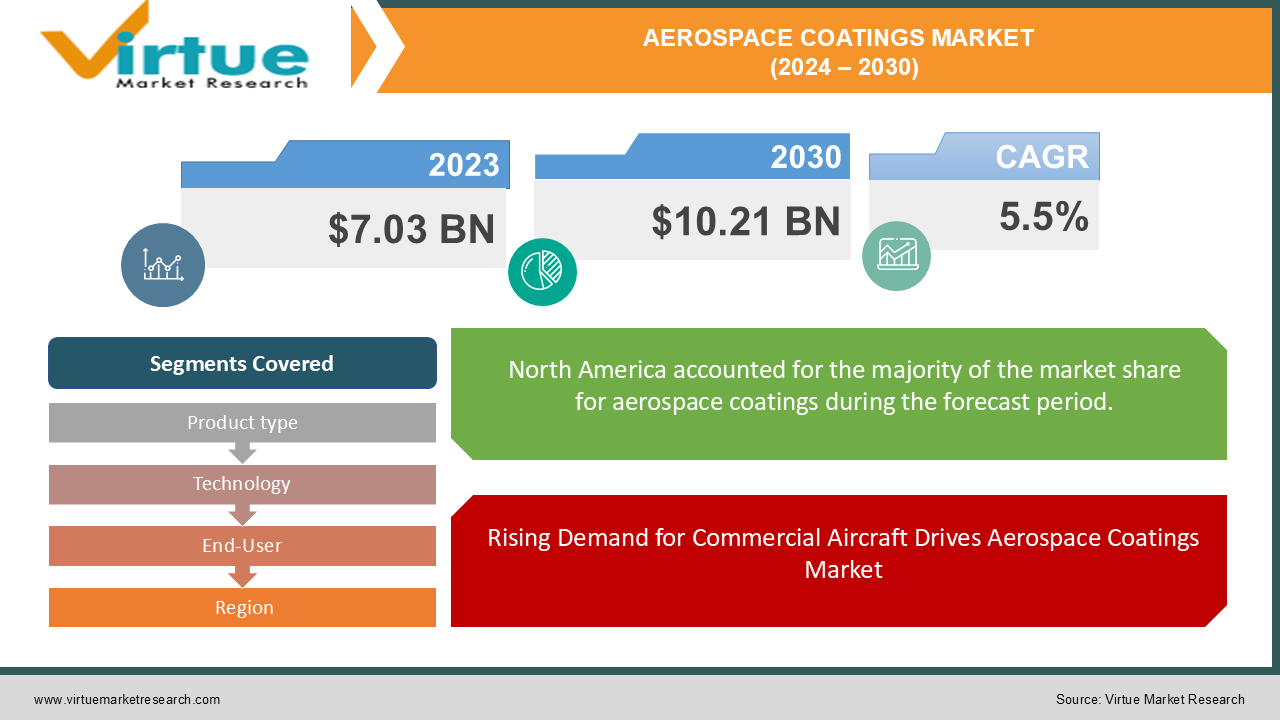

Aerospace Coatings Market Size (2024 – 2030)

The Global Aerospace Coatings Market was valued at USD 7.03 billion in 2023 and is projected to reach a market size of USD 10.21 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5.5% between 2024 and 2030.

The Global Aerospace Coatings Market plays a crucial role in the aviation and defense industries, providing specialized coatings that protect aircraft from harsh environmental conditions and enhance their performance. These coatings are designed to withstand extreme temperatures, UV radiation, corrosion, and other challenges that aircraft face during flight. They also contribute to improved fuel efficiency by reducing drag, as well as enhancing the aesthetic appeal of both commercial and military aircraft. With advancements in technology, aerospace coatings have evolved to offer better durability, lightweight properties, and eco-friendly formulations, meeting the stringent regulations of the aerospace sector. The growing demand for commercial air travel, coupled with increased defense spending, has fueled the expansion of the aerospace coatings market. Moreover, the rise in aircraft manufacturing and maintenance, repair, and overhaul (MRO) activities is driving the need for high-performance coatings that ensure longer service life and reduced maintenance costs. Key players in the market are focusing on innovation, and developing new coating solutions that enhance performance while being environmentally sustainable. As the aviation industry continues to grow, the global aerospace coatings market is expected to experience steady growth, driven by technological advancements and increased demand for both commercial and defense aircraft.

