Aerospace Rivets Market Size (2024 – 2030)

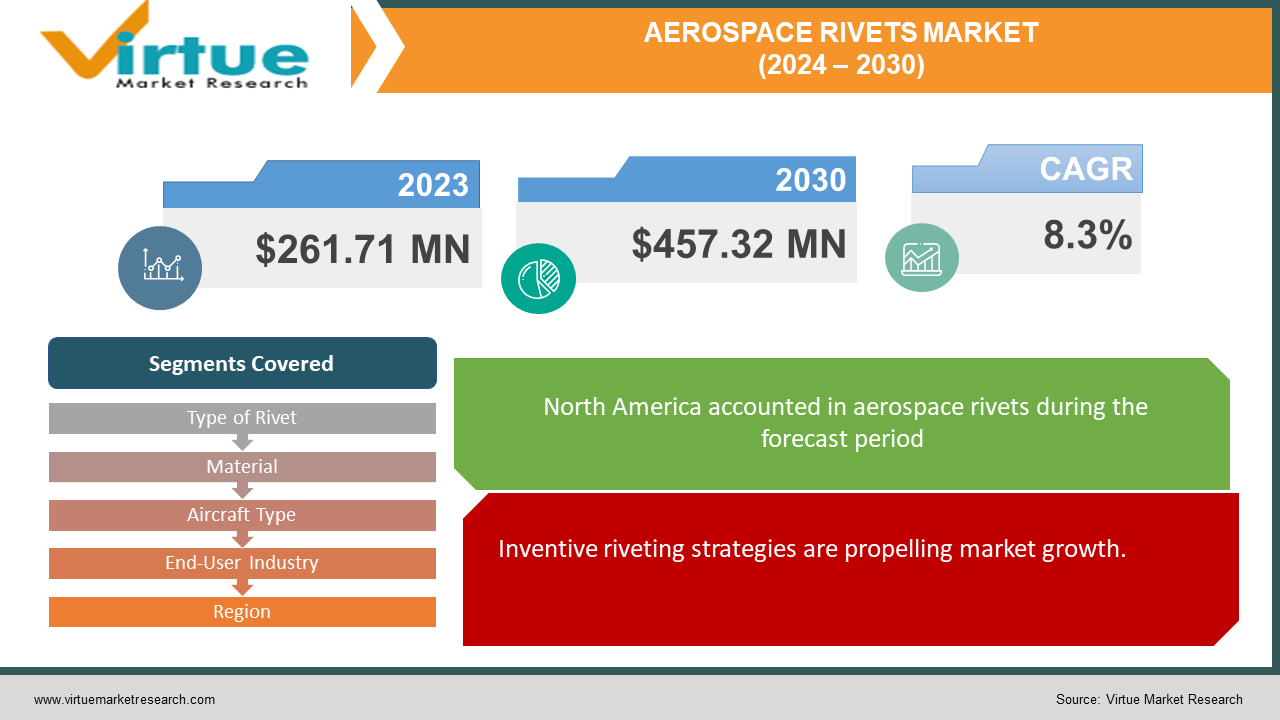

The market for aerospace rivets was estimated to be worth 261.71 USD million in 2023 and is expected to increase to 457.32 USD million by 2030, with a projected compound annual growth rate (CAGR) of 8.3% from 2024 to 2030.

Metal components in airplanes are fastened together using aerospace rivets. They are employed because, in comparison to welded connections, they more equally transmit load and stress across components. In the aircraft business, where forces may be quite high, this is crucial.

Key Market Insights:

The need for lightweight materials, the development of the commercial aviation industry, and inventive riveting techniques are the main factors propelling the aviation rivet market's progress. Costs associated with raw materials, obstacles to innovation, and compliance issues provide serious obstacles to market expansion. Technological developments in additive manufacturing and environmentally friendly solutions provide bright prospects for industry growth. Due to their advantages in lightweight construction and aircraft assembly, blind rivets and aluminum emerge as the largest and fastest-growing sectors, respectively. Each region contributes to the expansion and development of the industry, with North America holding the largest market share, followed by Europe and Asia-Pacific.

Global Aerospace Rivets Market Drivers:

Inventive riveting strategies are propelling market growth.

