Agent Based Security Market Size (2024-2030)

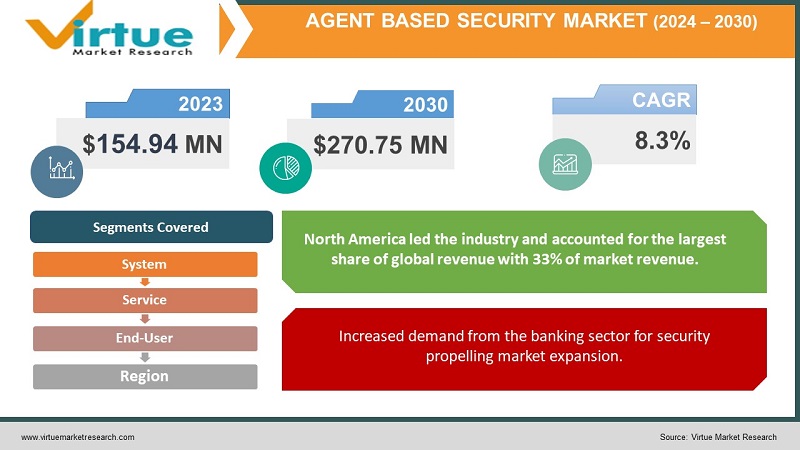

The Agent Based Security Market was valued at USD 154.94 Million in 2023 and is projected to reach a market size of USD 270.75 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.3%.

Security describes a set of cyber security measures that protect against unauthorized access to an organization's data, computers, and networks. It covers a variety of IT security topics, including network, web endpoint, and cloud, user and application security. By preventing hackers from accessing sensitive information, it helps protect its integrity and privacy.

One of the main reasons that encourage companies to install effective security measures to prevent threats and potential security threats, which can have a negative impact on the financial health of companies, is the increase in cybercrime and operations. In addition, IT security is widely used in the energy sector to meet the growing need for constant electricity supply worldwide. In addition, healthcare facilities are now relying on specialized information systems, including electronic health records (HER), electronic prescriptions, practice management support, clinical decision support, radiology and computerized entry of physician orders. This raises the need to protect the availability, privacy and integrity of data and electronic assets through access, use and disclosure, thereby promoting market expansion.

Key Market Insights:

Cyber threats in the air and complex combat zones are driving the growing agent-based security market. AI-powered agents adapt and defend in real-time, perfect for focused IT and compliance needs. Expect integration with AI, automation and special agents, but be wary of integration constraints, operational requirements and changing standards. In India, government initiatives and revenue generation will be key. This dynamic market has great potential to transform cybersecurity.

The agent-based security market is experiencing significant growth, resulting in increased cybersecurity concerns and a changing threat landscape. As cyber threats increase in frequency and sophistication, organizations are increasingly turning to agent-based security solutions to strengthen their defenses. These solutions, often focused on endpoint protection, have become important during remote work and the proliferation of mobile devices. Using behavioral analysis and machine learning algorithms, agent security tools excel at detecting and responding to threats in real time. Integration with security information and incident management (SIEM) solutions is essential for organizations seeking comprehensive threat intelligence. The need to comply with data protection regulations drives the compliance of security agents, especially those who ensure compliance with GDPR, HIPAA, and other regulations. As cloud adoption continues, the demand for agent-based security solutions with strong native capabilities is increasing. In addition, these solutions play an important role in enforcing the Zero Trust security model, ensuring that trust does not assume that consent is a requirement to access resources. Continuous monitoring, event response capabilities, and user awareness features contribute to the quality of agent security solutions in the ever-changing cybersecurity landscape of new brands and fierce market competition.

Agent Based Security Market Drivers:

There has been a rise in terrorism and illegal activities fueling market growth.

The threat posed by organized crime (TOC) to national and international security is large and growing, and has significant implications for global public health, security, democratic processes and stability. Criminal networks are not only growing, but also expanding their operations. As a result, threats that were once separate and had explosive and destructive effects have converged. The demand for security products and services has increased exponentially as terrorism and illegal activities have increased. Governments, businesses and individuals often invest in security measures to protect themselves and their assets when companies face high risk. High-profile terrorist and criminal activities can alert the public to security breaches and encourage individuals and organizations to take precautions to protect their assets and data. . In response to security concerns, governments often invest more money to strengthen their security infrastructure, which can increase the need for security systems and technologies. New and advanced security solutions are created as technology advances.

Increased demand from the banking sector for security propelling market expansion.

