Aerospace Forging Market Size (2024 – 2030)

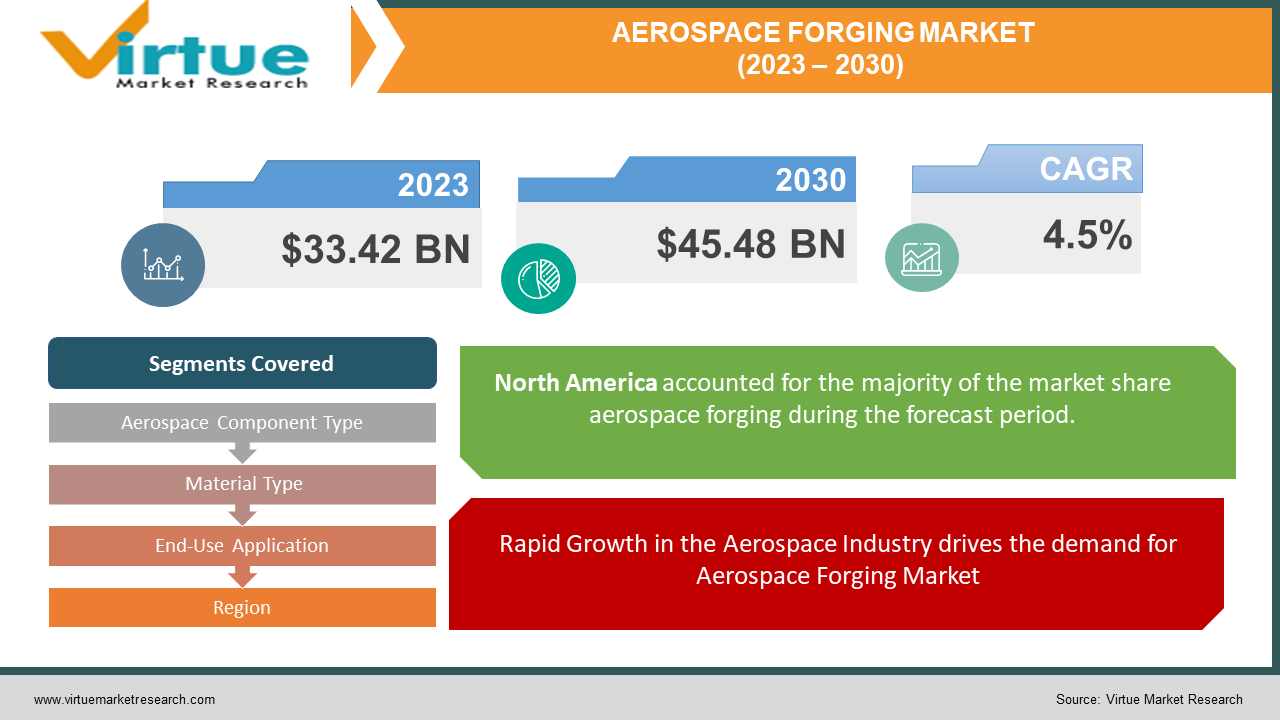

The Global Aerospace Forging Market was valued at USD 33.42 billion in 2023 and is projected to reach a market size of USD 45.48 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.5%.

Aerospace forging includes the process of shaping metal using localized compressive forces and is used in the aerospace industry. Aerospace forging is used to manufacture critical components such as landing gear, engine components, structural parts, and other high-strength, precision parts. Forged components are commonly preferred in aerospace applications due to their strength, durability, and reliability. The Aerospace Forging Market is expected to grow significantly in the coming years due to the rising growth of the aerospace industry and technological advancements.

The major well-established key players in the Aerospace Forging Market are

Precision Castparts Corp. (PCC), Arconic Inc., Bharat Forge Limited, VSMPO-AVISMA Corporation, and Allegheny Technologies Incorporated (ATI).