Innovative progressions in riveting methods, such as computerized riveting frameworks and progressed materials, are revolutionizing the aviation industry. These developments empower quicker and more exact gathering forms, lessening generation time and improving the general quality and unwavering quality of airship structures. Also, computerized riveting frameworks progress specialist security by minimizing manual labor and dreary assignments, whereas advertising more noteworthy adaptability in plan and customization.

The demand for lightweight bolts is boosting the market.

With a developing emphasis on fuel productivity and natural maintainability, there's a rising demand for lightweight materials in flying machine fabrication. Aviation bolts, made from materials like aluminum, titanium, and composite combinations, play a basic role in diminishing the general airplane weight without compromising auxiliary astuteness. As carriers and flying machine producers look to optimize execution and operational costs, the appropriation of lightweight bolts proceeds to accelerate, driving development within the aviation bolt market.

The expansion of the commercial flying division is enabling the development.

The quick extension of the worldwide commercial flying division, driven by expanding air travel demand and rising expendable livelihoods, is a noteworthy driver for the aviation bolts market. Commercial carriers are persistently modernizing and growing their armadas to meet developing traveler activity, making a vigorous demand for modern airships and upkeep administrations. As a result, aviation bolt producers are encountering increased demand for their items, especially in locales seeing fast-flying development, such as Asia-Pacific and the Middle East.

Global Aerospace Rivets Market Restraints and Challenges:

The market is often subjected to compliance challenges.

Aviation bolt producers experience noteworthy administrative compliance challenges due to rigid flying security benchmarks and certification necessities. Guaranteeing that bolts meet the thorough details sketched out by administrative bodies such as the Government Flying Organization (FAA) or the European Flying Security Organization (EASA) adds complexity to the fabrication preparation. Compliance with advancing directions requires ceaseless ventures in investigation and improvement, testing, and documentation, which can increase generation costs and lead times for aviation bolt providers.

Crude fabric costs and instability affect growth.

The aviation bolts market faces challenges related to the fetched weights and cost instability of crude materials. Vacillations within the costs of metals like aluminum, titanium, and steel, which are commonly utilized in bolt generation, specifically affect fabricating costs and benefit edges. Furthermore, geopolitical variables, supply chain disturbances, and exchange pressures can compound cost instability, making it challenging for aviation bolt producers to figure out and oversee generation costs viably. As a result, keeping up cost competitiveness while guaranteeing item quality remains a diligent challenge within the industry.

Overcoming advancement obstructions is a significant hurdle.

The aviation bolts market faces innovative complexity and advancement boundaries that obstruct the advancement of progressed riveting arrangements. Whereas innovative progressions offer openings for moved-forward execution and proficiency, the coordination of unused advances into existing fabricating forms can be challenging. Aviation bolt producers must contribute to inquiry about and advancement to overcome specialized obstacles, such as fabric compatibility, versatility, and administrative compliance.

Global Aerospace Rivets Market Opportunities:

Advancements in additive manufacturing are beneficial.

The appropriation of added substance fabricating (AM) advances presents critical openings for the aviation bolt market. AM forms, such as 3D printing, empower the generation of complex and customized bolts with diminished fabric squander and lead times. Aviation producers can use AM to create lightweight and high-strength bolts custom-made for particular flying machine applications. Advertising has moved forward in execution and effectiveness. Furthermore, AM encourages on-demand fabricating and decentralized generation, empowering cost-effective prototyping and low-volume generation of aviation bolts and, in this manner, extending market openings for inventive providers.

Eco-friendly arrangements provide the market with many possibilities.

The developing emphasis on supportability within the aviation industry presents openings for bolt producers to embrace eco-friendly materials and fabricate hones. Renewable and recyclable materials, such as bio-based polymers and composites, offer alternatives to conventional metal bolts, diminishing the carbon impression and natural effect. Besides, executing energy-efficient generation forms and squandering diminishment procedures can upgrade the maintainability accreditations of aviation bolt providers. By adjusting to the industry's maintainability objectives and tending to develop natural concerns, bolt manufacturers can separate themselves within the market and capitalize on the expanding demand for eco-friendly arrangements.

Manufacturers are embracing new possibilities for expansion.