BFSI is one of the fastest growing sectors in the security market due to strict regulations and compliance of BFSI companies regarding information security. Financial services providers may need to improve. Their security solutions use fast protection as cyberattacks have a direct impact on market growth.

Agent Based Security Market Restraints and Challenges:

Choosing a wired or wireless security system will have a significant impact on the cost and quality of the installation. Depending on where you want to install the aerial camera. Installing a wired system over a wireless system will usually cost two or three times more. High-resolution cameras, infrared sensors, facial recognition software, and cloud storage are just a few examples of modern technology commonly used in advanced security systems. The costs associated with developing and maintaining these technologies can increase consumer prices.

Most security systems include monitoring functions so you can keep an eye on your home at all times. Continuous staffing and equipment requirements for these monitoring services increase overall costs. Companies that invest in R&D to develop expensive security solutions consider their costs when determining the price of the finished product. Integrating and installing security systems can require special knowledge and skills. Companies may charge more for professional installation and configuration.

Agent Based Security Market Opportunities:

Protecting user data and privacy has become a priority due to the proliferation of Internet of Things (IoT) connected devices and security systems. Strict rules for the collection, processing and storage of personal data are established by regulations such as the European Union's General Data Protection Regulation (GDPR) and various local data protection laws. To protect people's privacy rights, many laws apply to the use of surveillance cameras and video recording equipment. Laws often define where and how surveillance takes place, how long the data is stored, and who has access to the video. Access control systems can be controlled by regulations and laws that ensure that only those with the appropriate authority can access certain areas or information, especially critical infrastructure and government agencies.

AGENT BASED SECURITY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.3% |

|

Segments Covered |

By System, service, end use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Johnson Controls, Honeywell International, Inc., ZABAG Security Engineering GmbH, Teledyne FLIR LLC, Axis Communications AB, ASSA ABLOY, Apex Fabrication & Design, Inc., Apex Perimeter Protection, Anixter Inc., Perimeter Protection Germany GmbH |

Agent Based Security Market Segmentation:

Agent Based Security Market Segmentation: By System

- Access Control Systems

- Alarms & Notification Systems

- Intrusion Detection Systems

- Video Surveillance Systems

- Barrier Systems

- Others

In 2023, based on the system, Video Surveillance Systems dominated the market share. During the forecast period, video surveillance will dominate the commercial security system market. The increasing use of IP cameras has reduced installation costs, making video surveillance more affordable. High-definition IP cameras also offer a nice feature set. As a result, the video surveillance market has developed with additional services ranging from basic to sophisticated analysis, high performance and improved features, all available at low prices. The video surveillance software application of the commercial security software market is expected to witness the fastest growth during the forecast period. The use of video surveillance systems is expected to increase in the future due to features such as better performance and better home security. These surveillance tools are cheap and help bring attention to illegal activities.

Intrusion Detection Systems (IDS) is the fastest growing segment. Intrusion detection systems (IDS) play an important role in enhancing cybersecurity by monitoring networks or systems for malicious activity or unauthorized access. Including network-based and host-based solutions, IDS uses sophisticated algorithms and behavioral analysis to detect anomalies that indicate security vulnerabilities. Network IDS monitors incoming and outgoing traffic, identifying patterns that deviate from established patterns, while host-based IDS focuses on individual devices, scanning system logs and files. for contract marks. Rapid advances in machine learning and artificial intelligence have greatly enhanced the capabilities of IDS, making threat detection more accurate and faster. Real-time reporting by IDS helps organizations respond quickly to potential threats, reducing risk and strengthening their security posture. As cyber threats continue to evolve, the role of intrusion detection systems remains paramount in protecting digital assets and ensuring the integrity of information systems.

Agent Based Security Market Segmentation: By Service

- System Integration & Consulting

- Risk Assessment & Analysis

- Managed Security Services

- Maintenance and Support

In 2023, based on service Risk Assessment & Analysis market dominated the market share. Risk assessment and analysis is a critical area of work within the agent security market, including the process of identifying, analyzing and addressing cybersecurity threats and vulnerabilities. This process involves a systematic review of a company's digital infrastructure, assessing the availability and impact of various security risks. Using advanced tools and advanced skills, risk assessment professionals seek to provide information for making smart decisions to reduce potential risks effectively. By conducting in-depth analysis, organizations can proactively address vulnerabilities, allocate resources systematically, and implement customized security measures. In an ever-changing threat landscape, a focus on risk assessment and analysis is helpful for businesses looking to strengthen their security defenses and navigate the complex landscape of cybersecurity risks.

