Aerospace Biometric Market Size (2023 – 2030)

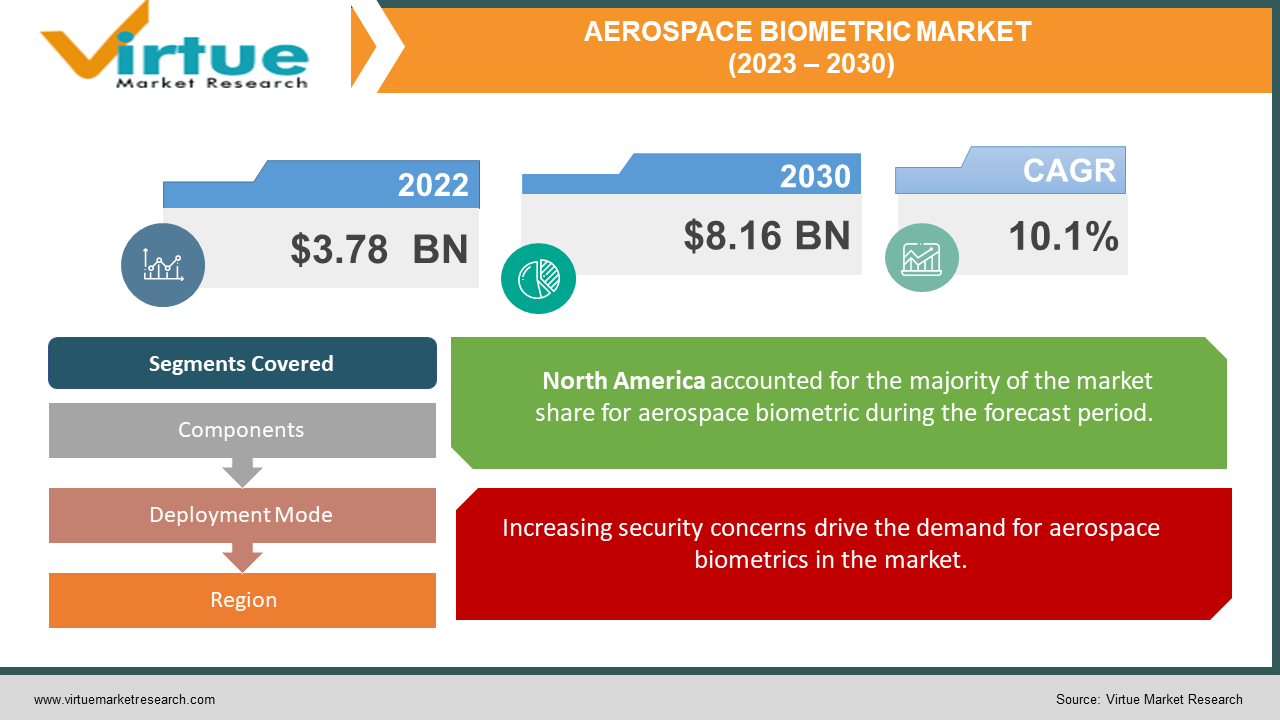

The Global Aerospace Biometric Market was valued at USD 3.78 billion and is projected to reach a market size of USD 8.16 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 10.1%.

Biometric technology was widely used for fingerprint recognition, especially for identity verification and for security purposes. With the advent of technology in the aerospace industry, biometric technology is now increasingly used in airports for passenger check-ins and for maintaining security. Moreover, the increase in concerns among the airport authority regarding terrorism and violence in the airports, have increased the usage of biometric technology with more advanced features such as iris scanning, facial recognition, voice and speech recognition, and others. These technologies increase the security effectiveness at airports and control access to these areas. Nowadays, aircraft cabin security has become a matter of concern for the airport authority and hence biometric technology is used for cabin crew authentication to ensure that only authorized personnel enter the cockpit. The future holds positive for the aerospace biometric industry with the advent of more advanced identity verification technologies and increasing adoption of AI technology.

Key Market Insights:

According to SITA, nearly three-quarters of airports have invested now in biometric solutions and further airline investment in biometric boarding is anticipated to increase by 60% by 2024.

As per the IATA (International Air Transport Association) Survey, 73% of passengers are willing to share their biometric data with the airport to improve airport security processes.

