Aerospace Context Awareness Computing Market Size (2024-2030)

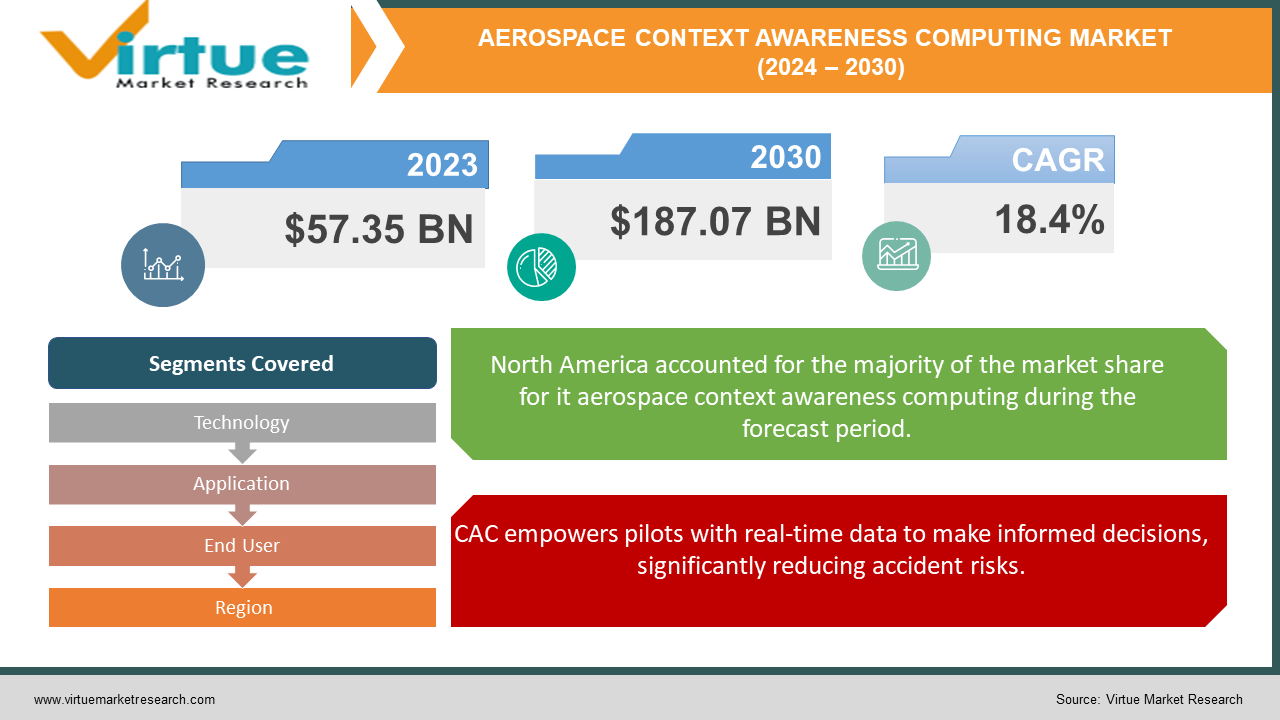

The Aerospace Context Awareness Computing Market was valued at USD 57.35 billion in 2023 and is projected to reach a market size of USD 187.07 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 18.4%.

The aerospace industry is embracing a transformative technology: context-aware computing (CAC). CAC empowers systems to gather and analyze surrounding data, adapting their behavior accordingly.

Key Market Insights:

The aerospace industry is on the verge of a data-driven revolution fueled by context-aware computing (CAC). CAC empowers onboard systems to act as intelligent companions, gathering and analyzing real-time data from their surroundings. This translates into significant safety and efficiency gains. Pilots will have real-time insights on weather, nearby aircraft, and potential hazards, leading to improved situational awareness and reduced risk of accidents.

Several factors are propelling this nascent market forward. The relentless pursuit of safety and efficiency in aerospace makes CAC highly attractive.

According to a report by Technavio, the aerospace AI market specifically is forecasted to increase by USD 4.7 billion between 2023 and 2028, growing at a CAGR of 43.6%.

CAC has the potential to significantly reduce accidents by providing real-time data and intelligent decision support to pilots. Furthermore, the ever-growing availability of sensor data from various sources provides the lifeblood for CAC applications.

The Aerospace Context Awareness Computing Market Drivers:

CAC empowers pilots with real-time data to make informed decisions, significantly reducing accident risks.

The aerospace industry operates with an unwavering commitment to safety, prioritizing the well-being of passengers and crew above all else. This commitment is reflected in the significant financial resources dedicated to safety measures and accident prevention. Context-aware computing (CAC) emerges as a game-changer in this relentless pursuit of safety.

CAC streamlines logistics and facilitates predictive maintenance, minimizing downtime and boosting profitability.

Efficiency is another cornerstone principle for airlines, as it directly impacts profitability and competitiveness. Here too, CAC offers a powerful set of tools for optimization. Real-time logistics tracking capabilities within CAC systems enable airlines to streamline operations, ensuring aircraft and cargo arrive at their destinations on time. Predictive maintenance, another key feature of CAC, plays a crucial role in optimizing efficiency by minimizing aircraft downtime.