Key Market Insights:

-

Aerospace coatings improve fuel efficiency by up to 2%, reducing drag on aircraft.

-

50% of the aerospace coatings market is driven by the commercial aviation sector.

-

Solvent-based coatings account for nearly 40% of the market but are being replaced by eco-friendly alternatives.

-

The Asia-Pacific region is expected to grow at a CAGR of over 6%, driven by increasing aircraft production.

-

Polyurethane coatings dominate the market, making up about 60% of aerospace coating applications due to their durability.

-

OEM coatings represent more than 45% of the total aerospace coatings market demand.

Global Aerospace Coatings Market Drivers:

Rising Demand for Commercial Aircraft Drives Aerospace Coatings Market

One of the key drivers in the Global Aerospace Coatings Market is the increasing demand for commercial aircraft, driven by the rapid growth of air travel. With airlines expanding their fleets to meet rising passenger numbers, the need for high-performance aerospace coatings has surged. These coatings play a critical role in improving aircraft durability, and protecting surfaces from extreme weather conditions, corrosion, and UV radiation, while also contributing to fuel efficiency. The aviation industry’s shift towards lightweight materials, such as composites, further increases the demand for specialized coatings that can adhere to these materials without compromising performance. Moreover, emerging markets, especially in regions like Asia-Pacific, are seeing a significant rise in aircraft production to accommodate the expanding middle class and growing tourism. This expansion requires frequent maintenance and new deliveries of aircraft, increasing the demand for coatings in both original equipment manufacturer (OEM) and maintenance, repair, and overhaul (MRO) segments. As the global aviation sector continues to grow, aerospace coatings remain essential in ensuring safety, longevity, and efficiency for commercial fleets.

Technological Advancements in Aerospace Coatings are Revolutionizing Operational Efficiency

Technological advancements are driving significant growth in the Global Aerospace Coatings Market, as companies innovate to meet the stringent demands of the aerospace industry. New coating technologies focus on enhancing durability, reducing maintenance costs, and improving environmental sustainability. For instance, eco-friendly water-based and chrome-free coatings are gaining traction as they align with global environmental regulations aimed at reducing volatile organic compound (VOC) emissions and hazardous substances. Innovations in nanotechnology and smart coatings are also revolutionizing the market by offering superior resistance to corrosion, wear, and temperature fluctuations, as well as self-healing properties that extend the service life of aircraft components. Additionally, advanced coatings designed for composite materials are becoming increasingly important as the use of composites in modern aircraft continues to rise. These technological developments not only improve the performance of aerospace coatings but also help reduce the overall weight of aircraft, thereby enhancing fuel efficiency. As a result, aerospace manufacturers and maintenance providers are increasingly adopting these cutting-edge coatings, propelling the market growth.

Global Aerospace Coatings Market Restraints and Challenges:

The Global Aerospace Coatings Market faces several restraints and challenges, primarily stemming from stringent environmental regulations and high production costs. Environmental concerns regarding volatile organic compound (VOC) emissions and hazardous chemicals used in traditional solvent-based coatings have led to stricter regulations, particularly in North America and Europe. Compliance with these regulations requires manufacturers to invest in eco-friendly alternatives, such as water-based or chrome-free coatings, which can be more expensive and require additional research and development. Additionally, the complex and highly regulated nature of the aerospace industry creates challenges in terms of product certification and approval, often resulting in longer timelines for new products to enter the market. The high cost of raw materials, such as titanium dioxide and advanced polymers used in premium coatings, also contributes to increased production costs, limiting their widespread adoption, especially among smaller players. Furthermore, the market is heavily dependent on the aerospace industry’s cyclical nature, making it vulnerable to downturns in aircraft manufacturing and maintenance activities. Economic uncertainties, such as the COVID-19 pandemic, have also disrupted the demand for aerospace coatings, leading to delays in new aircraft deliveries and reduced MRO activities. These factors collectively pose significant challenges to the growth of the aerospace coatings market.

