Aerospace & Defense Chemical Distribution Market Size (2024 – 2030)

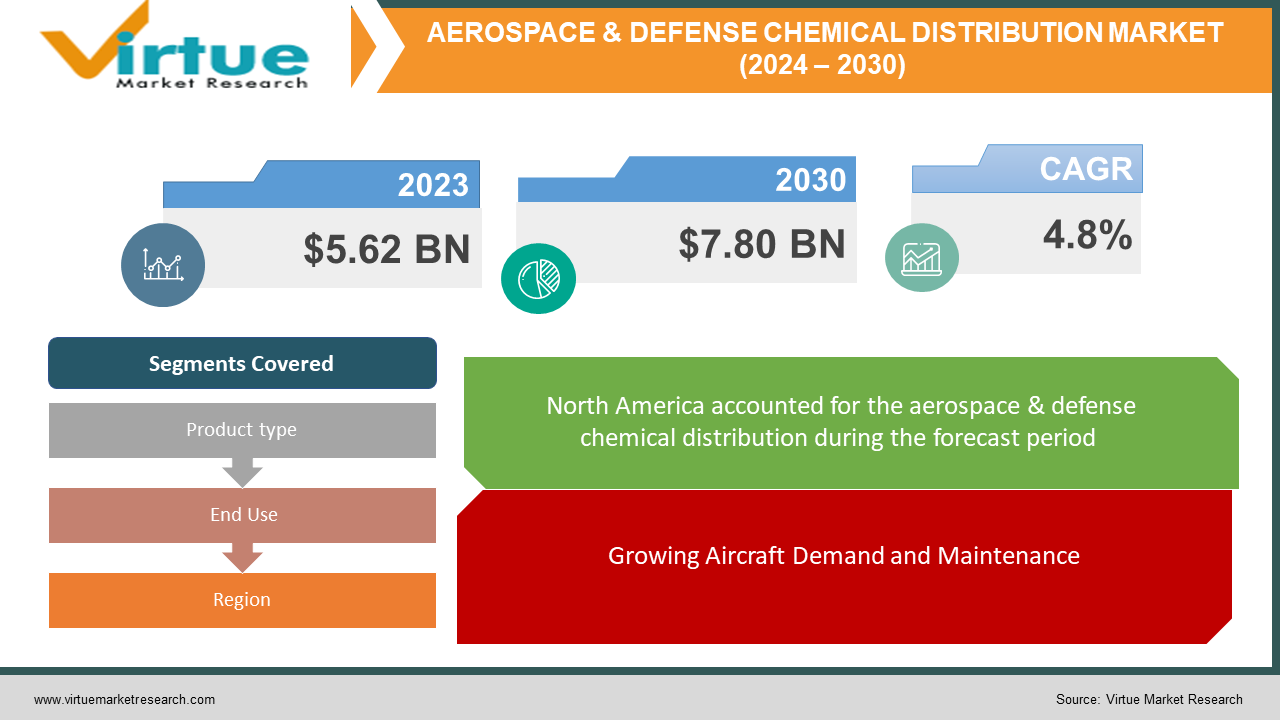

The Global Aerospace & Defense Chemical Distribution Market was valued at USD 5.62 billion in 2023 and is projected to reach a market size of USD 7.80 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 4.8%.

Key Market Insights:

The global growth is driven by factors like increasing demand for air travel, rising global aircraft fleets, and expanding defense sectors in various regions.

The commercial segment is projected to hold the largest market share exceeding 70% due to the surging air travel demand, particularly in the Asia Pacific region. Within the product categories, adhesives & sealants, lubricants & greases, and paints & coatings are anticipated to be the leading segments due to their crucial role in aircraft manufacturing and maintenance.

Stringent regulatory compliance for aerospace-approved chemicals is a crucial factor influencing the market. Additionally, demand for on-demand access to these chemicals and increased focus on cost-effective solutions are shaping the competitive landscape, with players offering customized packaging and alternative materials like FAA-approved sealants.