Managed security services (MSS) are experiencing rapid growth in response to the complexity of cyber threats and the need for comprehensive security solutions. MSS providers offer a variety of services, including continuous monitoring, threat detection and incident response, which are critical for organizations looking to improve their cybersecurity posture.

Agent Based Security Market Segmentation: By End-use

- Government

- Military & Defence

- Transportation

- Commercial

- Industrial

- Others

In 2023, the military and defence sector dominate the market and accounts for a revenue share of over 26%. In the military and security end markets, security equipment such as cameras with advanced program corrections, integrated image processing, automatic exposure and effective program exposure are often used. The military and security forces of many countries have been forced to implement the best security measures due to the growing threat of terrorism and international immigration. In addition, law enforcement facilities such as prisons, jails, and other prisons must have high security to prevent criminals from escaping or committing crimes. For example, telecom infrastructure company Vihaan Networks Ltd announced the global launch of its Intrusion Detection System. (VNL) in March 2022. The company offers an intelligent border security system that uses various sensors to create a unified, security system that can detect, prevent, delay and prevent border attacks.

The manufacturing sector is a critical part of the agent security market, representing many of the most critical assets in the manufacturing industry. Faced with a growing threat landscape, manufacturing companies are investing more in advanced security solutions to protect their operations. Whether ensuring the integrity of production processes or protecting sensitive data, the manufacturing sector places great importance on strong cyber security measures. Agent-based security solutions suitable for enterprise applications include a variety of technologies, including intrusion detection and prevention systems, access control and real-time monitoring, addressing the unique security challenges in the enterprise environment. As companies embrace the digital revolution, the demand for sophisticated safety systems in the manufacturing industry continues to drive innovation and growth in the representative safety market.

Agent Based Security Market Segmentation: Regional Analysis

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2023, North America led the industry and accounted for the largest share of global revenue with 33% of market revenue. This high number can be linked to the increase in terrorist activities and recruitment in the region. Due to their advantages in remote access, optimal energy management, etc., monitoring systems are becoming more and more important in various applications, which are driving the market. The North American market is expected to grow due to increasing security breaches, immediate response to threats and threats, and the rise of Big Data.

In North America, the agent security market is experiencing strong growth, due to several key factors. The region, which includes the United States and Canada, is still at the forefront of new technologies, relying on digital infrastructure in all areas. The increasing number and sophistication of cyber threats has led organizations to prioritize cyber security, increasing the demand for advanced solutions. Government policies, stricter data protection regulations, and growing awareness of the financial and reputational risks associated with cyber incidents are driving the adoption of proxy security technologies. The presence of advanced cyber-attacks has increased the sense of urgency, prompting businesses to invest in comprehensive security measures. As North America is a global economic center and home to many important industries, including finance, healthcare and technology, the region's involvement in strong cybersecurity practices is influencing growth and innovation in the security market.

Asia-Pacific is the fastest growing region. The Asia Pacific region is witnessing significant growth in the agent security market, due to several factors. The rapid digitalization of the economy, growing internet penetration and increasing cyber threats have prompted various organizations in different parts of the region to take a strong security approach. Governments in countries such as China, India and Japan are working hard to strengthen national cyber security systems, creating an environment for the adoption of advanced security solutions. The changing landscape, which emphasizes data protection and privacy, is also driving the demand for agent-based security technologies. In addition, the region's strong economic growth and the expansion of critical infrastructure projects are contributing to increasing awareness and investment in cybersecurity, thus shaping the landscape of the security market based in the Asian region. -Peaceful.

COVID-19 Impact Analysis on the Agent Based Security Market:

Businesses and organizations have tried to improve their remote security capabilities by implementing containment and social isolation measures. The demand for access control, indoor monitoring and video surveillance systems has increased. Because of the confusion surrounding the situation at the beginning of the outbreak, many security operations were delayed or abandoned. But the growing need for remote security solutions has more than stopped this. The outbreak has disrupted global supply chains, causing delays in the production and delivery of supplies. This may affect the availability of specific devices and security systems. This disease has created problems in the health sector. The importance of cybersecurity has increased as hospitals and academic institutions have become primary targets for cyber-attacks.

