Aerospace Electrical Inserts Market Size (2024 – 2030)

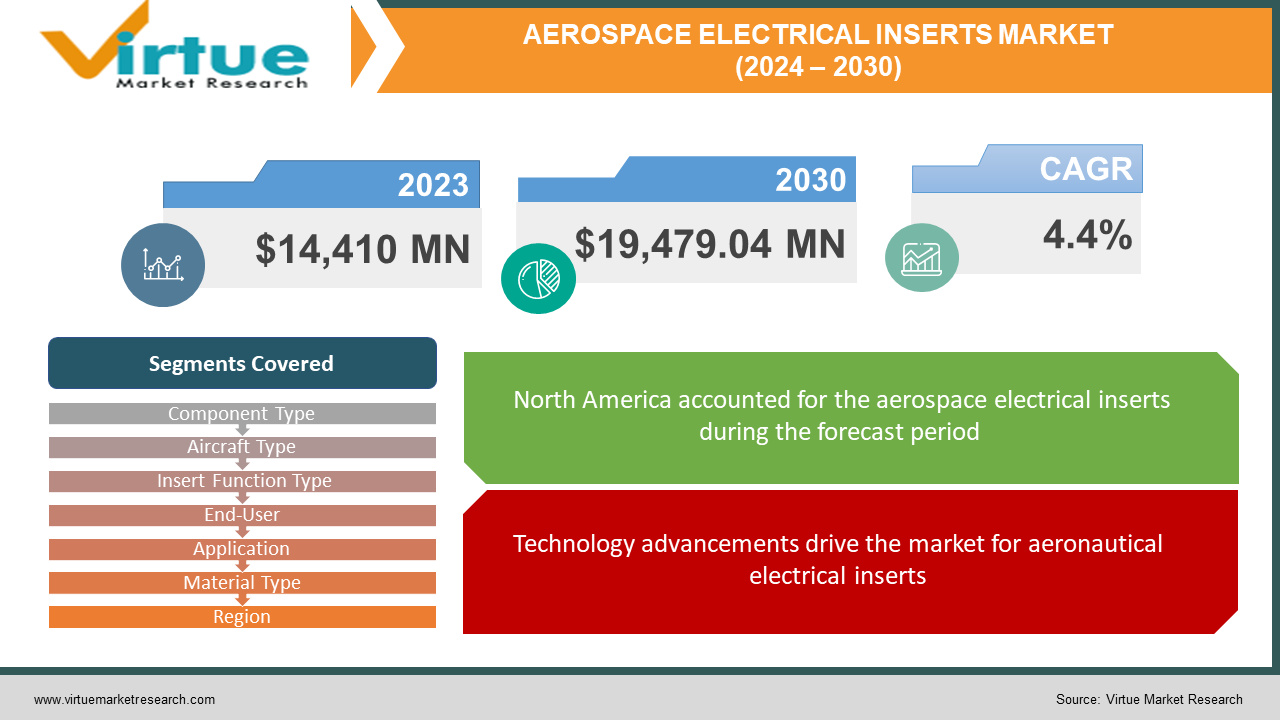

The Global Aerospace Electrical Inserts Market was valued at USD 14,410 million and is projected to reach a market size of USD 19,479.04 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.4%.

A segment of the aerospace industry dedicated to the development and integration of electrical components essential to aircraft operations is known as the Aerospace Electrical Inserts Market. This includes a variety of components that are essential to maintaining the efficiency, safety, and dependability of aircraft, such as wiring, connectors, and avionics. Ongoing technical improvements have an impact on market dynamics, with a focus on lightweight and efficient solutions. Safety and dependability are still of the utmost importance, motivating advancements in electrical systems to comply with strict industry standards. The industry is expanding because of aircraft manufacturers' ongoing efforts to reduce fuel consumption as well as its incorporation of cutting-edge avionics and communication systems.

Key Market Insights:

The industry's principal driver continues to be the rising demand for aeroplanes brought on by the growth of air travel. The market is evolving because of technological developments in electronics and avionics, with an emphasis on lighter and more efficient components. The industry is also adapting to the need for improved electrical systems because of environmental concerns and the requirement for fuel efficiency. The aerospace industry is highly susceptible to changes in defence budgets and geopolitical conditions, indicating the substantial influence of the defence sector. The dynamics of global supply chains, legal constraints, and the effects of mergers and acquisitions all add to the complexity of the situation. Investments in research and development are vital in determining the future of the business and in promoting innovation in aerospace electrical components.

