Aerospace IoT Market Size (2024-2030)

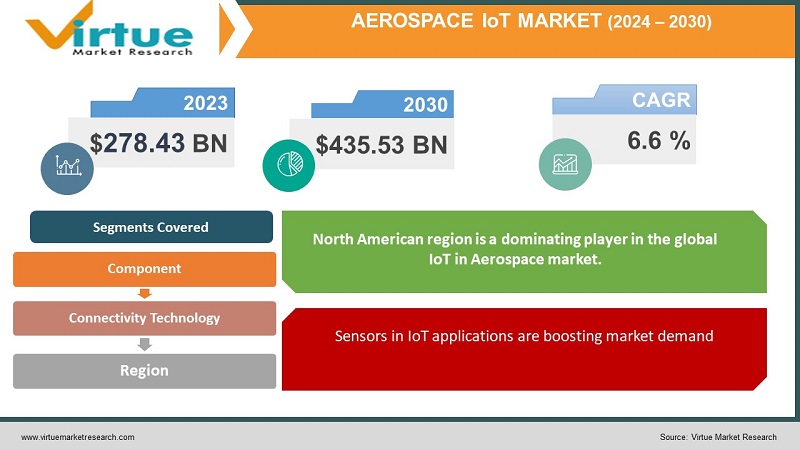

The Aerospace Market is valued at USD 278.43 billion in 2023 and is projected to reach a market size of USD 435.53 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 6.6%.

IoT in Aerospace is the network of physical objects and devices, integrated with software, sensors, and network connectivity that enable them to collect and exchange data. This technology permits Aerospace organizations to remotely monitor and control devices on a large-scale, resulting in increased efficiency and minimal costs. The Global IoT in Aerospace market is estimated to develop significantly over the next few years. This is due to the accelerating demand for advanced analytics and automation solutions and the increasing need for connected devices across the Aerospace industry. This market is also estimated to be driven by the increasing investments in Civil and Military Aircraft and Unmanned Aerial Vehicles around the world.

Key Market Insights:

- As per the report of PWC, 93% of executives believe the benefits of IoT outweigh the risks. And according to Cisco, 500 billion devices are estimated to be connected to the internet by 2030.

- Malware attacks on IoT devices rose by 77% in the first half of 2022. And more than 25% of all cyberattacks against businesses will include IoT, reports Gartner.

- According to Statista, in 2023, the smart home market is valued at $139 million in the first quarter and 16% of homes are segmented as smart homes. Consumer expensing on smart home devices is up to $127 billion in the United States in 2023.

- Industrial IoT (IIoT) is one of the dominating segments for IoT projects, anticipated to reach $106.1 billion by 2026. Global energy IoT is forecasted to reach $75.3 billion by 2026. Construction has been a recent adopter, but IoT expenditure is expected to reach $16.8 billion by 2024 in this sector.

Aerospace IoT Market Drivers:

- The heightened demand for advanced safety features in the Aerospace industry

Driving sources like the growing need for secure operations and the necessity for reliable and accurate data. Modernised safety features provide improved data accuracy, improved situational awareness and enhanced security. This accelerated demand is being driven by the need for better safety, reliability and increased performance from aircraft and other vehicles used in the Aerospace industry. In order to enable precise and up-to-date information on energy usage throughout the whole production phase, Aerospace companies are implementing IoT-enabled smart meters in the manufacturing of airplanes.

- Sensors in IoT applications are boosting market demand.

Continuing from the above factor, employing sophisticated analytics algorithms, the smart meters examine energy consumption and suggest energy-saving strategies. Success depends on reducing the amount of time an aircraft is grounded. IoT sensors were put to use by Aerospace to do this. Aerospace businesses can keep planes in the air and save money by solving problems as soon as they land credits to robust IoT sensors that offer performance data from thousands of angles.

