Aerospace Grade Polyurethane Foam Market Size (2024 – 2030)

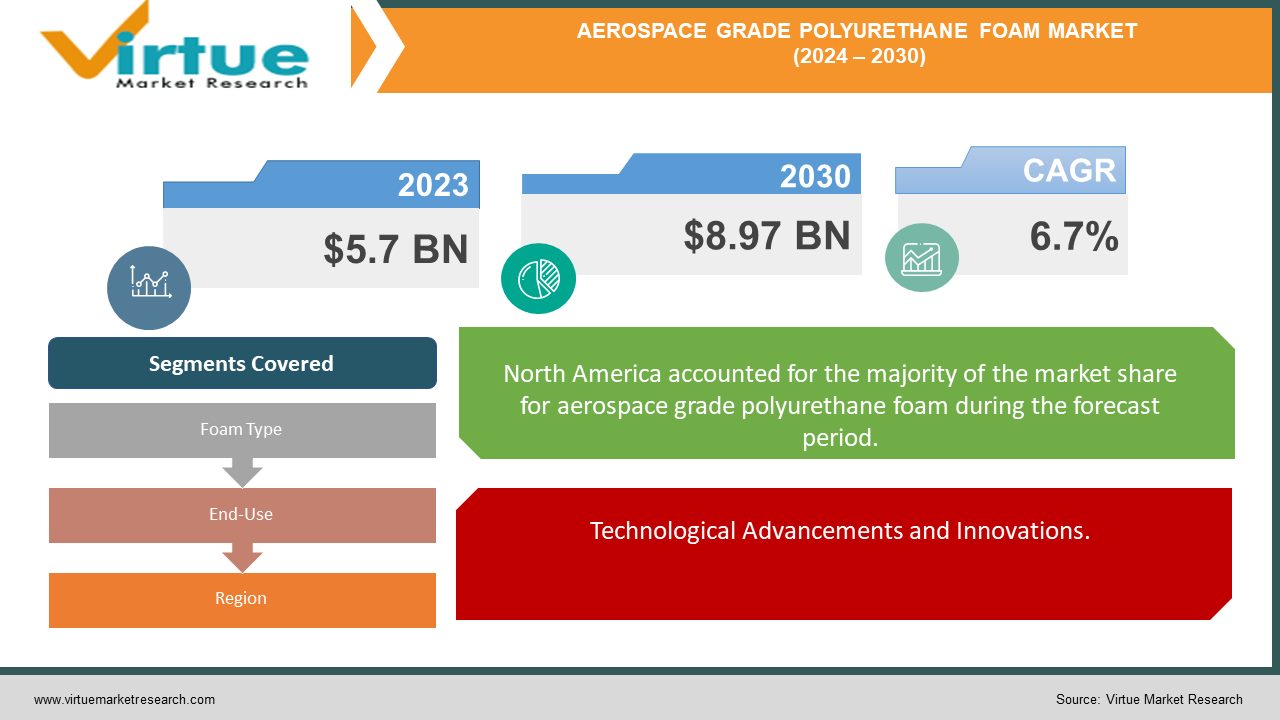

The Global Aerospace Grade Polyurethane Foam Market was valued at USD 5.7 billion in 2023 and is projected to reach a market size of USD 8.97 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 6.7% between 2024 and 2030.

The Global Aerospace Grade Polyurethane Foam Market is witnessing significant growth due to the increasing demand for lightweight and durable materials in the aerospace industry. Aerospace grade polyurethane foam is renowned for its exceptional properties such as high strength-to-weight ratio, excellent thermal insulation, and superior impact resistance, making it an ideal choice for various aerospace applications including aircraft seating, interior panels, and insulation. The market's expansion is driven by rising air travel, advancements in aerospace technology, and the growing emphasis on fuel efficiency and sustainability. Additionally, stringent regulations regarding emissions and environmental impact are pushing manufacturers to adopt advanced materials like polyurethane foam. The ongoing research and development efforts to enhance the performance characteristics of polyurethane foam further bolster its adoption in the aerospace sector. North America holds a significant share of the market, owing to the presence of major aerospace manufacturers and increasing investments in aerospace innovations. Meanwhile, the Asia-Pacific region is expected to exhibit robust growth due to the rapid expansion of the aviation industry and increasing defense budgets. As the aerospace sector continues to evolve, the demand for high-performance materials like aerospace grade polyurethane foam is poised to grow, driving market expansion globally.

Key Market Insights:

North America holds the largest market share, accounting for around 35% of the global market, due to major aerospace manufacturers and significant investments in aerospace innovations.