Aerospace Electrical Inserts Market Drivers:

Technology advancements drive the market for aeronautical electrical inserts.

The market for aerospace electrical inserts is mostly driven by ongoing developments in aerospace technologies. New and improved electrical inserts that are lighter, more complex, and more efficient are the result of ongoing research and invention. Improvements in connection, miniaturisation, and materials science all lead to increased aircraft performance and capabilities. Modern electrical inserts are becoming more and more in demand as the industry adopts new technologies, guaranteeing that aviation systems will always be at the forefront of technical advancement.

Aerospace Electrical Inserts Surge Amid Growing Aviation.

The Aerospace Electrical Inserts Market is being driven primarily by the necessity for airlines worldwide to expand their fleets, which is a result of the growing demand for air travel. Advanced electrical inserts have a steady and expanding demand thanks to the increase in aircraft production. Aviation manufacturers need state-of-the-art electrical systems to fulfil the ever-evolving standards of safety, efficiency, and dependability. This demand is driven by both technology improvements and market demand. The demands of military aviation and other specialised applications are met in addition to the commercial aviation industry by this enhanced production.

Aerospace Electrical Inserts Are Essential for Progress in Green Aviation.

One of the main factors impacting the need for advanced electrical inserts is the aerospace industry's persistent focus on fuel efficiency. The importance of novel electrical components increases as manufacturers and airlines look for ways to improve fuel efficiency and lessen their impact on the environment. Improved energy efficiency and weight reduction in aeroplanes are made possible by advanced materials, energy-efficient systems, and smart technology. To meet this demand, the aerospace electrical inserts market offers solutions that support the industry's sustainability objectives, which eventually affects how well modern aeroplanes operate.

Aerospace Electrical Inserts Market Restraints and Challenges

Numerous obstacles affect the Aerospace Electrical Inserts Market's ability to function within the aerospace sector. The aerospace sector is subject to cyclical issues, as changes in the economy have an impact on investments in new aircraft and maintenance of existing aircraft. To fulfil safety standards, large investments in research, development, and testing are required for strict regulatory compliance. Market volatility is influenced by high production costs, geopolitical conflicts, and uncertainty in the world economy. Quick technical progress.

Aerospace Electrical Inserts Market Opportunities:

The market for aerospace electrical inserts is characterised by a few encouraging opportunities brought about by developments in technology and industry trends. The popularity of electric and hybrid aircraft creates opportunities for speciality electrical inserts that meet cutting-edge needs for power and control. Unmanned Aerial Vehicles (UAVs) are becoming increasingly popular, which gives manufacturers a chance to extend their product lines and cater to the unique requirements of unmanned systems. Electrical inserts that enable data connectivity and communication are made possible by the integration of Internet of Things (IoT) technology in aircraft. Developments in materials science and manufacturing techniques present an opportunity to create robust, lightweight inserts that support the industry's efforts to reduce weight. The growing emphasis on aviation cybersecurity offers manufacturers a chance to create safe electrical inserts.

AEROSPACE ELECTRICAL INSERTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.4% |

|

Segments Covered |

By Component Type, Aircraft Type, Insert Function Type, End-User, Application, Material Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Aerolux Ltd, AIM Altitude (AVIC International, Bucher Leichtbau AG, Diehl Stiftung & Co. KG, DYNAMO Aviation, Korita Aviation (Suzhou) Co. Ltd., Loipart AB,. JAMCO Corporation, Rockwell Collins, Inc., Zodiac Aerosystems |

Aerospace Electrical Inserts Market Segmentation - By Component Type

-

Connectors

-

Wire systems

-

Avionics

To provide the safe and reliable passage of energy and electrical signals between various aircraft systems and components, aerospace electrical connectors are essential. The complex electrical network of an aeroplane operates flawlessly. The development and integration of electrical wire and cable assemblies, which serve as the foundation of the aircraft's electrical infrastructure, become crucial in this context. To fulfil the strict criteria of aviation regulations, these assemblies are carefully planned and implemented, guaranteeing both safety and dependability throughout the flight. Moreover, an aircraft's avionics comprise a complex range of electronic systems, including instrumentation and communication devices essential for monitoring, communication, and navigation. The way that avionics and aircraft electrical connectors work together is a prime example of how complex and intertwined the technology developments are that support modern flight.

