Agave Nectar Market Size (2024 – 2030)

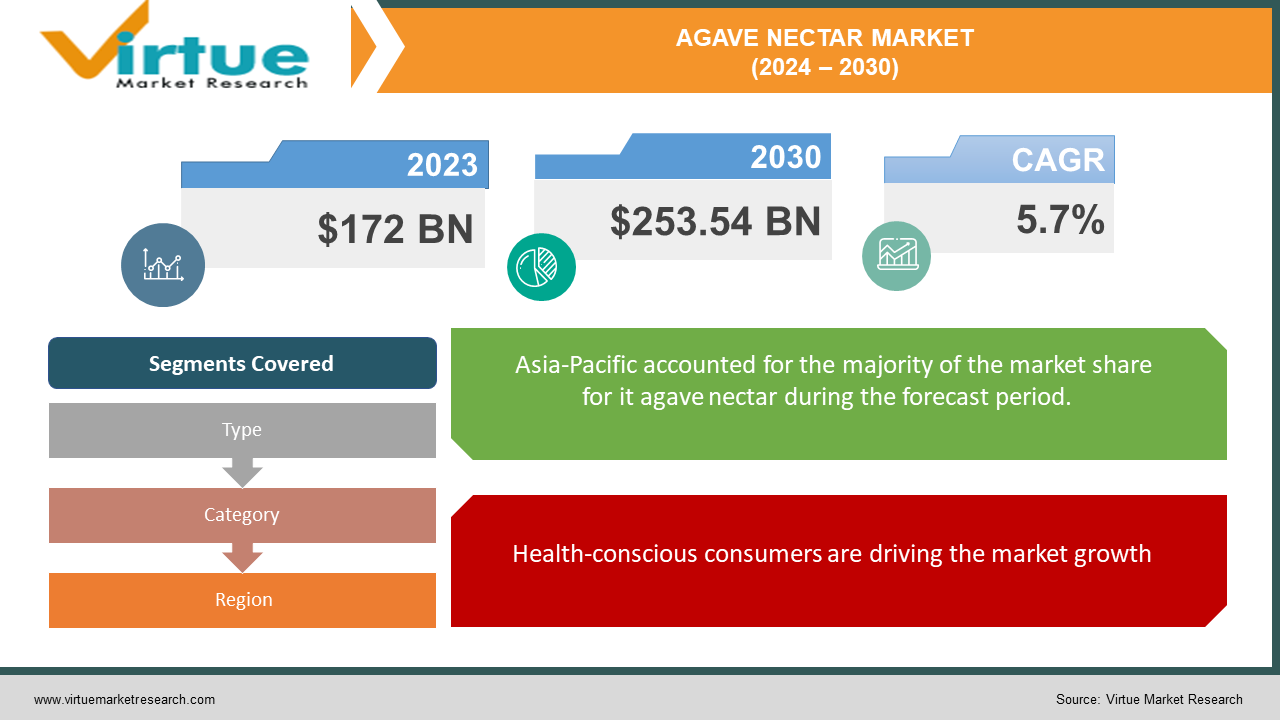

The Global Agave Nectar Market was valued at USD 172 billion in 2023 and will grow at a CAGR of 5.7% from 2024 to 2030. The market is expected to reach USD 253.54 billion by 2030.

The Agave Nectar Market caters to health-conscious consumers seeking natural sweeteners. Despite facing challenges like high fructose content and agave plant maturity cycles, the market is expected to grow, driven by rising awareness and popularity in regions like Asia-Pacific. Innovation in product variations, potential fructose reduction methods, and a focus on sustainability are shaping the market's future.

Key Market Insights:

A growing number of health-conscious consumers are seeking natural sweeteners due to concerns about the negative effects of artificial sweeteners and table sugar.

Light agave nectar currently holds the leading market share at around 58.4%, followed by dark agave nectar at 41.6%.

Blue agave is the dominant source of agave nectar, accounting for roughly 59% of the market value in 2020.

Asia Pacific is the current leader in the global agave nectar market.

Global Agave Nectar Market Drivers:

Health-conscious consumers are driving the market growth

Capitalizing on health trends, consumers are actively seeking natural alternatives to refined sugar and high-fructose corn syrup. Agave nectar's perceived health benefits, particularly its lower glycemic index compared to sugar, have positioned it as a favorable substitute. The glycemic index (GI) ranks carbohydrates based on their impact on blood sugar levels. Lower GI foods cause a slower rise in blood sugar, potentially aiding in weight management and diabetes control. This perception of agave nectar as a healthier sweetener fuels its popularity among health-conscious consumers. However, it's important to note that some studies suggest agave nectar may be even higher in fructose than table sugar, so moderation is key.