The aircraft seating segment represents about 30% of the total demand for aerospace grade polyurethane foam, driven by the need for lightweight, comfortable, and durable seating solutions.

Polyurethane foam with enhanced flame retardancy properties constitutes approximately 25% of the market, highlighting the importance of safety in aerospace applications.

The adoption of advanced manufacturing techniques, such as 3D printing and automation, is expected to grow by 20% over the next five years, enhancing the production efficiency and customization of polyurethane foam components.

Bio-based polyurethane foams, derived from renewable resources, are anticipated to capture around 15% of the market by 2030, as the industry shifts towards more sustainable materials.

The Asia-Pacific region is projected to exhibit the highest growth rate, with a CAGR of over 9% during the forecast period, fueled by rapid industrialization and expanding aerospace sectors in countries like China and India.

Global Aerospace Grade Polyurethane Foam Market Drivers:

Increasing Demand for Lightweight and Durable Materials.

One of the primary drivers of the Global Aerospace Grade Polyurethane Foam Market is the escalating demand for lightweight and durable materials in the aerospace industry. As aircraft manufacturers strive to improve fuel efficiency and reduce carbon emissions, the use of lightweight materials has become crucial. Aerospace grade polyurethane foam, with its high strength-to-weight ratio, provides an optimal solution for these requirements. Its application in aircraft seating, interior panels, and insulation helps significantly reduce the overall weight of the aircraft, thereby enhancing fuel efficiency and lowering operational costs. Furthermore, the material’s durability ensures long-term performance, reducing the need for frequent replacements and maintenance. This combination of lightweight and durability makes polyurethane foam an attractive choice for aerospace manufacturers, driving its market demand.

Technological Advancements and Innovations.

Technological advancements and innovations in the aerospace industry are also major drivers of the Global Aerospace Grade Polyurethane Foam Market. Continuous research and development efforts are being made to enhance the properties of polyurethane foam, such as its thermal insulation, impact resistance, and flame retardancy. These improvements make the foam more suitable for a wider range of aerospace applications, including those with stringent safety and performance requirements. Additionally, innovations in manufacturing processes have led to the production of higher-quality foam with greater consistency and reliability. The integration of advanced technologies in aerospace design and manufacturing has created new opportunities for the application of polyurethane foam, further propelling market growth. As the aerospace industry continues to evolve, the adoption of advanced materials like aerospace grade polyurethane foam is expected to increase, driven by these technological advancements.

Global Aerospace Grade Polyurethane Foam Market Restraints and Challenges:

Despite the promising growth prospects, the Global Aerospace Grade Polyurethane Foam Market faces several restraints and challenges that could impede its expansion. One of the primary challenges is the high cost associated with the production and application of aerospace grade polyurethane foam. The advanced manufacturing processes and stringent quality control measures required to produce this high-performance material result in elevated costs, which can be a deterrent to widespread adoption, particularly among smaller aerospace manufacturers and emerging markets. Additionally, the aerospace industry is subject to rigorous safety and environmental regulations, which can pose significant hurdles for the approval and use of new materials. Ensuring compliance with these regulations necessitates extensive testing and certification, further adding to the time and cost involved. Moreover, the market faces competition from other advanced materials, such as carbon fiber composites and advanced metal alloys, which offer similar benefits and are also being increasingly adopted in aerospace applications. These factors, coupled with potential supply chain disruptions and the need for continual innovation to meet evolving industry standards, present notable challenges that could constrain the growth of the aerospace grade polyurethane foam market.

Global Aerospace Grade Polyurethane Foam Market Opportunities:

The Global Aerospace Grade Polyurethane Foam Market presents numerous opportunities for growth, primarily driven by the increasing focus on sustainable and energy-efficient solutions in the aerospace industry. As environmental concerns and regulatory pressures mount, there is a growing demand for materials that contribute to reduced fuel consumption and lower emissions. Aerospace grade polyurethane foam, with its excellent thermal insulation properties and lightweight nature, plays a crucial role in achieving these sustainability goals. Moreover, the burgeoning aerospace sectors in emerging economies, particularly in the Asia-Pacific region, offer significant market opportunities. Rapid industrialization, expanding defense budgets, and the increasing number of air passengers in these regions are driving the demand for advanced aerospace materials. Additionally, advancements in manufacturing technologies, such as 3D printing and automation, are enabling the production of customized and high-quality polyurethane foam components, further expanding its application scope. Collaborations between aerospace manufacturers and material scientists are likely to yield innovative solutions that enhance the performance and efficiency of polyurethane foam. The trend towards electric and hybrid aircraft also opens new avenues for the use of lightweight and durable materials like polyurethane foam, positioning the market for substantial growth in the coming years as the aerospace industry continues to prioritize innovation and sustainability.