Market Drivers:

Growing Aircraft Demand and Maintenance

Increasing air travel, particularly in the Asia Pacific region, is driving the need for more aircraft, leading to a higher demand for chemicals used in their manufacturing and maintenance. Stricter regulations for aircraft safety and performance further necessitate the use of specialized chemicals for corrosion protection, cleaning, and lubrication.

Rising Defense Spending

Growing global concerns about security and geopolitical tensions are leading to increased government investments in defense sectors across various regions. This translates to a higher demand for defense aircraft and military vehicles, which require specialized chemicals for their construction, maintenance, and operation.

Shifting Regulatory Landscape

Stringent environmental regulations are pushing the development and adoption of sustainable and eco-friendly chemicals in the aerospace and defense industry. This creates a demand for chemical distributors to adapt their offerings and cater to the evolving regulatory environment. Additionally, stricter regulations on the safety and handling of these chemicals also influence distribution strategies.

Market Restraints and Challenges:

Stringent Regulatory Compliance

The aerospace and defense industries operate under strict regulations concerning the chemicals used in their operations. These regulations ensure the safety, performance, and environmental impact of the chemicals, but also pose challenges for distributors. Meeting the complex compliance requirements associated with these chemicals can be costly and time-consuming for distributors, requiring investments in specialized knowledge, staff training, and certifications.

Fluctuations in Demand and Supply

The aerospace and defense industries are cyclical in nature, experiencing periods of boom and bust depending on various factors like economic conditions, government funding, and geopolitical situations. This can lead to uncertainties in demand for chemicals, making it difficult for distributors to maintain consistent inventory levels and optimize their pricing strategies.

Competition and Price Pressures

The aerospace and defense chemical distribution market is becoming increasingly competitive, with both established players and new entrants vying for market share. This puts pressure on profit margins for distributors as they struggle to balance offering competitive prices with maintaining quality products and services. Additionally, the high cost of maintaining regulatory compliance further adds to the pressure.

Market Opportunities:

Emerging Markets

The Asia Pacific region, particularly countries like China and India, is experiencing rapid growth in its aerospace and defense sectors. This presents a significant opportunity for distributors to expand their reach and cater to the growing demand for chemicals in these regions. Localized distribution networks and partnerships with local players can be crucial for success in these emerging markets.

E-commerce and Digitalization

The adoption of e-commerce platforms for ordering and managing chemical supplies is gaining traction in the aerospace and defense industry. This trend offers opportunities for distributors to improve efficiency, enhance customer experience, and reach a wider audience. Investing in user-friendly online platforms and robust logistics networks can be key to capitalizing on this opportunity.

Sustainable and Eco-friendly Solutions

As mentioned earlier, environmental regulations are driving the demand for sustainable and eco-friendly chemicals in the aerospace and defense industry. This opens a window for distributors to specialize in offering these green alternatives and cater to the evolving needs of manufacturers and maintainers. Building partnerships with chemical manufacturers focused on sustainable solutions and educating customers about the benefits of these products can be valuable strategies in this space.

AEROSPACE & DEFENSE CHEMICAL DISTRIBUTION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.8% |

|

Segments Covered |

By Product type, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Airbus, Boeing, ChemPoint, Hisco, Krayden Univar Solutions, SAFIC-ALCAN, Vantage Specialty Chemicals, W.W. Grainger, Inc., Wilhelmsen Chemicals |

Aerospace & Defense Chemical Distribution Market Segmentation: By Product Type

-

Adhesives & Sealants

-

Coatings

-

Lubricants & Greases

-

Solvents

-

Others

Adhesives & Sealants: Play a vital role in aircraft manufacturing and maintenance, ensuring structural integrity and preventing leaks. This segment is expected to maintain steady growth due to the increasing demand for lightweight and composite materials in aircraft construction.

Coatings: Crucial for corrosion protection, fire resistance, and aesthetics of aerospace and defense vehicles. This segment is expected to benefit from the growing demand for environmentally friendly coatings that comply with stricter regulations.

