentless security arrangements, with their cloud-based arrangement models and lightweight impression, advertised organizations the adaptability and adaptability required to secure conveyed systems and endpoints viably. Moreover, the widespread underscored the significance of permeability and control over IT framework, driving requests for agentless security arrangements that give comprehensive observing and assurance capabilities without compromising execution or client involvement. Looking ahead, the COVID-19 widespread is anticipated to proceed driving the selection of agentless security arrangements as organizations prioritize cybersecurity flexibility and adjust to the unused substances of inaccessible work and computerized change.

Latest Trends/ Developments:

Within the energetic scene of agentless security, a few most recent patterns and improvements are forming the advertising, driving development, and changing cybersecurity hones. One outstanding slant is the merging of agentless security arrangements with progressed advances such as counterfeit insights (AI) and machine learning (ML). By saddling AI and ML calculations, agentless security arrangements can analyze tremendous sums of information in real time, empowering proactive danger discovery, behavioral investigation, and inconsistency discovery. This enables organizations to remain ahead of advancing cyber dangers and react quickly to emerging security occurrences. Furthermore, there's a developing accentuation on zero-trust security systems, which accept that all gadgets, clients, and applications are possibly compromised. Agentless security arrangements play a significant part in executing zero-trust standards by giving nonstop observing and verification of organized activity and endpoints, in this manner decreasing the assault surface and minimizing the chance of horizontal development by risk on-screen characters. Moreover, the rise of edge computing and Web of Things (IoT) advances is driving requests for agentless security arrangements capable of securing conveyed and interconnected frameworks. By amplifying security capabilities to the edge of the arrange, agentless arrangements empower organizations to secure IoT gadgets, edge computing situations, and inaccessible endpoints without the requirement for resource-intensive agents or complex frameworks. By and large, these most recent patterns and improvements reflect a developing acknowledgment of the significance of proactive, brilliantly, and spry security measures in combating advancing cyber dangers and shielding basic resources in today's computerized scene.

Key Players:

-

CrowdStrike Holdings, Inc.

-

Carbon Black, Inc. (VMware)

-

Palo Alto Networks, Inc.

-

FireEye, Inc.

-

Symantec Corporation (Broadcom Inc.)

-

Trend Micro Incorporated

-

McAfee, LLC

-

Cisco Systems, Inc.

-

Fortinet, Inc.

-

Sophos Group plc

-

SentinelOne, Inc.

-

Bitdefender SRL

Chapter 1. Agentless Security Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Agentless Security Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Agentless Security Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Agentless Security Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Agentless Security Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Agentless Security Market – By Deployment Mode

6.1 Introduction/Key Findings

6.2 Cloud-based

6.3 On-premises

6.4 Y-O-Y Growth trend Analysis By Deployment Mode

6.5 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 7. Agentless Security Market – By Organization Size

7.1 Introduction/Key Findings

7.2 Small and Medium-sized Enterprises (SMEs)

7.3 Large Enterprises

7.4 Y-O-Y Growth trend Analysis By Organization Size

7.5 Absolute $ Opportunity Analysis By Organization Size, 2024-2030

Chapter 8. Agentless Security Market – By Application

8.1 Introduction/Key Findings

8.2 Network Security

8.3 Endpoint Security

8.4 Cloud Security

8.5 Application Security

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Application

8.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Agentless Security Market – By End-User Industry

9.1 Introduction/Key Findings

9.2 BFSI (Banking, Financial Services, and Insurance)

9.3 Healthcare

9.4 Government

9.5 IT and Telecommunications

9.6 Retail

9.7 Manufacturing

9.8 Others

9.9 Y-O-Y Growth trend Analysis By End-User Industry

9.10 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 10. Agentless Security Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Deployment Mode

10.1.3 By Organization Size

10.1.4 By Application

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Deployment Mode

10.2.3 By Organization Size

10.2.4 By Application

10.2.5 By End-User Industry

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Deployment Mode

10.3.3 By Organization Size

10.3.4 By Application

10.3.5 By End-User Industry

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Deployment Mode

10.4.3 By Organization Size

10.4.4 By Application

10.4.5 By End-User Industry

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Deployment Mode

10.5.3 By Organization Size

10.5.4 By Application

10.5.5 By End-User Industry

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Agentless Security Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 CrowdStrike Holdings, Inc.

11.2 Carbon Black, Inc. (VMware)

11.3 Palo Alto Networks, Inc.

11.4 FireEye, Inc.

11.5 Symantec Corporation (Broadcom Inc.)

11.6 Trend Micro Incorporated

11.7 McAfee, LLC

11.8 Cisco Systems, Inc.

11.9 Fortinet, Inc.

11.10 Sophos Group plc

11.11 SentinelOne, Inc.

11.12 Bitdefender SRL

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for global agentless security market was estimated to be worth 2.65 USD million in 2023 and is expected to increase to 35.16 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 44.68% from 2024 to 2030.

The essential drivers of the worldwide agentless security advertise incorporate the expanding modernity and recurrence of cyber dangers, the selection of cloud-based frameworks, and the requirement for versatile and robotized security arrangements.

The key challenges confronting the worldwide agentless security advertise incorporate interoperability issues with existing frameworks, execution concerns related to asset utilization, and constrained permeability and control over certain angles of the IT foundation.

In 2023, North America held the largest share of the global agentless security market.

CrowdStrike Holdings, Inc., Carbon Black, Inc. (VMware), Palo Alto Networks, Inc., FireEye, Inc., Symantec Corporation (Broadcom Inc.), Trend Micro Incorporated, McAfee, LLC, Cisco Systems, Inc., Fortinet, Inc., Sophos Group plc, SentinelOne, Inc., Bitdefender SRL are the main players.