Moreover, India is currently home to 126 facial recognition technology systems, of which 13 are installed in Maharashtra, 12 in Delhi, and 8 systems in Gujrat. Furthermore, the Government of India invested Rs. 165.43 crore in the installation of facial recognition technology for four airports in June 2022. These four airports are Varanasi, Vijayawada, Pune, and Kolkata.

To date, CBP (US Customs and Border Protection) has processed more than 300 million travellers in the country by using biometric facial comparison technology and prevented the entry of 1800 imposters in the USA.

According to the National Institute of Standards and Technology, facial biometric systems in the USA are 99.5% accurate.

Aerospace Biometric Market Drivers:

Increasing security concerns drive the demand for aerospace biometrics in the market.

The aerospace industry is at the prime concern of threats and unauthorized access, and hence airport security personnel are increasingly devising advanced methods to maintain security and protect the area from potential threats. With rising threats in hijacking, kidnapping, and airport cyber-attacks, there is a growing need for robust security systems such as biometric technology that authenticate the identity and behavioural patterns of people entering the airport premises. As per Eurocontrol, a European organization that focuses on European aviation, published in its EATM-CERT Aviation Cyber Event Map that 52 cyber-attacks occurred in the year 2020 and 48 in the year 2021 against the aviation industry. Moreover, the most common types of attacks were ransomware attacks accounting for 225, data breaches accounting for 18.6%, and DDoS accounting for 7.3%. This showcases the increasing need for a robust secured network that authenticates every access inside the airport premises. Further, new developments in biometric technology such as fraud detection and biometrics enable airport security personnel to identify digital anomalies and protect the system from potential threats.

Advancements in biometric technology have boosted the demand for aerospace biometrics in the market.

The continuous development in biometric technology such as improved accuracy in identifying unauthorized individuals or detecting false and negative anomalies, has boosted the demand for biometric technology in the aerospace industry. Further, faster speed and greater scalability of biometric software have enabled airport authorities to analyze data faster even during busy hours. Moreover, advances in integration technology such as multi-modal integration allows the biometric systems to integrate in multiple mode of integration for enhanced security. These included a combination of facial recognition and fingerprint recognition, iris scanning and fingerprint recognition, and others. Furthermore, rising trends in AI technology, enable security professionals to automate the biometric identification and verification process, and analyze the behavioural patterns of individuals such as facial expressions, voice, gait recognition, angles, and others. Moreover, AI can predict potential threats at the security checkpoints in airports and prevent unauthorized entry or exit.

Aerospace Biometric Market Restraints and Challenges:

Privacy and data leak concerns can reduce the market demand for aerospace biometrics. Since biometric data is stored on online cloud servers, it is exposed to unauthorized access such as data leaks and privacy issues, leading to an increase in cyber-terrorism.

Aerospace Biometric Market Opportunities:

The Global Aerospace Biometric Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches and agreements during the forecasted period. Furthermore, rising passenger demand for self-boarding and check-in systems is predicted to develop the market for aerospace biometrics and enhance its future growth opportunities.

AEROSPACE BIOMETRIC MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

10.1% |

|

Segments Covered |

By Components, Deployment Mode, Biometric type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amadeus IT Group, Vision-Box, Idemia, Materna IPS, Collins Aerospace, Mantra Softech India Pvt Ltd, Star Alliance, NextGen50 |

Aerospace Biometric Market Segmentation: By Components

-

Hardware

-

Software

-

Services

In 2022, based on market segmentation by components, hardware occupies the highest share of about 18.5% in the market. The hardware segment comprises biometric sensors, security cameras, and scanners that help security personnel identify and verify the entry of passengers. Further, biometric sensors are increasingly used at airports as it helps them to capture biometric data such as fingerprint, facial features, or iris patterns of an individual. Moreover, security cameras and biometric integrated cameras help security personnel capture facial images of passengers and ensure correct and secure check-ins in the airport. Moreover, AI-enabled cameras automatically capture and analyze the behaviour of individuals for fraud detection or unauthorized access.