AEROSPACE GRADE POLYURETHANE FOAM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.7% |

|

Segments Covered |

By Foam Type, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Dow Inc., Huntsman Corporation, Rogers Corporation, Boyd Corporation, Armacell International S.A., SABIC (Saudi Basic Industries Corporation), Recticel NV, The Woodbridge Group |

Global Aerospace Grade Polyurethane Foam Market Segmentation: By Foam Type

-

Polyurethane (PU) Foam

-

Polyethylene (PE) Foam

-

Ceramic Foam

-

Melamine Foam

-

Metal Foam

The Global Aerospace Grade Polyurethane Foam Market by Foam Type, Polyurethane (PU) Foam market share last year and is poised to maintain its dominance throughout the forecast period. Polyurethane (PU) foam remains a cornerstone of the aerospace industry due to its versatile properties, making it suitable for a wide range of applications. Its ability to be engineered from soft and flexible to rigid and dense provides unmatched versatility, while its lightweight nature is crucial for reducing aircraft weight, thereby enhancing fuel efficiency. PU foam's excellent thermal and acoustic insulation properties are essential for passenger comfort and aircraft performance, while its superior shock absorption offers effective cushioning for seats and other components. Additionally, PU foam is generally more cost-effective compared to other foam types, which further drives its popularity in the aerospace sector. The growing aerospace industry, fueled by the increasing demand for both commercial and military aircraft, necessitates the use of high-performance, lightweight materials like PU foam. Airlines are also heavily investing in passenger comfort, focusing on comfortable seating and noise reduction, which PU foam effectively addresses. Weight reduction initiatives remain a top priority in the aerospace industry to improve fuel efficiency and payload capacity. Given these factors, PU foam is expected to maintain its dominant position in the aerospace market. However, potential advancements in other foam types, especially those offering enhanced fire resistance or superior weight-to-strength ratios, could challenge PU foam's market dominance in the future.

Global Aerospace Grade Polyurethane Foam Market Segmentation: By End-Use

-

Commercial Aviation

-

Military Aviation

-

General Aviation

The Global Aerospace Grade Polyurethane Foam Market by End-Use, Commercial Aviation market share last year and is poised to maintain its dominance throughout the forecast period. Commercial aviation plays a pivotal role in driving the aerospace grade polyurethane foam market due to several key factors. Airlines operate large fleets that require constant replacement and refurbishment of interior components, making polyurethane foam essential for seating, insulation, and acoustic treatments that enhance passenger comfort. The higher production rates in commercial aviation compared to military or general aviation further boosts the demand for polyurethane foam. Additionally, the focus on fuel efficiency in the commercial sector drives the adoption of lightweight materials like polyurethane foam, which helps reduce overall aircraft weight and fuel consumption. However, it is essential to consider that the military and general aviation segments are also experiencing growth, albeit at different paces. Economic conditions can influence the commercial aviation industry's growth rate, impacting the demand for polyurethane foam. Moreover, technological advancements in other foam types or materials could pose a challenge to polyurethane foam's dominance in the future. Innovations offering enhanced fire resistance, improved weight-to-strength ratios, or other superior properties could disrupt the market. Thus, while commercial aviation is currently the primary driver of the aerospace grade polyurethane foam market, monitoring trends in other end-use segments and potentially disruptive technologies is crucial for maintaining a competitive edge.

Global Aerospace Grade Polyurethane Foam Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Global Aerospace Grade Polyurethane Foam Market by Region, North America market share last year and is poised to maintain its dominance throughout the forecast period. North America, particularly the United States, stands as a global leader in aerospace manufacturing, with industry giants like Boeing and Lockheed Martin driving its dominance. The region's early adoption of advanced aerospace technologies has facilitated the extensive use of polyurethane foam in aircraft applications. Substantial investments in research and development within the aerospace sector have spurred innovation in materials, including polyurethane foam, and bolstered a robust supply chain for these materials across North America. However, this dominance faces challenges. The rapid expansion of the aerospace industries in regions like Asia-Pacific presents rising competition, which could potentially erode North America's market share. Additionally, economic fluctuations can impact the aerospace industry, affecting the demand for polyurethane foam. Furthermore, advancements in foam technology or the development of alternative materials could disrupt the current market landscape. Thus, while North America holds a strong position in the aerospace-grade polyurethane foam market, continuous monitoring of global trends and competitive dynamics is essential to assess the sustainability of its dominance.

COVID-19 Impact Analysis on the Global Aerospace Grade Polyurethane Foam Market.