Natural and organic movement is driving market growth

The clean label movement is a powerful force shaping consumer preferences, and agave nectar finds itself riding this wave. This movement champions products with recognizable, natural ingredients and minimal processing. Agave nectar, derived from the sap of the agave plant, fits the bill perfectly. Unlike refined sugar or artificial sweeteners with long, complicated ingredient lists, agave nectar boasts a simple, natural identity. This resonates with consumers who want to understand what they're putting in their bodies and avoid synthetic additives. Furthermore, some agave nectar brands capitalize on this trend by obtaining organic certification, signifying the use of organically grown agave plants and minimal processing techniques. This additional layer of transparency further strengthens agave nectar's appeal within the clean label movement.

The growing diabetic population is driving the market growth

The burgeoning global diabetic population is a major driver for the agave nectar market. As diabetics strive to manage blood sugar levels, agave nectar's perceived benefit in this area makes it an attractive option. Unlike table sugar, which causes a rapid rise in blood sugar, agave nectar boasts a lower glycemic index (GI). The GI ranks carbohydrates based on their impact on blood sugar. Lower GI foods cause a slower and steadier rise, potentially aiding in diabetes management. This is particularly enticing for diabetics who need to control blood sugar spikes. However, it's crucial to note that the story isn't entirely black and white. While agave nectar may have a lower GI, some research suggests it's even higher in fructose than table sugar. Fructose, when metabolized by the liver, can contribute to insulin resistance and fatty liver disease, both concerns for diabetics. Therefore, moderation and consulting a healthcare professional are essential before incorporating agave nectar into a diabetic diet.

Global Agave Nectar Market challenges and restraints:

High Fructose Content Concerns are restricting the market growth

Agave nectar's marketing as a healthy sweetener faces a hurdle due to its high fructose content, exceeding even table sugar. This contradicts the initial appeal to health-conscious consumers seeking natural alternatives. The fructose in agave nectar is primarily processed by the liver, and excessive intake has been linked to potential health risks like fatty liver disease and metabolic issues. This raises concerns among informed consumers who are actively researching healthier options. As a result, they may shift towards alternative sweeteners like stevia or monk fruit extract, which offer sweetness without fructose drawbacks. This trend highlights the need for the agave nectar industry to address these concerns and potentially explore processing methods to reduce fructose content if they want to retain health-focused consumers in the long run.

Availability and Price Fluctuations is restricting the market growth

The agave nectar market faces a balancing act due to the agave plant's long maturity cycle, typically taking several years to reach harvest. This extended growth period makes agave nectar production susceptible to disruptions. Unforeseen events like extreme weather, pests, or diseases can significantly impact agave yields, leading to shortages in the market. This domino effect throws supply chains into disarray and triggers price hikes for consumers. Unfortunately, producers have limited control over these external factors. To mitigate these challenges, diversifying agave sources and implementing sustainable farming practices can help build resilience against unforeseen events. Additionally, exploring alternative production methods or establishing strategic stockpiles could potentially act as buffers during periods of low agave availability. By taking proactive steps, the agave nectar industry can work towards price stabilization and ensure a more consistent supply for consumers.

Market Opportunities:

The agave nectar market is brimming with opportunities, fueled by a confluence of health and wellness trends. Health-conscious consumers are ditching refined sugar and high-fructose corn syrup, and seeking natural alternatives. Agave nectar's perceived health halo, particularly its lower glycemic index compared to sugar, positions it as a favorable substitute. This resonates with diabetics as well, who struggle to manage blood sugar levels. Agave nectar's potential for slower blood sugar rise due to its lower GI makes it an attractive option, though moderation is key due to possible high fructose content. Furthermore, the clean label movement emphasizes natural ingredients, and minimally processed agave nectar aligns perfectly. Unlike refined sugar with complex ingredient lists, agave nectar boasts a simple, natural identity, further boosted by some brands achieving organic certification. This transparency resonates with consumers seeking to understand what they're consuming. Additionally, agave nectar's versatility across various applications, from baked goods to beverages, makes it a desirable ingredient for manufacturers. By capitalizing on these trends, innovation in product development can unlock new markets. For instance, exploring darker agave nectars with a richer flavor profile can cater to adventurous palates. Blending agave nectar with other natural sweeteners can offer a wider range of flavors and functionalities for manufacturers. With continued focus on health, natural ingredients, and product innovation, the agave nectar market is poised for significant growth.

AGAVE NECTAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.7% |

|

Segments Covered |

By Type, Category, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Madre Tierra, TerraVia, Honey's Raw, Wholesome Sweeteners, Imperial Sugar Company, Mangata, Agave Nectar Company, Sucanat, Mevoflavours, Roquette |

Agave Nectar Market Segmentation - By Type

-

Light Agave Nectar

-

Dark Agave Nectar

Light agave nectar currently holds the dominant position in the agave nectar market. This popularity can be attributed to its versatility. The mild sweetness and neutral flavor make it a perfect substitute for sugar in various recipes and beverages without altering the overall taste profile. This characteristic is especially appealing to home cooks and manufacturers who desire a sweetener that blends seamlessly without overpowering other ingredients. Additionally, light agave nectar's lighter color makes it visually preferable for use in clear beverages or applications where maintaining a lighter appearance is desired. While dark agave nectar offers a unique flavor profile, its dominance is limited by its stronger taste and darker color, making it less universally applicable.