Key Market Insights:

The accelerating growth of the aerospace industry, technological advancements, the demand for lightweight and high-strength materials, stringent regulatory standards, the globalization of the aerospace supply chain, increasing emphasis on environmental sustainability, innovations in material science and alloy development, and continuous focus on fuel efficiency in aircraft are propelling the Aerospace Forging Market. The restraints on the Aerospace Forging Market include supply chain disruptions, raw material price fluctuations, stringent regulatory compliance, and high initial setup costs. North America occupies the highest share of the Aerospace Forging Market. Asia-Pacific is the fastest-growing segment during the forecast period. Globally, Airbus and Boeing have collaboratively delivered more than 20,000 jetliners in the last ten years, showcasing a remarkable 66% increase compared to the preceding decade. Data from Airbus indicates that the Asia Pacific region is expected to experience a demand for 10,040 new aircraft deliveries from 2028 to 2038.

Aerospace Forging Market Drivers:

Rapid Growth in the Aerospace Industry drives the demand for Aerospace Forging Market.

The surge in global air travel has led to a growing demand for new aircraft. This resulted in the aerospace industry's expansion. This expansion contributes significantly to the aerospace forging market. There is a growing need for new aircraft, leading to increased demand for forged components such as engine parts, landing gear, and structural elements. As aircraft production increases, there is a corresponding rise in the demand for forged components. The growth in the aerospace sector creates a huge market for forging manufacturers. This stimulates production and innovation to meet industry requirements. Thus growth of the aerospace industry impacts the demand for forged components. As air travel continues to increase globally, there is a corresponding demand for new aircraft, leading to a surge in the aerospace forging market.

Advancements in Forging Technologies are propelling the Aerospace Forging Market.

Ongoing advancements in forging technologies have revolutionized the aerospace forging process. Computer-aided design (CAD), computer-aided manufacturing (CAM), and simulation tools technologies improve precision, reduce production times, and enhance overall efficiency in manufacturing high-strength aerospace components. Advanced technologies improved the precision and efficiency of the forging process. These advancements contribute to the overall competitiveness of the aerospace forging market. Evolution in die design, temperature control, and automation enhances the production of complex and customized aerospace components. This meets the industry's demand for high-performance reliable parts.

The continuous development of forging technologies is important for aerospace manufacturers. They increasingly seek sophisticated and specialized components. The ability to meet these demands becomes a key driver for the aerospace forging market.

Aerospace Forging Market Restraints and Challenges

The major challenge faced by the Aerospace Forging Market is the supply chain disruptions. Aerospace forging depends on a complex global supply chain. Disruptions due to geopolitical tensions, natural disasters, and other factors impact the timely availability of raw materials and components. Another challenge is the high initial setup costs. Establishing or upgrading forging facilities for aerospace-grade components includes high initial investment costs. This can be a restraint for new entrants and existing players. The other restraints to the Aerospace Forging Market include raw material price fluctuations, stringent regulatory compliance, the impact of geopolitical tensions, environmental and regulatory challenges, intensive research and development requirements, and dependency on aircraft production cycles

Aerospace Forging Market Opportunities:

The Aerospace Forging Market has various opportunities in the market. There is an ongoing growing demand for lightweight materials. There is also increasing focus on fuel efficiency and environmental sustainability in the aerospace industry. This creates opportunities for aerospace forging companies to develop and supply lightweight, high-strength materials for critical components. The rise of electric aircraft and hybrid propulsion systems creates new opportunities for aerospace forging manufacturers to supply components designed for these new innovative technologies. Continued advancements in forging technologies, such as 3D printing and advanced simulations, create opportunities for companies to enhance the precision, efficiency, and customization of forged aerospace components. The rise of Urban Air Mobility (UAM) and the increasing use of Unmanned Aerial Vehicles (UAVs) create opportunities for aerospace forging manufacturers to supply components for these emerging segments of the aerospace industry. Governments investing in the modernization of military aerospace present opportunities for forging companies to supply critical components for defense applications.

AEROSPACE FORGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Aerospace Component Type, Material Type, End-Use Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Precision Castparts Corp. (PCC), Arconic Inc., Bharat Forge Limited, VSMPO-AVISMA Corporation, Allegheny Technologies Incorporated (ATI), Thyssenkrupp Aerospace, Aubert & Duval, OTTO FUCHS KG, ATI Ladish LLC (a part of Allegheny Technologies), ATI Forged Products (a part of Allegheny Technologies) |

Aerospace Forging Market Segmentation: By Aerospace Component Type

-

Engine Components

-

Landing Gear

-

Structural Parts

-

Other Components

In 2023, based on market segmentation by Aerospace Component Type, Engine Components occupy the highest share of the Aerospace Forging Market. This is due to engines' requirement for highly specialized and precision-forged components to ensure optimal performance and safety. The complexity and critical nature of engine parts also contribute to their dominance in the market.