The COVID-19 pandemic had a profound impact on the Global Aerospace Grade Polyurethane Foam Market, largely due to the significant disruptions in the aerospace industry. The sudden halt in global air travel, combined with economic uncertainty, led to a sharp decline in demand for new aircraft and, consequently, the materials used in their production. Many airlines postponed or canceled orders, which directly affected the demand for aerospace grade polyurethane foam. Additionally, supply chain interruptions and manufacturing shutdowns further hampered the production and delivery of these materials. However, as the industry begins to recover, there is a gradual resurgence in demand driven by the resumption of air travel and the acceleration of aerospace projects that had been delayed. The pandemic also underscored the importance of health and safety, prompting innovations in aircraft interiors that incorporate advanced materials for enhanced hygiene, where polyurethane foam's antimicrobial properties could play a crucial role. Furthermore, the push towards more sustainable and efficient aircraft is expected to drive the adoption of lightweight materials like polyurethane foam as the industry rebounds. Overall, while the pandemic posed significant challenges, it also highlighted opportunities for innovation and adaptation in the aerospace grade polyurethane foam market.

Latest trends / Developments:

The Global Aerospace Grade Polyurethane Foam Market is experiencing several notable trends and developments driven by technological advancements and shifting industry priorities. One key trend is the increasing emphasis on sustainability, with manufacturers focusing on developing eco-friendly polyurethane foams that are recyclable and have lower environmental impact. Innovations in bio-based polyurethane foams, derived from renewable resources, are gaining traction as the aerospace industry seeks greener alternatives. Additionally, the integration of advanced manufacturing techniques, such as 3D printing and automated production processes, is enhancing the precision and efficiency of polyurethane foam production, allowing for more complex and customized components. The rising demand for enhanced passenger comfort and safety has led to the development of foams with superior thermal insulation, noise reduction, and fire retardancy properties. Furthermore, the growing adoption of lightweight materials to improve fuel efficiency and reduce emissions continues to drive the demand for high-performance polyurethane foams. Another significant development is the increasing investment in research and development to create foams with improved mechanical properties, such as higher tensile strength and greater durability. These trends collectively highlight the dynamic nature of the aerospace grade polyurethane foam market, as it adapts to meet evolving industry needs and regulatory requirements.

Key Players:

-

BASF SE

-

Dow Inc.

-

Huntsman Corporation

-

Rogers Corporation

-

Boyd Corporation

-

Armacell International S.A.

-

SABIC (Saudi Basic Industries Corporation)

-

Recticel NV

-

The Woodbridge Group

Chapter 1. Aerospace Grade Polyurethane Foam Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aerospace Grade Polyurethane Foam Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aerospace Grade Polyurethane Foam Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aerospace Grade Polyurethane Foam Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aerospace Grade Polyurethane Foam Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aerospace Grade Polyurethane Foam Market – By Foam Type

6.1 Introduction/Key Findings

6.2 Polyurethane (PU) Foam

6.3 Polyethylene (PE) Foam

6.4 Ceramic Foam

6.5 Melamine Foam

6.6 Metal Foam

6.7 Y-O-Y Growth trend Analysis By Foam Type

6.8 Absolute $ Opportunity Analysis By Foam Type, 2024-2030

Chapter 7. Aerospace Grade Polyurethane Foam Market – By End-Use

7.1 Introduction/Key Findings

7.2 Commercial Aviation

7.3 Military Aviation

7.4 General Aviation

7.5 Y-O-Y Growth trend Analysis By End-Use

7.6 Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 8. Aerospace Grade Polyurethane Foam Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Foam Type

8.1.3 By End-Use

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Foam Type

8.2.3 By End-Use

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Foam Type

8.3.3 By End-Use

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Foam Type

8.4.3 By End-Use

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Foam Type

8.5.3 By End-Use

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Aerospace Grade Polyurethane Foam Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Dow Inc.

9.3 Huntsman Corporation

9.4 Rogers Corporation

9.5 Boyd Corporation

9.6 Armacell International S.A.

9.7 SABIC (Saudi Basic Industries Corporation)

9.8 Recticel NV

9.9 The Woodbridge Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Aerospace Grade Polyurethane Foam market is expected to be valued at US$ 5.7 billion.

Through 2030, the Global Aerospace Grade Polyurethane Foam market is expected to grow at a CAGR of 6.7%.

By 2030, the Global Aerospace Grade Polyurethane Foam Market is expected to grow to a value of US$ 8.97 billion.

North America is predicted to lead the Global Aerospace Grade Polyurethane Foam market.

The Global Aerospace Grade Polyurethane Foam Market has segments By foam Type, end-use, and Region.