Lubricants & Greases: Essential for reducing friction and wear in various aircraft and defense vehicle components. This segment is driven by the need for high-performance lubricants that can withstand extreme temperatures and operating conditions.

Solvents: Used for cleaning, degreasing, and surface preparation in various aerospace and defense applications. This segment is expected to witness moderate growth, with a potential shift towards more sustainable and biodegradable solvent options due to environmental concerns.

Others: This segment encompasses a variety of other chemicals used in the aerospace and defense industry, such as acids, bases, and specialty chemicals. The growth of this segment will depend on specific developments and emerging trends within the industry.

Aerospace & Defense Chemical Distribution Market Segmentation: By End Use

-

Road Commercial

-

Military

-

General Aviation

Commercial: This is the leading segment, primarily encompassing airlines and commercial aircraft manufacturers, currently holds the largest market share and is projected to maintain its dominant position throughout the forecast period. The growth is driven by the increasing demand for air travel, particularly in the Asia Pacific region, which is experiencing rapid economic development and rising disposable incomes.

Military: This segment encompasses defense agencies and military aircraft manufacturers. While it currently holds a smaller market share compared to commercial, it is expected to witness significant growth due to rising global defense spending and increased demand for advanced military equipment.

General Aviation: This segment includes private jets, helicopters, and other non-commercial aircraft. It represents a niche market but can offer growth potential in specific regions with growing private aviation sectors.

Aerospace & Defense Chemical Distribution Market Segmentation: By Region

-

Asia-Pacific

-

North America

-

Europe

-

South America

-

Middle East and Africa

North America: Currently holds the largest market share due to the presence of major aircraft manufacturers and distributors like Boeing and Lockheed Martin, coupled with significant military spending. This region is expected to maintain its leading position shortly, albeit with a slower growth rate compared to other regions.

Asia Pacific: This region is witnessing rapid growth fuelled by the burgeoning economies of countries like China and India, leading to increased demand for air travel and defense equipment. This trend is projected to continue, making Asia Pacific one of the fastest-growing segments in the global market.

Europe: This established market is expected to witness stable growth due to the presence of major aerospace and defense companies like Airbus and BAE Systems. However, stricter environmental regulations may pose challenges for some distributors in this region.

South America and Middle East & Africa: These regions represent smaller market segments but offer potential for future growth due to developing economies and increasing investments in their aerospace and defense sectors. However, political and economic uncertainties can impact growth in these regions.

COVID-19 Impact Analysis on the Global Aerospace & Defense Chemical Distribution Market:

The COVID-19 pandemic significantly impacted the Aerospace & Defense Chemical Distribution Market, creating a mixed picture across segments. The commercial aviation sector, a major driver of the market, witnessed a steep decline in passenger traffic. This led to a reduced demand for new aircraft and spare parts, consequently impacting the demand for chemicals used in manufacturing and maintenance. Additionally, travel restrictions and lockdowns disrupted supply chains, causing temporary shortages and price fluctuations for certain chemicals.

However, the defense segment of the market showed more resilience. While production processes might have slowed down due to similar disruptions, the core demand for military equipment and related chemicals remained relatively stable. Government defense budgets are typically allocated well in advance, and critical projects continued despite the pandemic. This provided some stability to the defense-related segment of the market.

Overall, the COVID-19 pandemic hurt the overall growth trajectory of the Aerospace & Defense Chemical Distribution Market in the short term. However, the long-term outlook remains positive, with a projected recovery in the commercial aviation sector and continued growth in defense spending. As the industry navigates the post-pandemic landscape, there's an increased focus on on-demand chemical access and cost-effective solutions for distributors.

Latest Trends/Developments:

Focus on Sustainable and Eco-friendly Solutions

Stringent environmental regulations and growing concerns about sustainability are driving the demand for eco-friendly and biodegradable chemicals in the aerospace and defense industry. This trend is prompting distributors to expand their offerings to include green alternatives like bio-based lubricants and water-based cleaning solutions.