However, Structural Parts is also the fastest-growing segment during the forecast period and is projected to grow at a CAGR of 12%. This is due to the ongoing emphasis on lightweight materials and fuel efficiency by the aerospace industry.

Aerospace Forging Market Segmentation: By Material Type

-

Titanium Alloys

-

Aluminum Alloys

-

Nickel Alloys

-

Other Alloys

In 2023, based on market segmentation by Material Type, the Aluminum Alloys segment occupies the highest share of the Aerospace Forging Market. It has a market share of around 60%. This is mainly due to their lightweight properties, making them suitable for various aerospace applications. Forged aluminum components are used in aircraft structures, wing components, and other parts where weight reduction is crucial. Also, 90% of aircraft body is made of aluminum materials.

However, the Titanium alloys are the fastest-growing segment during the forecast period. This is mainly due to their excellent strength-to-weight ratio, corrosion resistance, and high-temperature performance. Titanium alloys are commonly used in critical components such as aircraft structures, engine parts, and landing gear.

Aerospace Forging Market Segmentation: By End-Use Application

-

Commercial Aviation

-

Military & Defense

-

Space Exploration

In 2023, based on market segmentation by the Commercial Aviation segment occupies the highest share of the Aerospace Forging Market. It has a market share of around 59%. This is mainly due to increasing demand for new commercial aircraft and continuous growth in global air travel.

However, the military segment is the fastest-growing segment during the forecast period. This growth is driven by escalating demand for military aircraft attributed to increasing defense budgets. The persistent rise in defense spending, fueled by growing global security concerns and a dedicated focus on military modernization, are fueling the expansion of this segment.

The Space Exploration sector is also growing significantly and is expected to increase by 20%. The growth is fueled by the increasing focus on space exploration, satellite deployment, and the development of space-related technologies

Aerospace Forging Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by region, North America occupies the highest share of the Aerospace Forging Market. It has a market share of 40%. This growth is due to the increasing demand for forged components. North America is a technologically advanced region with a significant presence of key aerospace manufacturers. North America is a hub for the latest technological innovation and aircraft production. Precision Castparts Corp. (PCC), a major player in the aerospace forging industry, provides complex metal components for critical aerospace and defense applications.

However, Asia-Pacific is the fastest-growing segment during the forecast period. This is mainly due to the rising demand for air travel, increasing defense budgets, and the emergence of new aviation players. Countries like China, India, Japan, and Australia, have significant market share. China, one of the fastest-growing aviation markets globally, is projected to witness over 8,000 new aircraft deliveries in the next two decades. These provide opportunities with an estimated value of USD 1.6 trillion for aftermarket services. China is both a leading consumer and producer of various forging types. China accounted for 16 % of the global revenue share and is anticipated to progress at a Compound Annual Growth Rate (CAGR) of 4.7% over the forecast period.

COVID-19 Impact Analysis on the Global Aerospace Forging Market:

The COVID-19 pandemic had a significant impact on the Aerospace Forging Market. There were lockdowns and travel restrictions. There were global supply chain disruptions. This affected the aerospace forging industry and the timely availability of materials, leading to production delays. The aviation industry experienced a sharp decline in demand for air travel during the pandemic. This led to a decrease in the demand for forged components. The financial challenges faced by airlines during the pandemic resulted in reduced maintenance and aircraft orders. This, in turn, impacted the aftermarket demand for aerospace forgings. The pandemic accelerated the adoption of vaccination efforts. As air travel gradually resumes, the demand for new aircraft and aftermarket services, including aerospace forgings, improved.

Latest Trends/ Developments:

In February 2023, Bharat Forge Limited, an Indian forging company, inked an agreement with Paramount Group Inc., a US aerospace and technology firm. This involves collaboration in the development and manufacturing of composite rotor blades, mission systems, and store management systems for medium lift helicopters. The partnership aims to establish an Indian "Centre of Excellence" dedicated to the design, development, and production of these components, supporting future initiatives both in India and globally.