The quick development of the unmanned airborne vehicle (UAV) market presents profitable openings for aviation bolt producers. UAVs, utilized for different applications such as reconnaissance, conveyance, and foundation review, require lightweight and solid bolts to resist operational demands. As innovative progressions drive the improvement of progressed UAV stages with enhanced capabilities and independence, there's a developing demand for specialized riveting arrangements custom-made to UAV manufacturers' one-of-a-kind prerequisites. By catering to the advancing needs of the UAV market and advertising imaginative riveting arrangements, aviation bolt providers can capitalize on this burgeoning segment and drive market development.

AEROSPACE RIVETS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.3% |

|

Segments Covered |

By Type of Rivet, Material, Aircraft Type, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Stanley Engineered Fastening (Stanley Black & Decker), LISI Aerospace, Precision Castparts Corp. (PCC), Arconic Inc., Huck International (Alcoa Fastening Systems), National Aerospace Fasteners Corporation (NAFCO), Cherry Aerospace (PCC), Monogram Aerospace Fasteners (TriMas Corporation), Bollhoff Group, Alcoa Corporation, TriMas Corporation |

Aerospace Rivets Market Segmentation: By Type of Rivet

-

Solid Rivets

-

Blind Rivets

-

Tubular Rivets

-

Semi-Tubular Rivets

-

Drive Rivets

-

Split Rivets

-

Structural Rivets

Blind rivets are the largest and fastest-growing type. The aircraft industry has come to rely on blind rivets because they can create sturdy, dependable joins without requiring access to both sides of the workpiece. This function comes in very handy while assembling airplanes since it might be difficult to access specific spots for riveting. Additionally, blind rivets' appeal to aircraft makers is further enhanced by the variety of designs, materials, and sizes available, which enable customized solutions to meet particular engineering needs. Blind rivets are anticipated to continue to be a favored option as aircraft designs develop, placing a greater emphasis on lightweight construction and efficient production procedures. This will propel blind rivets' continuous rise in the aerospace rivet market.

Aerospace Rivets Market Segmentation: By Material

-

Aluminum

-

Stainless Steel

-

Titanium

-

Nickel-based Alloys

-

Others

Aluminum is the largest and fastest-growing material. Aluminum alloys are widely utilized in aircraft construction because they provide a good balance of strength, lightweight characteristics, and corrosion resistance. Their appeal is further influenced by their comparatively low cost when compared to materials like titanium and alloys based on nickel. Because of its adaptability, simplicity of manufacture, and capacity to satisfy demanding performance standards, aluminum is the material of choice in the aircraft industry. Furthermore, developments in aluminum alloy formulas and production techniques have improved the alloy's suitability for aerospace applications, which is fueling the market's ongoing expansion. Titanium is the fastest-growing category. Titanium has a special combination of properties that make it exceedingly alluring for aviation applications. Its uncommon strength-to-weight proportion, erosion resistance, and high-temperature resistance make it perfect for utilization in flying machine structures where toughness and unwavering quality are foremost. Titanium bolts offer prevalent quality compared to other materials while still being lightweight, which is significant for decreasing general flying machine weight and progressing fuel proficiency. Also, titanium's resistance to erosion guarantees a life span and unwavering quality in cruel working situations, such as high-altitude flights and marine climates. Even though titanium rivets may come at a better cost compared to other materials, their execution benefits and life span legitimize the speculation, making them a favored choice for basic aviation applications where security and execution are non-negotiable.

Aerospace Rivets Market Segmentation: By Aircraft Type

-

Commercial Aircraft

-

Regional Aircraft

-

Helicopter

-

Military Aircraft

-

General Aviation

The commercial airplane is the largest and fastest-growing aircraft type. Commercial airplanes speak to a noteworthy parcel of the aviation industry, with a developing worldwide demand for discussed travel driving nonstop development and modernization of commercial armadas. Aviation bolts utilized in commercial airships must meet exacting prerequisites for security, unwavering quality, and execution, given the thorough operational demands and administrative guidelines within the commercial aviation segment. Bolts play a basic part in the gathering and basic astuteness of commercial airplanes, guaranteeing that components are safely secured and competent to withstand the stresses of flight. Moreover, the competitive nature of the commercial flying market drives development in aircraft plans and fabrication, driving the selection of advanced riveting advances and materials to improve fuel productivity, diminish support costs, and move forward traveler consolation. As aircraft around the world proceed to contribute to armada development and modernization programs to meet the discussed travel demand, the demand for aviation bolts within the commercial airship section is anticipated to stay vigorous, displaying noteworthy openings for market players