Aerospace Electrical Inserts Market Segmentation - By Aircraft Type

-

Commercial Aviation

-

Military Aviation

-

General Aviation

This extensive category of aerospace electrical components serves a variety of aviation applications, from general aviation to military and big passenger aircraft. Designed to satisfy the unique needs of big passenger aircraft and the electrical requirements of commercial airlines, the parts guarantee the effectiveness and security of air travel on a wide scale. Simultaneously, a significant emphasis is placed on defence applications and military aircraft. Specialised electrical inserts are designed to meet the demanding requirements of military standards, improving operating capabilities. Concurrently, this part broadens its scope to encompass the electrical requirements of general aviation applications, encompassing private jets and smaller aircraft. The focus here is on designing components that balance efficiency, weight, and size subtly.

Aerospace Electrical Inserts Market Segmentation - By Insert Function Type

-

Power Distribution

-

Communication system

-

Control Systems

The power distribution system, which generates and carefully controls electrical power, is essential to the smooth operation of an aircraft's electrical network. A network of interconnected parts makes it easier for this electricity to be distributed throughout the aircraft, guaranteeing a steady and effective supply to different systems. Amidst this complex network of aviation technology, particular focus is placed on electrical inserts that are essential for avionics and communication devices, facilitating efficient communication and navigation. These inserts are essential to the overall navigation, communication, and monitoring capabilities of the aircraft because they support the complex electronic systems that makeup avionics. Taken together, the parts in this category are essential to the electrical systems that regulate and improve monitoring, control, and navigational operations.

Aerospace Electrical Inserts Market Segmentation - By End-User

-

OEMs (Original Equipment Manufacturers)

-

Aftermarket

In this category, parts are painstakingly made to conform to certain Original Equipment Manufacturer (OEM) requirements, intended for smooth integration during the first stages of construction of new aircraft. The emphasis goes beyond the domain of new aircraft production to include the wider range of replacement, modernization, and maintenance requirements for already-built aircraft. This market sector offers specialised electrical inserts designed for component replacement, enhancement, or retrofitting to meet the changing needs of aircraft that are already in operation after production. This category guarantees a thorough and flexible approach to satisfying the changing electrical needs of various aviation scenarios by addressing the full lifecycle of an aircraft, from its conception to continuous maintenance.

Aerospace Electrical Inserts Market Segmentation - By Application

-

Power Systems

-

Lighting Systems

-

Entertainment Systems

This section, which is devoted to the foundational elements of aviation electrical systems, concentrates on parts that are necessary for the generation, management, and distribution of electrical power inside the aircraft. In addition to addressing the critical function of lighting, this part goes so far as to include electrical inserts designed for a variety of lighting uses in aeroplanes. This involves giving careful thought to the lighting needs both inside and outside to achieve the best possible atmosphere and visibility. Furthermore, the section explores how to improve the passenger experience by going over parts that are essential to in-flight entertainment and communication systems. These specialised components highlight the value of an all-encompassing approach to aircraft electrical technology by assisting in the smooth operation of systems that enhance the travel experience for passengers.

Aerospace Electrical Inserts Market Segmentation - By Material Type

-

Conductive Materials

-

Insulating Materials

The materials used to carefully create the components in this sector are known for their excellent electrical conductivity, which guarantees a dependable and efficient transfer of electrical impulses. The selection of materials that promote excellent electrical conductivity and enhance the overall reliability of the gearbox systems is prioritised. On the other hand, the part also covers the important topic of insulation, using materials that are specifically made to block electrical current. These materials ensure the overall safety of the system while also reducing undesirable conductivity. The dedication to designing components that prioritise the safety and dependability of the electrical systems they are a part of in addition to maximizing electrical performance is highlighted by the careful consideration given to both conductivity and insulation.

Aerospace Electrical Inserts Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The aerospace electrical insert market is anticipated to grow at the fastest rate in North America. Major aerospace firms, technology developments, and a strong aerospace industry ecosystem are responsible for the region's prominence. A major factor in the market's expansion has been the United States, namely, which has made consistent investments in aerospace R&D and innovation. Regional differences can be seen in the aerospace electrical inserts market, with environmental objectives and technology improvements driving growth in North America and Europe. Demand is fuelled by the growing air travel industry in Asia-Pacific, and partnership prospects are presented by the economic expansion of Latin America. With their expanding aerospace industries, the Middle East and Africa present opportunities for customised solutions and infrastructure involvement. To effectively take advantage of a variety of opportunities across the global aerospace electrical inserts market, manufacturers must negotiate these regional dynamics.