The software segment is the fastest-growing segment during the forecast period. Biometric software helps to store the data captured by the hardware and enables airport authorities to identify and verify individuals. AI and machine learning models help in storing and analyzing biometric data and provide insights to security professionals that help them verify and authenticate passengers easily and quickly. Moreover, predictive analytics software enables airport personnel to detect potential threats beforehand and hence helps the security personnel in taking preventive measures for maintaining and enhancing the security and safety at the airport.

Aerospace Biometric Market Segmentation: By Deployment Mode

-

Cloud

-

On-Premises

In 2022, based on market segmentation by deployment mode, the cloud segment occupies the highest share of about 29% in the market. Cloud-based biometric software is stored and managed by third-party service providers. Cloud-based software ensures greater accessibility and scalability as it can be accessed from any device and can handle large volumes of data sets efficiently. Further, it is a cost-effective option, as it automatically updates and maintains the software without the need for any extra charge.

Aerospace Biometric Market Segmentation: By Biometric type

-

Fingerprint Recognition

-

Facial Recognition

-

Iris Recognition

-

Voice Recognition

-

Behavioural Biometrics

-

Others

In 2022, based on market segmentation by biometric type, fingerprint recognition occupies the highest share of about 25% in the market. Fingerprint recognition is the most common type of biometric used at airports for identifying individuals' fingerprints and thereby verifying their identity. Moreover, it is most often used at the immigration and security checkpoints of airports for authenticating the check-ins of various passengers.

Facial recognition is the fastest-growing segment during the forecast period. Facial recognition has gained momentum in recent times, due to contact-less authentication methods. That is, this biometric type captures passengers’ images and analyzes their facial patterns such as eyes, nose, forehead, and other features of the face to verify it with the legal identity document provided by the passenger. It is widely used at the security checkpoints in the airport.

Aerospace Biometric Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, based on market segmentation by region, North America occupies the highest share of about 31% in the market. Well-established technological infrastructure at the airports and contactless trends in travelling post-pandemic such as the use of near-field communication for scanning the identity of passengers and the use of behavioural biometrics to automatically capture the facial images of the passengers for identification and verification of any threats in the behaviour has contributed to the growth of aerospace biometric in the region.

Asia-Pacific is the fastest-growing region during the forecast period. Rising security concerns due to an increase in cyber threats and terrorism, and rapid technological adoption such as the use of AI and ML models for automatic identification and verification of passengers’ data in the aviation industry have contributed to the growth of aerospace biometrics in the region.

COVID-19 Impact Analysis on the Global Aerospace Biometric Market:

The pandemic had a significant impact on the aerospace biometric market. Due to social distancing norms and travel restrictions, there was an increasing trend in contactless travel, which boosted the demand for biometric technology in the market. These include near-field communication technologies and facial recognition technology, as it identify passengers’ identities without physical interaction. Moreover, hygienic biometric scanners at the airport gained momentum, as the demand for contactless boarding increased. Further, trends in biometric self-boarding increased due to social distancing norms during the pandemic. Moreover, the integration of health data such as vaccine data with the biometric systems at the airport enabled airport authorities to record passengers’ data and ensure that health and safety requirements are met during the pandemic.

Latest Trends/ Developments:

The global Aerospace Biometric Market is reasonably split and fragmented with the existence of several global companies. These players are motivated to achieve higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. With increasing trends in contactless travelling and self-boarding kiosks, biometric technology has witnessed an increase in demand from the aerospace industry. AI-enabled facial recognition systems and self-check-in smart apps have made airport boarding faster and easier for passengers. Moreover, the deployment of touchless biometric scanners has minimized physical interaction and enhanced safety and security inside the airport premises.

Key Players:

-

Amadeus IT Group

-

Vision-Box

-

Idemia

-

Materna IPS

-

Collins Aerospace

-

Mantra Softech India Pvt Ltd

-

Star Alliance

-

NextGen50

-

In December 2022, the Ministry of Civil Aviation, Government of India, launched the DigiYatra app, which is a facial recognition app installed at three airports namely – Delhi, Bengaluru, and Varanasi in the country. Further, the app aims to minimize paperless entry and store passengers’ data based on facial recognition, automatically at the security checkpoints in the airport.