Latest Trends/ Developments:

A significant evolution is seen towards the integration of advanced technology in the face of the evolution of cyber threats. Artificial intelligence (AI) and machine learning (ML) are used to increase the power of agent-based security solutions, enabling more accurate and proactive threat detection. The growth of Zero Trust security models is influencing the market, emphasizing continuous trust and strict access control. Cloud security solutions designed for modern infrastructure are growing in importance, reflecting the widespread adoption of cloud technologies. In addition, emphasis is placed on comprehensive threat intelligence, real-time monitoring, and adaptive response systems to strengthen the cyber security posture. As organizations navigate the increasingly complex digital landscape, these systems demonstrate their dedication to innovation and strength in the agent security market.

Key Players:

- Johnson Controls

- Honeywell International, Inc.

- ZABAG Security Engineering GmbH

- Teledyne FLIR LLC

- Axis Communications AB

- ASSA ABLOY

- Apex Fabrication & Design, Inc.

- Apex Perimeter Protection

- Anixter Inc.

- Perimeter Protection Germany GmbH

- In December 2022, Johnson Controls, an American conglomerate based in Ireland, announced the acquisition of CDS Integrated Security Systems and Gem Security Services. The acquisition will expand Johnson Controls' portfolio of low-cost, integrated electronic security solutions designed to protect people, property and equipment around the clock.

- In February 2022, Neudesic, one of the leading American cloud service consultancies with expertise in multi-cloud and in particular the Microsoft Azure platform, was acquired by IBM. The Company’s hybrid cloud and AI planning house work will be stronger from this acquisition, which will be clear.

Chapter 1. GLOBAL AGENT BASED SECURITY MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL AGENT BASED SECURITY MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL AGENT BASED SECURITY MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL AGENT BASED SECURITY MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL AGENT BASED SECURITY MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL AGENT BASED SECURITY MARKET– BY SYSTEM

6.1. Introduction/Key Findings

6.2. Access Control Systems

6.3. Alarms & Notification Systems

6.4. Intrusion Detection Systems

6.5. Video Surveillance Systems

6.5. Barrier Systems

6.6. Others

6.7. Y-O-Y Growth trend Analysis By System

6.8. Absolute $ Opportunity Analysis By System , 2024-2030

Chapter 7. GLOBAL AGENT BASED SECURITY MARKET– BY SERVICE

7.1. Introduction/Key Findings

7.2. System Integration & Consulting

7.3. Risk Assessment & Analysis

7.4. Managed Security Services

7.5. Maintenance and Support

7.6. Y-O-Y Growth trend Analysis By SERVICE

7.7. Absolute $ Opportunity Analysis By SERVICE , 2024-2030

Chapter 8. GLOBAL AGENT BASED SECURITY MARKET– BY END-USE

8.1. Introduction/Key Findings

8.2 Government

8.3. Military & Defence

8.4. Transportation

8.5. Commercial

8.6. Industrial

8.7. Others

8.8. Y-O-Y Growth trend Analysis End-use

8.9. Absolute $ Opportunity Analysis End-use , 2024-2030

Chapter 9. GLOBAL AGENT BASED SECURITY MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By SERVICE

9.1.3. By System

9.1.4. By End-use

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By SERVICE

9.2.3. By System

9.2.4. By End-use

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By SERVICE

9.3.3. By System

9.3.4. By End-use

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By SERVICE

9.4.3. By System

9.4.4. By End-use

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By SERVICE

9.5.3. By System

9.5.4. By End-use

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL AGENT BASED SECURITY MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 Johnson Controls

10.2. Honeywell International, Inc.

10.3. ZABAG Security Engineering GmbH

10.4. Teledyne FLIR LLC

10.5. Axis Communications AB

10.6. ASSA ABLOY

10.7. Apex Fabrication & Design, Inc.

10.8. Apex Perimeter Protection

10.9. Anixter Inc.

10.10. Perimeter Protection Germany GmbH

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Agent Based Security Market was valued at USD 154.94 Million in 2023 and is projected to reach a market size of USD 270.75 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.3%.

Increase in cyber fraud cases are driving factor for Agent Based Security Market.

Based on Service, the Agent Based Security Market is segmented into System Integration & Consulting, Risk Assessment & Analysis, Managed Security Services, and Maintenance and Support

North America is the most dominant region for the Agent Based Security Market.

Johnson Controls, Honeywell International, Inc., ZABAG Security Engineering GmbH, Teledyne FLIR LLC, Axis Communications AB, ASSA ABLOY, Apex Fabrication & Design, Inc., Apex Perimeter Protection, Anixter Inc., Perimeter Protection Germany GmbH are the key players operating in the Agent Based Security Market