COVID-19 Impact Analysis on the Global Aerospace Electrical Inserts Market:

The pandemic of COVID-19 caused significant disruptions to the aerospace industry, including the global aerospace electrical inserts market. Manufacturing plant closures and other logistical issues caused supply chain disruptions that impacted the availability and production of aircraft electrical components. Reduced air travel caused a huge slowdown in the aviation industry, which was a key user of these components and consequently resulted in a decline in the demand for new aircraft and maintenance. Due to labour shortages and budgetary constraints, aircraft manufacturers had to deal with delays and cancellations in aircraft production. Due to their extreme financial difficulties, airlines slashed costs, which influenced the aftermarket for aerospace electrical inserts. The demand for electrical inserts was further impacted by the industry's decision to postpone non-essential projects and concentrate on survival tactics because of the epidemic. Government support and stimulus packages provided some relief to aerospace companies, but the overall market dynamics were undoubtedly shaped by the complex interplay of these factors. For the most accurate and recent insights, consulting up-to-date industry reports and market analyses is recommended.

Key Players:

-

Aerolux Ltd

-

AIM Altitude (AVIC International

-

Bucher Leichtbau AG

-

Diehl Stiftung & Co. KG

-

DYNAMO Aviation

-

Korita Aviation (Suzhou) Co. Ltd.

-

Loipart AB

-

JAMCO Corporation

-

Rockwell Collins, Inc.

-

Zodiac Aerosystems

Latest trends and developments:

The creation of electrical inserts that can withstand high temperatures is the most recent industrial development to hit the market. These inserts, which were just launched, are made to resist the extremely high temperatures that are frequently encountered during aircraft operations and high-altitude flights. By meeting the aviation industry's increasing demand for more durable and resilient components, the innovation improves the electrical systems' dependability and safety in aeroplanes. The development of electrical inserts that can withstand high temperatures is a major step forward in guaranteeing the robustness and efficiency of electrical systems in demanding aircraft settings.

Chapter 1. Aerospace Electrical Inserts Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aerospace Electrical Inserts Market – Executive Summary

2.1 Market Size & Forecast – (2024– 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aerospace Electrical Inserts Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aerospace Electrical Inserts Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aerospace Electrical Inserts Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aerospace Electrical Inserts Market – By Component

6.1 Introduction/Key Findings

6.2 Connectors

6.3 Wire systems

6.4 Avionics

6.5 Services (Maintenance, Support, and Consulting)

6.6 Y-O-Y Growth trend Analysis By Component

6.7 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Aerospace Electrical Inserts Market – By Aircraft Type

7.1 Introduction/Key Findings

7.2 Commercial Aviation

7.3 Military Aviation

7.4 General Aviation

7.5 Y-O-Y Growth trend Analysis By Aircraft Type

7.6 Absolute $ Opportunity Analysis By Aircraft Type, 2024-2030

Chapter 8. Aerospace Electrical Inserts Market – By Insert Function Type

8.1 Introduction/Key Findings

8.2 Power Distribution

8.3 Communication system

8.4 Control Systems

8.5 Y-O-Y Growth trend Analysis End-Use Industry

8.6 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Aerospace Electrical Inserts Market – By End-User

9.1 Introduction/Key Findings

9.2 OEMs (Original Equipment Manufacturers)

9.3 Aftermarket

9.4 Y-O-Y Growth trend Analysis End-User

9.5 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Aerospace Electrical Inserts Market – By Application

10.1 Introduction/Key Findings

10.2 Power Systems

10.3 Lighting Systems

10.4 Entertainment Systems

10.5 Y-O-Y Growth trend Analysis Construction

10.6 Absolute $ Opportunity Analysis Construction, 2024-2030

Chapter 11. Aerospace Electrical Inserts Market – By Material Type

11.1 Introduction/Key Findings

11.2 Conductive Materials

11.3 Insulating Materials

11.4 Y-O-Y Growth trend Analysis Site

11.5 Absolute $ Opportunity Analysis Site, 2024-2030

Chapter 12. Aerospace Electrical Inserts Market, By Geography – Market Size, Forecast, Trends & Insights