CAC harnesses the ever-growing data from aircraft and surroundings to extract valuable insights for operational optimization.

The aerospace industry is witnessing an explosion of data generated by various sources. Sensor data from onboard systems, coupled with information about the surrounding environment, creates a vast and valuable treasure trove for CAC applications. Imagine the sheer volume of data – a single commercial flight can generate terabytes of information (source needed)! CAC systems are adept at harnessing this data deluge, extracting meaningful insights that can be used to optimize various aspects of aerospace operations.

AI and ML algorithms empower CAC systems to analyze complex data and generate intelligent insights for improved decision-making.

The true power of CAC is unleashed by the advancements in artificial intelligence (AI) and machine learning (ML) algorithms. These powerful tools enable CAC systems to analyze complex datasets containing flight data, sensor information, and environmental factors. By identifying patterns and trends within this data, AI and ML algorithms generate intelligent insights that inform decision-making within CAC systems. This allows for a more proactive and optimized approach to various aspects of aerospace operations, leading to enhanced safety, efficiency, and overall performance.

The Aerospace Context Awareness Computing Market Restraints and Challenges:

While context-aware computing (CAC) offers a revolutionary vision for the aerospace industry, there are hurdles to overcome before it takes flight. The high cost of development and implementation is a major concern. These sophisticated systems require cutting-edge hardware, complex software, and seamless integration with existing infrastructure. This can be a significant barrier for airlines, particularly smaller ones, who may be hesitant to invest heavily in this new technology.

Security is another paramount concern. The sensitivity of aerospace data, encompassing flight paths, aircraft health, and passenger information, necessitates robust security measures to shield it from cyberattacks and unauthorized access. Implementing and maintaining these safeguards add to the overall cost and complexity of CAC systems.

Finally, the lack of standardization can hinder interoperability. The absence of standardized protocols and interfaces for CAC systems can create compatibility issues, making it difficult for airlines to integrate systems from different vendors. Collaborative efforts between industry leaders, regulatory bodies, and research institutions are crucial to address these challenges. Investment in research and development, establishing industry standards, and developing cost-effective solutions will pave the way for the widespread adoption of CAC and unlock its transformative potential for the aerospace industry.

The Aerospace Context Awareness Computing Market Opportunities:

The future of aerospace is brimming with exciting possibilities thanks to context-aware computing (CAC). Imagine pilots with a complete picture of their surroundings, courtesy of real-time data analysis by CAC systems. This translates to a heightened awareness of weather conditions, nearby aircraft, potential hazards, and even runway situations. This enhanced situational awareness empowers pilots to make informed decisions, leading to safer and more efficient flights.

But the benefits extend far beyond the cockpit. CAC can revolutionize maintenance practices by continuously monitoring aircraft systems, enabling a shift from reactive to proactive maintenance. Predictive maintenance allows airlines to address issues before they escalate, minimizing downtime, extending the lifespan of crucial components, and ultimately reducing overall maintenance costs.

The passenger experience isn't left behind either. CAC has the potential to personalize travel by tailoring in-flight services and entertainment based on real-time data. Imagine receiving movie or music recommendations based on your preferences and flight duration, or even real-time updates on potential delays and alternative travel options.

AEROSPACE CONTEXT AWARENESS COMPUTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

18.4% |

|

Segments Covered |

By Technology, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Boeing, Airbus, IBM, Microsoft, Google, Flybits, Honeywell Astronics, EUROCONTROL, FAA |

Aerospace Context Awareness Computing Market Segmentation: By Technology

-

Hardware

-

Software

-

Services

By technology, software is expected to be the dominant segment in the aerospace context-aware computing market. Software applications are the brains of the operation, analyzing data, generating insights, and powering various functionalities. However, the fastest-growing segment is likely to be services. As CAC adoption increases, the demand for implementation, maintenance, and ongoing support services will surge, creating a lucrative space for companies specializing in these areas.

Aerospace Context Awareness Computing Market Segmentation: By Application

-

Pilot Decision Support

-

Predictive Maintenance

-

Logistics Optimization

-

Passenger Experience Personalization

Segmentation within the aerospace CAC market reveals two key areas: applications and end users. By application, predictive maintenance is likely the most dominant segment as airlines prioritize cost-saving measures and extending aircraft lifespans. However, logistics optimization is expected to be the fastest-growing segment. Real-time tracking for smoother operations and efficiency gains, particularly in a climate of rising fuel costs, makes this a highly attractive application for airlines.

Aerospace Context Awareness Computing Market Segmentation: By End User

-

Commercial Airlines

-

Business Aviation

-

Military Aviation

-

Air Traffic Control (ATC)

The commercial airline segment dominates the aerospace CAC market due to its relentless focus on safety, efficiency, and passenger experience. However, the fastest-growing segment is expected to be Asia-Pacific, driven by a surge in air travel demand and significant investments in infrastructure development across the region. This creates exciting opportunities for CAC players to cater to this rapidly expanding market.