E-commerce and Digitalization

The adoption of e-commerce platforms for ordering and managing chemical supplies is gaining traction in the aerospace and defense sector. This trend allows distributors to offer improved efficiency, enhanced customer experience, and access to a wider audience. Investing in user-friendly online platforms and robust logistics networks is crucial for capitalizing on this opportunity.

3D Printing and Additive Manufacturing

The growing adoption of 3D printing and additive manufacturing technologies in the aerospace and defense industry creates a demand for specialized chemicals used in these processes. These chemicals need to possess unique properties like high-temperature resistance and compatibility with various printing materials. Distributors who can stay updated on these advancements and source the appropriate chemicals are well-positioned to cater to this emerging trend.

Key Players:

-

Airbus

-

Boeing

-

ChemPoint

-

Hisco

-

Krayden

-

Univar Solutions

-

SAFIC-ALCAN

-

Vantage Specialty Chemicals

-

W.W. Grainger, Inc.

-

Wilhelmsen Chemicals

GracoRoberts acquires U.K.-based Silmid to become the most technically-focused aerospace specialty chemicals distributor: This acquisition, announced in February 2024, highlights the growing importance of technical expertise in the aerospace and defense chemical distribution market. It indicates a trend toward consolidation as companies strive to offer a wider range of specialized products and services.

Henkel launches a new flame-retardant solution for the aerospace industry: This news, announced in January 2024, demonstrates the ongoing development of innovative and advanced chemical solutions catering to specific needs within the aerospace sector. It highlights the importance of continuous innovation for market players to stay competitive.

Boeing and Airbus announced plans to invest in sustainable aviation fuels (SAF): This development, announced in December 2023, while not directly related to the distribution market, has significant implications. Increased adoption of SAF can lead to a shift in demand towards bio-based and sustainable chemicals used in their production and handling. This trend presents an opportunity for distributors who can adapt their offerings to cater to the evolving needs of the aerospace industry.

Chapter 1. Aerospace & Defense Chemical Distribution Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aerospace & Defense Chemical Distribution Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aerospace & Defense Chemical Distribution Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aerospace & Defense Chemical Distribution Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aerospace & Defense Chemical Distribution Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aerospace & Defense Chemical Distribution Market – By Product Type

6.1 Introduction/Key Findings

6.2 Adhesives & Sealants

6.3 Coatings

6.4 Lubricants & Greases

6.5 Solvents

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Aerospace & Defense Chemical Distribution Market – By End-Use Industry

7.1 Introduction/Key Findings

7.2 Road Commercial

7.3 Military

7.4 General Aviation

7.5 Y-O-Y Growth trend Analysis By End-Use Industry

7.6 Absolute $ Opportunity Analysis By End-Use Industry , 2024-2030

Chapter 8. Aerospace & Defense Chemical Distribution Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By End-Use Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By End-Use Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By End-Use Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By End-Use Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By End-Use Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Aerospace & Defense Chemical Distribution Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Airbus

9.2 Boeing

9.3 ChemPoint

9.4 Hisco

9.5 Krayden

9.6 Univar Solutions

9.7 SAFIC-ALCAN

9.8 Vantage Specialty Chemicals

9.9 W.W. Grainger, Inc.

9.10 Wilhelmsen Chemicals

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Aerospace & Defense Chemical Distribution Market was valued at USD 5.62 billion in 2023 and is projected to reach a market size of USD 7.80 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 4.8%.

Key drivers include the Growing Aircraft Demand and Maintenance, Rising Defense Spending, and Shifting Regulatory Landscape.

Commercial, Military and General Aviation are end users of the Global Aerospace & Defense Chemical Distribution Market.

North America dominates the market with a significant share of over 40%.

Airbus, Boeing, ChemPoint, Hisco, Krayden, Univar Solutions, SAFIC-ALCAN, Vantage Specialty Chemicals, W.W. Grainger, Inc., and Wilhelmsen Chemicals are some leading players in the Global Aerospace & Defense Chemical Distribution Market.