-

In December 2022, UAE airport launched a facial recognition biometric service at the Abu Dhabi airport, which does not require the need for passport or ticket. The service is implemented at self-service baggage touchpoints, immigration e-gates, and boarding gates in the airport. Moreover, it is based on AI technology designed by NEXT50 tech company in Abu-Dhabi.

Chapter 1. Aerospace Biometric Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Global Filling Machines Market– Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aerospace Biometric Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aerospace Biometric MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aerospace Biometric Market- Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aerospace Biometric Market -BY COMPONENTS

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Services

6.5 Y-O-Y Growth trend Analysis BY COMPONENTS

6.6 Absolute $ Opportunity Analysis BY COMPONENTS, 2023-2030

Chapter 7. Aerospace Biometric Market -BY DEPLOYMENT MODE

7.1 Introduction/Key Findings

7.2 Cloud

7.3 On-Premises

7.4 Y-O-Y Growth trend Analysis BY DEPLOYMENT MODE

7.5 Absolute $ Opportunity Analysis BY DEPLOYMENT MODE, 2023-2030

Chapter 8. Aerospace Biometric Market - By Biometric type

8.1 Introduction/Key Findings

8.2 Fingerprint Recognition

8.3 Facial Recognition

8.4 Iris Recognition

8.5 Voice Recognition

8.6 Behavioural Biometrics

8.7 Others

8.8 Y-O-Y Growth trend Analysis BY DEPLOYMENT MODE

8.9 Absolute $ Opportunity Analysis BY DEPLOYMENT MODE, 2023-2030

Chapter 9. Aerospace Biometric Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.2 BY COMPONENTS

9.3 BY DEPLOYMENT MODE

9.4 By Biometric type

9.5 Countries & Segments - Market Attractiveness Analysis

9.6 Europe

9.6.1 By Country

9.6.1.1 U.K.

9.6.1.2 Germany

9.6.1.3 France

9.6.1.4 Italy

9.6.1.5 Spain

9.6.1.6 Rest of Europe

9.7 BY COMPONENTS

9.8 BY DEPLOYMENT MODE

9.9 By Biometric type

9.10 Countries & Segments - Market Attractiveness Analysis

9.11 Asia Pacific

9.11.1 By Country

9.11.1.1 China

9.11.1.2 Japan

9.11.1.3 South Korea

9.11.1.4 India

9.11.1.5 Australia & New Zealand

9.11.1.6 Rest of Asia-Pacific

9.12 BY COMPONENTS

9.13 BY DEPLOYMENT MODE

9.14 By Biometric type

9.15 Countries & Segments - Market Attractiveness Analysis

9.16 South America

9.16.1 By Country

9.16.1.1 Brazil

9.16.1.2 Argentina

9.16.1.3 Colombia

9.16.1.4 Chile

9.16.1.5 Rest of South America

9.17 BY COMPONENTS

9.18 BY DEPLOYMENT MODE

9.19 By Biometric type

9.20 Countries & Segments - Market Attractiveness Analysis

9.21 Middle East & Africa

9.21.1 By Country

9.21.1.1 United Arab Emirates

9.21.1.2 Saudi Arabia

9.21.1.3 Qatar

9.21.1.4 Israel

9.21.1.5 South Africa

9.21.1.6 Nigeria

9.21.1.7 Kenya

9.21.1.8 Egypt

9.21.1.9 Rest of MEA

9.22 BY COMPONENTS

9.23 BY DEPLOYMENT MODE

9.24 By Biometric type

9.25 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Aerospace Biometric Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Amadeus IT Group

10.2 Vision-Box

10.3 Idemia

10.4 Materna IPS

10.5 Collins Aerospace

10.6 Mantra Softech India Pvt Ltd

10.7 Star Alliance

10.8 NextGen50

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Aerospace Biometric Market was valued at USD 3.78 billion and is projected to reach a market size of USD 8.16 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 10.1%.

Increasing security concerns and Advancement in biometric technology are the market drivers of the Global Aerospace Biometric Market.

Fingerprint Recognition, Facial Recognition, Iris Recognition, Voice Recognition, Behavioural Biometrics, and Others are the segments under the Global Aerospace Biometric Market by biometric type.

North America is the most dominant region for the Global Aerospace Biometric Market.

Asia-Pacific is the fastest-growing region in the Global Aerospace Biometric Market.