Aerospace Context Awareness Computing Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America boasts a significant market share due to the presence of major aerospace manufacturers like Boeing and Airbus, as well as leading airlines like American Airlines and United Airlines. Early adoption of new technologies, coupled with a strong focus on safety and efficiency, positions North America as a key player in the CAC market.

Home to prominent aerospace giants like Airbus and Rolls-Royce, Europe prioritizes technological advancements and research & development. Stringent regulations and a focus on safety further contribute to the growth of the European CAC market. Additionally, initiatives like the Single European Sky aim to optimize air traffic management, creating opportunities for CAC solutions in this area.

Asia-Pacific is expected to be the fastest-growing market for aerospace CAC. With a booming aviation sector and significant investments in infrastructure development across countries like China and India, the demand for air travel is skyrocketing. This surge, coupled with a growing focus on modernization and efficiency within the industry, creates fertile ground for the adoption of CAC technologies.

COVID-19 Impact Analysis on the Aerospace Context Awareness Computing Market:

The global COVID-19 pandemic undeniably cast a long shadow over the aerospace industry, and the nascent market for context-aware computing (CAC) was not spared. The most immediate impact was felt through a dramatic decline in air travel, which directly stifled demand for new technologies like CAC. Airlines, struggling to stay afloat, were forced to tighten their belts, putting investments in new technologies on hold to focus on survival. Research and development efforts also slowed down as travel restrictions and social distancing measures hampered collaboration between industry players. Disruptions in global supply chains due to lockdowns and travel restrictions could have caused delays in obtaining critical hardware for CAC systems, further hindering implementation.

However, there were silver linings amidst the challenges. The pandemic sharpened the focus on operational efficiency within airlines. CAC, with its capabilities to optimize logistics and maintenance practices, emerged as an attractive cost-saving measure. Safety concerns were also at an all-time high, and CAC's ability to provide real-time data and support enhanced situational awareness, potentially contributing to a safer flying experience.

Latest Trends/ Developments:

The world of aerospace context-aware computing (CAC) is buzzing with innovation. A key trend is the tight integration of artificial intelligence (AI) and machine learning (ML) into CAC systems. Imagine AI predicting equipment failures before they happen, allowing for proactive maintenance and smoother operations. But with this growing reliance on data, robust cybersecurity measures are crucial. New trends involve advanced encryption techniques and intrusion detection systems to safeguard sensitive data from cyberattacks.

Another interesting development is the rise of open-source platforms for CAC. This fosters collaboration, speeds up innovation, and potentially lowers costs for airlines looking to adopt CAC technologies. However, the lack of standardized protocols can still cause compatibility issues. The industry is actively working on establishing common standards to ensure seamless integration between systems from different vendors, giving airlines more flexibility when choosing CAC solutions.

Key Players:

-

Boeing

-

Airbus

-

IBM

-

Microsoft

-

Google

-

Flybits

-

Honeywell

-

Astronics

-

EUROCONTROL

-

FAA

Chapter 1. Aerospace Context Awareness Computing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aerospace Context Awareness Computing Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aerospace Context Awareness Computing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aerospace Context Awareness Computing Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aerospace Context Awareness Computing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aerospace Context Awareness Computing Market – By Technology

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Services

6.5 Y-O-Y Growth trend Analysis By Technology

6.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Aerospace Context Awareness Computing Market – By End User

7.1 Introduction/Key Findings

7.2 Commercial Airlines

7.3 Business Aviation

7.4 Military Aviation

7.5 Air Traffic Control (ATC)

7.6 Y-O-Y Growth trend Analysis By End User

7.7 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. Aerospace Context Awareness Computing Market – By Application

8.1 Introduction/Key Findings

8.2 Pilot Decision Support

8.3 Predictive Maintenance

8.4 Logistics Optimization

8.5 Passenger Experience Personalization

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Aerospace Context Awareness Computing Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Technology

9.1.3 By End User

9.1.4 By By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Technology

9.2.3 By End User

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Technology

9.3.3 By End User

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Technology

9.4.3 By End User

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Technology

9.5.3 By End User

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Aerospace Context Awareness Computing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Boeing

10.2 Airbus

10.3 IBM

10.4 Microsoft

10.5 Google

10.6 Flybits

10.7 Honeywell

10.8 Astronics

10.9 EUROCONTROL

10.10 FAA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Aerospace Context Awareness Computing Market was valued at USD 57.35 billion in 2023 and is projected to reach a market size of USD 187.07 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 18.4%.

Unrelenting Focus on Safety, Optimizing Efficiency Across Operations, Leveraging the Power of Data, Unlocking Potential with AI and Machine Learning.

Pilot Decision Support, Predictive Maintenance, Logistics Optimization, and Passenger Experience Personalization.

North America holds the dominant position in the Aerospace Context Awareness Computing Market due to the presence of major aerospace manufacturers and airlines.

Boeing, Airbus, IBM, Microsoft, Google, Flybits, Honeywell, Astronics, EUROCONTROL, FAA.