Aerospace Rivets Market Segmentation: By End-User Industry

-

Original Equipment Manufacturers (OEMs)

-

Maintenance, Repair, and Overhaul (MRO) Service Providers

OEMs stand out as the largest and fastest-growing end-user. OEMs play a significant role in the aviation industry, planning and fabricating unused aircraft to meet the demands of both commercial and military markets. As the essential makers of airplanes, OEMs have rigid necessities for bolts, demanding high-quality, precision-engineered components to guarantee the security, unwavering quality, and execution of their airship. Aviation bolts utilized in OEM fabrication must meet thorough determinations and administrative measures, with a focus on solidity, weight optimization, and ease of assembly. OEMs also drive development in aviation riveting advances, collaborating with providers to create progressed bolt plans and fabricating forms that progress productivity, diminish generation costs, and improve flying machine execution. Besides, OEMs frequently set up long-term associations with bolt producers to guarantee a dependable supply chain and streamline generation forms, emphasizing the significance of OEMs as key partners within the aviation bolts market.

Aerospace Rivets Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The worldwide aviation bolts market shows an assorted distribution of market share by locale, with North America driving the pack, commanding a critical share of 32%. North America's dominance can be attributed to its vigorous aviation industry, characterized by the nearness of major airplane producers, broad investigation and advancement exercises, and a solid defense division. Taking a close second is Europe, which captures a considerable market share of 26%. Europe boasts a well-established aviation fabricating environment, with driving companies included in airship generation, support, and advancement. Asia-Pacific is the fastest market, holding a significant market share of 25%. Asia-Pacific's developing flying segment, driven by rising discussed travel demand, extending armadas, and expanding speculations in aviation foundations, contributes to its critical nearness within the aviation bolts market. South America, the Middle East, and Africa districts hold smaller but outstanding market offers of 9% and 8%, respectively. Despite confronting challenges such as financial instability and geopolitical insecurity, these locales illustrate the potential for development, driven by variables such as armada modernization activities and expanding defense investing. In general, the dispersion of market share by locale underscores the worldwide nature of the aviation bolts market, with each locale contributing to the industry's strength and advancement.

COVID-19 Impact Analysis on the Global Aerospace Rivets Market:

The widespread COVID-19 has essentially affected the worldwide aviation bolt market, presenting challenges and disturbances in the industry. With far-reaching travel limitations, diminished travel demand, and supply chain disturbances, aviation producers confronted generation slowdowns and arranged cancellations, driving a decrease in demand for aviation bolts. The pandemic-induced financial downturn compelled carriers to concede armada extension plans and prioritize cost-cutting measures, influencing modern airship orders and aftermarket administrations. Moreover, brief closures of flying machine fabricating offices and MRO benefit centers disturbed the supply chain, causing delays in bolt generation and establishment exercises. Despite these challenges, the aviation industry has appeared strong, with progressive recuperation watched as inoculation endeavors advance and discuss travel bounce back. Besides, the widespread demand has incited aviation producers to reevaluate supply chain strength, quicken digitalization endeavors, and investigate openings for collaboration and development to relieve future disturbances. As the flying industry steadily recuperates and adjusts to the modern typical, the aviation bolts market is anticipated to bounce back, driven by pent-up demand, armada modernization activities, and progressing speculations in aviation framework and innovation.

Latest Trends/ Developments:

One eminent trend is the expanding selection of advanced materials and fabricating methods to improve the execution and supportability of bolts. Producers are leveraging lightweight combinations, composite materials, and added substance fabricating forms to deliver bolts that offer predominant strength-to-weight proportions, erosion resistance, and environmental supportability.

Also, there's a developing emphasis on digitalization and robotization in riveting forms, empowering speedier generation cycles, more noteworthy accuracy, and moving forward quality control. Furthermore, sustainability has ended up being a key driver within the aviation industry, driving the advancement of eco-friendly riveting arrangements and reusing activities aimed at lessening squander and carbon emanations. As the industry proceeds to enhance and adjust to advancing market flow, the most recent patterns and improvements in aviation bolts reflect a commitment to advancing technology, sustainability, and operational productivity to meet the demands of the end of the aviation scene.