There are multiple other contributors to the growth of IoT in Aerospace industry, such as -

-Rising adoption of advanced technologies

-Accelerated demand for connected devices

-Growing government investments in research and development activities in IoT development.

Aerospace IoT Market Restraints and Challenges:

Cost is a major element for the adoption of IoT in Aerospace market. The technology is expensive and not all businesses can manage to invest in it. There are several cost-cutting measures available, however, the market is yet to achieve its full potential in terms of cost-effectiveness.

Implementing IoT solutions need technical expertise which is not easy to come by. Several organizations lack the resources and personnel to deploy such solutions. Furthermore, the lack of standardization in data formats further complicates the process of setting up and managing these systems.

Although IoT sensors have huge potential, there are problems regarding data privacy and security associated with IoT equipment. The IoT is wholly data driven. IoT-enabled devices and sensors produce a huge volume of data per second. Companies and Institutions use various sensors to monitor and control this data and take decisions based on it. As they rely more on machine-generated data for real-time business processes, it is necessary to ensure the authenticity of data and security, resilience and reliability of the devices that cumulate data. As IoT integrates numerous devices, it offers more decentralised entry points for Malware. If IoT devices are poorly secured then cyber attackers may use them as entry points to cause damage other devices in the network.

Aerospace IoT Market Opportunities:

The Global Internet of Things (IoT) in Aerospace Market is expected to experience an exponential growth rate due to the rising demand for advanced technologies in the Aerospace industry. The rising demand for smart technologies is creating an opportunity for Aerospace manufacturers to leverage the benefits of IoT. By implementing IoT solutions, organizations can earn improved efficiency, cost savings and accelerated productivity. Organizations are executing connected technologies to develop production processes and to enable effective asset tracking and monitoring. The collaboration of IoT with Aerospace systems aids organizations to enhance their operational efficiency. Also, IoT solutions are applied to monitor and analyse the performance of equipment and minimise the downtime of aircrafts and other equipment. The advent of new technologies, such as 5G, Artificial Intelligence (AI), and edge computing, are further influencing the growth of the Global IoT in Aerospace Market. The deployment of 5G networks in the Aerospace sector is expected to enable organizations to connect multiple devices over a single network. Moreover, AI-based solutions are being utilised to enhance the accuracy of data analysis and predictive maintenance. Furthermore, edge computing is being invested in the Aerospace industry to enable the analysis of data in real-time. Overall, the Global IoT in Aerospace Market is expected to experience a pivotal growth rate in the coming years due to the growing adoption of advanced technologies, such as 5G, AI, and edge computing. Organizations are leveraging the advantages of IoT solutions to gain improved efficiency, cost savings, and increased productivity.

AEROSPACE IOT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.6% |

|

Segments Covered |

By Connectivity technology, component, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AeroVironment , ATandT , Elbit Systems, Freewave Technologies, General Atomics Aeronautical Systems, Honeywell International, Northrup Grunman, Prox Dynamics, Radisys, Textron Systems |

Aerospace IoT Market Segmentation:

Aerospace IoT Market By Component

- Hardware

- Software

- Services

The Hardware segment gathered the highest market share in 2023. Due to rising IoT device demand, the necessity for low-cost equipment and the need for numerous sensors and chips for smart devices, the IoT in Aerospace is developing. Since the updated security highlights for IoT devices, such as substance security, verification, infection discovery, and burglary obstruction, it is expected that the showcase for IoT in Aviation would enlarge.

Aerospace IoT Market By Connectivity Technology

- Cellular

- Wi-Fi

- Satellite Communication

- Radio Frequency

The Cellular segment accounted for the largest income in IoT in Aerospace market and hence called the dominating segment. The major elements affecting Cellular networks in IoT in Aerospace Market are the advancement of Machine-to-Machine (M2M) innovation, advancement of long-term advancement (LTE) and optimized utilization of available cellular organize.