Global Aerospace Coatings Market Opportunities:

The Global Aerospace Coatings Market presents numerous opportunities, driven by advancements in technology and the growing focus on sustainability. One significant opportunity lies in the development of eco-friendly coatings, such as water-based and low-VOC formulations, which are increasingly in demand due to stricter environmental regulations. As the aerospace industry continues to prioritize reducing its environmental impact, the adoption of these sustainable coatings is expected to rise, creating growth prospects for manufacturers that invest in green technologies. Additionally, the increasing use of lightweight composite materials in modern aircraft offers opportunities for coatings specifically designed to adhere to these materials, enhancing durability and fuel efficiency. The growing need for maintenance, repair, and overhaul (MRO) services, particularly in the expanding aviation markets of Asia-Pacific and the Middle East, also presents a lucrative opportunity. These regions are witnessing a rapid increase in air traffic and aircraft production, leading to higher demand for coatings used in both new aircraft and MRO applications. Furthermore, advancements in smart coatings, which offer features such as self-healing and corrosion resistance, are poised to revolutionize the market by improving the lifespan and performance of aircraft. Companies that capitalize on these innovations are well-positioned to benefit from the evolving needs of the aerospace industry.

AEROSPACE COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Product type, Technology, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

PPG Industries, Inc., Akzo Nobel N.V., The Sherwin-Williams Company, Mankiewicz Gebr. & Co., Hentzen Coatings, Inc., BASF SE, Henkel AG & Co. KGaA., IHI Ionbond AG, BryCoat Inc, Axalta Coating Systems |

Global Aerospace Coatings Market Segmentation: Product Type

-

Primers

-

Topcoats

-

Clear Coats

-

Resin Type

-

Epoxy

-

Acrylic

-

Polyurethane

In 2023, based on market segmentation by Product Type, Primers had the highest share of the Global Aerospace Coatings Market. Primers serve as the foundation of the aerospace coatings system, providing a crucial base layer that ensures topcoats adhere effectively and perform optimally. These primers are designed to offer protection against corrosion, which is critical given the harsh conditions aircraft face, including exposure to extreme temperatures, humidity, and chemical contaminants. By creating a strong bond between the surface of the aircraft and the topcoat, primers enhance the durability and longevity of the entire coating system, reducing the need for frequent maintenance. In the aerospace industry, regulatory compliance is paramount, and primers play a key role in meeting the stringent standards for corrosion resistance, durability, and environmental compatibility. These coatings are also essential for ensuring the aircraft’s safety and performance, particularly in complex aircraft structures where a variety of materials, such as composites and metals, are used. The ability of primers to adapt to these intricate shapes and materials makes them indispensable in ensuring uniform protection across all surfaces. Although topcoats and clear coats contribute to the aesthetic and protective qualities of the aircraft, primers are considered the backbone of the system, accounting for a significant portion of the aerospace coatings market due to their pivotal role in ensuring overall coating performance.