Agave Nectar Market Segmentation - By Category

-

Organic Agave Nectar

-

Conventional Agave Nectar

Conventional agave nectar reigns supreme in the market. This is likely due to several factors. Conventional farming practices tend to be more cost-effective, making conventionally produced agave nectar a more affordable option for consumers. Additionally, organic certification can add extra steps and costs to production, potentially limiting its widespread availability. While the market for organic agave nectar is growing due to the increasing demand for natural and minimally processed foods, conventional agave nectar remains the dominant category due to its affordability and wider accessibility.

Agave Nectar Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region is projected to experience the highest growth rate in the coming years. This surge is driven by a growing health-conscious consumer base in developing countries like India and China, who are increasingly seeking natural alternatives to sugar. Furthermore, the rising popularity of bakery products and a cultural affinity for sweet treats in this region are expected to further propel the demand for agave nectar. This shift in consumer preferences suggests that the Asia-Pacific region has the potential to become a major agave nectar market leader in the near future.

COVID-19 Impact Analysis on the Global Agave Nectar Market

The COVID-19 pandemic delivered a mixed bag of impacts on the Agave Nectar Market. Initial lockdowns and disruptions in global supply chains hampered the transportation of agave nectar, especially from major producers like Mexico. This resulted in temporary shortages and price fluctuations. Additionally, with a shift in consumer priorities towards essential goods, the demand for agave nectar, often considered a premium product, dipped slightly.

However, the pandemic also presented unexpected opportunities. As home cooking surged, consumers became more mindful of ingredients and embraced healthy alternatives. This renewed focus on health resonated with the existing perception of agave nectar as a natural sweetener, potentially leading to increased consumption in the long run. Furthermore, the rise of e-commerce platforms facilitated easier access to agave nectar, partially offsetting the challenges faced by traditional distribution channels. Overall, while the pandemic brought initial hurdles, the agave nectar market has shown signs of recovery and adaptation, with the potential to benefit from a growing health-conscious consumer base in the post-pandemic era.

Latest trends/Developments

The Agave Nectar Market is buzzing with innovation as it strives to address consumer concerns and capitalize on emerging trends. One key development is the introduction of new product variations. Manufacturers are exploring organic agave nectar options, catering to the growing demand for clean-label products. Additionally, flavored agave nectars are hitting the shelves, offering a wider variety for consumers seeking specific taste profiles. Technology is also playing a role, with research focusing on methods to potentially reduce the fructose content in agave nectar, making it a more attractive option for health-conscious buyers. Furthermore, sustainability efforts are gaining traction. Producers are implementing sustainable agave farming practices to ensure long-term availability and environmental responsibility. Looking ahead, collaborations between agave nectar companies and food and beverage manufacturers hold promise for the development of innovative products infused with agave nectar's sweetness. This could lead to a wider range of applications beyond traditional uses, potentially propelling the market forward.

Key Players:

-

Madre Tierra

-

TerraVia

-

Honey's Raw

-

Wholesome Sweeteners

-

Imperial Sugar Company

-

Mangata

-

Agave Nectar Company

-

Sucanat

-

Mevoflavours

-

Roquette

Chapter 1. Agave Nectar Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Agave Nectar Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Agave Nectar Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Agave Nectar Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Agave Nectar Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Agave Nectar Market – By Type

6.1 Introduction/Key Findings

6.2 Light Agave Nectar

6.3 Dark Agave Nectar

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Agave Nectar Market – By Category

7.1 Introduction/Key Findings

7.2 Organic Agave Nectar

7.3 Conventional Agave Nectar

7.4 Y-O-Y Growth trend Analysis By Category

7.5 Absolute $ Opportunity Analysis By Category, 2024-2030

Chapter 8. Agave Nectar Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Category

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Category

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Category

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Category

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Category

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Agave Nectar Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Madre Tierra

9.2 TerraVia

9.3 Honey's Raw

9.4 Wholesome Sweeteners

9.5 Imperial Sugar Company

9.6 Mangata

9.7 Agave Nectar Company

9.8 Sucanat

9.9 Mevoflavours

9.10 Roquette

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Agave Nectar Market was valued at USD 172 billion in 2023 and will grow at a CAGR of 5.7% from 2024 to 2030. The market is expected to reach USD 253.54 billion by 2030.

The growing diabetic population and natural and organic movement are the reasons that are driving the market.

Based on type it is divided into two segments – Light Agave Nectar, Dark Agave Nectar

Asia Pacific is the most dominant region for the Agave Nectar Market.

Agave Nectar Company, Mevoflavours, Roquette