Aerospace IoT Market By Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

The North American region is a dominating player in the global IoT in Aerospace market. The region is base to some of the world’s leading Aerospace companies, and is a primary hub for research and development in the sector. The region is seeing strong development in the IoT in Aerospace market, driven by the rising demand for connected aircraft systems. The region is also seeing increased deployment in the development of advanced technologies such as Artificial Intelligence, Machine Learning and robotics, which are directing the growth of the market. The region is also seeing more demand for connected Aircraft systems due to the growing need for enhanced security and safety. In addition, the region is seeing accelerated investment in the development of advanced technologies such as blockchain, which are estimated to further drive the growth of the market. Overall, the North American region is a big player in the global IoT in Aerospace market and is guessed to continue to experience strong growth in the coming years.

COVID-19 Impact Analysis on the Aerospace IoT Market:

During the early days of the pandemic, social distancing was being maintained to restrict the number of workers on the shop floor. This impacted in reducing the manufacturing operations and capacity. Some Companies had completely ceased the manufacturing operations, which disrupted the supply chain. Supplying essential manufacturing components and raw materials to regions that were under the complete lockdown became tough. This further resulted the commercial activities to come to a standstill situation, thereby negatively affecting the market’s development, especially in the manufacturing sector.

Latest Trends:

- Growing demand for Sensors

IoT sensor data can aid cut down on the cost, labour and time needed to perform routine maintenance. Owing to the faster reduction in the sensor size and high adoption of microelectromechanical systems (MEMS) technology, sensors are finding application in Automotive, Aerospace, Healthcare and Consumer products. This has played a major role in the overall growth of sensors market. In the past 5 years, smaller sensors have rapidly been used in devices such as Smartphones, drones, wearables and robots.

Key Players:

- AeroVironment

- ATandT

- Elbit Systems

- Freewave Technologies

- General Atomics Aeronautical Systems

- Honeywell International

- Northrup Grunman

- Prox Dynamics

- Radisys, Textron Systems

Chapter 1. GLOBAL AEROSPACE IOT MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL AEROSPACE IOT MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL AEROSPACE IOT MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL AEROSPACE IOT MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL AEROSPACE IOT MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL AEROSPACE IOT MARKET – By Component

6.1. Introduction/Key Findings

6.2. Hardware

6.3. Software

6.4. Services

6.5. Y-O-Y Growth trend Analysis By Component

6.6. Absolute $ Opportunity Analysis By Component , 2024-2030

Chapter 7. GLOBAL AEROSPACE IOT MARKET – By Connectivity Technology

7.1. Introduction/Key Findings

7.2. Cellular

7.3. Wi-Fi

7.4. Satellite Communication

7.5. Radio Frequency

7.6. Y-O-Y Growth trend Analysis By Connectivity Technology

7.7. Absolute $ Opportunity Analysis By Connectivity Technology , 2024-2030

Chapter 8. GLOBAL AEROSPACE IOT MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Connectivity Technology

8.1.3. By Component

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Connectivity Technology

8.2.3. By Component

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Connectivity Technology

8.3.3. By Component

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Connectivity Technology

8.4.3. By Component

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Connectivity Technology

8.5.3. By Component

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL AEROSPACE IOT MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 AeroVironment

9.2. ATandT

9.3. Elbit Systems

9.4. Freewave Technologies

9.5. General Atomics Aeronautical Systems

9.6. Honeywell International

9.7. Northrup Grunman

9.8. Prox Dynamics

9.9. Radisys, Textron Systems

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Aerospace Market is valued at USD 278.43 billion in 2023 and is projected to reach a market size of USD 435.53 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 6.6%.

The demand for use of IoT devices and sensors is propelling the Aerospace IoT industry

Aerospace IoT Market is segmented based on Component, Connectivity Technology, and Region.

North America is the most dominant region for the Aerospace IoT Market.

. AeroVironment, ATandT, Elbit Systems, Freewave Technologies and General Atomics Aeronautical Systems, are the few of the key players operating in the Aerospace IoT Market.