Key Players:

-

Stanley Engineered Fastening (Stanley Black & Decker)

-

LISI Aerospace

-

Precision Castparts Corp. (PCC)

-

Arconic Inc.

-

Huck International (Alcoa Fastening Systems)

-

National Aerospace Fasteners Corporation (NAFCO)

-

Cherry Aerospace (PCC)

-

Monogram Aerospace Fasteners (TriMas Corporation)

-

Bollhoff Group

-

Alcoa Corporation

-

TriMas Corporation

Chapter 1. Aerospace Rivets Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aerospace Rivets Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aerospace Rivets Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aerospace Rivets Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aerospace Rivets Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aerospace Rivets Market – By Type of Rivet

6.1 Introduction/Key Findings

6.2 Solid Rivets

6.3 Blind Rivets

6.4 Tubular Rivets

6.5 Semi-Tubular Rivets

6.6 Drive Rivets

6.7 Split Rivets

6.8 Structural Rivets

6.9 Y-O-Y Growth trend Analysis By Type of Rivet

6.10 Absolute $ Opportunity Analysis By Type of Rivet, 2024-2030

Chapter 7. Aerospace Rivets Market – By Material

7.1 Introduction/Key Findings

7.2 Aluminum

7.3 Stainless Steel

7.4 Titanium

7.5 Nickel-based Alloys

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Material

7.8 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 8. Aerospace Rivets Market – By Aircraft Type

8.1 Introduction/Key Findings

8.2 Commercial Aircraft

8.3 Regional Aircraft

8.4 Helicopter

8.5 Military Aircraft

8.6 General Aviation

8.7 Y-O-Y Growth trend Analysis By Aircraft Type

8.8 Absolute $ Opportunity Analysis By Aircraft Type, 2024-2030

Chapter 9. Aerospace Rivets Market – By End-User Industry

9.1 Introduction/Key Findings

9.2 Original Equipment Manufacturers (OEMs)

9.3 Maintenance, Repair, and Overhaul (MRO) Service Providers

9.4 Y-O-Y Growth trend Analysis By End-User Industry

9.5 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 10. Aerospace Rivets Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Type of Rivet

10.1.3 By Material

10.1.4 By Aircraft Type

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Type of Rivet

10.2.3 By Material

10.2.4 By Aircraft Type

10.2.5 By End-User Industry

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Type of Rivet

10.3.3 By Material

10.3.4 By Aircraft Type

10.3.5 By End-User Industry

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Type of Rivet

10.4.3 By Material

10.4.4 By Aircraft Type

10.4.5 By End-User Industry

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Type of Rivet

10.5.3 By Material

10.5.4 By Aircraft Type

10.5.5 By End-User Industry

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Aerospace Rivets Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Stanley Engineered Fastening (Stanley Black & Decker)

11.2 LISI Aerospace

11.3 Precision Castparts Corp. (PCC)

11.4 Arconic Inc.

11.5 Huck International (Alcoa Fastening Systems)

11.6 National Aerospace Fasteners Corporation (NAFCO)

11.7 Cherry Aerospace (PCC)

11.8 Monogram Aerospace Fasteners (TriMas Corporation)

11.9 Bollhoff Group

11.10 Alcoa Corporation

11.11 TriMas Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for aerospace rivets was estimated to be worth 261.71 USD million in 2023 and is expected to increase to 457.32 USD million by 2030, with a projected compound annual growth rate (CAGR) of 8.3% from 2024 to 2030.

The essential drivers of the global aerospace rivets market are the extending aviation industry, demand for lightweight materials, and mechanical progressions in riveting methods.

The key challenges confronting the global aerospace rivets market are administrative compliance, certification prerequisites, and innovative complexity.

In 2023, North America held the largest share of the global aerospace rivets market.

Stanley Engineered Fastening, LISI Aerospace, Precision Castparts Corp. (PCC), Arconic Inc., Huck International, National Aerospace Fasteners Corporation (NAFCO), Cherry Aerospace, Monogram Aerospace Fasteners, Bollhoff Group, Alcoa Corporation, TriMas Corporation, and Avdel Global (a division of Stanley Black & Decker) are among the main players in the aerospace rivets market.