In January 2023, General Atomics Aeronautical Systems Inc., a US-based provider of advanced technology solutions, joined forces with Bharat Forge Limited for the production of main landing gear components, subassemblies, and assemblies for remotely piloted aircraft. This collaboration enhance the capabilities of both entities and contribute to the growth of the Indian unmanned aircraft industry.

In December 2022, Forged Solutions Group, a US-based provider of forging solutions, completed the acquisition of Continental Forge for an undisclosed amount. This strategic move aims to integrate Continental Forge's operational expertise into Forged Solutions Group, expanding its footprint in the aerospace, defense, military, automotive, and other sectors.

In April 2023, SMS group, a German-based aerospace forging company, introduced the SMX 900 / 18 MN, a state-of-the-art hydraulic radial forging machine. With a press force of 18 MN for each of its four press cylinders, this machine is engineered to forge advanced materials for the aerospace industry. The revolutionary SMX forging process not only enhances material properties but also facilitates cost-effective production, ushering in a new era of efficiency in aerospace forging.

Key Players:

-

Precision Castparts Corp. (PCC)

-

Arconic Inc.

-

Bharat Forge Limited

-

VSMPO-AVISMA Corporation

-

Allegheny Technologies Incorporated (ATI)

-

Thyssenkrupp Aerospace

-

Aubert & Duval

-

OTTO FUCHS KG

-

ATI Ladish LLC (a part of Allegheny Technologies)

-

ATI Forged Products (a part of Allegheny Technologies)

Chapter 1. Aerospace Forging Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aerospace Forging Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aerospace Forging Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aerospace Forging Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aerospace Forging Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aerospace Forging Market – By Aerospace Component Type

6.1 Introduction/Key Findings

6.2 Engine Components

6.3 Landing Gear

6.4 Structural Parts

6.5 Other Components

6.6 Y-O-Y Growth trend Analysis By Aerospace Component Type

6.7 Absolute $ Opportunity Analysis By Aerospace Component Type, 2024-2030

Chapter 7. Aerospace Forging Market – By Material Type

7.1 Introduction/Key Findings

7.2 Titanium Alloys

7.3 Aluminum Alloys

7.4 Nickel Alloys

7.5 Other Alloys

7.6 Y-O-Y Growth trend Analysis By Material Type

7.7 Absolute $ Opportunity Analysis By Material Type, 2024-2030

Chapter 8. Aerospace Forging Market – By End-Use Application

8.1 Introduction/Key Findings

8.2 Commercial Aviation

8.3 Military & Defense

8.4 Space Exploration

8.5 Y-O-Y Growth trend Analysis By End-Use Application

8.6 Absolute $ Opportunity Analysis By End-Use Application, 2024-2030

Chapter 9. Aerospace Forging Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Aerospace Component Type

9.1.3 By Material Type

9.1.4 By By End-Use Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Aerospace Component Type

9.2.3 By Material Type

9.2.4 By End-Use Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Aerospace Component Type

9.3.3 By Material Type

9.3.4 By End-Use Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Aerospace Component Type

9.4.3 By Material Type

9.4.4 By End-Use Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Aerospace Component Type

9.5.3 By Material Type

9.5.4 By End-Use Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Aerospace Forging Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Precision Castparts Corp. (PCC)

10.2 Arconic Inc.

10.3 Bharat Forge Limited

10.4 VSMPO-AVISMA Corporation

10.5 Allegheny Technologies Incorporated (ATI)

10.6 Thyssenkrupp Aerospace

10.7 Aubert & Duval

10.8 OTTO FUCHS KG

10.9 ATI Ladish LLC (a part of Allegheny Technologies)

10.10 ATI Forged Products (a part of Allegheny Technologies)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Aerospace Forging Market was valued at USD 33.42 billion and is projected to reach a market size of USD 45.48 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.5%.

Rising growth of the aerospace industry and technological advancements are the market drivers of the Global Aerospace Forging Market.

Titanium Alloys, Aluminum Alloys, Nickel Alloys, and Other Alloys are the segments under the Global Aerospace Forging Market by Material Type.

North America is the most dominant region for the Global Aerospace Forging Market.

Precision Castparts Corp. (PCC), Arconic Inc., Bharat Forge Limited, VSMPO-AVISMA Corporation, Allegheny Technologies Incorporated (ATI), Thyssenkrupp Aerospace, Aubert & Duval, and OTTO FUCHS KG are the key players in the Global Aerospace Forging Market.