Global Aerospace Coatings Market Segmentation: Technology

-

Solvent-Based

-

Water-Based

-

Powder Coatings

In 2023, based on market segmentation by Technology, Solvent-Based had the highest share of the Global Aerospace Coatings Market. The statements about solvent-based coatings in the aerospace industry are largely true. Solvent-based coatings have been a staple in aerospace applications for many years, offering established performance characteristics such as excellent durability, corrosion resistance, and chemical resistance. These coatings are well-regarded for their ability to provide superior gloss, color retention, and overall aesthetic appeal, which are critical factors in aerospace applications where appearance and long-term performance matter. Additionally, solvent-based coatings are mature products that are widely available, making them easy to source and apply using traditional methods like spraying or brushing. Their familiarity and the extensive experience of technicians in applying these coatings further contribute to their dominance in the market. While water-based and powder coatings have gained traction due to their lower environmental impact and compliance with stricter regulations, solvent-based coatings still hold a significant share of the aerospace coatings market. This is primarily due to their proven performance and the industry's existing reliance on them. As regulations continue to evolve, the aerospace industry is gradually shifting towards more sustainable options, but solvent-based coatings remain a key component of the market for the time being.

Global Aerospace Coatings Market Segmentation: End-User

-

Commercial Aviation

-

Military Aviation

-

General Aviation

In 2023, based on market segmentation by End-User, Commercial Aviation had the highest share of the Global Aerospace Coatings Market. Commercial aviation is the largest end-user in the aerospace coatings market, primarily due to the substantial fleet size operated by airlines worldwide. This vast number of aircraft necessitates regular maintenance, repairs, and repainting, creating a continuous demand for high-performance coatings. The strict safety and regulatory standards governing commercial aviation further amplify this need, as frequent inspections and maintenance, including repainting, are mandated to ensure compliance with aviation regulations. Additionally, the aesthetic appeal of aircraft plays a crucial role in the brand image; airlines strive to present a visually appealing fleet to attract customers and enhance their market presence. This focus on appearance drives the demand for high-quality coatings that provide not only durability but also an attractive finish. While military aviation and general aviation contribute to the overall aerospace coatings market, the sheer volume of commercial aircraft and the frequency of their maintenance requirements solidify commercial aviation's position as the leading segment. As airlines continue to expand their fleets and enhance their services, the demand for innovative and efficient aerospace coatings will remain a critical factor in sustaining growth within this sector.

Global Aerospace Coatings Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by Region, North America had the highest share of the Global Aerospace Coatings Market. North America is a dominant player in the Global Aerospace Coatings Market, largely due to its strong aerospace industry, which encompasses major aircraft manufacturers, maintenance, repair, and overhaul (MRO) facilities, and defense contractors. This robust industry foundation drives significant demand for aerospace coatings, as manufacturers require high-performance solutions to ensure aircraft safety and longevity. The region is also a leader in technological advancements related to aerospace coatings, fostering innovation in product development that meets the evolving needs of the industry. North American companies are at the forefront of creating eco-friendly and high-performance coatings that comply with stringent regulatory standards. These regulations often pertain to coatings' performance, durability, and environmental impact, compelling aerospace manufacturers to invest in high-quality coatings that can withstand rigorous operational conditions. While other regions, such as Europe and Asia-Pacific, have seen notable growth in the aerospace coatings market, North America’s combination of a strong industry base, technological prowess, and a stringent regulatory environment has solidified its position as the leading region. As the aerospace sector continues to evolve, North America will likely remain a key player in driving innovations and setting standards in the coatings market.

COVID-19 Impact Analysis on the Global Aerospace Coatings Market.

The COVID-19 pandemic had a significant impact on the Global Aerospace Coatings Market, primarily due to the severe disruptions in the aviation industry. The pandemic led to a sharp decline in air travel as governments imposed lockdowns, travel restrictions, and social distancing measures, resulting in reduced demand for new aircraft and a slowdown in aircraft manufacturing. Airlines around the world grounded fleets, postponed orders for new planes, and delayed maintenance, repair, and overhaul (MRO) activities, directly affecting the demand for aerospace coatings. Additionally, supply chain disruptions caused delays in the availability of raw materials and components needed for coatings production, further hampering market growth. However, as air travel gradually resumes and the aviation industry recovers, the market is witnessing a slow resurgence. The increased emphasis on hygiene and safety has also prompted airlines to accelerate MRO activities, driving demand for coatings in this segment. In the long term, the pandemic has underscored the importance of innovation in the aerospace coatings market, with a greater focus on eco-friendly solutions and coatings that offer enhanced durability to reduce maintenance frequency. While recovery is underway, it will take time for the market to return to pre-pandemic levels, influenced by the pace of the aviation industry's rebound.