12.1 North America

12.1.1. By Country

12.1.1.1 U.S.A.

12.1.1.2 Canada

12.1.1.3 Mexico

12.1.2 By Component

12.1.2.1 By Aircraft Type

12.1.3 By Insert Function Type

12.1.4 By Application

12.1.5 Countries & Segments - Market Attractiveness Analysis

12.1 Europe

12.2.1 By Country

12.2.1.1 U.K

12.2.1.2 Germany

12.2.1.3 France

12.2.1.4 Italy

12.2.1.5 Spain

12.2.1.6 Rest of Europe

12.2.2 By Component

12.2.3 By Aircraft Type

12.2.4 By Insert Function Type

12.2.5 By End-User

12.2.6 By Application

12.2.7 By Material Type

12.2.8 Countries & Segments - Market Attractiveness Analysis

12.3 Asia Pacific

12.3.1 By Country

12.3.1.1 China

12.3.1.2 Japan

12.3.1.3 South Korea

12.3.1.4 India

12.3.1.5 Australia & New Zealand

12.3.1.6 Rest of Asia-Pacific

12.3.2 By Component

12.3.3 By Aircraft Type

12.3.4 By Insert Function Type

12.3.5 By End-User

12.3.6 By Application

12.3.7 By Material Type

12.3.8 By Integration Level

12.3.9 By Power Generation Source

12.3.10 By End-User Industry

12.3.11 Countries & Segments - Market Attractiveness Analysis

12.4 South America

12.4.1 By Country

12.4.1.1 Brazil

12.4.1.2 Argentina

12.4.1.3 Colombia

12.4.1.4 Chile

12.4.1.5 Rest of South America

12.4.2 By Component

12.4.3 By Aircraft Type

12.4.4 By Insert Function Type

12.4.5 By End-User

12.4.6 By Application

12.4.7 By Material Type

12.4.8 By Integration Level

12.4.9 By Power Generation Source

12.4.10 By End-User Industry

12.4.11 Countries & Segments - Market Attractiveness Analysis

12.5 Middle East & Africa

12.5.1 By Country

12.5.1.1 United Arab Emirates (UAE)

12.5.1.2 Saudi Arabia

12.5.1.3 Qatar

12.5.1.4 Israel

12.5.1.5 South Africa

12.5.1.6 Nigeria

12.5.1.7 Kenya

12.5.1.8 Egypt

12.5.1.9 Rest of MEA

12.5.2 By Component

12.5.3 By Aircraft Type

12.5.4 By Insert Function Type

12.5.5 By End-User

12.5.6 By Application

12.5.7 By Material Type

12.5.8 By Integration Level

12.5.9 By Power Generation Source

12.5.10 By End-User Industry

12.5.11 Countries & Segments - Market Attractiveness Analysis

Chapter 13. Aerospace Electrical Inserts Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

13.1 Aerolux Ltd

13.2 AIM Altitude (AVIC International

13.3 Bucher Leichtbau AG

13.4 Diehl Stiftung & Co. KG

13.5 DYNAMO Aviation

13.6 Korita Aviation (Suzhou) Co. Ltd.

13.7 Loipart AB

13.8 JAMCO Corporation

13.9 Rockwell Collins, Inc.

13.10 Zodiac Aerosystems

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Aerospace Electrical Inserts Market was valued at USD 14,410 million and is projected to reach a market size of USD 19,479.04 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.4%.

Technological Advancements, Increased Aircraft Production, Focus on Fuel Efficiency, Integration of Avionics, Demand for In-Flight Entertainment and Connectivity, Growing Military Modernization Programs, Focus on Safety and Reliability, Emergence of Electric Aircraft, Rising Demand for Unmanned Aerial Vehicles (UAVs), Global Air Traffic Growth are the market drivers of the Global Aerospace Electrical Inserts Market.

Global Aerospace Electrical Inserts Market Segmentation By Type of component (connectors, wire system, Avionics), By End-User (OEMs, Aftermarket); By Aircraft Type (commercial aviation, military aviation, general aviation); By Insert Function Type (Power Distribution, Communication system, •Control Systems), By Application (Power Systems, Lighting Systems, Entertainment Systems), By Material Type (Conductive Materials, Insulating Materials) and by region.

North America is the most dominant region for the Global Aerospace Electrical Inserts Market.

Aerolux Ltd, AIM Altitude (AVIC International, Bucher Leichtbau AG, Diehl Stiftung & Co. KG, DYNAMO Aviation, Korita Aviation (Suzhou) Co. Ltd., Loipart AB, JAMCO Corporation, Rockwell Collins, Inc., Zodiac Aerosystems are the key players in the Global Aerospace Electrical Inserts Market.