Latest trends / Developments:

The Global Aerospace Coatings Market is witnessing several key trends and developments that are shaping its growth and future potential. One of the most prominent trends is the increasing shift toward eco-friendly and sustainable coatings, driven by stricter environmental regulations aimed at reducing volatile organic compounds (VOC) and hazardous chemicals. Water-based coatings and chrome-free alternatives are gaining traction as airlines and aircraft manufacturers seek to minimize their environmental impact. Another major trend is the growing demand for advanced coatings designed for lightweight composite materials, which are increasingly used in modern aircraft to enhance fuel efficiency and performance. Smart coatings, which offer self-healing, anti-corrosion, and wear-resistant properties, are also gaining attention, providing longer service life and reducing maintenance costs. In terms of regional developments, the Asia-Pacific region is emerging as a significant growth area due to the rapid expansion of the aviation sector, leading to increased aircraft production and MRO activities. Additionally, the ongoing advancements in nanotechnology are further driving innovation in aerospace coatings, resulting in products that offer superior protection against extreme temperatures, UV radiation, and other harsh conditions. As the aerospace industry continues to evolve, these trends are expected to play a key role in driving the demand for innovative coating solutions.

Key Players:

-

PPG Industries, Inc.

-

Akzo Nobel N.V.

-

The Sherwin-Williams Company

-

Mankiewicz Gebr. & Co.

-

Hentzen Coatings, Inc.

-

BASF SE

-

Henkel AG & Co. KGaA

-

IHI Ionbond AG

-

BryCoat Inc.

-

Axalta Coating Systems

Chapter 1. Aerospace Coatings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aerospace Coatings Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aerospace Coatings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aerospace Coatings Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aerospace Coatings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aerospace Coatings Market – By Product Type

6.1 Introduction/Key Findings

6.2 Primers

6.3 Topcoats

6.4 Clear Coats

6.5 Resin Type

6.6 Epoxy

6.7 Acrylic

6.8 Polyurethane

6.9 Y-O-Y Growth trend Analysis By Product Type

6.10 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Aerospace Coatings Market – By Technology

7.1 Introduction/Key Findings

7.2 Solvent-Based

7.3 Water-Based

7.4 Powder Coatings

7.5 Y-O-Y Growth trend Analysis By Technology

7.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Aerospace Coatings Market – End-User

8.1 Introduction/Key Findings

8.2 Commercial Aviation

8.3 Military Aviation

8.4 General Aviation

8.5 Y-O-Y Growth trend Analysis End-User

8.6 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 9. Aerospace Coatings Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Technology

9.1.4 End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Technology

9.2.4 End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Technology

9.3.4 End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Technology

9.4.4 End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Technology

9.5.4 End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Aerospace Coatings Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 PPG Industries, Inc.

10.2 Akzo Nobel N.V.

10.3 The Sherwin-Williams Company

10.4 Mankiewicz Gebr. & Co.

10.5 Hentzen Coatings, Inc.

10.6 BASF SE

10.7 Henkel AG & Co. KGaA

10.8 IHI Ionbond AG

10.9 BryCoat Inc.

10.10 Axalta Coating Systems

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Aerospace Coatings market is expected to be valued at US$ 7.03 billion.

Through 2030, the Global Aerospace Coatings market is expected to grow at a CAGR of 5.5%.

By 2030, the Global Aerospace Coatings Market is expected to grow to a value of US$ 10.21 billion.

North America is predicted to lead the Global Aerospace Coatings market.

The Global Aerospace Coatings Market has segments By Technology, Product Type, End-User, and Region.